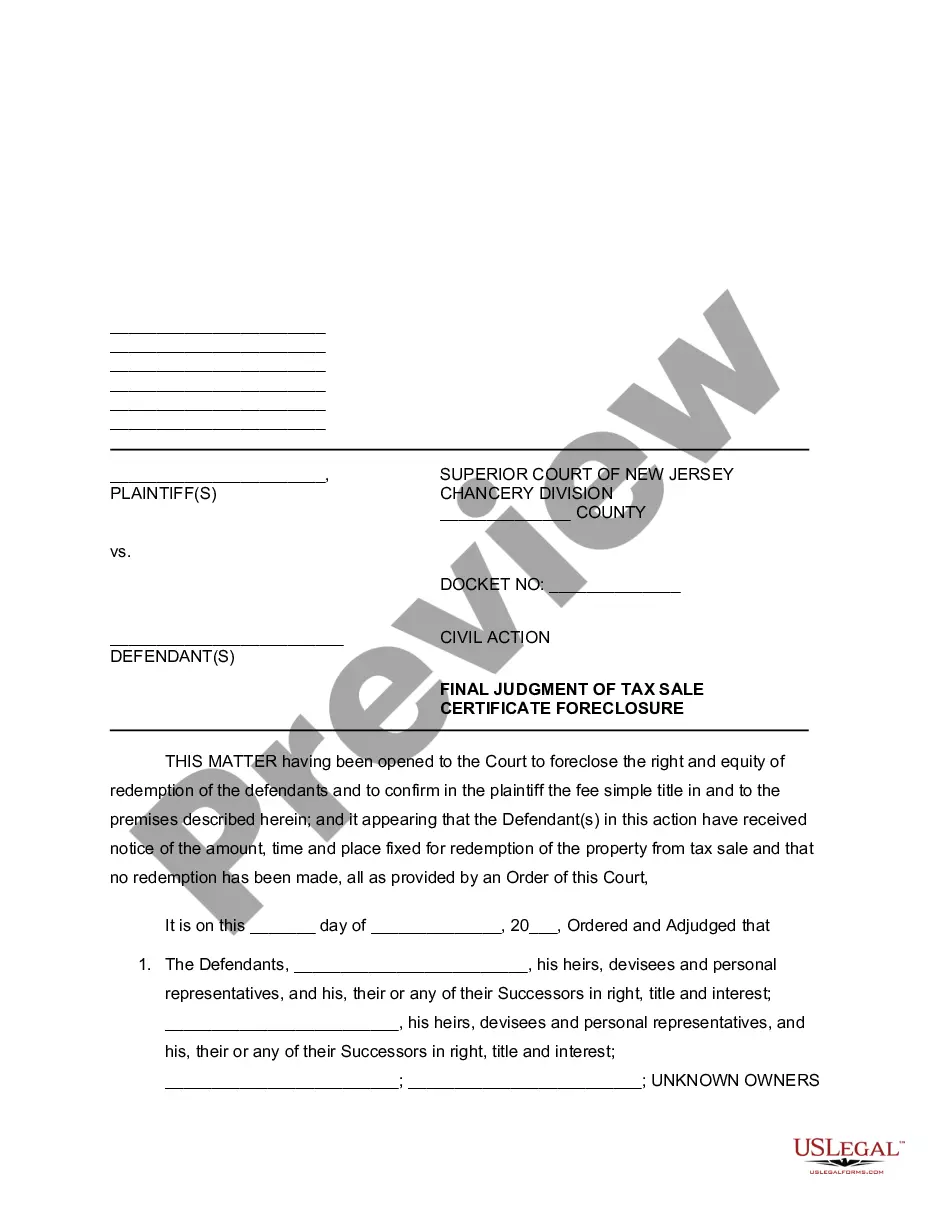

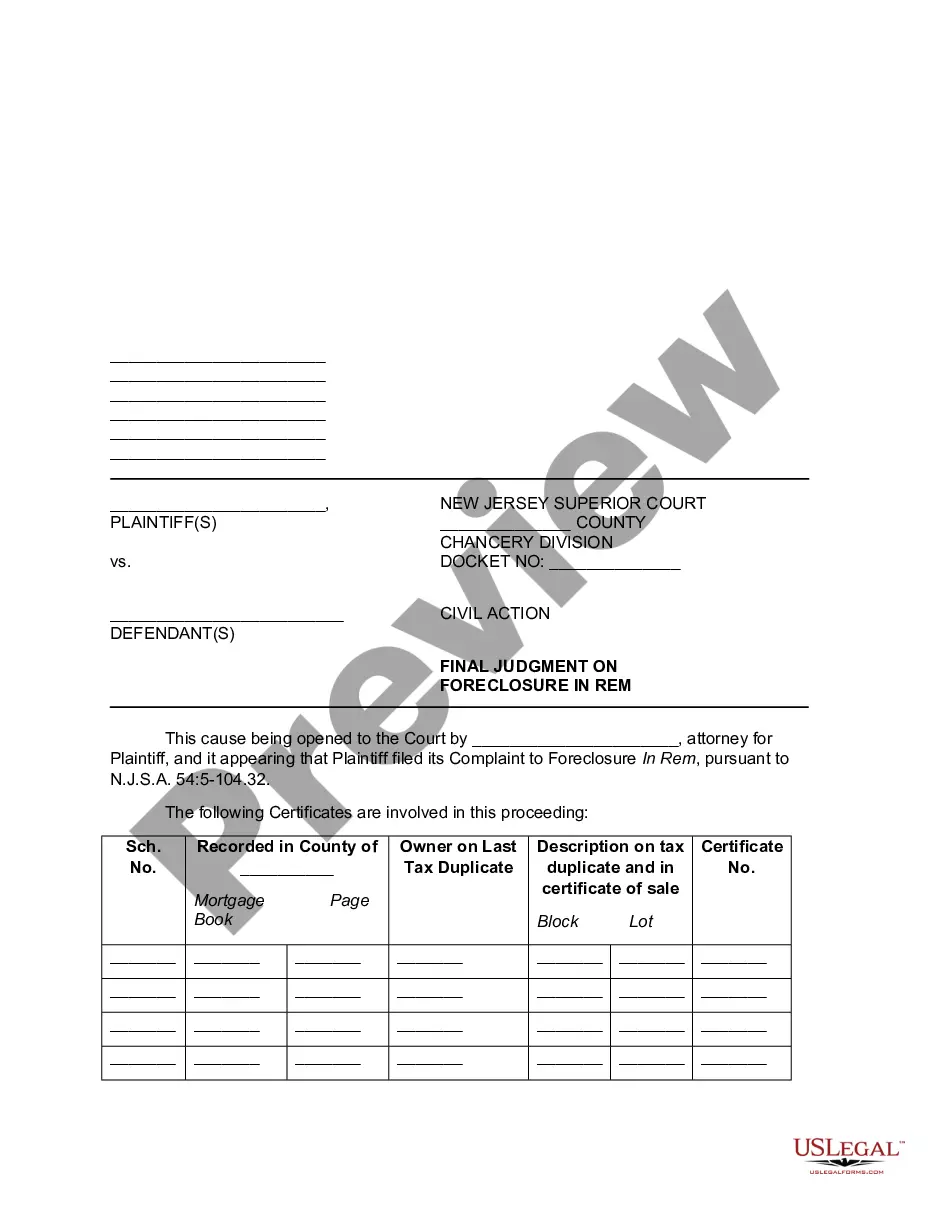

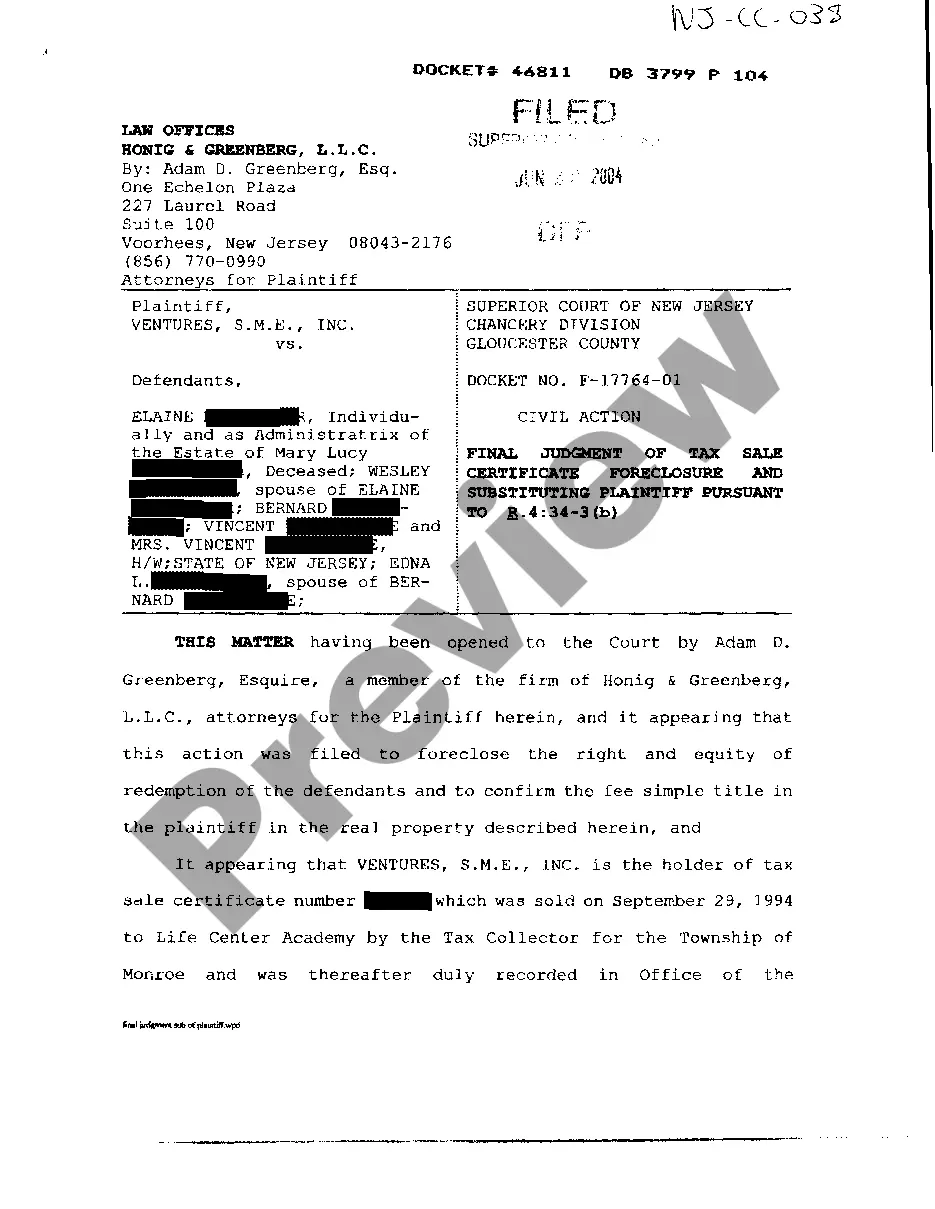

New Jersey Final Judgment of Tax Sale Certificate Foreclosure

Description

How to fill out New Jersey Final Judgment Of Tax Sale Certificate Foreclosure?

US Legal Forms is actually a unique platform to find any legal or tax document for filling out, including New Jersey Final Judgment of Tax Sale Certificate Foreclosure. If you’re tired with wasting time searching for suitable samples and paying money on record preparation/lawyer charges, then US Legal Forms is precisely what you’re searching for.

To experience all the service’s benefits, you don't need to download any software but simply select a subscription plan and sign up your account. If you have one, just log in and get a suitable template, download it, and fill it out. Downloaded documents are all saved in the My Forms folder.

If you don't have a subscription but need to have New Jersey Final Judgment of Tax Sale Certificate Foreclosure, check out the guidelines below:

- make sure that the form you’re considering applies in the state you want it in.

