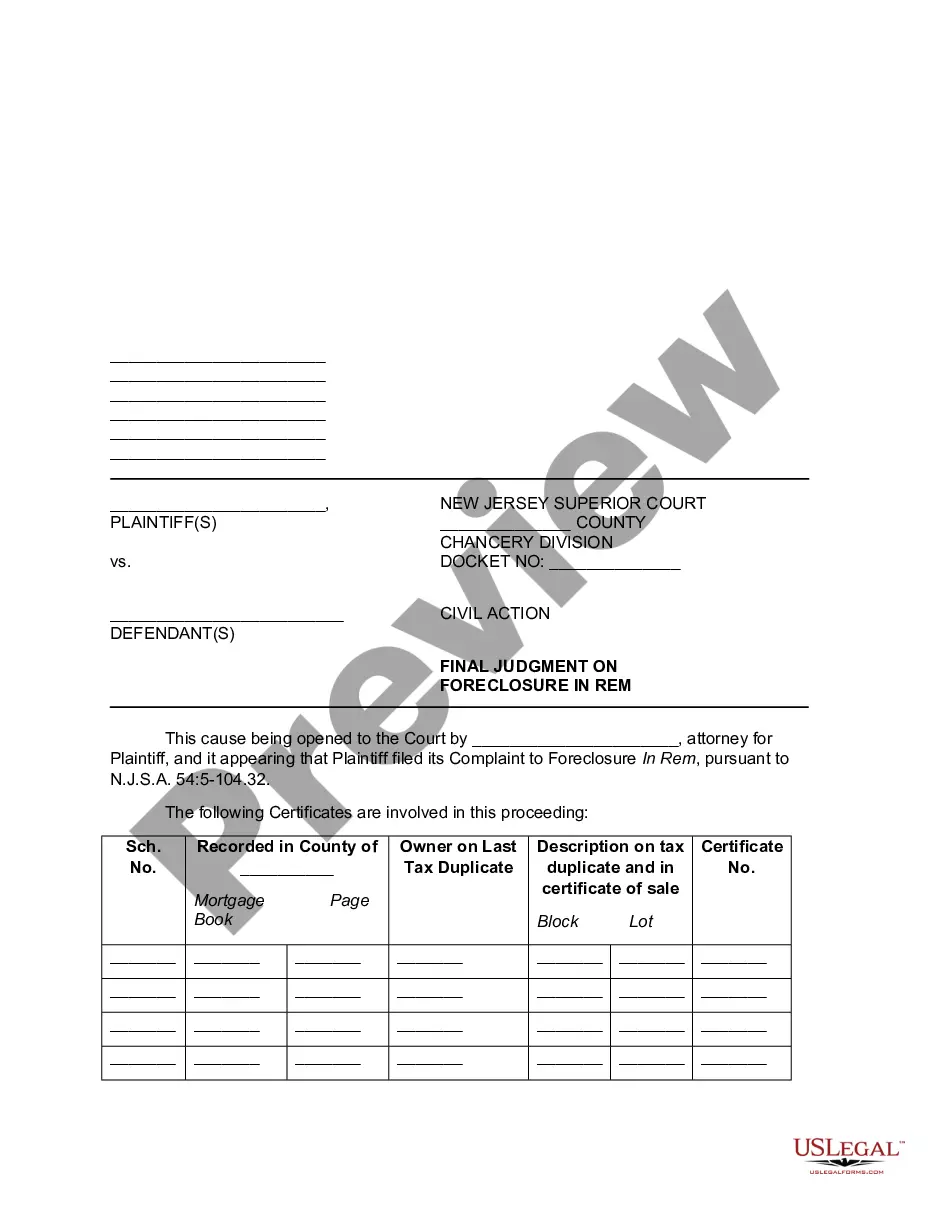

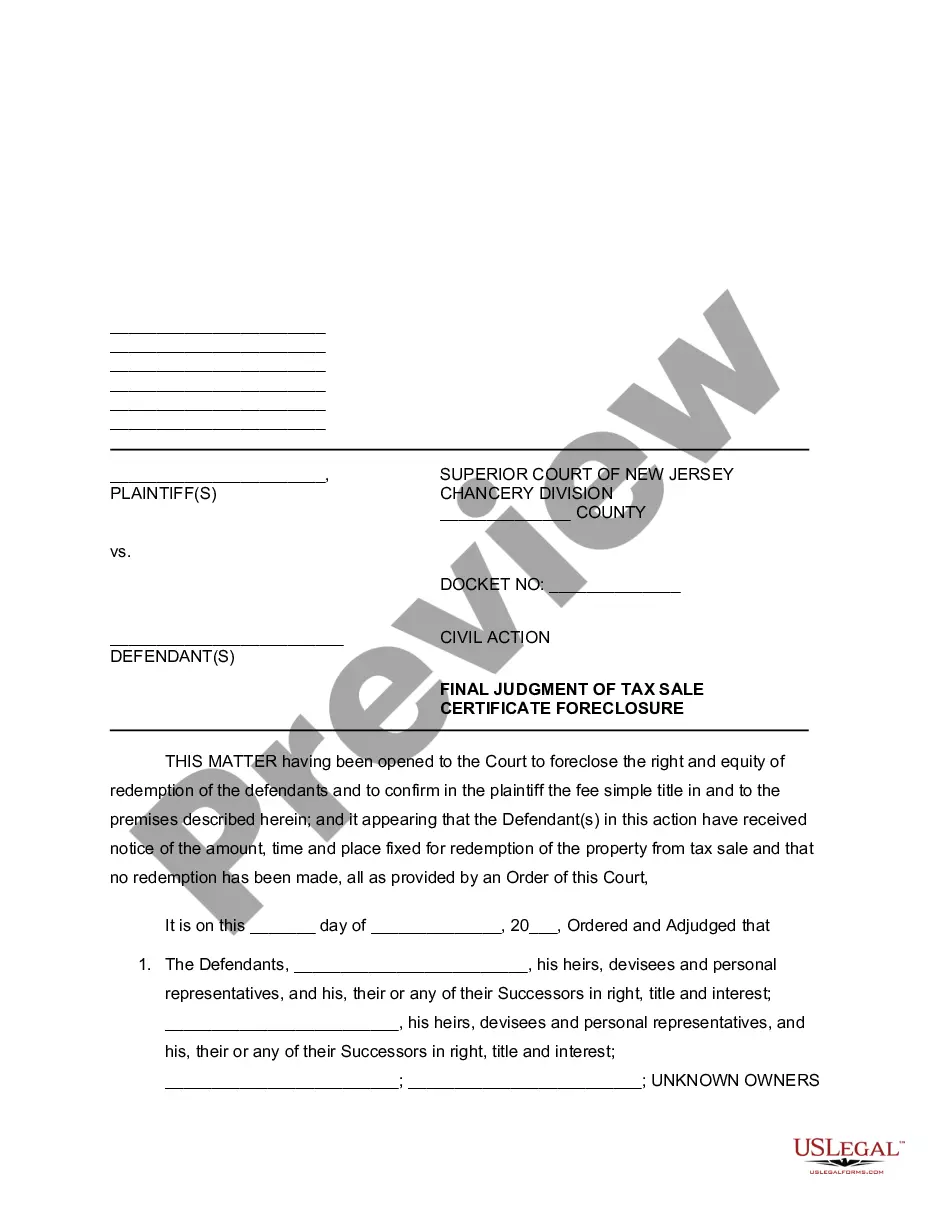

New Jersey Final Judgment on Foreclosure In Rem

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

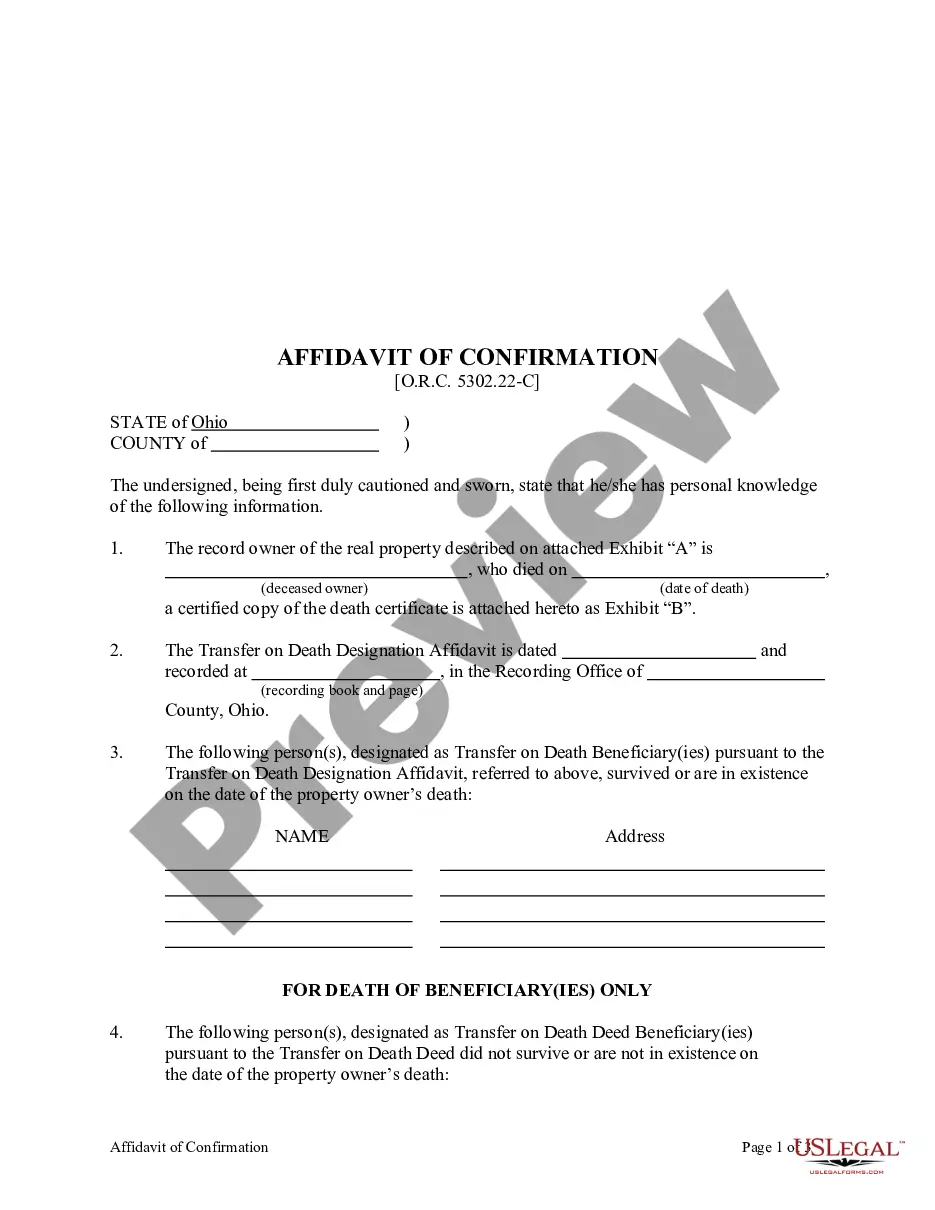

Looking for another form?

How to fill out New Jersey Final Judgment On Foreclosure In Rem?

US Legal Forms is really a unique system to find any legal or tax template for submitting, such as New Jersey Final Judgment on Foreclosure In Rem. If you’re fed up with wasting time seeking perfect samples and paying money on record preparation/legal professional fees, then US Legal Forms is precisely what you’re searching for.

To reap all of the service’s benefits, you don't have to download any application but simply choose a subscription plan and register your account. If you already have one, just log in and look for an appropriate sample, download it, and fill it out. Downloaded documents are stored in the My Forms folder.

If you don't have a subscription but need New Jersey Final Judgment on Foreclosure In Rem, have a look at the recommendations listed below:

- Double-check that the form you’re considering is valid in the state you want it in.

- Preview the sample its description.

- Simply click Buy Now to get to the sign up page.

