Matching Gift Form

What this document covers

The Matching Gift Form is a charitable contributions document that allows companies to match donations made by employees to nonprofit organizations. This form helps ensure that charitable contributions are eligible for matching funds, enhancing the impact of the employee's gift without requiring additional effort. It is specifically tailored for organizations that support various causes, distinguishing it from standard donation forms by ensuring that company matching policies are adhered to.

Key parts of this document

- Part I: Employee details - includes the name, address, social security number, gift amount, and certification regarding the donation.

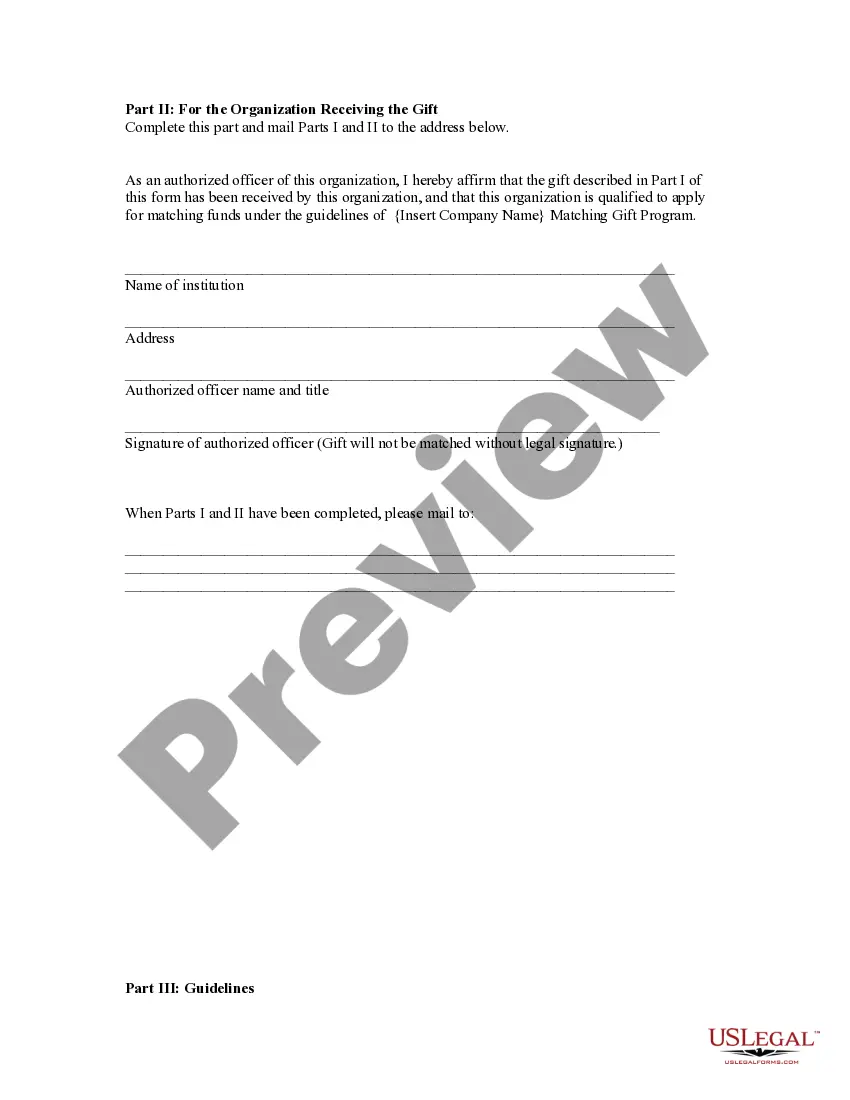

- Part II: Organization details - requires information from the nonprofit confirming the receipt and eligibility of the gift for matching funds.

