New Mexico Heirship Affidavit - Descent

Understanding this form

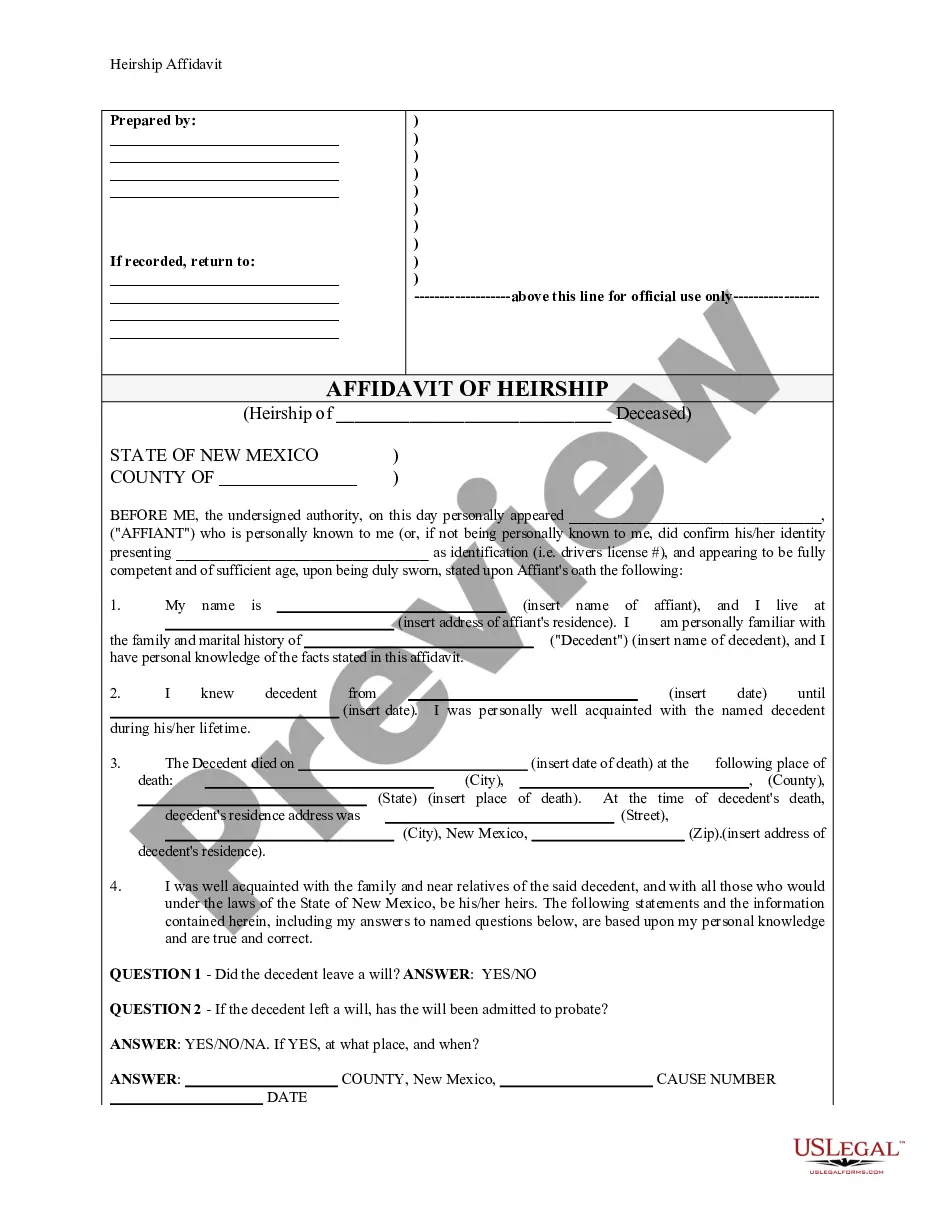

The Heirship Affidavit - Descent is a legal document used to declare the heirs of a deceased individual. This form helps establish the rightful ownership of personal and real property when someone passes away without a will. Unlike a will, which outlines a person's wishes for the distribution of their estate, this affidavit serves to affirm the legal heirs under state law, making it a crucial tool for heirs who need to secure their inheritance.

