Arkansas Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption

Description

How to fill out Certification Of No Information Reporting On Sale Or Exchange Of Principal Residence - Tax Exemption?

Have you found yourself in a situation where you need documents for either business or personal use nearly every day.

There are numerous legal document templates accessible online, but locating ones you can trust is challenging.

US Legal Forms offers thousands of template options, including the Arkansas Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption, which are designed to comply with state and federal regulations.

Select the pricing plan you wish to use, fill in the required information to create your account, and complete the purchase using your PayPal or Visa or Mastercard.

Choose a convenient file format and download your copy. Access all the document templates you have purchased via the My documents section. You can acquire an additional copy of the Arkansas Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption at any time if needed. Just click the desired document to download or print the template.

Utilize US Legal Forms, the most extensive collection of legal documents, to save time and avoid errors. The service provides professionally crafted legal document templates that you can use for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After logging in, you can download the Arkansas Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption template.

- If you do not have an account and wish to use US Legal Forms, follow these steps.

- Obtain the template you need and ensure it is for the correct city/state.

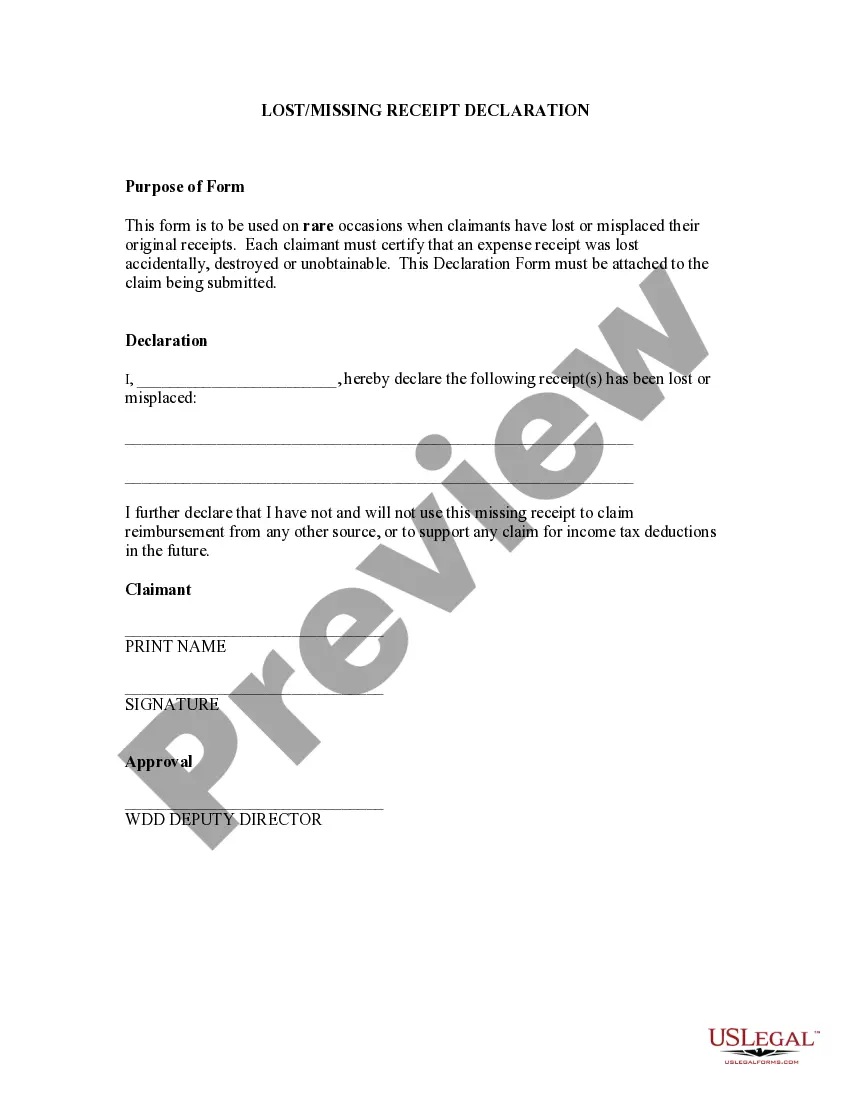

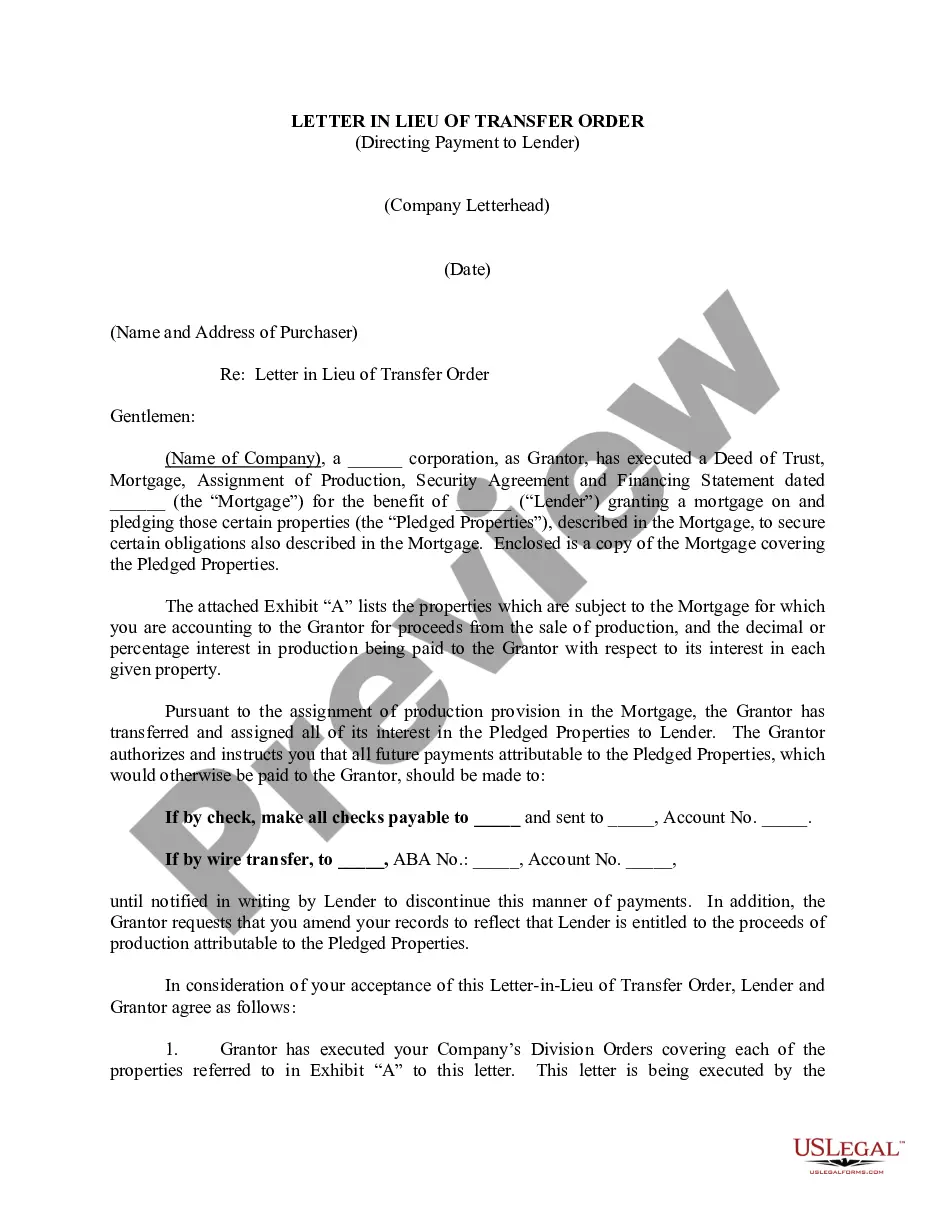

- Utilize the Review button to inspect the form.

- Read the description to ensure you have selected the correct document.

- If the document is not what you are looking for, use the Search field to find the form that suits your needs.

- Once you find the right document, click Get now.

