New Mexico Transfer on Death Deed from Two Individuals / Husband and Wife to Two Individuals / Husband and Wife

About this form

The Transfer on Death Deed allows a married couple or two individuals to transfer property to designated grantees without the property going through probate upon their death. Unlike traditional property transfers, this deed is revocable until the death of the last surviving grantor. It provides flexibility for the grantors, as they can change the beneficiary at any time during their lifetime. The grantees can hold the property either as tenants in common, joint tenants with the right of survivorship, or as community property, in accordance with state laws.

When to use this form

This form is useful when a married couple or two individuals wish to plan for the future transfer of property to heirs without going through the probate process. It can be used when both grantors want to ensure that their property is passed efficiently to their chosen grantees and want to maintain control over the deed while they are still alive.

Who this form is for

This form is intended for:

- Married couples who want to manage their property transfer upon death.

- Two individuals who wish to transfer property to another couple or individual.

- Individuals seeking a simple estate planning solution to avoid probate for their property.

How to complete this form

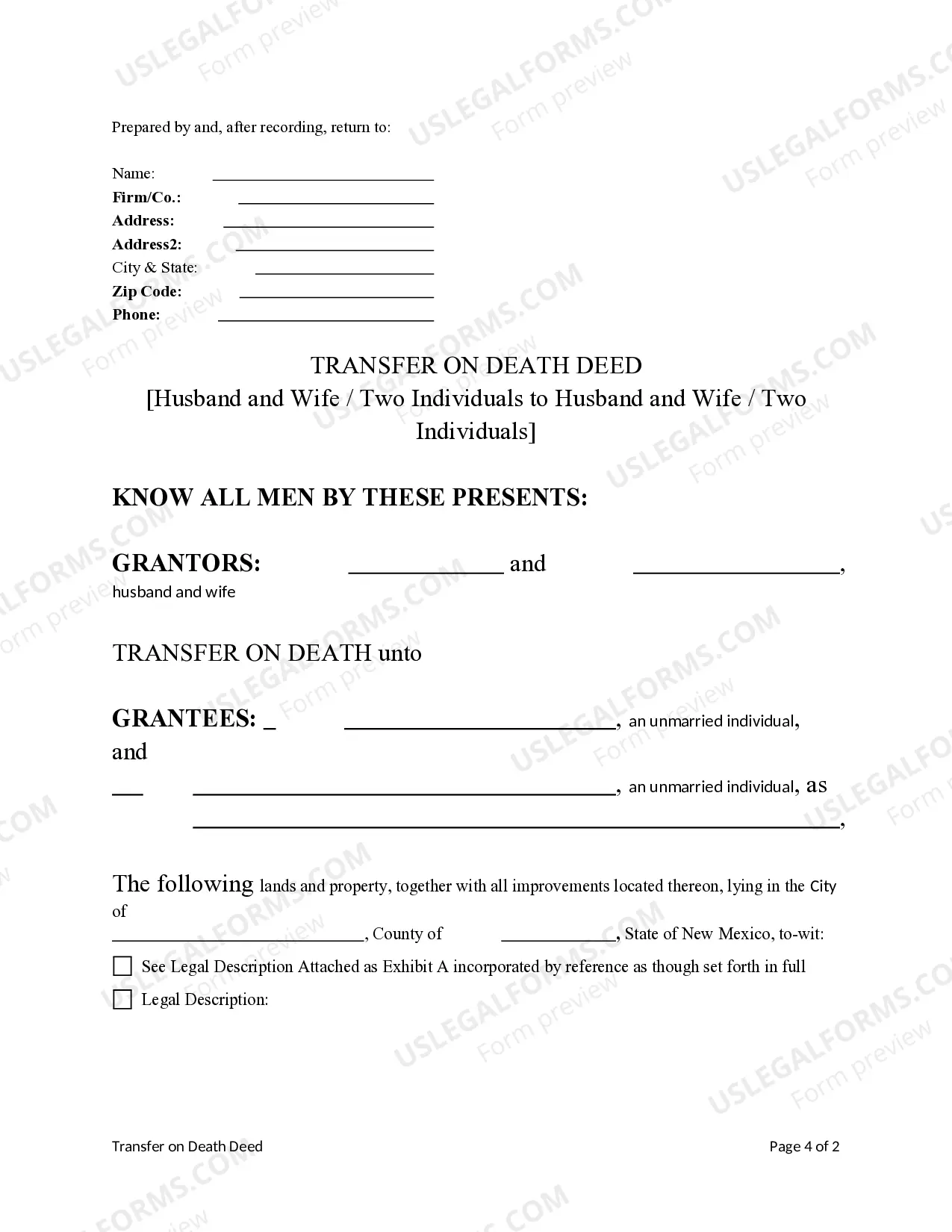

- Identify the grantors: List the names of the husband and wife or the two individuals transferring the property.

- Specify the grantees: Enter the names of the individuals who will receive the property upon the passing of the last grantor.

- Describe the property: Provide a clear description of the real estate being transferred.

- Select the tenancy type: Indicate whether the property will be held as tenants in common, joint tenants with the right of survivorship, community property, or community property with right of survivorship.

