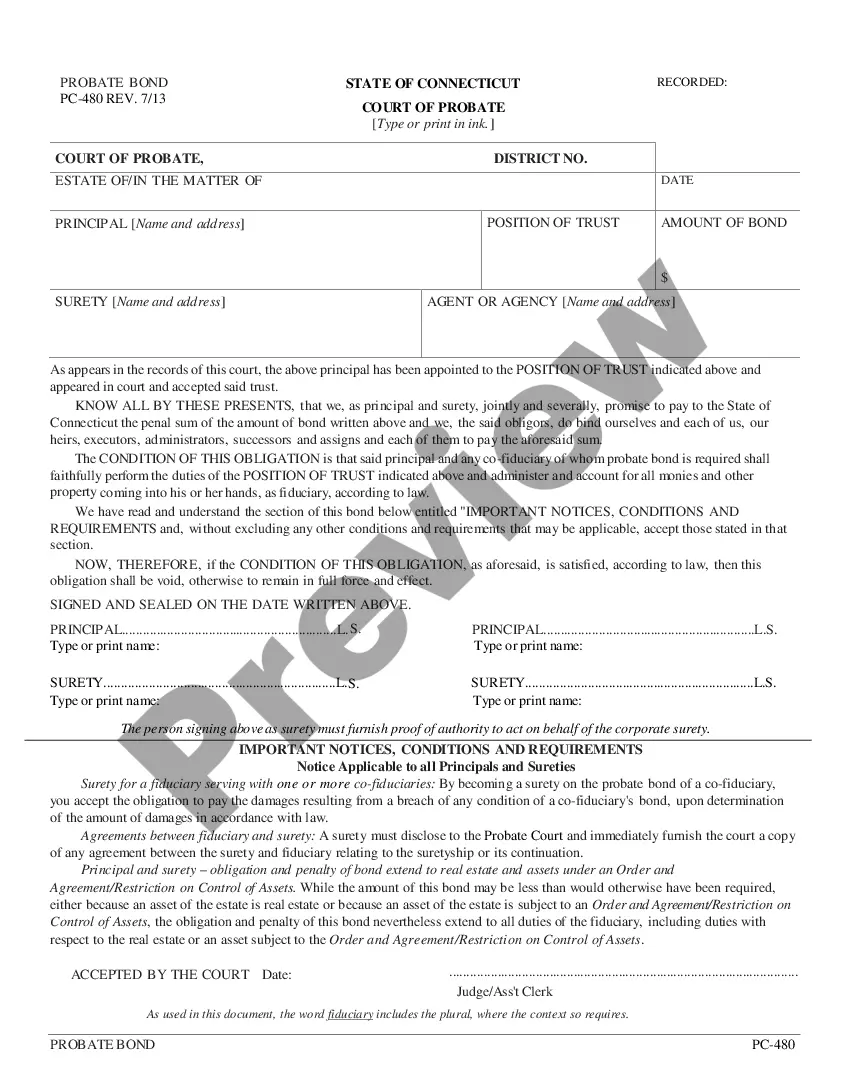

This is an official form from the Connecticut Court System, which complies with all applicable laws and statutes. USLF amends and updates forms as is required by Connecticut statutes and law.

Connecticut Bond Waiver

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Connecticut Bond Waiver?

The more documentation you are required to produce - the more anxious you become.

You can find countless Connecticut Bond Waiver templates online, yet you remain uncertain which of them to trust.

Eliminate the frustration to make obtaining samples significantly easier with US Legal Forms.

Access each template you have in the My documents menu. Simply navigate there to complete a new version of your Connecticut Bond Waiver. Even when using professionally prepared forms, it is still crucial to consider consulting a local attorney to ensure your document is accurately filled out. Achieve more for less with US Legal Forms!

- Ensure the Connecticut Bond Waiver is recognized in your state.

- Verify your choice by reviewing the description or utilizing the Preview mode if available for the chosen document.

- Press Buy Now to initiate the registration process and select a pricing plan that matches your preferences.

- Provide the necessary information to create your account and pay for the order using PayPal or a credit card.

- Select a preferred document type and retrieve your template.

Form popularity

FAQ

To avoid probate in Connecticut, you can use several strategies such as creating a revocable living trust or naming beneficiaries on accounts. Joint ownership of property also allows for seamless transfer upon death. By employing a Connecticut Bond Waiver, you can simplify your estate planning and enhance your ability to manage your assets efficiently, reducing the chance of probate.

Waiving a bond means that the requirement for the executor or administrator to secure a bond is eliminated. This decision typically reflects trust in the individual's ability to manage the estate effectively without the additional financial burden of a bond. By utilizing a Connecticut Bond Waiver, heirs can simplify the legal process, enabling quicker asset distribution. It also fosters a smoother administration of the estate with less red tape.

In Connecticut, creditors generally have six months from the date of probate to collect debts from an estate. This timeframe allows creditors to assert their claims, ensuring all debts are settled before asset distribution. Adhering to the Connecticut Bond Waiver can streamline these proceedings, providing a clearer path for managing estate obligations. Understanding these timelines is crucial for both executors and beneficiaries alike.

A waiver of bond by an heir or beneficiary is a legal declaration allowing the estate executor or administrator to proceed without posting a bond. This often occurs when beneficiaries trust the executor's ability to manage the estate responsibly. By opting for a Connecticut Bond Waiver, heirs can save time and reduce expenses associated with bonding. It simplifies the process of estate administration and can expedite the distribution of assets.

To avoid probate in Connecticut, consider using strategies such as establishing a living trust or designating beneficiaries on accounts. These methods allow your assets to pass directly to your heirs without going through the lengthy probate process. Additionally, you might explore options like joint ownership of property. Consulting with a legal expert can help you implement the best strategies tailored to your situation, including utilizing a Connecticut Bond Waiver if applicable.

The waiver of notice allows certain parties to forgo receiving formal notifications regarding court proceedings. This can simplify and speed up the legal process, particularly in cases where all parties are in agreement. By obtaining a waiver of notice, you can more efficiently manage your case without unnecessary delays. Legal platforms like USLegalForms can guide you through obtaining necessary waivers.

The waiver of a bond means that a court agrees to eliminate the requirement for a bond in a specific case. This can happen when the court believes that the risk of loss is minimal, and it helps expedite legal proceedings. When you pursue a Connecticut Bond Waiver, you can potentially bypass financial burdens that come with posting a bond. It's important to consult with legal experts to ensure you meet the necessary criteria for the waiver.