- Select a pricing plan and continue signing up by entering some info.

- Decide on a payment method to finish the sign up.

- Download the document by selecting your preferred file format (.docx or .pdf)

Now, fill out the file online or print out it. If you are unsure concerning your New Jersey Final Judgment on Foreclosure In Rem form, speak to a lawyer to review it before you send or file it. Start hassle-free!

Form popularity

FAQ

Latin, In the thing itself. A lawsuit against an item of property, not against a person (in personam). An action in rem is a proceeding that takes no notice of the owner of the property but determines rights in the property that are conclusive against all the world.

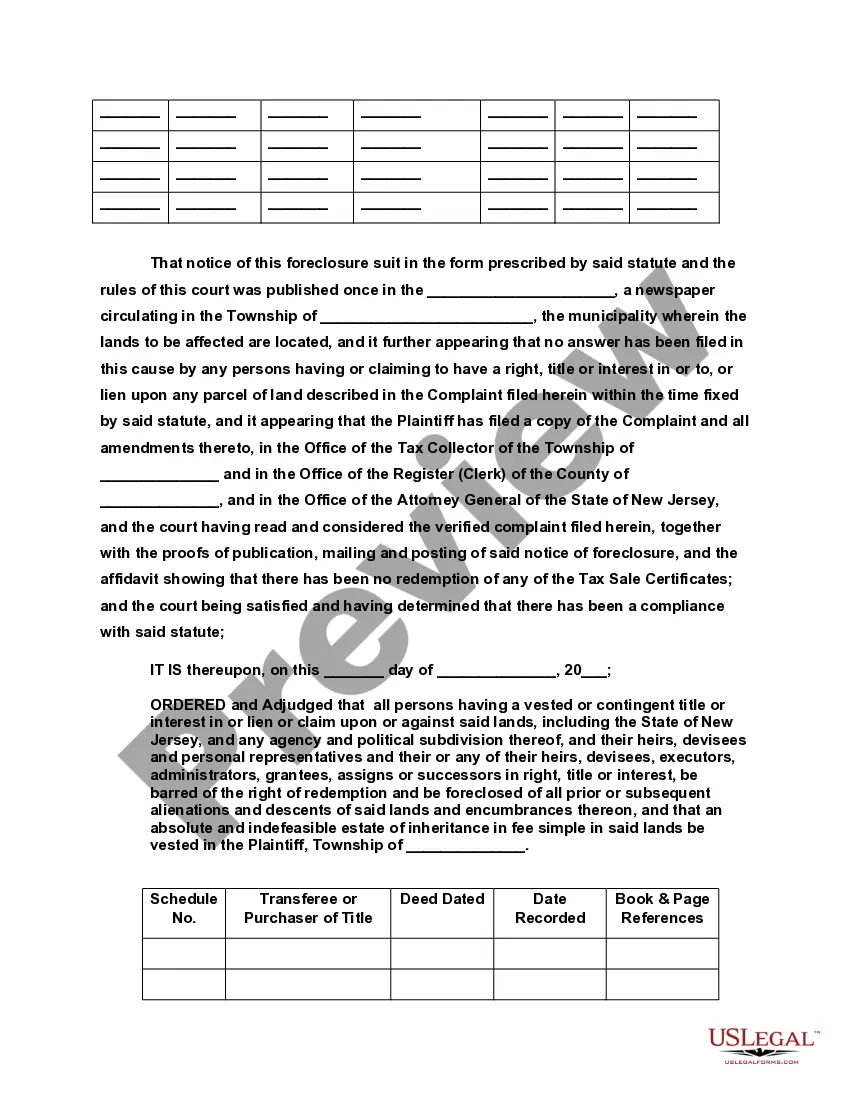

Foreclosure Eliminates Liens, Not Debt Following a first-mortgage foreclosure, all junior liens (including a second mortgage and any junior judgment liens) are extinguished and the liens are removed from the property title.

