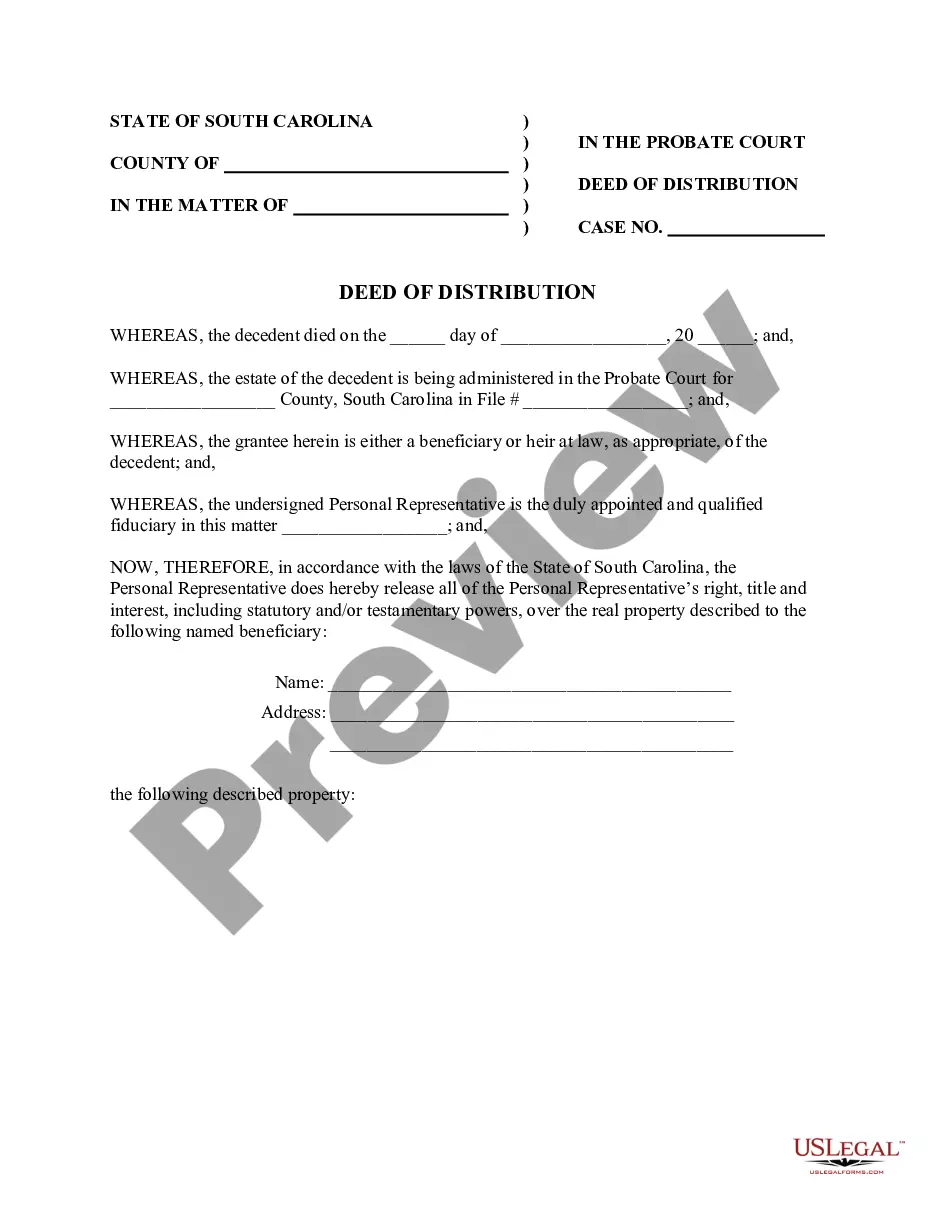

South Carolina Deed of Distribution - Personal Representative to Beneficiary

Description

How to fill out South Carolina Deed Of Distribution - Personal Representative To Beneficiary?

Among lots of free and paid examples that you’re able to find online, you can't be certain about their reliability. For example, who made them or if they’re qualified enough to take care of the thing you need these to. Keep calm and utilize US Legal Forms! Discover South Carolina Deed of Distribution - Personal Representative to Beneficiary samples developed by professional legal representatives and avoid the high-priced and time-consuming process of looking for an lawyer and after that having to pay them to write a papers for you that you can find on your own.

