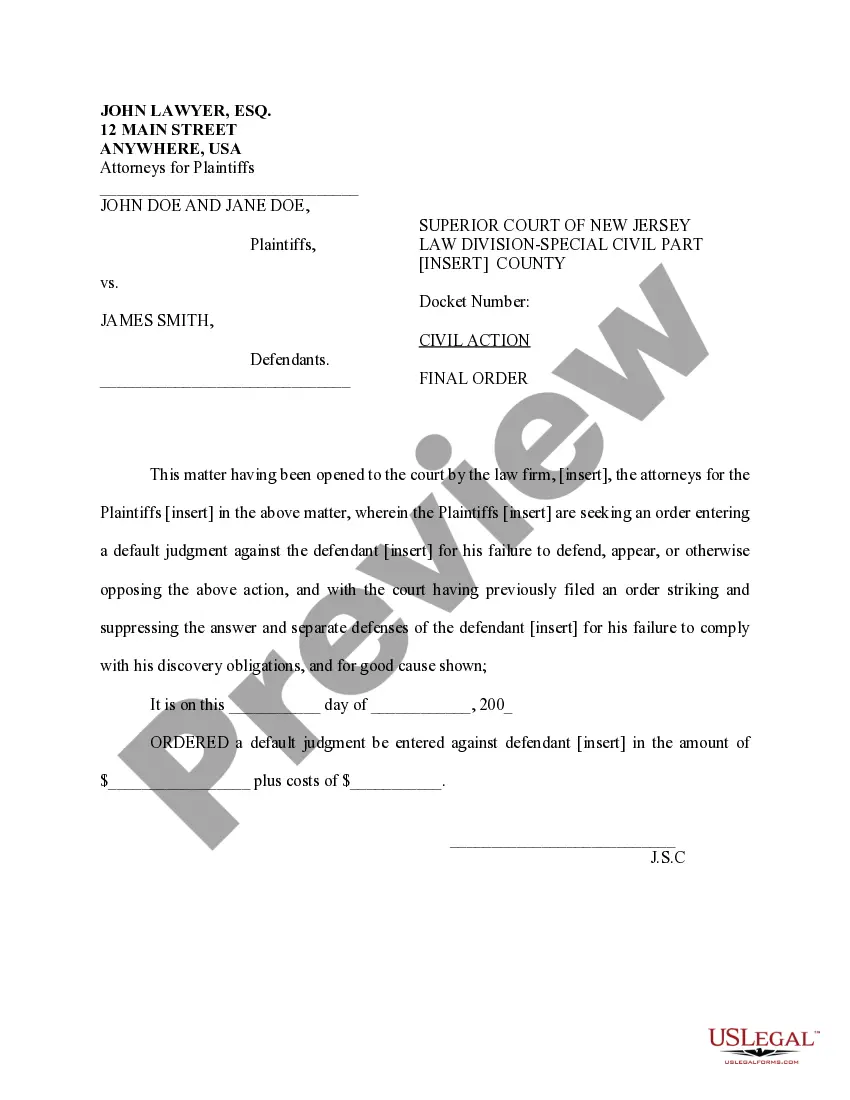

New Jersey Order Entering Judgment And Directing Deposit Of Funds

Description

How to fill out New Jersey Order Entering Judgment And Directing Deposit Of Funds?

US Legal Forms is really a unique platform where you can find any legal or tax form for filling out, such as New Jersey Order Entering Judgment And Directing Deposit Of Funds. If you’re tired of wasting time searching for suitable samples and paying money on record preparation/legal professional charges, then US Legal Forms is precisely what you’re searching for.

To enjoy all of the service’s advantages, you don't need to download any application but simply pick a subscription plan and register your account. If you have one, just log in and get the right template, download it, and fill it out. Downloaded files are stored in the My Forms folder.

If you don't have a subscription but need to have New Jersey Order Entering Judgment And Directing Deposit Of Funds, take a look at the recommendations below:

- check out the form you’re looking at applies in the state you want it in.

- Preview the sample and read its description.

- Click on Buy Now button to get to the register page.

- Choose a pricing plan and proceed signing up by providing some info.

- Decide on a payment method to finish the registration.

- Download the file by selecting your preferred format (.docx or .pdf)

Now, submit the document online or print it. If you are unsure about your New Jersey Order Entering Judgment And Directing Deposit Of Funds sample, contact a lawyer to examine it before you decide to send or file it. Begin hassle-free!

Form popularity

FAQ

A judgment from another state can be enforced by docketing it with the Clerk of the Superior Court in Trenton. It will then be a lien on any real estate owned by the debtor in New Jersey and other collection efforts must be made through the Sheriff's Office in the county where the debtor has assets.

Judgments in New Jersey remain in effect for 20 years and may be renewed for an additional 20 years by filing a motion in the Superior Court, Law Division, Civil Part and/or in the Special Civil Part if the Special Civil Part case was assigned a DJ or J docket number.

Renew the judgment Money judgments automatically expire (run out) after 10 years.If the judgment is not renewed, it will not be enforceable any longer and you will not have to pay any remaining amount of the debt. Once a judgment has been renewed, it cannot be renewed again until 5 years later.

Judgments in New Jersey remain in effect for 20 years and may be renewed for an additional 20 years by filing a motion in the Superior Court, Law Division, Civil Part and/or in the Special Civil Part if the Special Civil Part case was assigned a DJ or J docket number.

In New Jersey, there is a six-year statute of limitations on collecting a debt. This means that a creditor can no longer make attempts to collect on a debt once six years have passed since the original date that payment was owed.

4:4-7, service may be made by mailing a copy of the summons and complaint by registered or certified mail, return receipt requested, to the usual place of abode of the defendant or a person authorized by rule of law to accept service for the defendant or, with postal instructions to deliver to addressee only, to

The statute of limitations for a debt collector to collect a past-due debt in New Jersey is six years, said Karra Kingston, a bankruptcy attorney in Union City.

In most cases, judgments can stay on your credit reports for up to seven years. This means that the judgment will continue to have a negative effect on your credit score for a period of seven years. In some states, judgments can stay on as long as ten years, or indefinitely if they remain unpaid.