Nevada Certificate of Trust by Corporation

Description

any person in lieu of providing a copy of the trust instrument to establish

the existence or terms of the trust. A certification of trust may be executed

by the trustee voluntarily or at the request of the person with whom the

trustee is dealing.

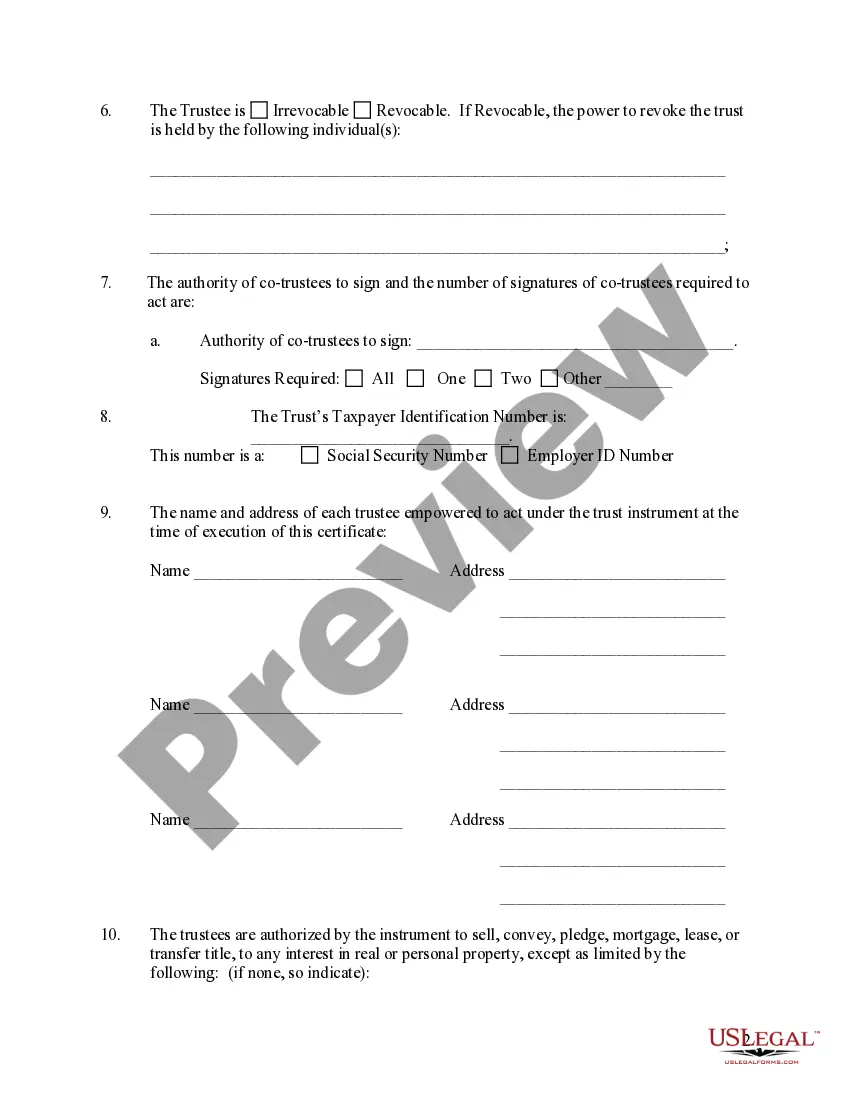

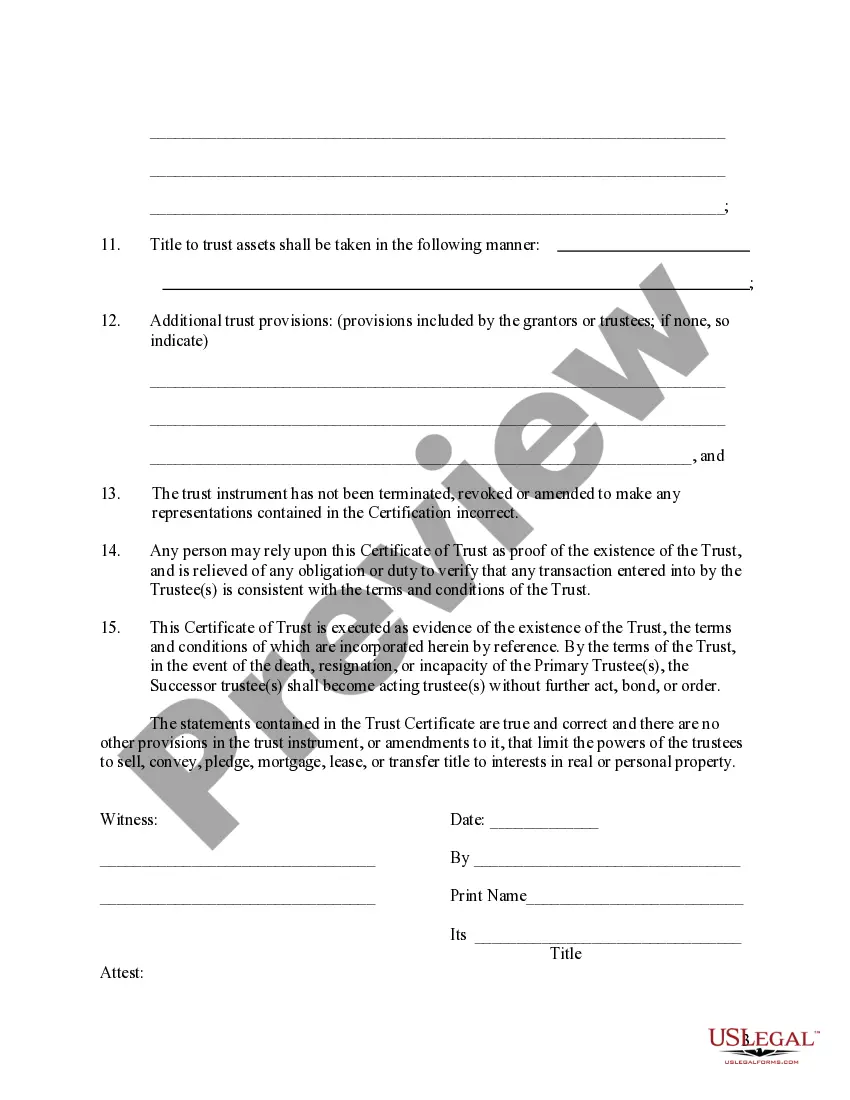

How to fill out Nevada Certificate Of Trust By Corporation?

US Legal Forms is really a unique platform to find any legal or tax template for completing, such as Nevada Certificate of Trust by Corporation. If you’re fed up with wasting time searching for perfect examples and spending money on file preparation/attorney fees, then US Legal Forms is exactly what you’re seeking.

To experience all the service’s benefits, you don't have to download any software but just pick a subscription plan and create your account. If you have one, just log in and find the right template, save it, and fill it out. Downloaded files are kept in the My Forms folder.

If you don't have a subscription but need to have Nevada Certificate of Trust by Corporation, have a look at the instructions listed below:

- Double-check that the form you’re looking at applies in the state you need it in.

- Preview the sample and look at its description.

- Click Buy Now to access the register page.

- Choose a pricing plan and carry on signing up by entering some info.

- Pick a payment method to complete the sign up.

- Save the document by choosing your preferred format (.docx or .pdf)

Now, complete the document online or print it. If you are unsure about your Nevada Certificate of Trust by Corporation form, speak to a legal professional to analyze it before you decide to send or file it. Get started without hassles!

Form popularity

FAQ

California Trust Certificates Law. Delaware Trust Certificates Law. Idaho Trust Certificates Law. Iowa Trust Certificates Law. Minnesota Trust Certificates Law. Mississippi Trust Certificates Law. Nevada Trust Certificates Law. Ohio Trust Certificates Law.