If you already have a subscription, log in to your account and find the Download button near the form you’re seeking. You'll also be able to access all of your earlier acquired samples in the My Forms menu.

If you’re utilizing our website for the first time, follow the instructions below to get your South Carolina Deed of Distribution - Personal Representative to Beneficiary fast:

- Make sure that the document you discover is valid in the state where you live.

- Review the file by reading the description for using the Preview function.

- Click Buy Now to start the ordering procedure or find another example using the Search field found in the header.

- Choose a pricing plan sign up for an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the preferred format.

As soon as you have signed up and bought your subscription, you may use your South Carolina Deed of Distribution - Personal Representative to Beneficiary as many times as you need or for as long as it stays active where you live. Revise it with your preferred offline or online editor, fill it out, sign it, and create a hard copy of it. Do much more for less with US Legal Forms!

Form popularity

FAQ

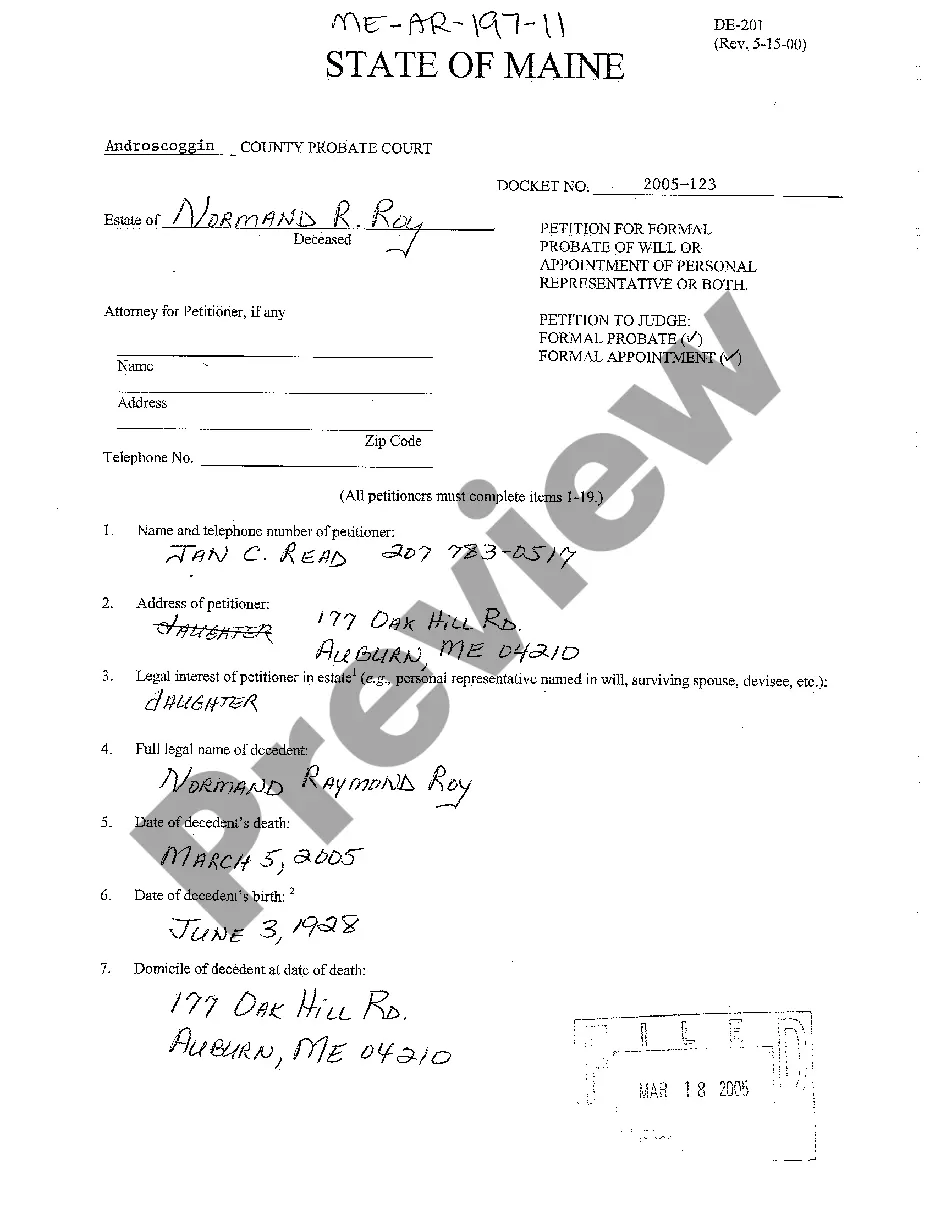

In South Carolina, it will take a minimum of eight months to probate because the law requires it to remain open to allow creditors to file claims. Beyond the minimum eight months, several factors determine how long probate takes to conclude.