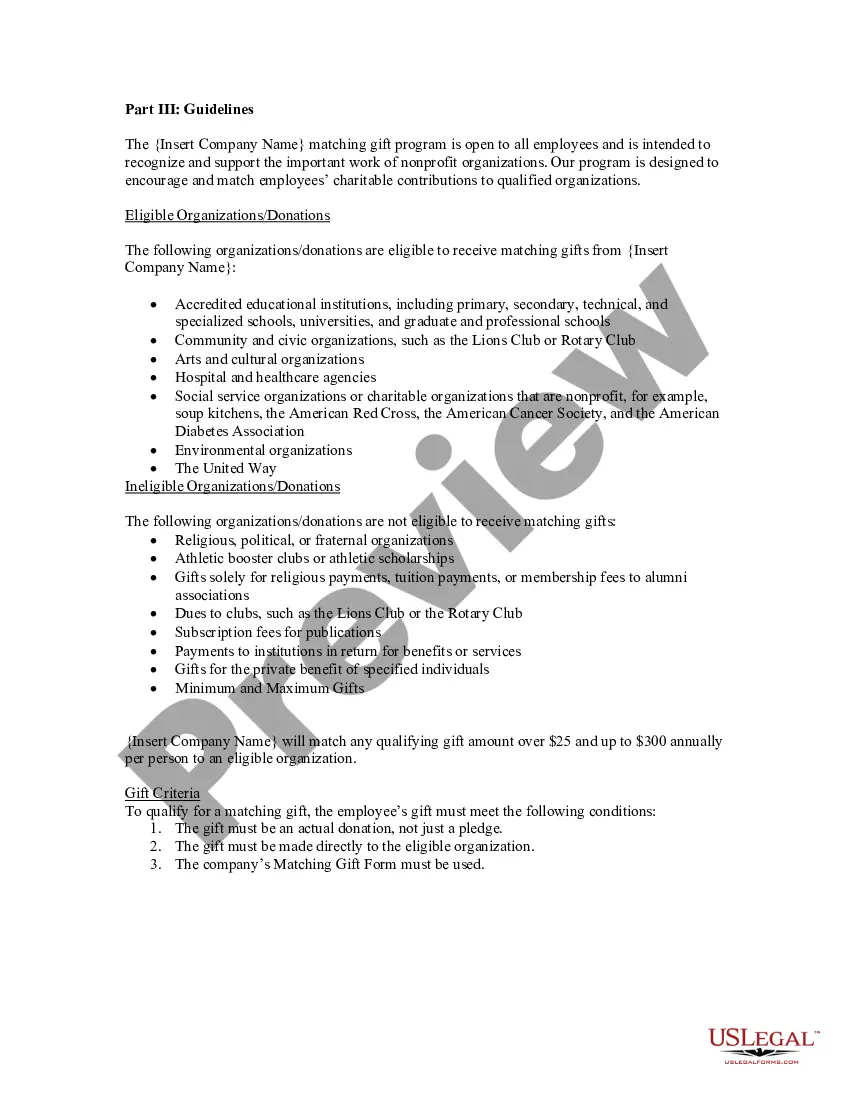

- Part III: Guidelines - outlines the types of eligible and ineligible organizations, as well as specific criteria for matching gifts.

When to use this form

You should use the Matching Gift Form when you, as an employee, make a contribution to a nonprofit organization that qualifies for your company's matching gift program. This is particularly useful if you want your charitable contributions to go further and help the organization benefit from additional financial support from your employer.

Who this form is for

- Employees of organizations that offer matching gift programs.

- Individuals wishing to donate to eligible nonprofit organizations.

- Authorized officers at the nonprofit organizations receiving the gifts.

Completing this form step by step

- Part I: Fill out your personal details, including your name, address, social security number, and the amount of the gift.

- Specify the organization category and check the applicable boxes.

- Sign and date Part I to certify the accuracy of your information.

- Part II: Provide the relevant details of the nonprofit organization, including its name, address, and an authorized officer's signature.

- Mail completed Parts I and II to the designated address provided in the form instructions.

Does this form need to be notarized?

This form usually doesn’t need to be notarized. However, local laws or specific transactions may require it. Our online notarization service, powered by Notarize, lets you complete it remotely through a secure video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes

- Failure to sign the form, resulting in an invalid application for matching funds.

- Inaccurate information, such as incorrect amounts or nonprofit details.

- Not verifying that the nonprofit organization qualifies for matching funds.

Advantages of online completion

- Immediate access to a template, saving time compared to creating a document from scratch.

- Editability allows for easy updates before finalizing your submission.

- Reliable, professionally drafted content ensures compliance with legal standards and company policies.

Looking for another form?

Form popularity

FAQ

Focusing on matching gift awareness can benefit nonprofits beyond just the incremental revenue. It turns out that 84% of donors are more likely to donate if their gifts are eligible to be matched, and mentioning matching in fundraising appeals results in 71% more donations and 51% higher donation amounts.

Corporate matching gifts are a type of philanthropy in which companies financially match donations that their employees make to nonprofit organizations. When an employee makes a donation, they'll request the matching gift from their employer, who then makes their own donation.

To receive a matching gift, donors just have to submit a request to their employers. If the donor's gift and your organization qualify, the company will send you a check for the same amount (or larger depending on the corporation's matching gift program).

Instead, choose words like partner, give, and support. "Donate" gives the impression that you only want (or need) their money. Words like "support" and "partner," followed by the name of your cause or campaign, can increase your donations significantly because they invite people into a relationship.

A matching gift is a charitable donation by a corporation that matches an employee's donation to an eligible nonprofit organization, most often dollar for dollar.A $100 donation to your organization is eligible to be matched by a corporate employer, literally doubling the donation for a total of $200.

When an employee makes a donation, they'll request the matching gift from their employer, who then makes their own donation. Companies usually match donations at a 1:1 ratio, but some will match at a 2:1, 3:1, or even a 4:1 ratio.

Since a matching gift is technically a donation, companies can deduct the matches they make from their reported income. Decreasing reported income means a company will not have to pay taxes on the donated money. Plus, the 10 percent rule doesn't apply to these donations.

Review your major donors for the right donor(s) Look for a donor who either a) hasn't given a gift yet this year, or b) you think has the capacity to give another gift at year-end. Approach the donor with a question. Share the stats with them. Give them a deadline.

Create a bold subject line. Make the ask near the beginning. Explain and describe why you're asking for a donation. Include links to your online donation page and contact info for donors who want to give by mail or phone. Say thank you in advance.