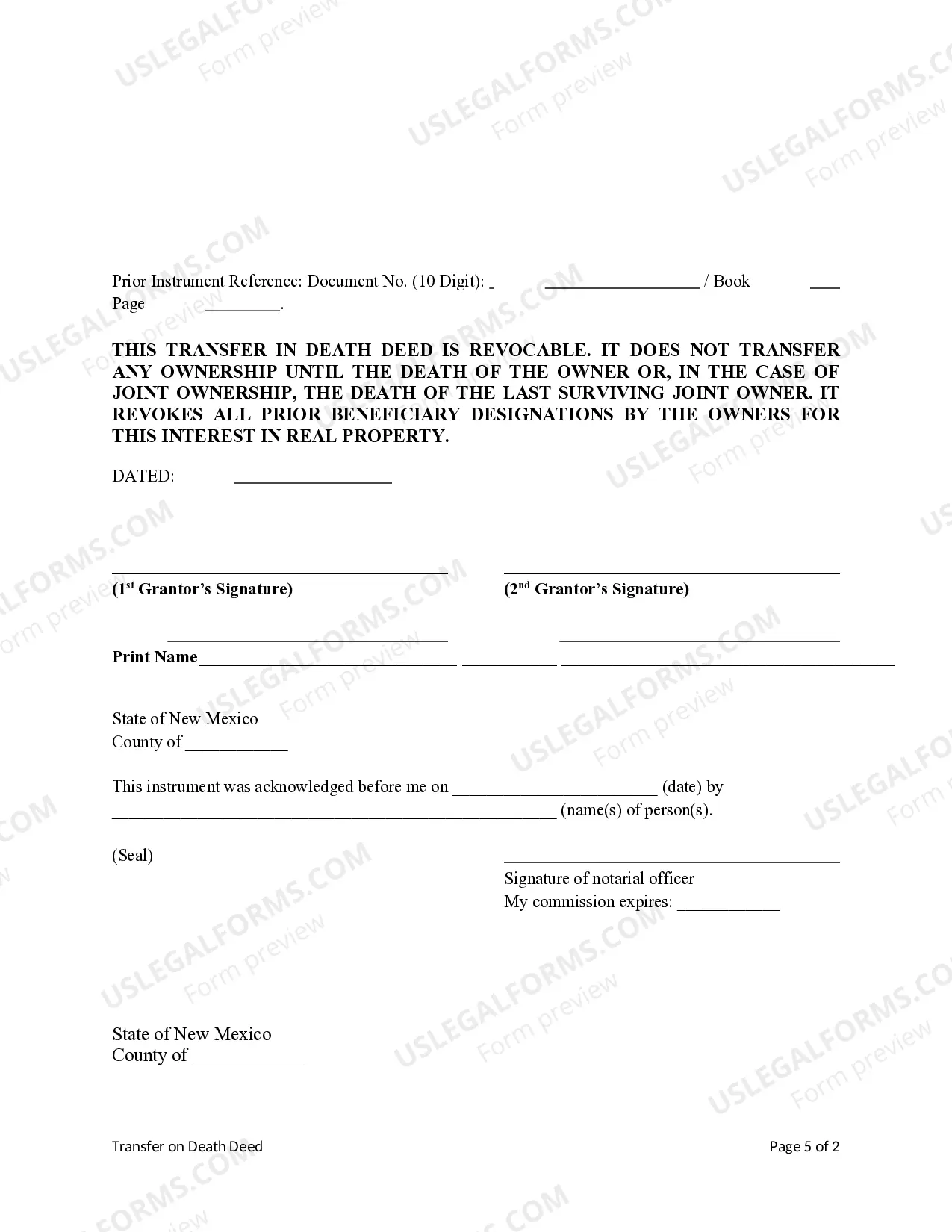

- Sign and date: Have both grantors sign and date the deed to complete the transfer legally.

Is notarization required?

This form must be notarized to be legally valid. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to specify how the grantees will hold the property.

- Leaving property descriptions vague or incomplete.

- Not signing the deed or missing dates, which can invalidate the transfer.

- Failing to keep the deed updated if personal circumstances change.

Benefits of using this form online

- Instant access: Download the form immediately after purchase for convenience.

- Editability: Easily fill out the form digitally to ensure accuracy.

- Reliability: Forms are drafted by licensed attorneys to comply with legal requirements.

Looking for another form?

Form popularity

FAQ

In most cases, the surviving owner or heir obtains the title to the home, the former owner's death certificate, a notarized affidavit of death, and a preliminary change of ownership report form. When all these are gathered, the transfer gets recorded, the fees are paid, and the county issues a new title deed.

To transfer it, you will have to get a succession certificate (for moveable property) and a letter of administration (for Immoveable property). While doing so, get the son and daughter to give no objections in court that they have no objection if all the property is transferred to the widow.

Get a Deed Form or Prepare Your Own. You can buy a state-specific TOD deed form for your state or type up your own document. Name the Beneficiary. Describe the Property. Sign the Deed. Record the Deed.

TOD becomes effective for joint accounts if both owners pass away simultaneously. Joint and TOD registration generally allow an account to pass outside the probate estate, enabling the surviving owner or beneficiaries to avoid the time and expense of that process for this account.

When one co-owner dies, property that was held in joint tenancy with the right of survivorship automatically belongs to the surviving owner (or owners). The owners are called joint tenants.

To transfer it, you will have to get a succession certificate (for moveable property) and a letter of administration (for Immoveable property). While doing so, get the son and daughter to give no objections in court that they have no objection if all the property is transferred to the widow.

If you'd like to avoid having your property going through the probate process, it's a good idea to look into a transfer on death deed. A transfer on death deed allows you to select a beneficiary who will receive your property, but only when you've passed away.

The California TOD deed form allows property to be automatically transferred to a new owner when the current owner dies, without the need to go through probate. It also gives the current owner retained control over the property, including the right to change his or her mind about the transfer.

All you need to do is fill out a simple form, provided by the bank, naming the person you want to inherit the money in the account at your death. As long as you are alive, the person you named to inherit the money in a payable-on-death (POD) account has no rights to it.