First, the relevant statute limits personal representative fees to 5% of the value of personal property, plus 5% of the sale of real property.

As the Personal Representative, you are responsible for doing the following: 2022 Collecting and inventorying the assets of the estate; 2022 Managing the assets of the estate during the probate process; 2022 Paying the bills of the estate. Making distribution to the heirs or beneficiaries of the estate.

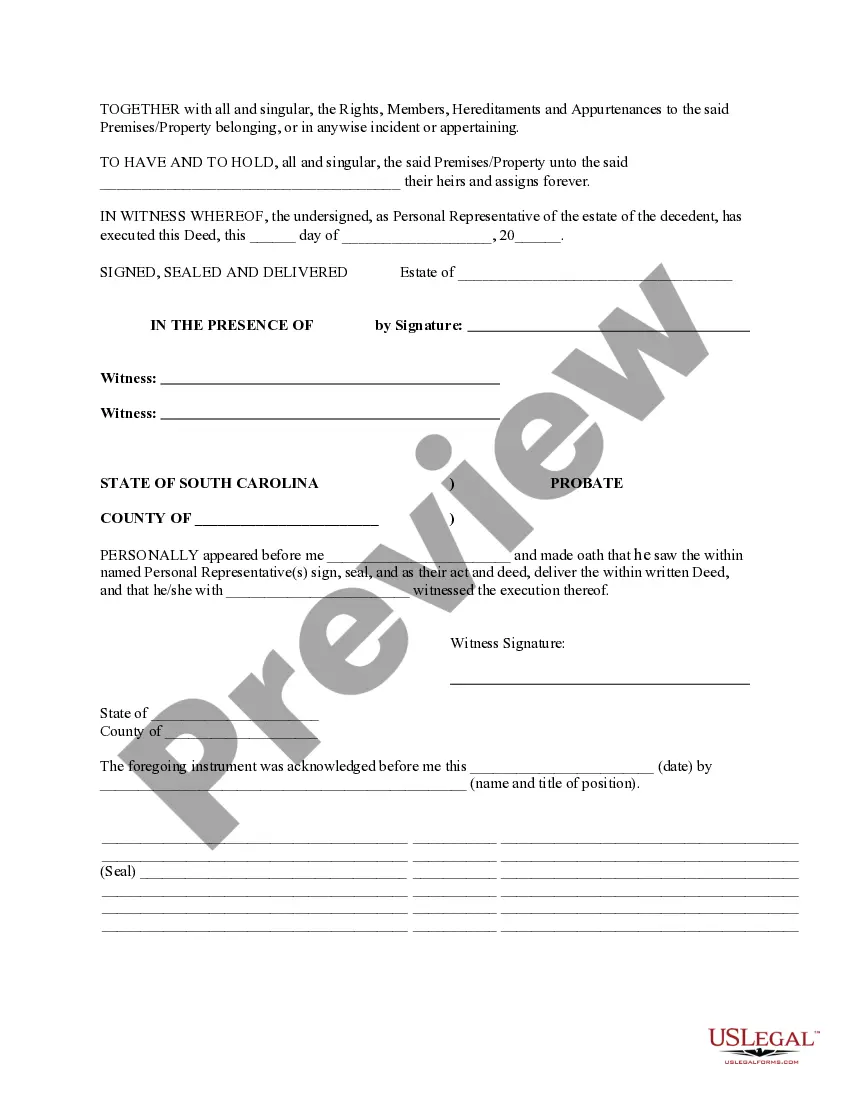

In South Carolina, the grantor must sign the deed in front of two witnesses and in the presence of an individual authorized by the state to administer an oath. Record the completed deed at the local county Recorder's office, along with an Affidavit of True Consideration (S.C. Code Ann.