Form popularity

FAQ

File Your Business Taxes Businesses that operate within Arkansas are required to register for one or more tax-specific identification numbers, licenses or permits, including income tax withholding, sales and use tax (seller's permit), and unemployment insurance tax.

The fee to register for a sales tax permit in the state of Arkansas is $50 and is non-refundable.

AR-OI (R 06/02/2020) ARKANSAS INDIVIDUAL INCOME TAX. OTHER INCOME/LOSS AND DEPRECIATION DIFFERENCES.

How do you register for a sales tax permit in Arkansas? You can register online at the Arkansas Taxpayer Access Point (ATAP) or fill out the paper application Just click Sign up and you'll be prompted to enter business info then register for your sales tax permit.

All non-residents must file a state tax return if they receive any in- come from an Arkansas source. Part-year residents must file a return if they re- ceive any income from any source while a resident of Arkansas.

The purpose of the certificate is to provide evidence of why sales tax was not collected on a transaction. Similar names for a resale certificate include reseller number, seller's permit, exemption certificate, wholesale license, or reseller's license.

AR1000F Full Year Resident Individual Income Tax Return.

To obtain exemption from Arkansas income tax: o Submit a copy of: 25aa 1) the IRS Determination Letter, 25aa 2) pages 1 and 2 of the IRS Form 1023, and 25aa 3) a statement declaring Arkansas Code Exemption: 2022 The statement must declare that the organization is exempt under ARK.

Most businesses operating in or selling in the state of Arkansas are required to purchase a resale certificate annually. Even online based businesses shipping products to Arkansas residents must collect sales tax. Obtaining your sales tax certificate allows you to do so.

You can register online at the Arkansas Taxpayer Access Point (ATAP) or fill out the paper application Just click Sign up and you'll be prompted to enter business info then register for your sales tax permit.