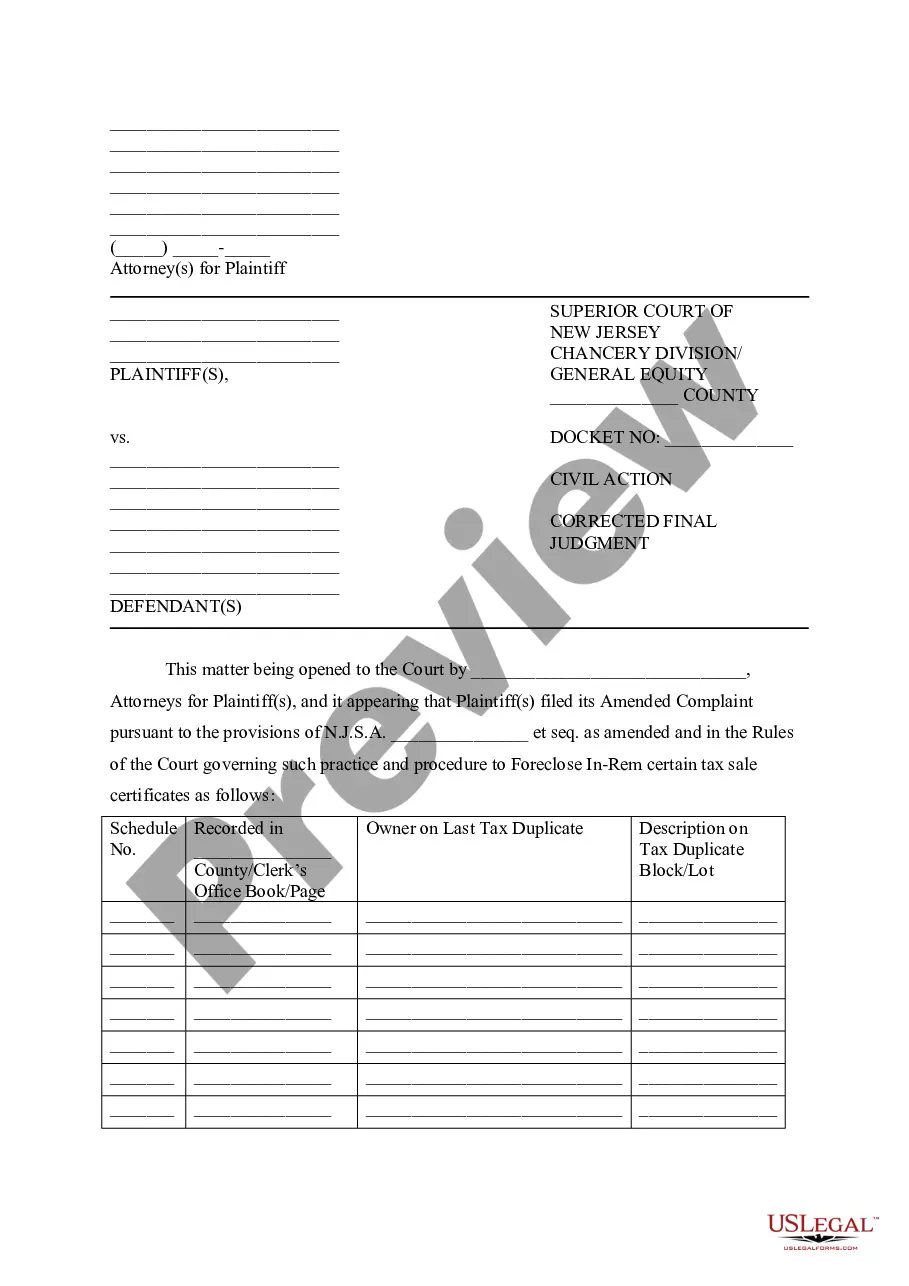

Normally it takes at least two years for a tax lien to be redeemed, but with vacant properties, they can have tax sale certificates foreclosed in as little as 6 months under the New Jersey Tax Sale law and if a municipality owns the lien it can also be foreclosed on in 6 months.

It is a lengthy process with strict rules for mortgage lenders and multiple opportunities for you to save your home (or arrange the most favorable alternative). According to Nolo.com, New Jersey has the third-longest foreclosure timeline. The average is 1,161 days (38 months) from that first foreclosure notice.