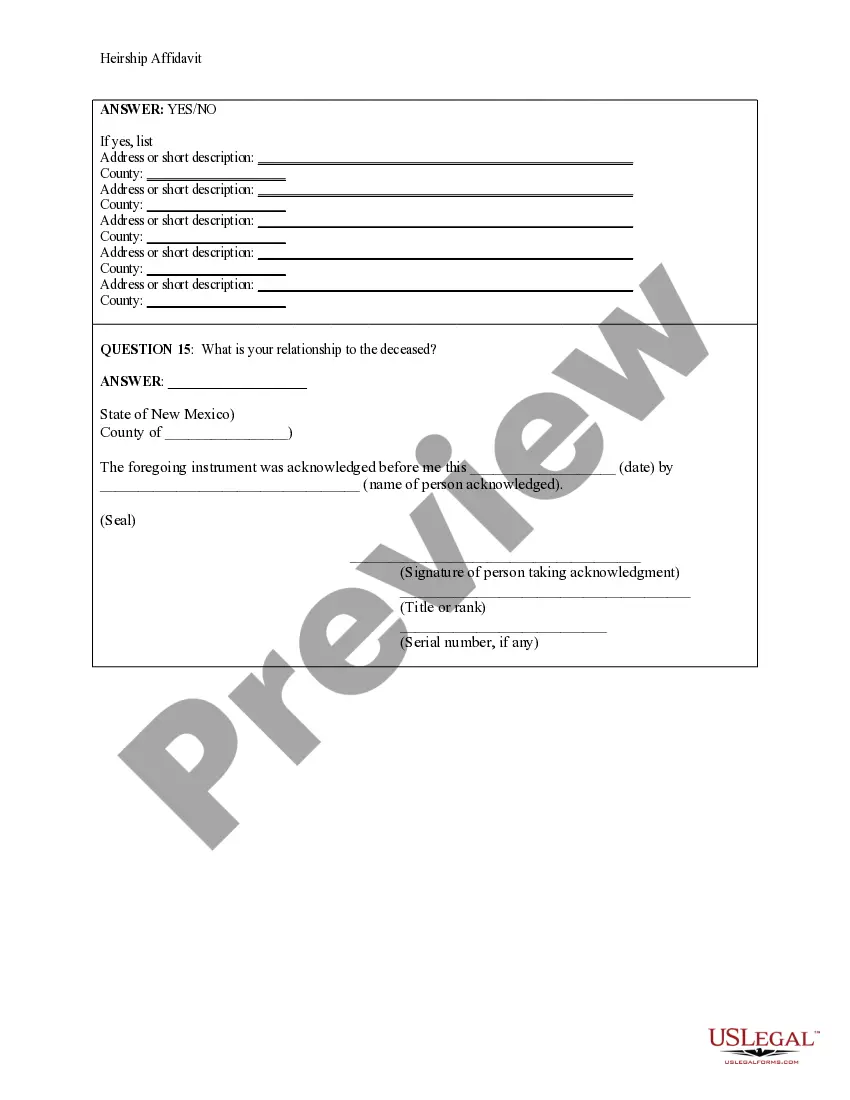

Form components explained

- Affiant's personal details including name and address.

- Information about the deceased, including name and date of death.

- Questions regarding the presence of a will and probate status.

