Nevada Quitclaim Deed - Individual to a Trust

Understanding this form

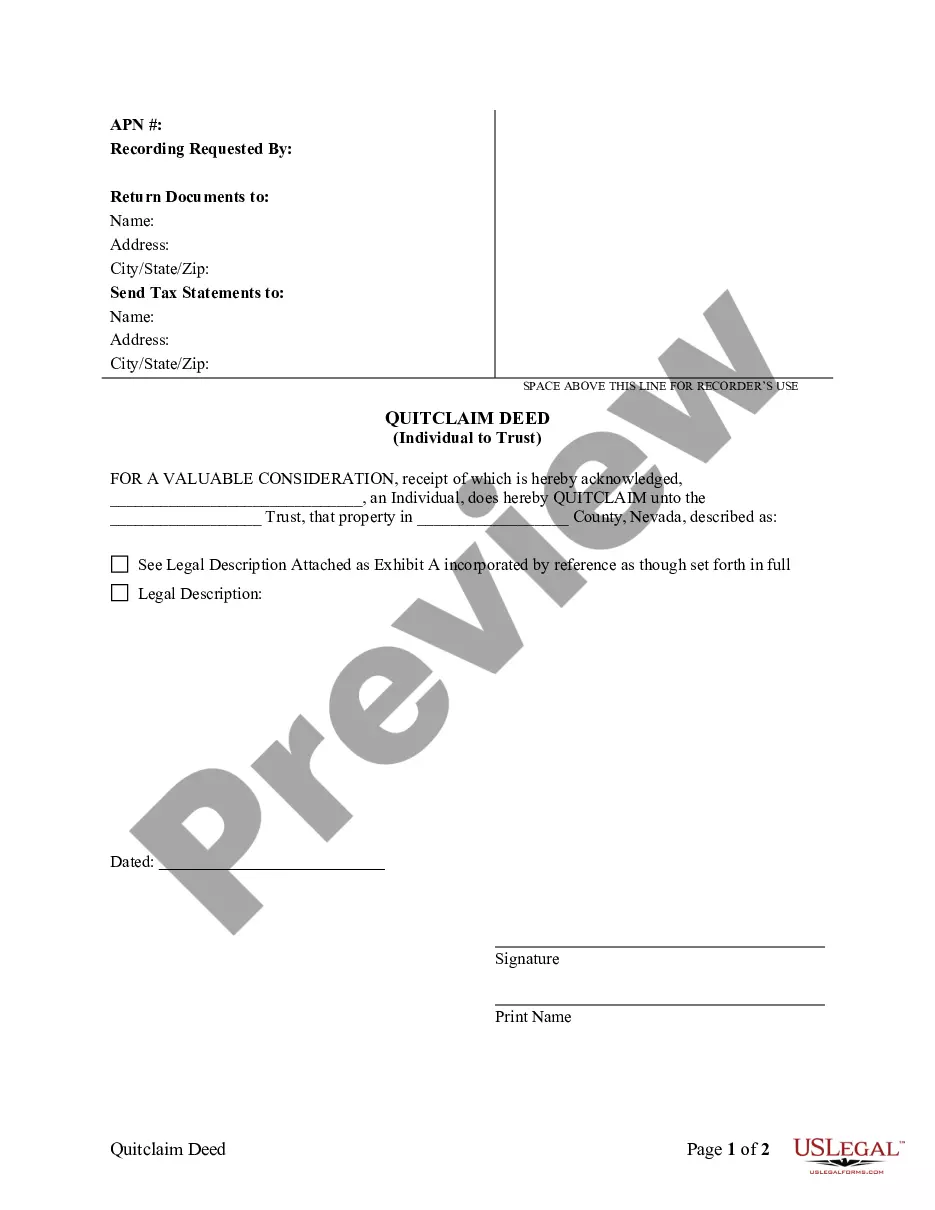

The Quitclaim Deed - Individual to a Trust is a legal document used to transfer property ownership from an individual (the Grantor) to a trust (the Grantee). This form allows the Grantor to convey and quitclaim their interest in the property, effectively transferring ownership without guaranteeing any claims against it. Unlike other deed types, a quitclaim does not require a title search, making it a straightforward option for property transfers to a trust.

What’s included in this form

- Identifies the Grantor (individual) and Grantee (trust) involved in the transaction.

- Includes a precise legal description of the property being transferred.

- Specifies the date of the transfer.

- Includes a statement of the Grantor's intent to quitclaim the property.

- Provides space for signatures of the Grantor and witnesses, if applicable.

Common use cases

This form is useful when an individual wishes to transfer real property to a trust they have established. It can be used for estate planning purposes, ensuring that the property is managed according to the terms of the trust. Additionally, it is applicable when the Grantor wants to simplify the transfer of property without the complexities of a warranty deed.

Intended users of this form

This form is suitable for:

- Individuals who are transferring property to their own trust.

- Trustees of a trust receiving property from a Grantor.

- Estate planners seeking to simplify asset management for beneficiaries.

How to complete this form

- Identify the parties involved: Enter the name of the Grantor and the name of the trustee or trust.

- Specify the property: Fill in the legal description of the property as required.

- Enter the date of the deed: Include the date on which the transfer occurs.