Meaning of Foreclosure A mortgage uses the house as collateral, which automatically makes any lien a lender files in rem or a way to gain value by seizing and selling the house. An in rem action to foreclose is a legal action to create a foreclosure sale so a lender can be paid.

When homeowners don't pay their property taxes, the overdue amount becomes a lien on the property. In New Jersey, once a tax lien is on your home, the collector (on behalf of the municipality) can then sell that lien at a public auction. (N.J. Stat.

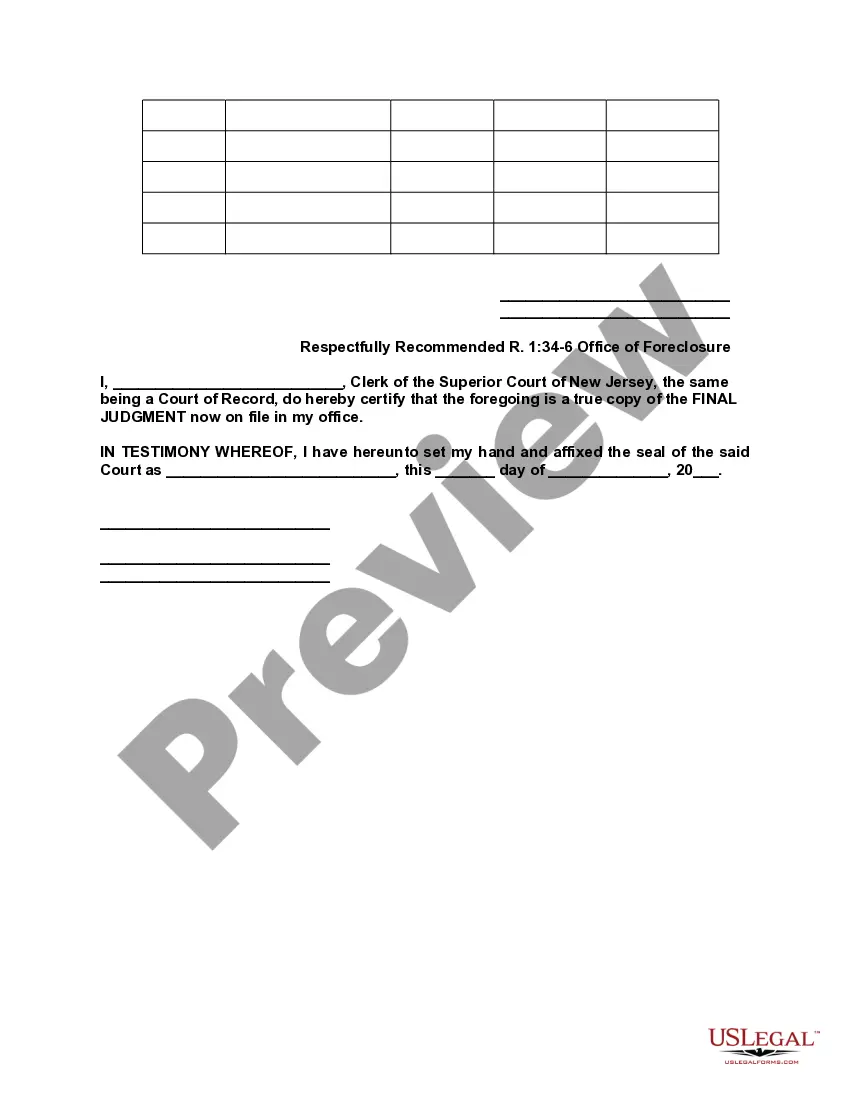

If the lender is successful at the end of foreclosure proceedings, it will obtain a final judgment approving the foreclosure and a Writ of Execution.Once the Writ has been received, the Sheriff must schedule an auction for the property within 120 days.

An in rem action is a lawsuit against property.The tax certificate represents a lien on unpaid real estate properties. Often parties purchase Tax Certificates as a means to secure a deed to property. However, a tax sales certificate applicant is not guaranteed title to the property.