Alaska Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption

Description

How to fill out Certification Of No Information Reporting On Sale Or Exchange Of Principal Residence - Tax Exemption?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a variety of legal template forms that can be downloaded or printed.

By using the website, you will find thousands of forms for commercial and individual purposes, organized by categories, states, or keywords. You can access the most up-to-date versions of forms like the Alaska Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption in just a few minutes.

If you currently hold a monthly subscription, Log In and download the Alaska Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption from your US Legal Forms library. The Acquire button will be visible on every form you review. You can access all previously downloaded forms in the My documents section of your account.

Process the transaction. Use your credit card or PayPal account to complete the transaction.

Select the format and download the form to your device. Edit. Fill out, modify, print, and sign the downloaded Alaska Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption. Each template added to your account does not expire and is yours permanently. Therefore, if you wish to download or print another copy, simply visit the My documents section and click on the form you require.

- Ensure you have selected the correct form for your area/county.

- Click the Review button to check the form's details.

- Verify the form information to make sure you have selected the appropriate one.

- If the form does not meet your requirements, use the Search box at the top of the screen to find the right one.

- If you are pleased with the selected form, confirm your choice by clicking the Get now button.

- Then, choose your preferred payment plan and provide your details to register for an account.

Form popularity

FAQ

To report the sale of shares, you need to complete Schedule D and report your capital gains or losses. Make sure to include any necessary details about the transactions and the costs associated with acquiring the shares. Using the Alaska Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption may help clarify if such capital gains apply to your situation.

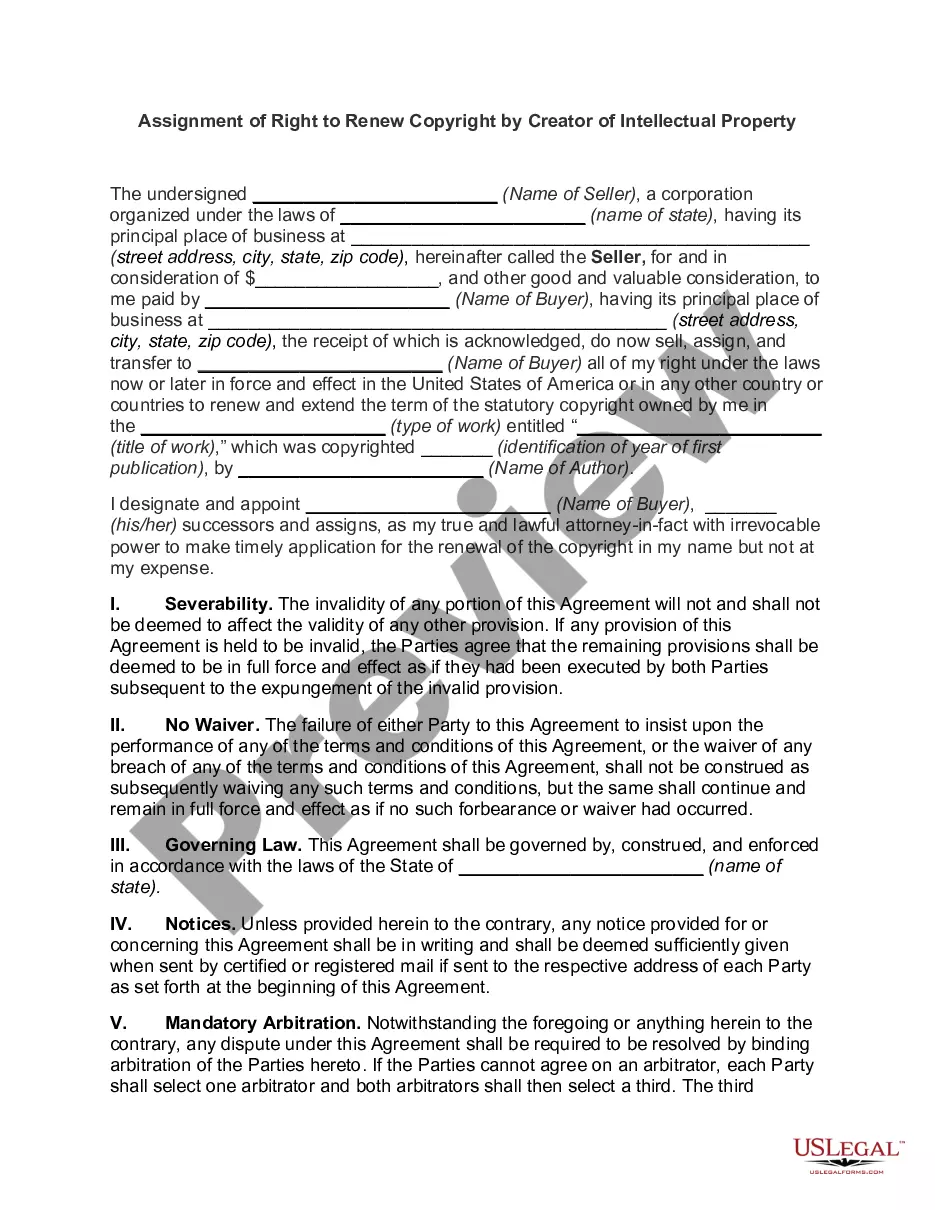

The form you are referring to Certification for No Information Reporting on the Sale or Exchange of a Principal Residence is a form which is to be completed by the seller of a principal residence in order to determine whether the sale or exchange needs to be reported to the IRS on Form 1099-S, Proceeds

CERTIFICATION FOR NO INFORMATION REPORTING. ON THE SALE OR EXCHANGE OF A PRINCIPAL RESIDENCE. This form may be completed by the seller of a principal residence.

As a real estate closing agent, you have many responsibilities, but those responsibilities don't end with the exchange of keys. Closing agents are required by the IRS to submit Form 1099-S to report the sale or exchange of real estate.

File Form 1099-S, Proceeds From Real Estate Transactions, to report the sale or exchange of real estate.

If you are looking for 1099s from earlier years, you can contact the IRS and order a wage and income transcript. The transcript should include all of the income that you had as long as it was reported to the IRS. All you need to do is fill out a Form 4506-T and mail or fax it off to the IRS.

If you have not received an expected 1099 by a few days after that, contact the payer. If you still do not get the form by February 15, call the IRS for help at 1-800- 829-1040. In some cases, you may obtain the information that would be on the 1099 from other sources.

When you sell your home, federal tax law requires lenders or real estate agents to file a Form 1099-S, Proceeds from Real Estate Transactions, with the IRS and send you a copy if you do not meet IRS requirements for excluding the taxable gain from the sale on your income tax return.

Businesses are required to issue a 1099 form to a taxpayer (other than a corporation) who has received at least $600 or more in non-employment income during the tax year. For example, a taxpayer might receive a 1099 form if they received dividends, which are cash payments paid to investors for owning a company's stock.

The form you are referring to Certification for No Information Reporting on the Sale or Exchange of a Principal Residence is a form which is to be completed by the seller of a principal residence in order to determine whether the sale or exchange needs to be reported to the IRS on Form 1099-S, Proceeds