Arkansas Certification of Seller

Description

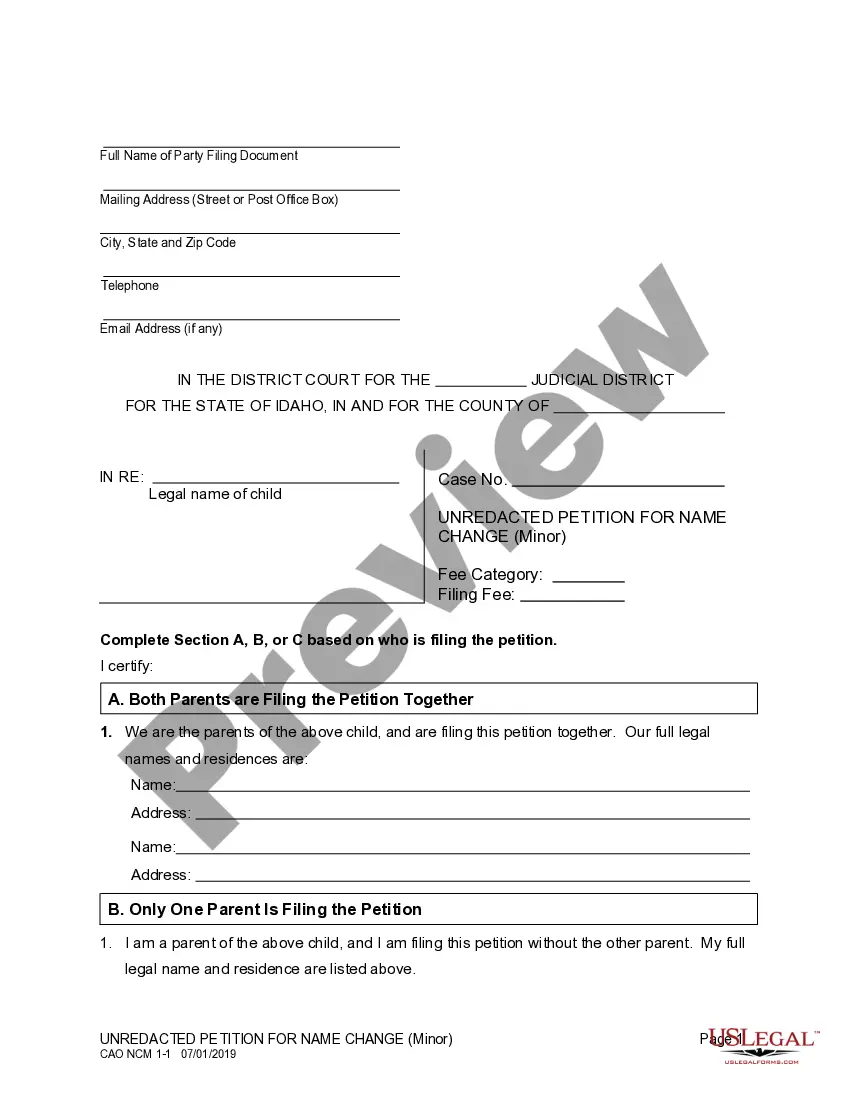

How to fill out Certification Of Seller?

Are you in a situation where you require documents for potential business or personal purposes almost all the time.

There are numerous legal document templates accessible online, but finding trustworthy ones can be challenging.

US Legal Forms offers a vast array of form templates, including the Arkansas Certification of Seller, which can be tailored to meet federal and state requirements.

Once you find the appropriate form, click Get now.

Select the pricing plan you want, complete the necessary information to set up your account, and pay for the transaction using PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Arkansas Certification of Seller template.

- If you do not have an account and want to start using US Legal Forms, follow these instructions.

- Locate the form you need and ensure it is for the correct city/county.

- Use the Review button to assess the form.

- Read the description to confirm you have selected the right form.

- If the form is not what you are looking for, use the Search section to find the form that meets your needs.

Form popularity

FAQ

Sales tax is levied on sales of tangible personal property and various types of services performed within Arkansas. A completed application for a sales tax permit and a fifty dollar ($50) non- refundable fee is required to register new businesses.

Most businesses operating in or selling in the state of Arkansas are required to purchase a resale certificate annually. Even online based businesses shipping products to Arkansas residents must collect sales tax. Obtaining your sales tax certificate allows you to do so.

How can you get a resale certificate in Arkansas? To get a resale certificate in Arkansas, you may either fill out the Arkansas Exemption Certificate (Form ST 391) or the Streamlined Exemption Certificate Form. You may use an out-of-state sales tax license number on these forms.

How do you register for a sales tax permit in Arkansas? You can register online at the Arkansas Taxpayer Access Point (ATAP) or fill out the paper application Just click Sign up and you'll be prompted to enter business info then register for your sales tax permit.

Sales tax is levied on sales of tangible personal property and various types of services performed within Arkansas. A completed application for a sales tax permit and a fifty dollar ($50) non- refundable fee is required to register new businesses.

To obtain exemption from Arkansas income tax: o Submit a copy of: 25aa 1) the IRS Determination Letter, 25aa 2) pages 1 and 2 of the IRS Form 1023, and 25aa 3) a statement declaring Arkansas Code Exemption: 2022 The statement must declare that the organization is exempt under ARK.

How to fill out Arkansas Sales Tax Exemption CertificateStep 1 Begin by downloading the Arkansas Sales Tax Exemption Certificate Form ST391.Step 2 Include the Arkansas Sales/Use Tax Permit Number or the state and Sales Tax Number if the buyer is from another state.Step 3 Identify the name of the seller.More items...?

How do you register for a sales tax permit in Arkansas? You can register online at the Arkansas Taxpayer Access Point (ATAP) or fill out the paper application Just click Sign up and you'll be prompted to enter business info then register for your sales tax permit.

Businesses that operate within Arkansas are required to register for one or more tax-specific identification numbers, licenses or permits, including income tax withholding, sales and use tax (seller's permit), and unemployment insurance tax.

Most businesses operating in or selling in the state of Arkansas are required to purchase a resale certificate annually. Even online based businesses shipping products to Arkansas residents must collect sales tax. Obtaining your sales tax certificate allows you to do so.