Alabama Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption

Description

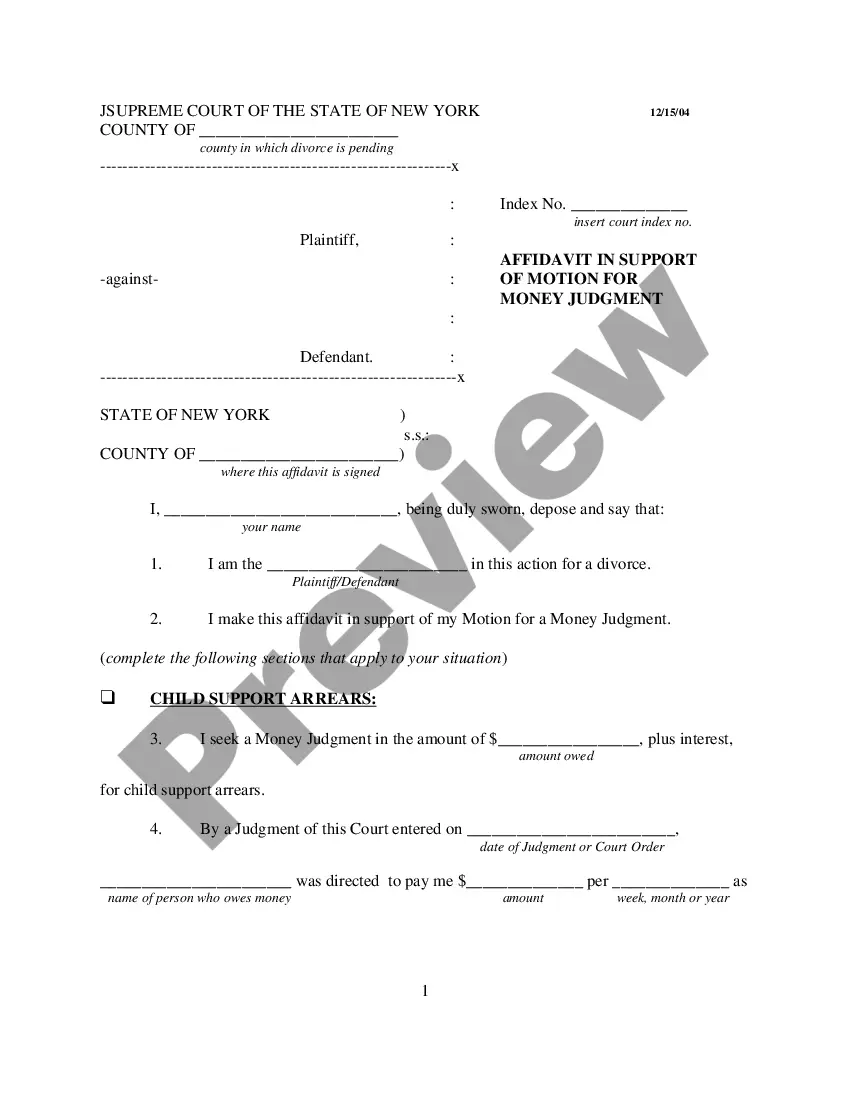

How to fill out Certification Of No Information Reporting On Sale Or Exchange Of Principal Residence - Tax Exemption?

You can spend hours online trying to locate the legal document template that meets the federal and state standards you require.

US Legal Forms offers thousands of legal documents that have been evaluated by professionals.

You can easily download or print the Alabama Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption from their service.

If available, use the Review button to look through the document template as well. If you wish to obtain another version of the form, utilize the Search field to find the template that suits your needs and requirements.

- If you already have a US Legal Forms account, you can Log In and click on the Download button.

- After that, you can complete, modify, print, or sign the Alabama Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption.

- Each legal document template you obtain is yours permanently.

- To get another copy of a purchased form, go to the My documents tab and click on the appropriate button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- Firstly, ensure that you have selected the correct document template for the county/city you choose.

- Review the form description to confirm that you have selected the right document.

Form popularity

FAQ

If you do not receive a 1099-S, you still need to report the sale on your tax return. Failing to report can lead to penalties from the IRS. You may qualify for the Alabama Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption, which could exempt you from reporting the sale. It's advisable to keep thorough records of the transaction.

If you Wish to Buy Items for Resale in Alabama Unlike many other states, you are not required to fill out a resale certificate. Instead, just a copy of your sales tax license will do the trick. Alabama even allows retailers to accept out-of-state resale certificates.

Business entities are liable for the Alabama business privilege tax for each taxable year during which the entity is in legal existence regardless of the level of business activity. With certain exceptions, the minimum business privilege tax is $100, and the maximum business privilege tax is $15,000.

You can easily acquire your Alabama Sales Tax License online using the My Alabama Taxes website. If you have quetions about the online permit application process, you can contact the Department of Revenue via the sales tax permit hotline (334) 242-1584 or by checking the permit info website .

You will need a sellers' use tax permit' if you have no physical presence in Alabama, otherwise, you will need a sales tax permit. Make sure you 'validate' the zip code for each address, or it won't let you move forward. You are required to complete the local tax section, even if you aren't collecting local tax.

You must complete your U.S. income tax return first, before you can prepare the Alabama tax return. The UA Tax Office usually hosts several tax seminars with the Alabama Department of Revenue to assist nonresident aliens with filing the Alabama tax return.

The state of Alabama is one of the few states that don't have a resale certificate. When asked for one by a vendor, an Alabama business will give them a copy of their Alabama Sales Tax License.

Yes. In general, income from the sale of Alabama property is required to be reported on an Alabama income tax return.

Form 40A is Alabama's Individual Resident Income Tax Return (short version) and it applies to full year residents only. Please keep in mind that if you file Form 40A close to the deadline, there might be a delay of 90 days until you receive the refund.

Alabama business that are buying items at wholesale prices will use this resale certificate. This form allows you to purchase items to be resold by your business or items to create products to be sold by your business at wholesale prices without paying tax on the wholesale cost.