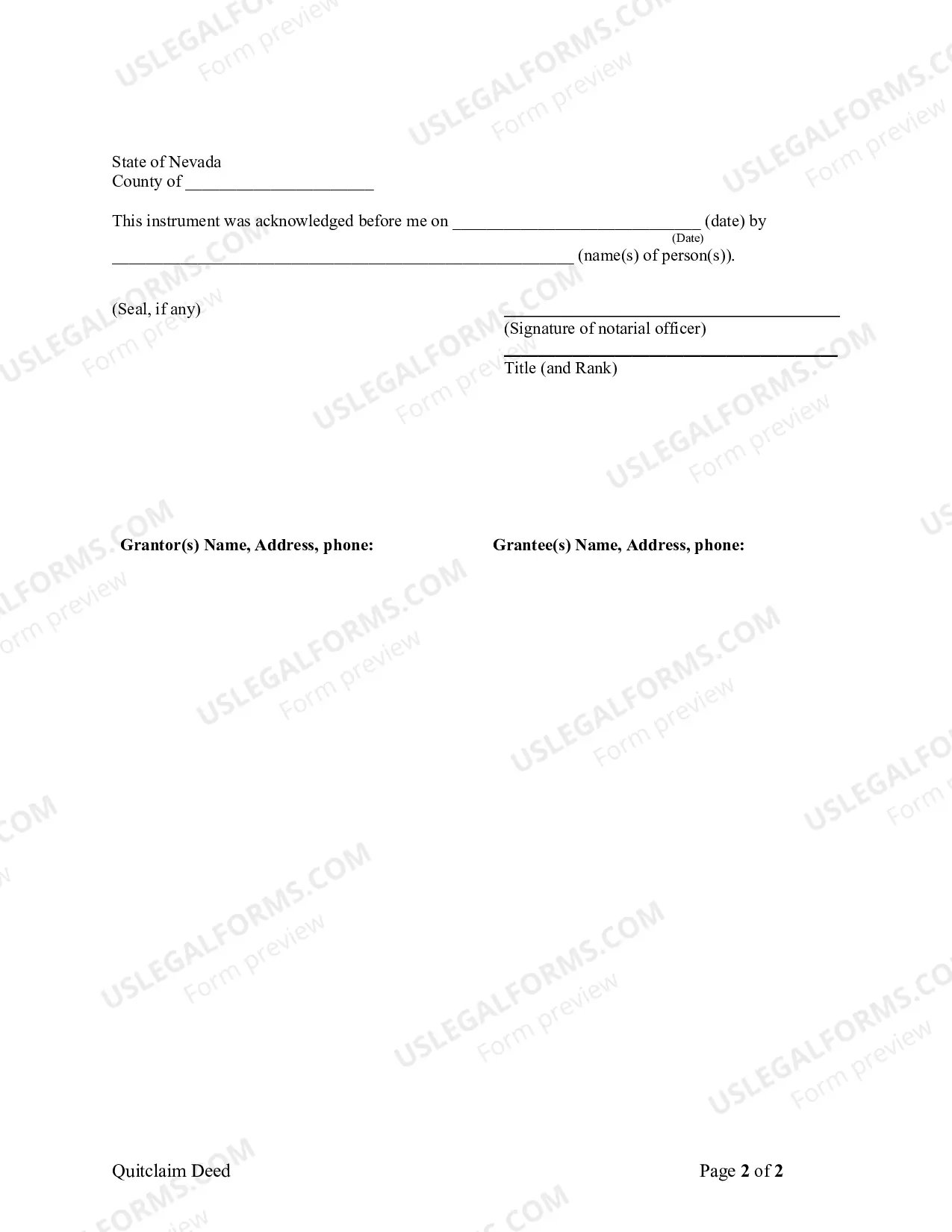

- Sign the document: The Grantor must sign in the designated area, and witnesses should sign if required by state law.

- Record the deed: File the completed quitclaim deed with the appropriate county office to finalize the transfer.

Notarization requirements for this form

This form must be notarized to be legally valid. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call.

Typical mistakes to avoid

- Failing to include a complete legal description of the property.

- Not signing the document in front of witnesses when required by state law.

- Neglecting to record the quitclaim deed with the county office.

Benefits of completing this form online

- Convenience of downloading and completing the form at your own pace.

- Editability allows you to update specific information easily.

- Reliable formats that comply with legal requirements in your state.

Legal use & context

- Provides a legal basis for transferring property without guarantees.

- Serves as a simple and cost-effective means to convey property to a trust.

- Generally enforceable but may not address potential liens on the property.

Key takeaways

- The Quitclaim Deed - Individual to a Trust is a straightforward way to transfer property ownership to a trust.

- Completing the form accurately is essential for valid property transfer.

- Being aware of state-specific requirements helps ensure the effectiveness of the deed.

Form popularity

FAQ

The act of transferring a property that is owned by an individual into a trust, will see the trust liable to pay stamp duty on acquisition of the asset. Additionally, the individual who is transferring ownership to the trust, will be liable to pay capital gains tax on the disposal of the asset.

Locate your current deed. Use the proper deed. Check with your title insurance company and lender. Prepare a new deed. Sign in the presence of a notary. Record the deed in the county clerk's office. Locate the deed that's in trust. Use the proper deed.

A quitclaim deed can be used to transfer property from a trust, but a Special Warranty Deed seems to be a more common way to do this.

Take the signed and notarized quitclaim deed to your county recorder's office to complete the transfer of title into your revocable trust. Check in two to four weeks to ensure it has been recorded. Include the address of the property on the asset list addendum attached to your trust.

Transferring Real Property to a Trust You can transfer your home (or any real property) to the trust with a deed, a document that transfers ownership to the trust. A quitclaim deed is the most common and simplest method (and one you can do yourself).