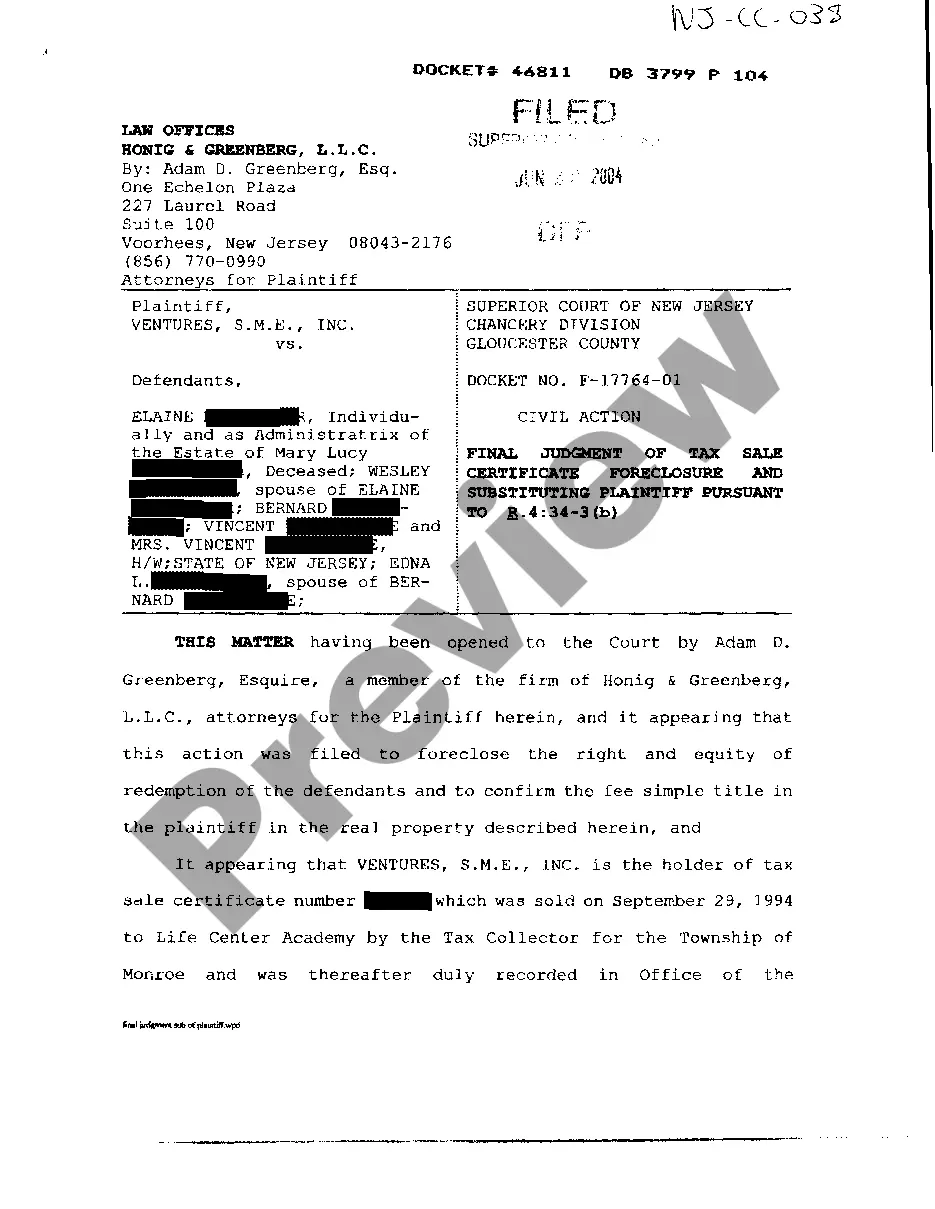

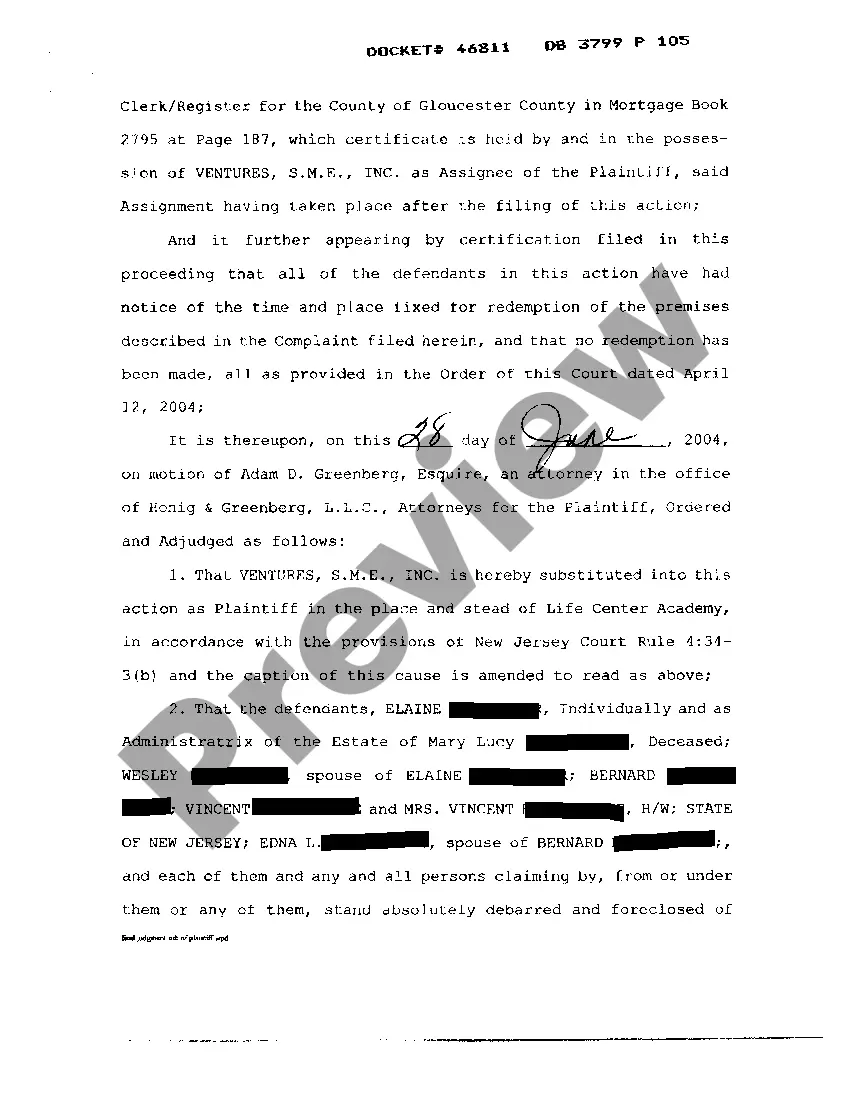

New Jersey Final Judgment of Tax Sale Certificate Foreclosure and Substituting Plaintiff Pursuant

