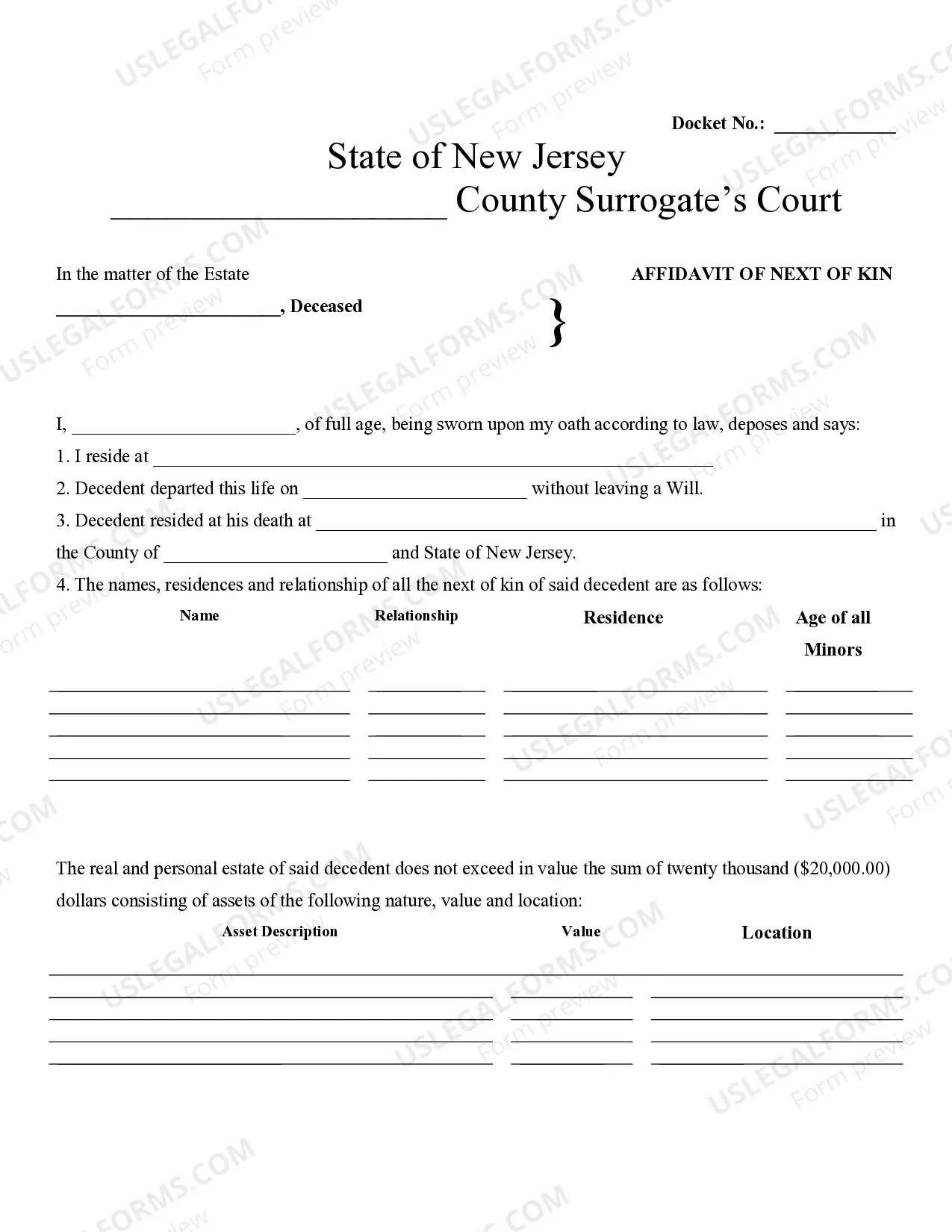

New Jersey Small Estate Affidavit for estates under 20,000

What this document covers

The Small Estate Affidavit is a legal document that allows a surviving spouse or next of kin to transfer assets from an estate valued under $20,000 in New Jersey without the need for formal administration. This form simplifies the process of estate settlement by enabling the surviving spouse or heirs to claim the deceased's assets directly, thereby avoiding lengthy probate procedures that may be required for larger estates.