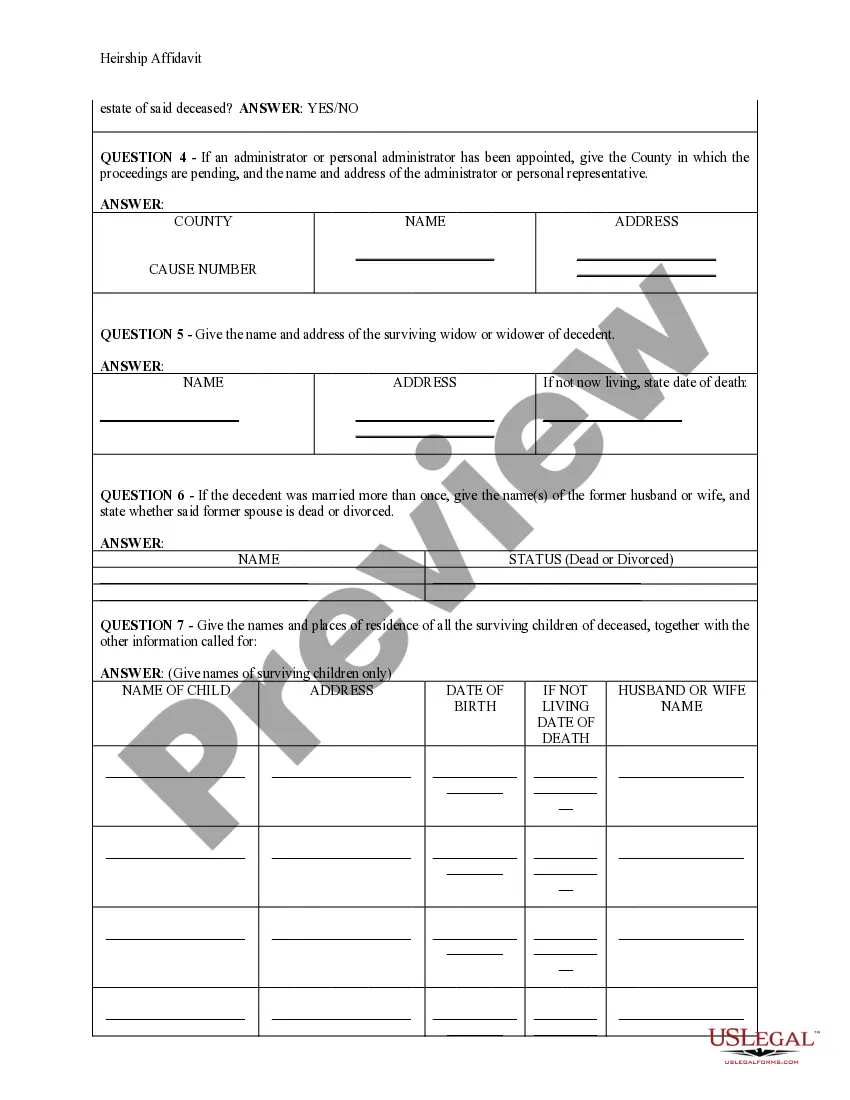

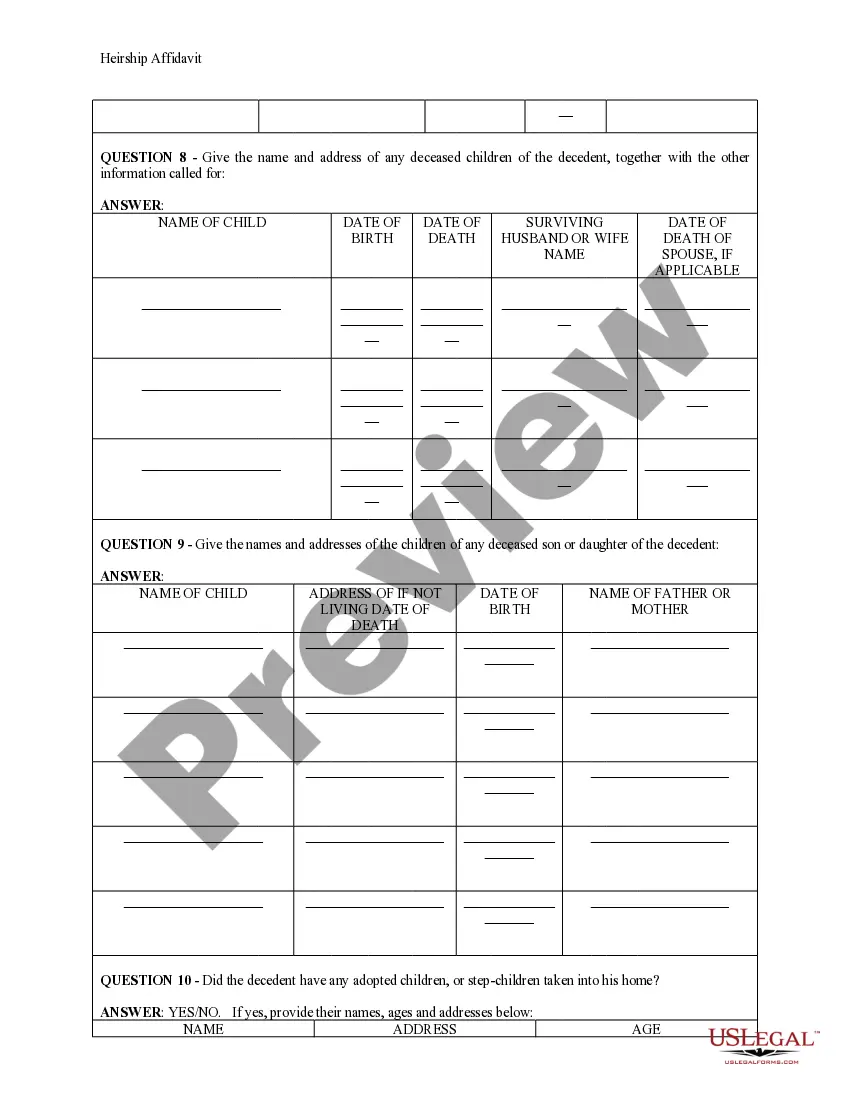

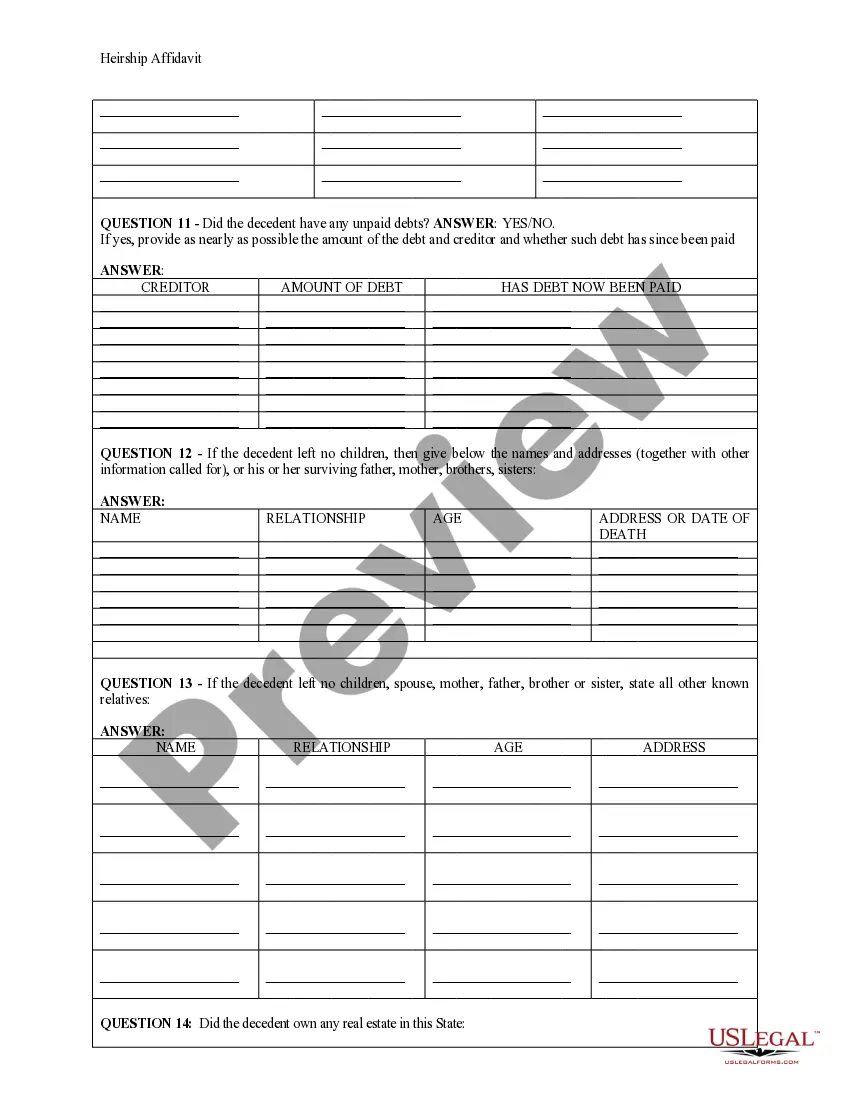

- Names and addresses of surviving heirs or relatives.

- Details about the deceased's property and debts.

- Signature and notarization section for legal validation.

When this form is needed

This form is typically used in situations where an individual dies intestate (without a will) and their heirs need to assert their rights to inherit property. For instance, if a person passes away leaving behind a house and other assets but no formal estate has been opened, heirs may need to file this affidavit to sell or transfer property legally. It is particularly useful when dealing with real estate transactions or settling estate matters efficiently.

Who this form is for

- Individuals who are heirs to an estate where the decedent left no will.

- Family members of the deceased who need to establish their legal rights to the decedent's property.

- Non-heirs acting on behalf of heirs to facilitate property transactions.

Completing this form step by step

- Identify yourself as the affiant by providing your name and address.

- Fill in the details about the deceased, including their name and date of death.

- Answer questions regarding the existence of a will and any probate proceedings.

- List the names and addresses of all known heirs and relatives.

- Sign the affidavit in the presence of a notary public for validation.

Does this document require notarization?