Description

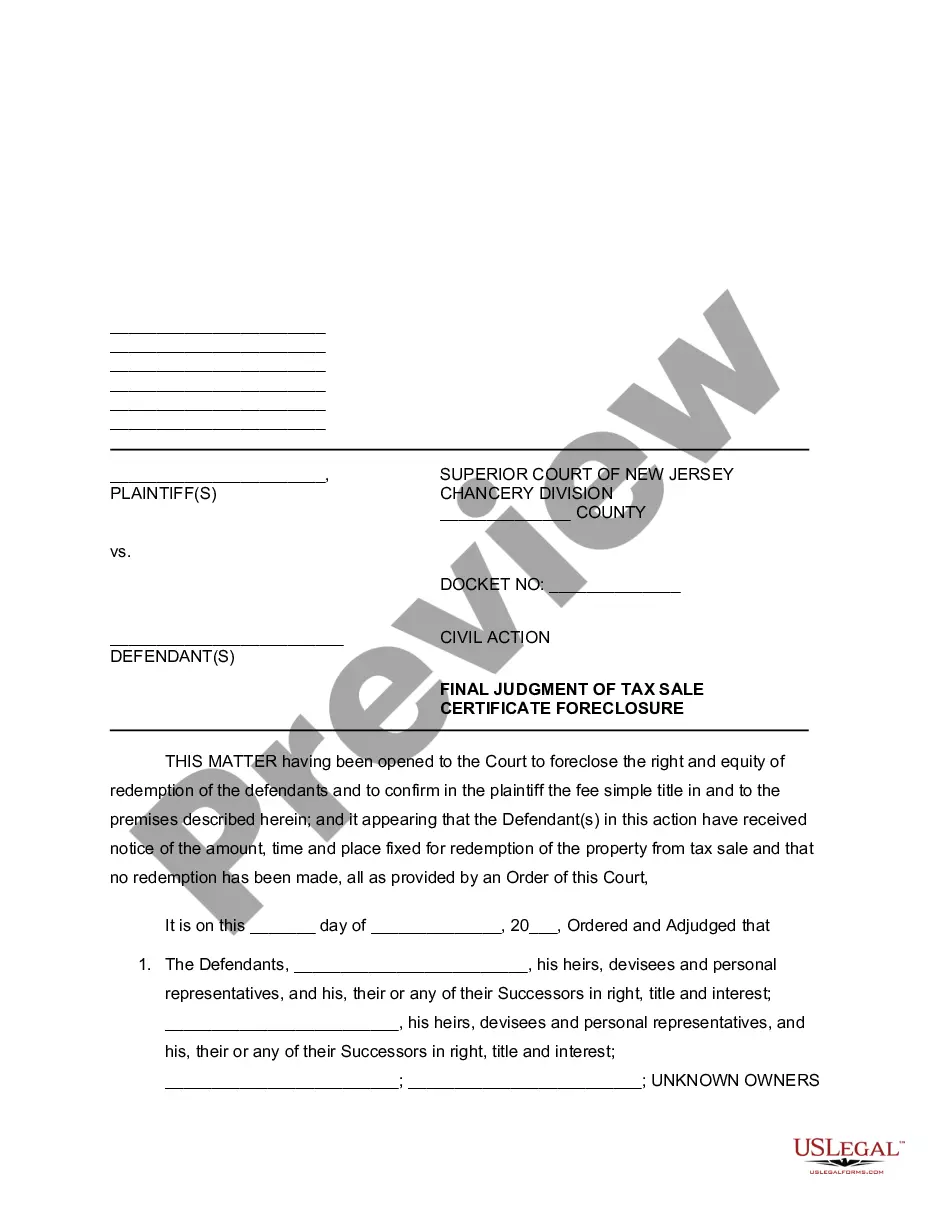

How to fill out New Jersey Final Judgment Of Tax Sale Certificate Foreclosure And Substituting Plaintiff Pursuant?

US Legal Forms is actually a unique platform to find any legal or tax document for filling out, including New Jersey Final Judgment of Tax Sale Certificate Foreclosure and Substituting Plaintiff Pursuant. If you’re sick and tired of wasting time seeking appropriate samples and spending money on papers preparation/lawyer charges, then US Legal Forms is exactly what you’re trying to find.

To reap all the service’s advantages, you don't have to install any software but simply choose a subscription plan and register your account. If you have one, just log in and find the right template, download it, and fill it out. Saved documents are all kept in the My Forms folder.

If you don't have a subscription but need to have New Jersey Final Judgment of Tax Sale Certificate Foreclosure and Substituting Plaintiff Pursuant, check out the instructions listed below:

- make sure that the form you’re checking out is valid in the state you want it in.

- Preview the example its description.

- Click Buy Now to get to the sign up page.

- Pick a pricing plan and continue signing up by entering some info.

- Decide on a payment method to complete the sign up.

- Save the document by selecting the preferred file format (.docx or .pdf)

Now, fill out the file online or print it. If you feel uncertain concerning your New Jersey Final Judgment of Tax Sale Certificate Foreclosure and Substituting Plaintiff Pursuant form, contact a lawyer to analyze it before you send or file it. Begin without hassles!

Form popularity

FAQ

If all attempts to collect on the delinquent taxes have been exhausted and the redemption period expires, the lien holder can initiate a judicial foreclosure proceeding against the property itself. The court then orders a foreclosure auction be held to collect the money to satisfy the unpaid tax lien.

If the court grants summary judgment in favor of the bank, typically after a hearing, the bank wins the case, and your home will be sold at a foreclosure sale.order the foreclosure sale, or. dismiss the case, usually without prejudice. (Without prejudice means the bank can refile the foreclosure.)