Main sections of this form

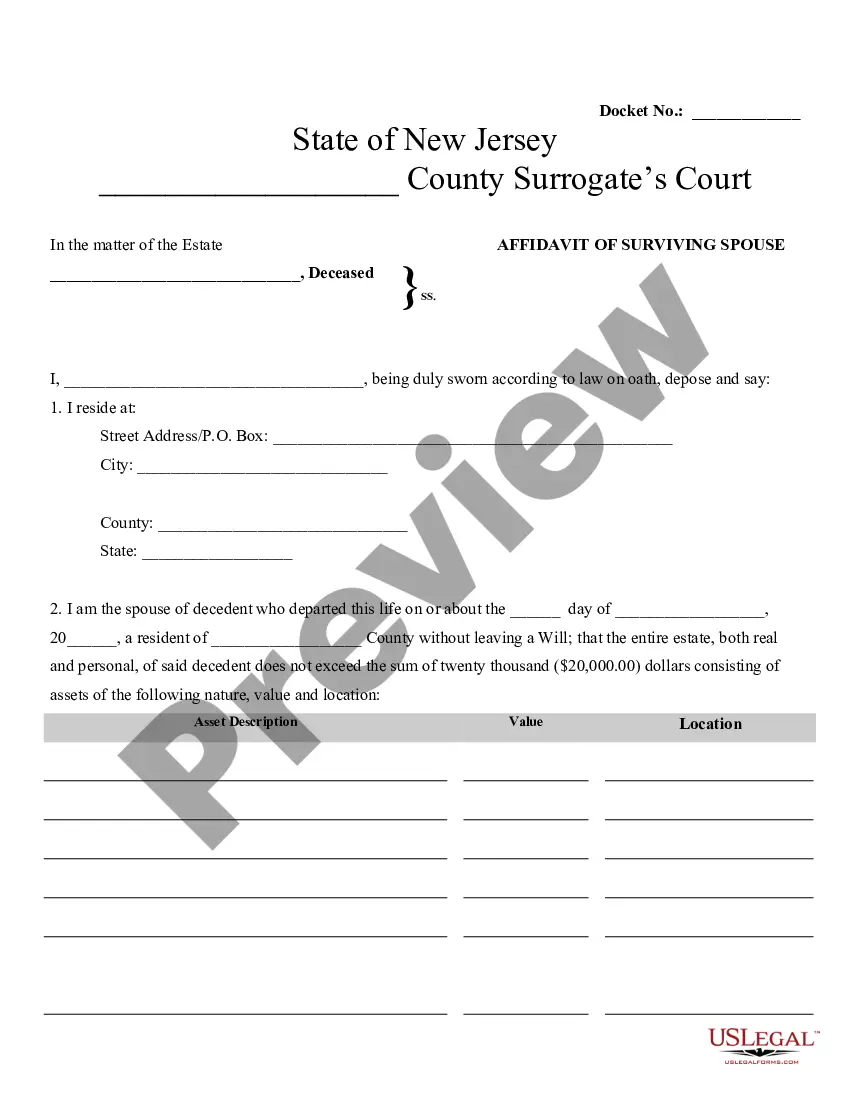

- Affidavit of Surviving Spouse: Certifies the spouse's right to the estate's assets.