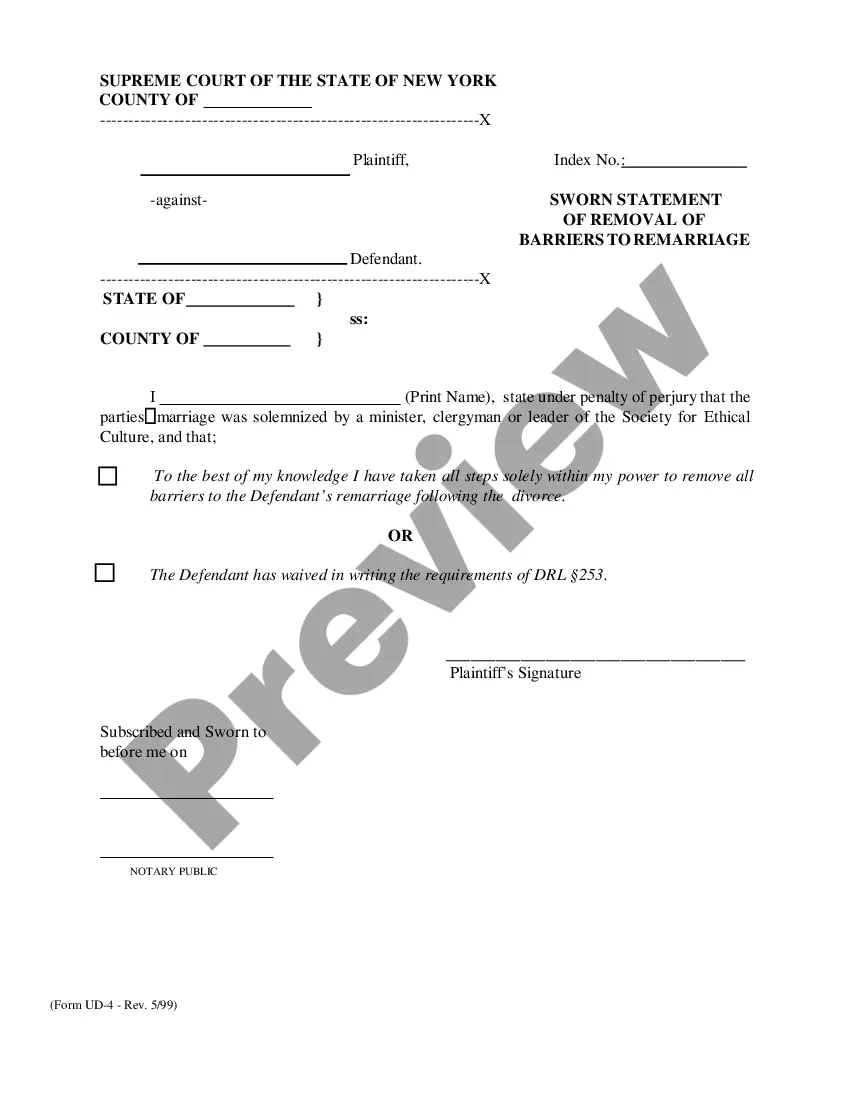

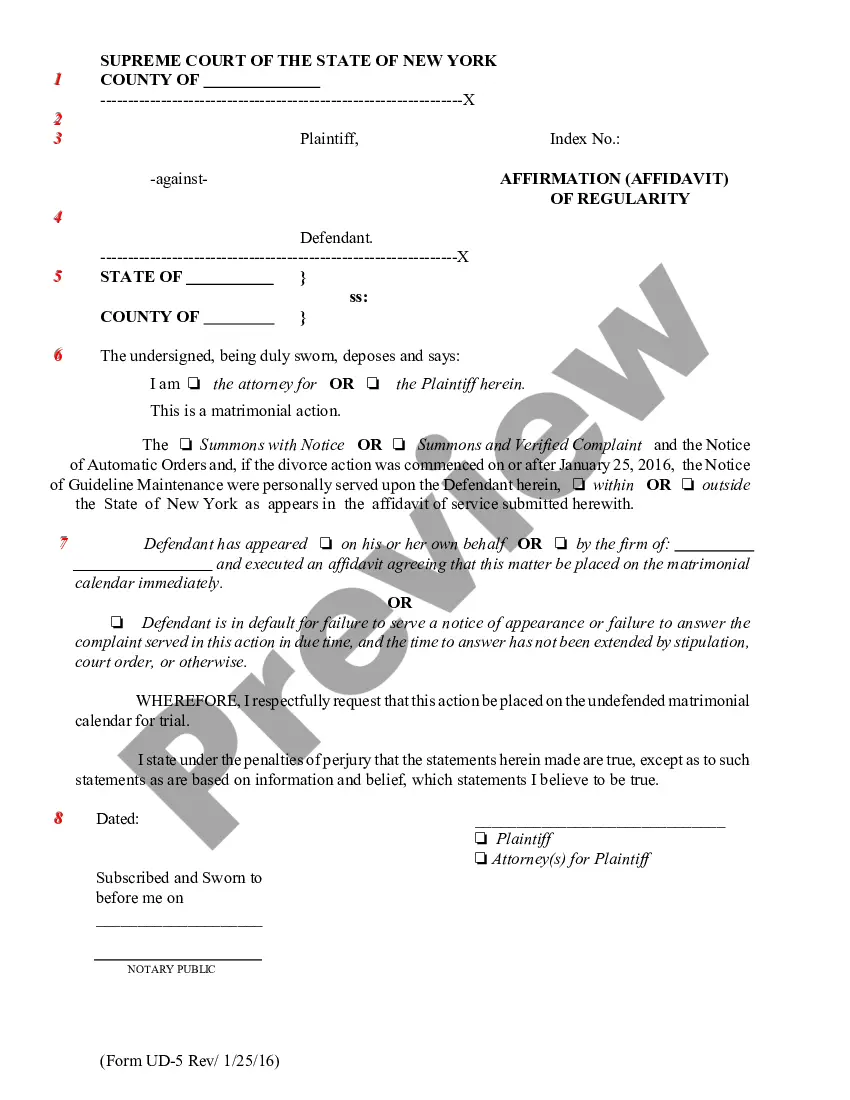

- Preview the sample its description.

- Click on Buy Now button to access the sign up page.

- Pick a pricing plan and proceed signing up by providing some information.

- Pick a payment method to complete the registration.

- Download the file by selecting your preferred format (.docx or .pdf)

Now, fill out the file online or print it. If you feel uncertain regarding your New Jersey Final Judgment of Tax Sale Certificate Foreclosure template, speak to a attorney to analyze it before you send or file it. Begin without hassles!

