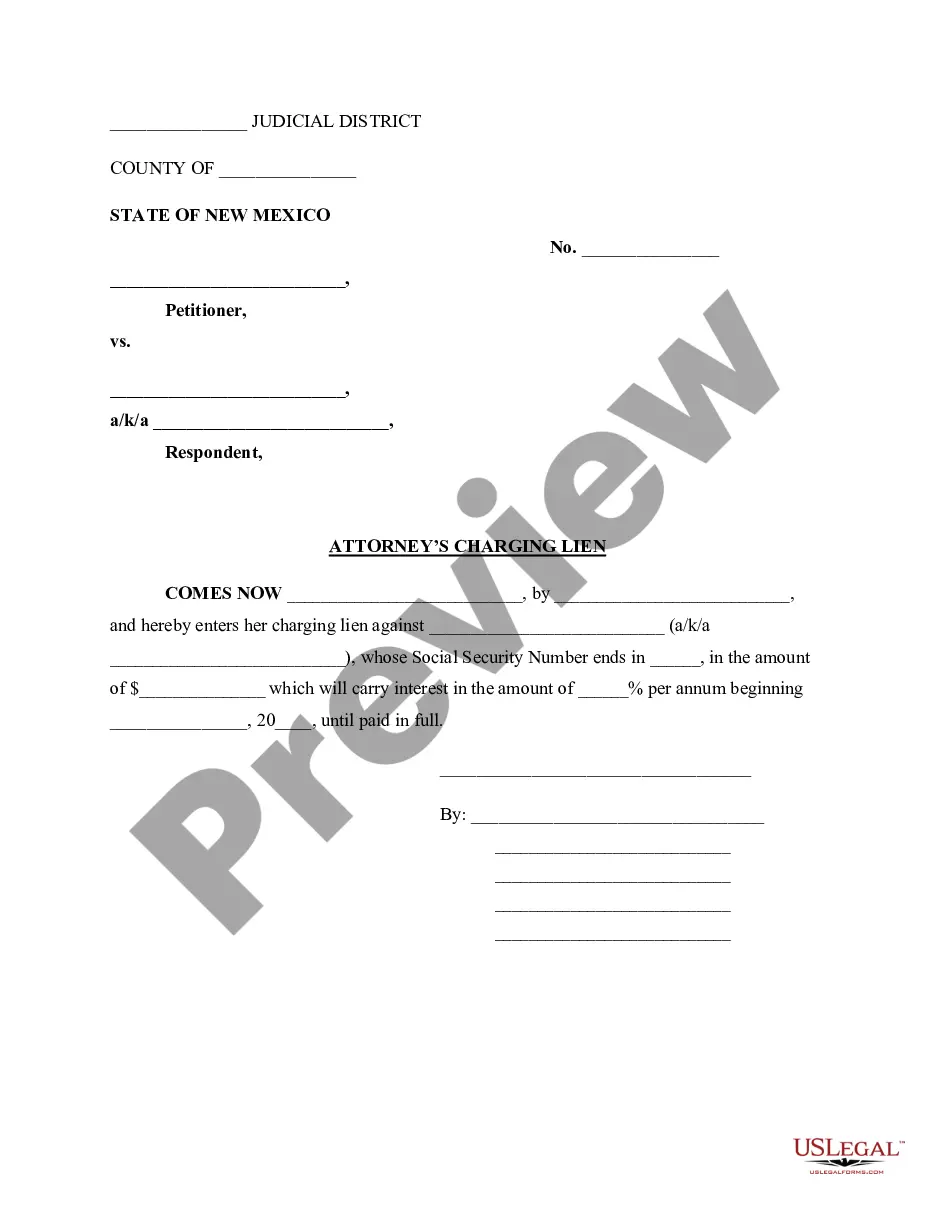

New Mexico Attorney Charging Lien

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out New Mexico Attorney Charging Lien?

US Legal Forms is really a unique system to find any legal or tax form for submitting, including New Mexico Attorney Charging Lien. If you’re sick and tired of wasting time searching for perfect examples and paying money on papers preparation/lawyer service fees, then US Legal Forms is exactly what you’re searching for.

To experience all the service’s advantages, you don't need to download any software but just choose a subscription plan and create your account. If you already have one, just log in and find a suitable template, download it, and fill it out. Downloaded files are all kept in the My Forms folder.

If you don't have a subscription but need New Mexico Attorney Charging Lien, check out the guidelines below:

- make sure that the form you’re considering applies in the state you need it in.

- Preview the example its description.

- Click Buy Now to get to the sign up webpage.

- Pick a pricing plan and proceed signing up by providing some info.

- Decide on a payment method to finish the registration.

- Save the file by choosing your preferred file format (.docx or .pdf)

Now, submit the file online or print out it. If you feel unsure about your New Mexico Attorney Charging Lien template, contact a lawyer to check it before you decide to send out or file it. Begin hassle-free!