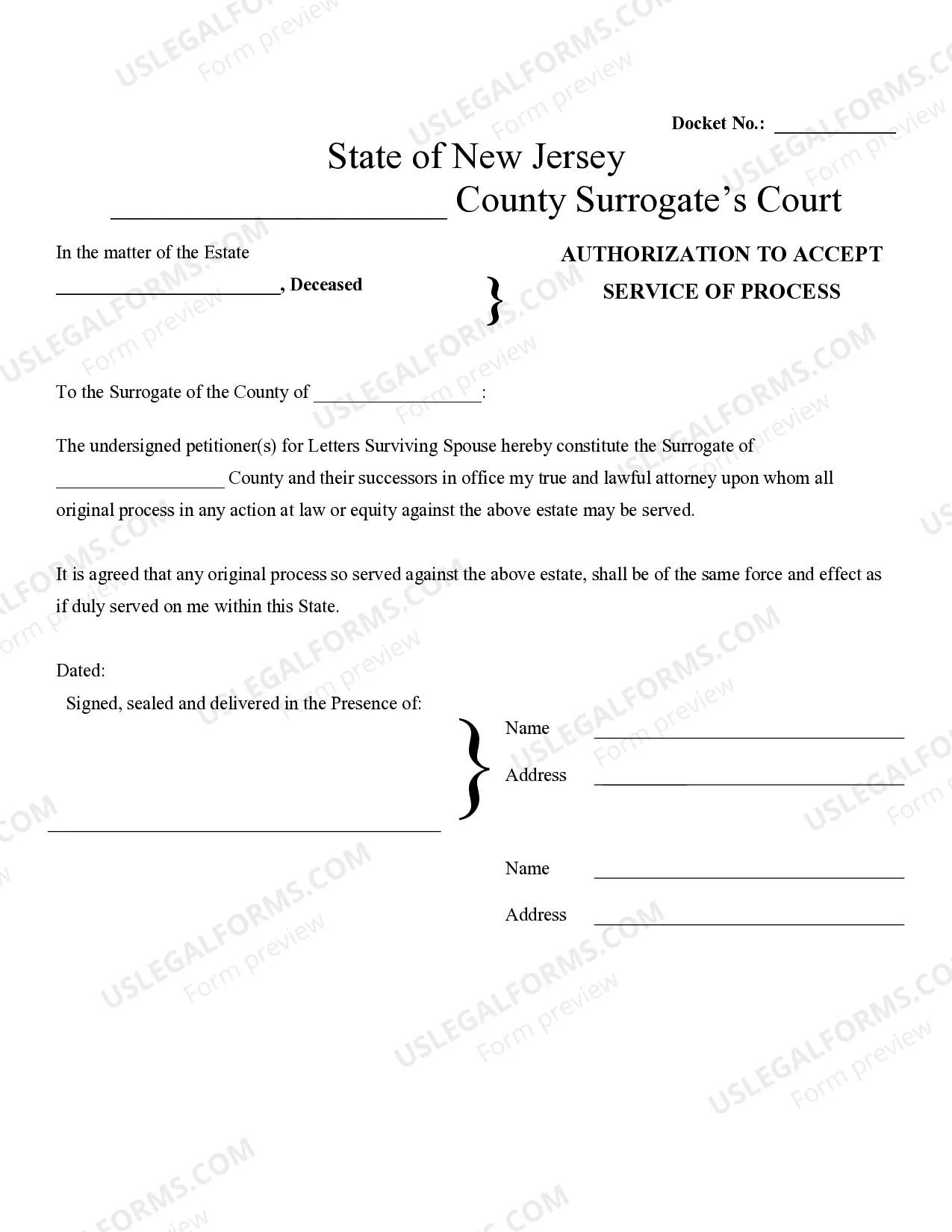

- Authorization to Accept Service of Process: Appoints a representative for legal notifications.

- Affidavit of Next of Kin: Declares the relationship and consent of heirs when no spouse is available.

- Consent to Next of Kin: Required when multiple heirs are involved, allowing one to act on behalf of all.

Situations where this form applies

This form is typically used in situations where an individual has passed away without a will (intestate) and their total estate is valued at less than $20,000. It is particularly useful for a surviving spouse who seeks to claim the decedent's assets or for next of kin who want to distribute the estate among themselves without going through probate court.

Who should use this form

The following individuals should consider using the Small Estate Affidavit:

- Surviving spouses of decedents with an estate valued at under $20,000.

- Heirs of a decedent who did not leave a surviving spouse and wish to claim assets.

- Any individual needing to settle a small estate without formal probate proceedings.

How to prepare this document

- Begin by gathering necessary information about the decedent, including their full name, address, and date of death.

- Complete Form One (Affidavit of Surviving Spouse) by indicating your relationship to the decedent and the details of the estate.

- If applicable, complete Forms Two, Four, and Five if there is no surviving spouse, ensuring all heirs consent.

- Sign the affidavit in the presence of the Surrogate or an authorized officer.

- File the completed forms with the county Surrogate's office or the Superior Court, based on where the decedent resided.

Notarization requirements for this form

This form needs to be notarized to ensure legal validity. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available anytime.

Common mistakes

- Failing to gather all required signatures from heirs.

- Not filing the forms in the correct jurisdiction.

- Incorrectly filling out the value of the estate.

- Neglecting to notarize documents when required.

Why complete this form online

- Convenience of completing the form from home without needing to visit a lawyer's office.

- Editable templates that allow users to customize the affidavits as needed.

- Access to forms that comply with New Jersey legal standards, ensuring compliance and validity.

Form popularity

FAQ

To be able to file a small estate affidavit in Texas for a loved one, when no will was executed, you must be a person who would inherit under Texas intestacy law (this is generally the spouse and children, or other close relatives if there are no spouse or children).

Affidavit of Heirship: In New Jersey, a small estate is considered $5,000 or less for finances, such as bank accounts or trusts.

The value of all of the assets left by the deceased person doesn't exceed $20,000, and the surviving spouse or domestic partner is entitled to all of it without probate (NJ Rev Stat § 3B:10-3), or. there is no surviving spouse or domestic partner and the value of all of the assets doesn't exceed $20,000.

The Illinois small estate affidavit provides a streamlined way for an heir-at-law of a decedent to gather and distribute the assets of the estate of a person who died, provided that no other petition to open an estate in probate court has been filed and that the assets of the person who died do not exceed $100,000.

Guadalupe County Small Estate Affidavit Checklist Individuals then fill out a form without reading the statute and without understanding Texas intestacy law. They pay a $261 filing fee and expect approval.

In most states, however, there is the option to use a small estate affidavit when the assets of the estate are under a certain dollar amount, which varies by state. An attorney is not required to file a small estate affidavit, although it may be helpful to consult with one prior to filing the small estate affidavit.

When you use a small estate affidavit , you have to pay the decedent's bills before paying money to anyone else. For example, the decedent might have owed money to a credit card company when they died. If you use the small estate affidavit, you must give money from the estate to pay the credit card company.

The Probate process is required by the state of NJ whenever someone dies. It is the government's way of making sure the assets of the deceased pass properly to their decedents. And of course to insure that any taxes or lien's owed to the state or other parties are fully paid.

4. All expenses related to the estate & funeral, along with debts and taxes must be paid from the estate before beneficiaries receive anything.