Form popularity

FAQ

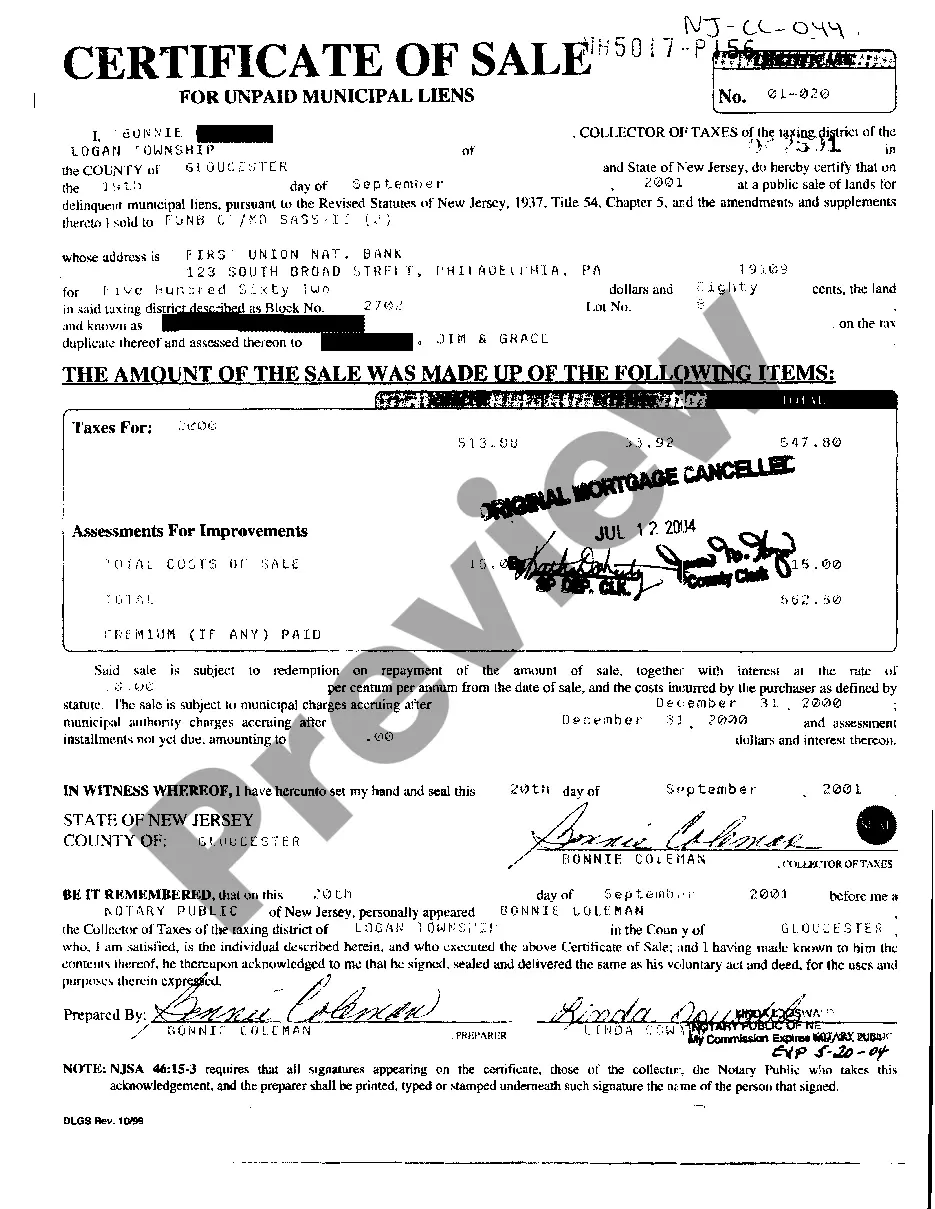

What is sold is a tax sale certificate, a lien on the property. Tax sale certificates can earn interest of up to 18 per cent, depending on the winning percentage bid at the auction. At the auction, bidders bid down the interest rate that will be paid by the owner for continuing interest on the certificate amount.

In California, you generally have five years to get current on delinquent property taxes. Otherwise, you could lose your home in a tax sale.

In New Jersey, property taxes are a continuous lien on the real estate. Property taxes are due in four installments during the year: February 1, May 1, August 1, and November 1. Delinquency on a property may accrue interest at up to 8 per cent for the first $1,500 due, and 18 per cent for any amount over $1,500.

When homeowners don't pay their property taxes, the overdue amount becomes a lien on the property. In New Jersey, once a tax lien is on your home, the collector (on behalf of the municipality) can then sell that lien at a public auction.

The taxes will be paid by your lender. After your lender forecloses, all sums that you owed, including the taxes, are satisfied by the transfer of the property to the lender under a foreclosure deed. The property taxes are actually a debt against the property, not against you personally.

The answer is, it depends. For homeowners who would like to keep their homes (by redeeming the mortgage during the 6 month redemption period) they must pay property taxes as well as any interest and costs as well as the balance of the loan. In that case, the answer is simple the homeowner is responsible.

Normally it takes at least two years for a tax lien to be redeemed, but with vacant properties, they can have tax sale certificates foreclosed in as little as 6 months under the New Jersey Tax Sale law and if a municipality owns the lien it can also be foreclosed on in 6 months.

If all attempts to collect on the delinquent taxes have been exhausted and the redemption period expires, the lien holder can initiate a judicial foreclosure proceeding against the property itself. The court then orders a foreclosure auction be held to collect the money to satisfy the unpaid tax lien.