A: An affidavit of trust and a certificate of trust are essentially the same thing. At least they serve the same functions. Simply put, an affidavit of trust is an abbreviated version of the trust agreement that provides general information about the terms of the trust.

The declaration of trust is your trust. The certificate of trust is not needed but can help keep things private and provide a easier way to open bank or stock accounts...

Nevada Business Trusts are great legal stallions for investment types of business ventures (although they are not limited to investment fund), governed by NRS Chapter 88A.Trusts are an investment and asset protection tools.

A trust document isn't required to be filed. If you are transferring real estate into a trust, a deed will need oo be filed at the county recorder's office.The declaration will detail the terms and conditions of the living trust, including who will serve as the Trustee.

If you have a trust in Michigan, state law provides that you can register the trust. Registering a Michigan trust is not required (except for certain charitable trusts, as discussed below). Even for non-charitable trusts, there are good reasons that a trust should be registered.

A certification of trust (or "trust certificate") is a short document signed by the trustee that simply states the trust's essential terms and certifies the trust's authority without revealing private details of the trust that aren't relevant to the pending transaction.

A Certificate of Trust is recorded in the Official Records of the county in which any trust real property is located. It aids in clearing title to the property. Generally, where the trust owns no real property, there is no need to record a Certificate...

A business trust is set up when the assets and property of a business corporation are entrusted to an appointed trustee. The trustees will manage the operation and assets of the business, not for their own profit, but for the profit of the beneficiaries.