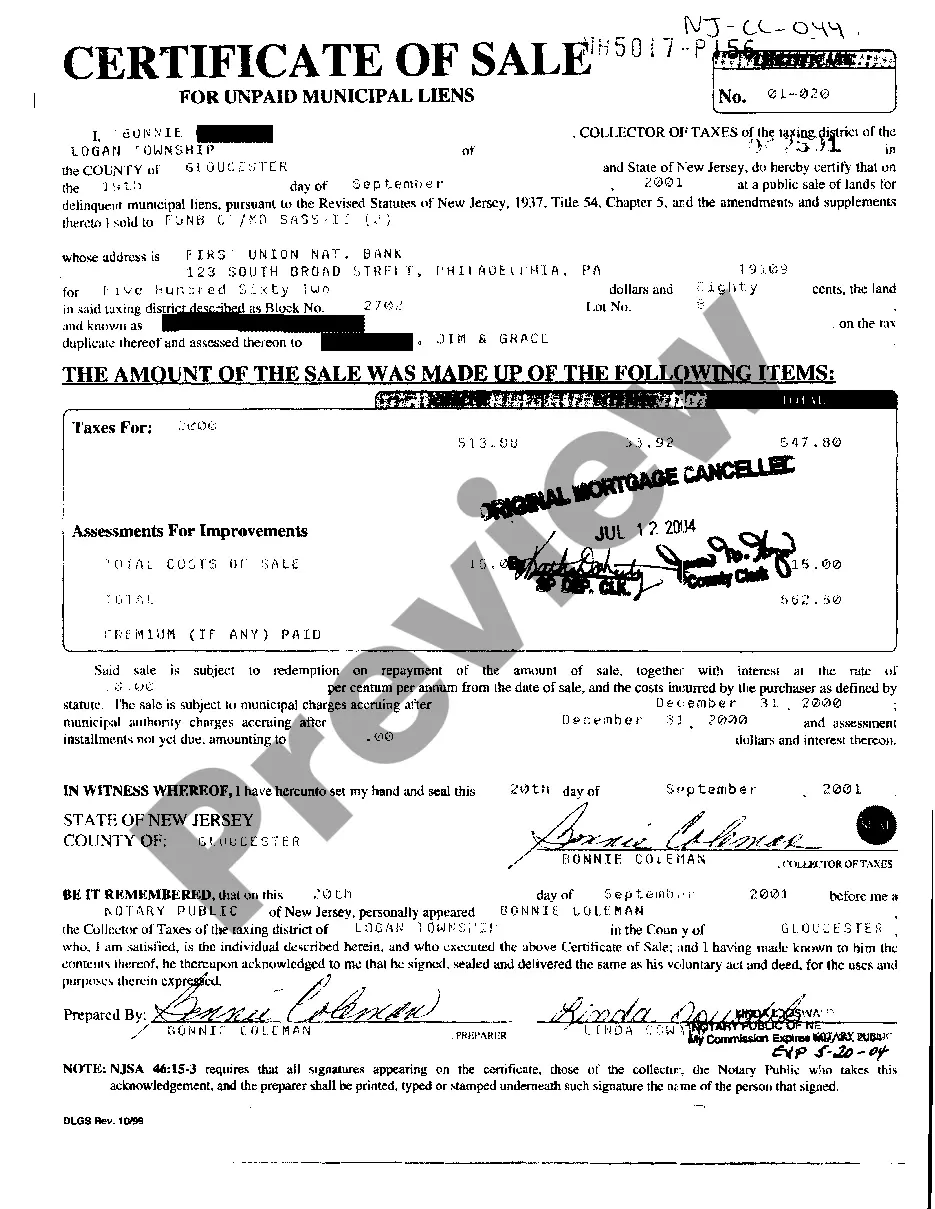

When homeowners don't pay their property taxes, the overdue amount becomes a lien on the property. In New Jersey, once a tax lien is on your home, the collector (on behalf of the municipality) can then sell that lien at a public auction.

In California, you generally have five years to get current on delinquent property taxes. Otherwise, you could lose your home in a tax sale.

Normally it takes at least two years for a tax lien to be redeemed, but with vacant properties, they can have tax sale certificates foreclosed in as little as 6 months under the New Jersey Tax Sale law and if a municipality owns the lien it can also be foreclosed on in 6 months.

Your three options following the court's grant of summary judgment or summary adjudication to the defense. This article explores the benefits and best practices of three options following the grant of summary judgment or summary adjudication: (1) a new-trial motion, (2) a writ, and (3) an appeal.

In a mortgage foreclosure, any judgment liens that were recorded after the mortgage will be wiped out by the foreclosure. Any surplus funds after the foreclosing lender's debt has been paid off will be distributed to other creditors holding junior liens, like second mortgages and judgment lienholders.

In New Jersey, property taxes are a continuous lien on the real estate. Property taxes are due in four installments during the year: February 1, May 1, August 1, and November 1. Delinquency on a property may accrue interest at up to 8 per cent for the first $1,500 due, and 18 per cent for any amount over $1,500.

Once a foreclosure case has successfully been through court proceedings, a judge signs the final judgement.The final judgement lists all amounts that are owed on the property and a copy of the document is provided to the previous owner under the law.