Nevada Charitable Contribution Payroll Deduction Form

Description

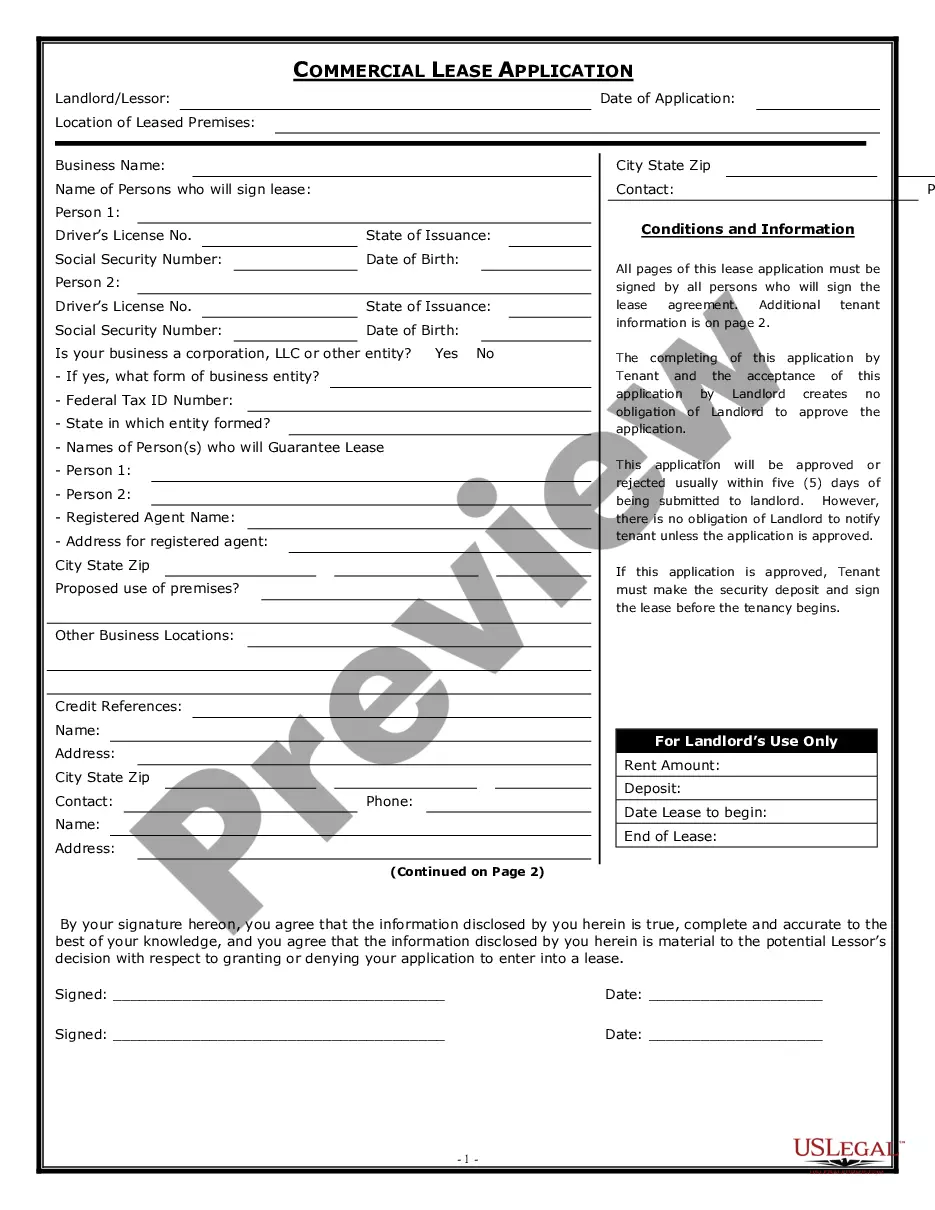

How to fill out Charitable Contribution Payroll Deduction Form?

Locating the appropriate legal document template can be quite a challenge. Clearly, there is an array of online templates available, but how do you uncover the specific legal type you require? Make use of the US Legal Forms website. This service offers numerous templates, including the Nevada Charitable Contribution Payroll Deduction Form, suitable for both business and personal purposes. All forms are verified by experts and comply with state and federal regulations.

If you are already registered, Log Into your account and click the Acquire button to obtain the Nevada Charitable Contribution Payroll Deduction Form. Use your account to review the legal forms you've previously purchased. Navigate to the My documents section of your account and download another copy of the document you require.

If you are a new user of US Legal Forms, here are some simple steps for you to follow: First, ensure that you have selected the correct form for your jurisdiction. You can preview the form using the Review button and read the form description to confirm it suits your needs. If the form does not meet your requirements, use the Search field to find the correct form. Once you are confident that the form is appropriate, click the Purchase now button to obtain the form. Choose the pricing plan you prefer and provide the required information. Create your account and complete the payment using your PayPal account or credit card. Select the document format and download the legal document template to your device. Finally, fill it out, modify, print, and sign the acquired Nevada Charitable Contribution Payroll Deduction Form.

- US Legal Forms is the largest repository of legal forms, offering a variety of document templates.

- Utilize the service to obtain professionally crafted documents that meet state regulations.

- Access a wide range of templates for various legal needs.

- Ensure compliance with both state and federal standards.

- Easily manage and track your purchased forms within your account.

Form popularity

FAQ

The standard payroll deductions are those that are required by law. They include federal income tax, Social Security, Medicare, state income tax, and court-ordered garnishments. Some cities, counties or school districts also levy a local income tax.

Some common voluntary payroll deduction plan examples include: 401(k) plan, IRA, or other retirement savings plan contributions. Medical, dental, or vision health insurance plans. Flexible spending account or pre-tax health savings account contributions.

Recording a Donation If you made a cash donation, start by setting up the charitable organization as a new vendor for your company. Next, record the outgoing money as a check or a bill in the name of the charity and the corresponding payment, like you would for any other bill.

Mandatory payroll deductionsFICA tax. Federal Insurance Contributions Act (FICA) tax is made up of Social Security and Medicare taxes.Federal income tax.State and local taxes.Garnishments.Health insurance premiums.Retirement plans.Life insurance premiums.Job-related expenses.

Instead, your charitable donations come out of your after-tax earnings. So you can deduct the total amount deducted from your payroll checks during the year on the Gifts to Charity line of your Schedule A (if you choose to itemize instead of claiming the standard deduction).

There are two types of deductions: voluntary deductions, such as health insurance and 401(k) deductions, and mandatory deductions (those required by law), such as federal income taxes and FICA taxes.

You may deduct charitable contributions of money or property made to qualified organizations if you itemize your deductions. Generally, you may deduct up to 50 percent of your adjusted gross income, but 20 percent and 30 percent limitations apply in some cases.

Voluntary Deductions Voluntary payroll deductions are the ones you control and choose. Along with health, life and disability insurance, these voluntary payroll deductions may include union dues, retirement or 401(k) contributions and flexible spending accounts for health care and dependent care expenses.

Mandatory Payroll Tax DeductionsFederal income tax withholding.Social Security & Medicare taxes also known as FICA taxes.State income tax withholding.Local tax withholdings such as city or county taxes, state disability or unemployment insurance.Court ordered child support payments.