Form popularity

FAQ

Once entered, a judgment is enforceable in New Mexico for fourteen years and cannot be renewed. In New Mexico, it is a crime to intentionally issue a bad check, punishable by incarceration of thirty days to three years, depending on the amount of the check.

Consensual liens are considered good liens and do not impact your credit. These include mortgages, vehicles, and business assets. Statutory liens are considered the bad kind and can will remain listed on your credit for seven years.These occur when a court grants a financial interest in your assets to a creditor.

If a creditor gets a judgment against you, it can then place a lien on your property. The lien gives the creditor an interest in your property so that it can get paid for the debt you owe.And in some cases, the lien gives the creditor the right to force a sale of your property in order to get paid.

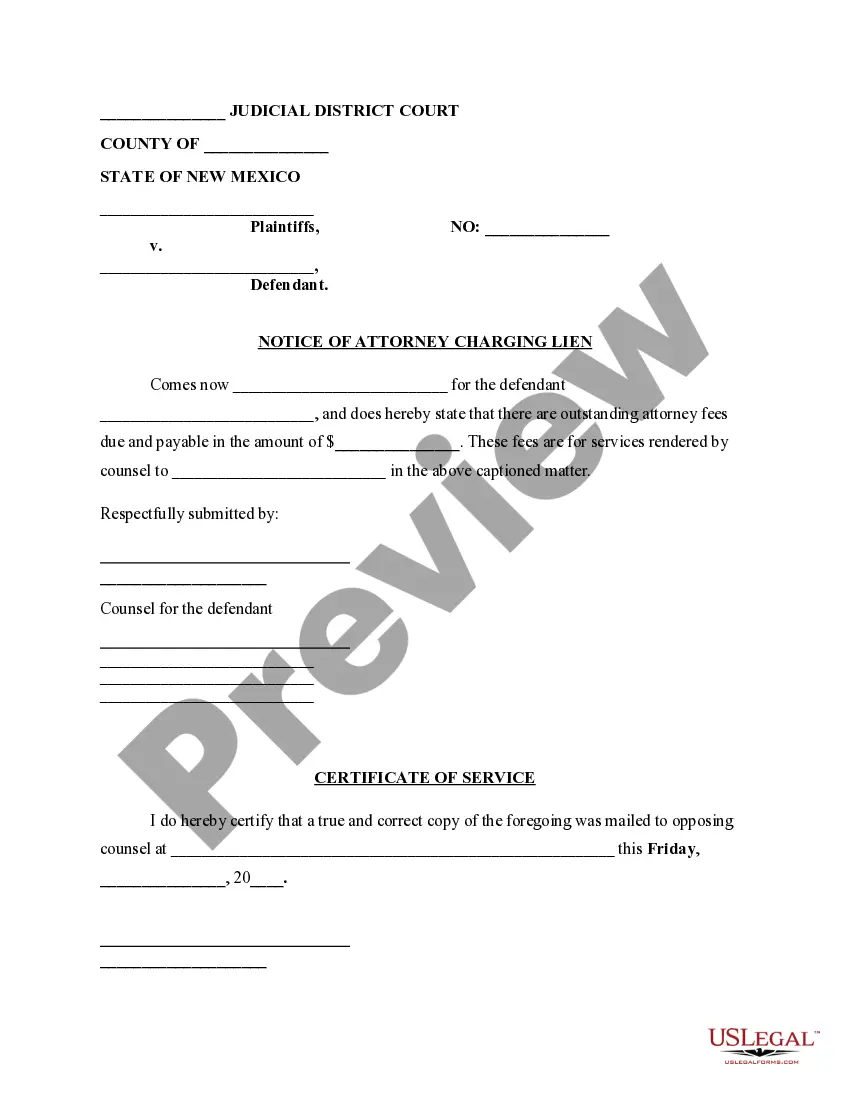

A type of attorney's lien under which a lawyer acquires an interest in a judgment awarded to the client. This may mean that the lawyer can eventually claim a portion of any money paid to the client due to the judgment. The lien arises because the client's failure to pay for legal services. See Retaining lien (compare).

The right of a lawyer to hold a client's property until the client pays for legal services provided. The property may include business files, official documents, and money awarded by a court.

Lien. n. any official claim or charge against property or funds for payment of a debt or an amount owed for services rendered. A lien is usually a formal document signed by the party to whom money is owed and sometimes by the debtor who agrees to the amount due.

How Liens Work. A lien provides a creditor with the legal right to seize and sell the collateral property or asset of a borrower who fails to meet the obligations of a loan or contract. The property that is the subject of a lien cannot be sold by the owner without the consent of the lien holder.

If you get sued, lose and don't pay, the claimant can file liens against your assets, including real estate. You won't be able to sell or borrow against the property without paying them first. And, if you fail to satisfy the lien, the lienholder can file for foreclosure.