This document requires notarization to meet legal standards. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to provide complete information about the deceased.

- Omitting the names of all potential heirs.

- Incorrectly stating the existence or status of a will.

- Not having the document notarized where required.

Benefits of completing this form online

- Accessible and convenient for users to complete at their own pace.

- Edit and update the document easily before finalizing.

- Reliable legal forms drafted by licensed attorneys.

- Ensures compliance with state-specific requirements.

Main things to remember

- The Heirship Affidavit - Descent establishes the heirs of a deceased person.

- It is essential in cases where no will exists to facilitate property transfers.

- Timely and accurate completion can prevent legal complications for heirs.

- Notarization is necessary for legal acceptance of the affidavit.

Looking for another form?

Form popularity

FAQ

In New Mexico, you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

Dying without a Will in New MexicoIf you die without a valid will, you'll lose control over what happens to your assets after your death.If there isn't a will, the court will appoint someone, usually an adult child or surviving spouse, to be the executor or personal representative.

When someone dies without a will (or intestate), New Mexico probate law designates the surviving family members to whom the estate will pass.If the deceased left no surviving spouse, then the deceased's surviving children (both biological and adopted) receive the deceased's property in equal shares.

Q: How Long Does an Executor Have to Distribute Assets From a Will? A: Dear Waiting: In most states, a will must be executed within three years of a person's death.

A simple estate with just a few, easy-to-find assets may be all wrapped up in six to eight months. A more complicated affair may take three years or more to fully settle.

Normally, a probate must be filed within three years following the decedent's death. Under New Mexico law no appointment of a personal representative may be made during the first 120 hours (five days) following the death.

In most cases, it takes around 9-12 months for an Executor to settle an Estate.There is no set time limit for completing the Estate administration process in full, but there is a deadline for submitting the Inheritance Tax form which must be met by the Executor.

When someone dies without a will, it's called dying intestate. When that happens, none of the potential heirs has any say over who gets the estate (the assets and property). When there's no will, the estate goes into probate.Legal fees are paid out of the estate and it often gets expensive.

From start to finish, most New Mexico probates take about two years to complete. However, 90% of the work is usually done in the first five or six months of a probate, and most estates distribute assets within a year. Creditors have up to one year to make a claim.