Generally speaking, a Personal Representative is responsible for opening the estate, collecting the assets of the estate, protecting the estate property, preparing an inventory of the property, paying various estate expenses, valid claims (including debts and taxes) against the estate, representing the estate in claims

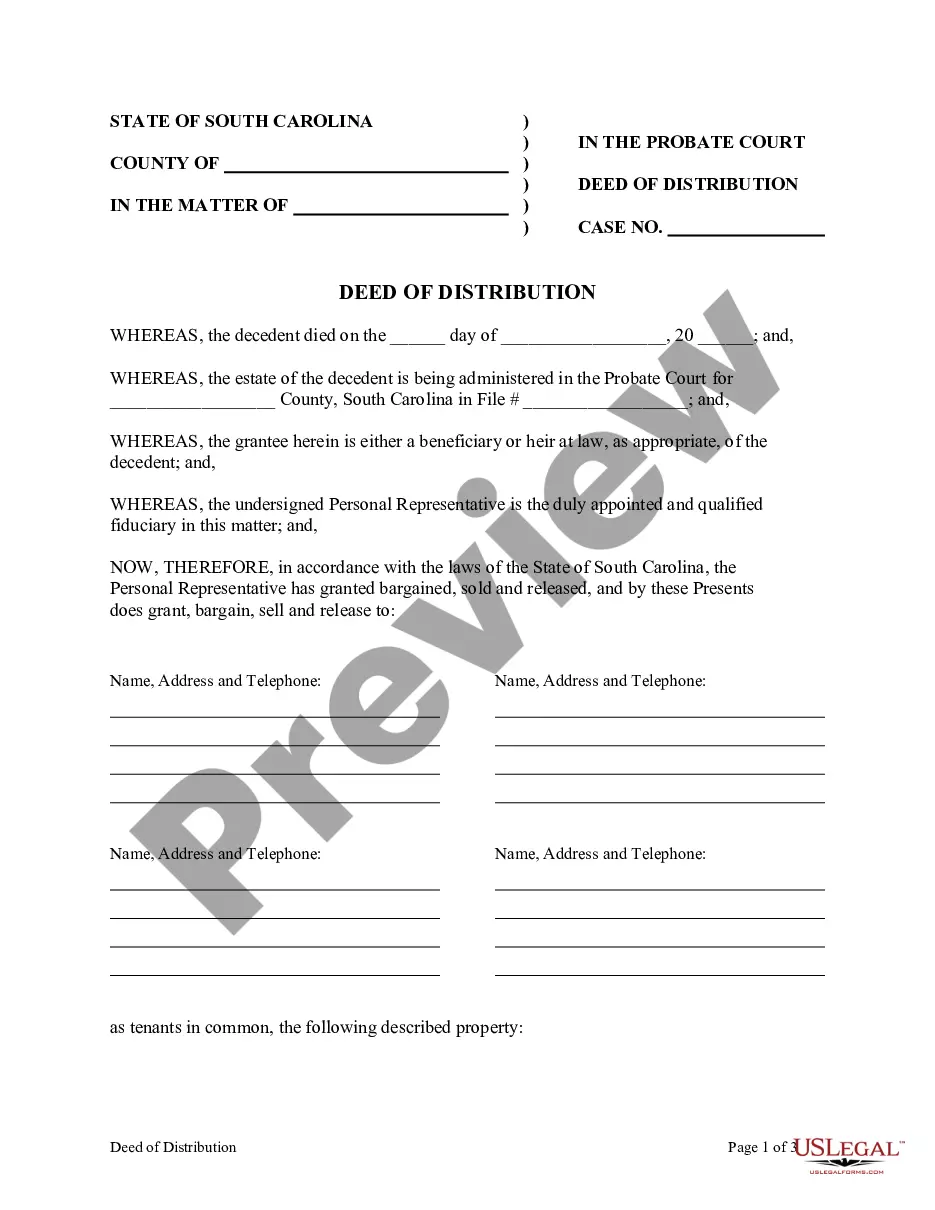

The deed of distribution is evidence of the beneficiary's title to the house, land or other real property interest of the decedent. An ancillary probate is often opened in South Carolina for the purpose of preparing a deed of distribution when an out-of-state decedent died owning real property in South Carolina.

South Carolina does not allow real estate to be transferred with transfer-on-death deeds.

A distribution deed is a way to legally transfer real property when the party who is supposed to receive the property cannot be determined from the decedent's will. In most cases, the distribution of a deceased person's estate will be done in accordance with the directions contained in the terms of their will.