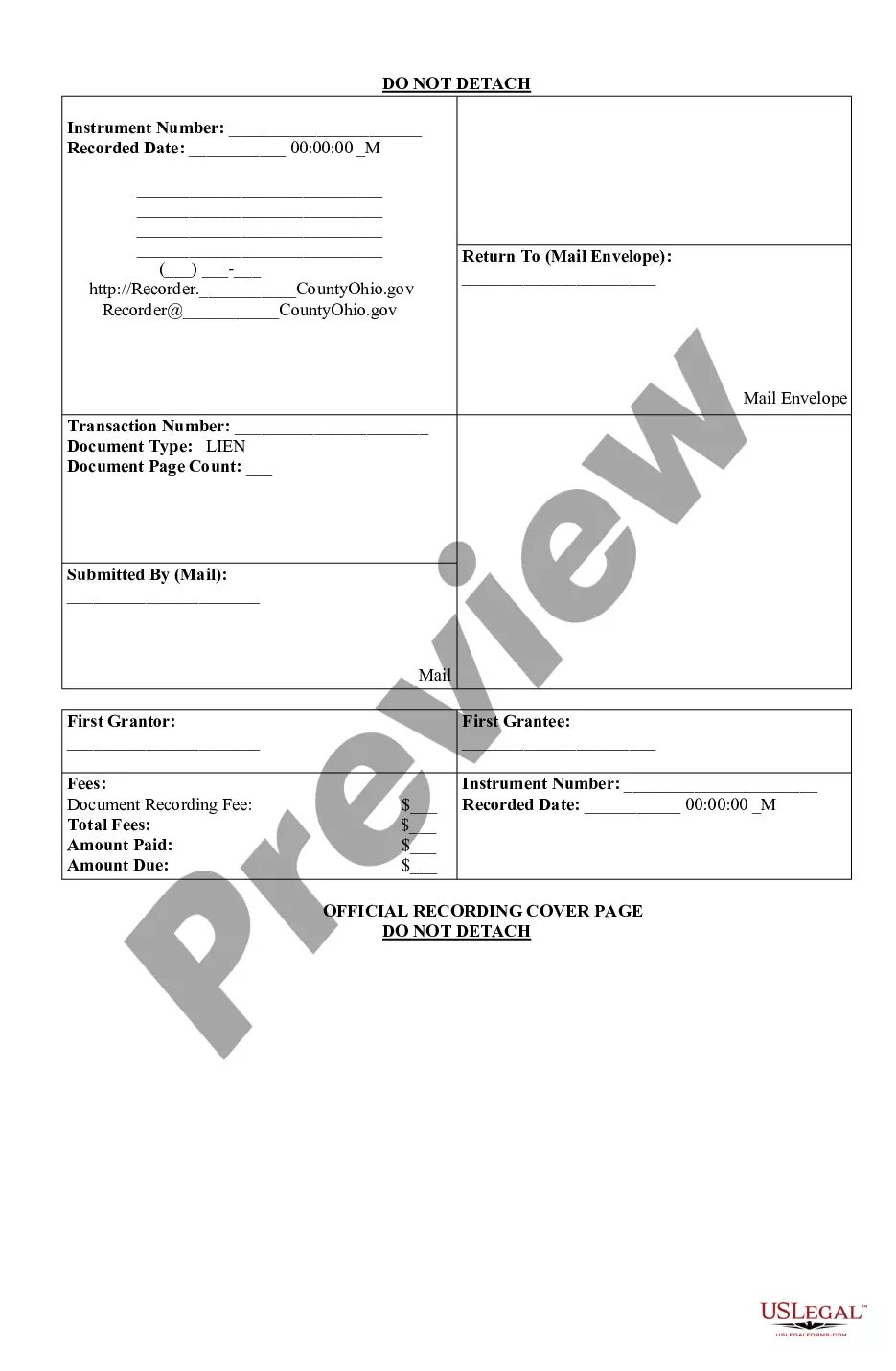

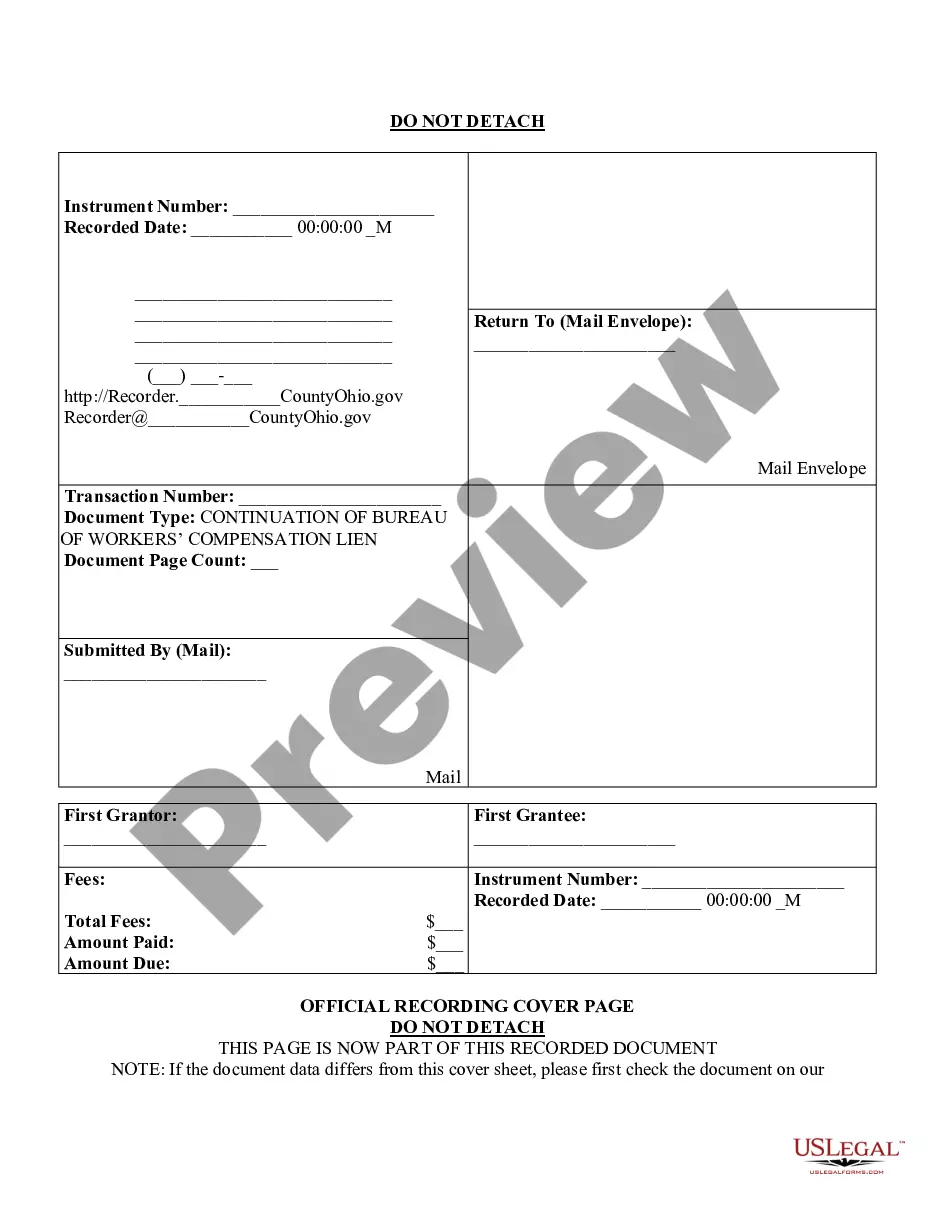

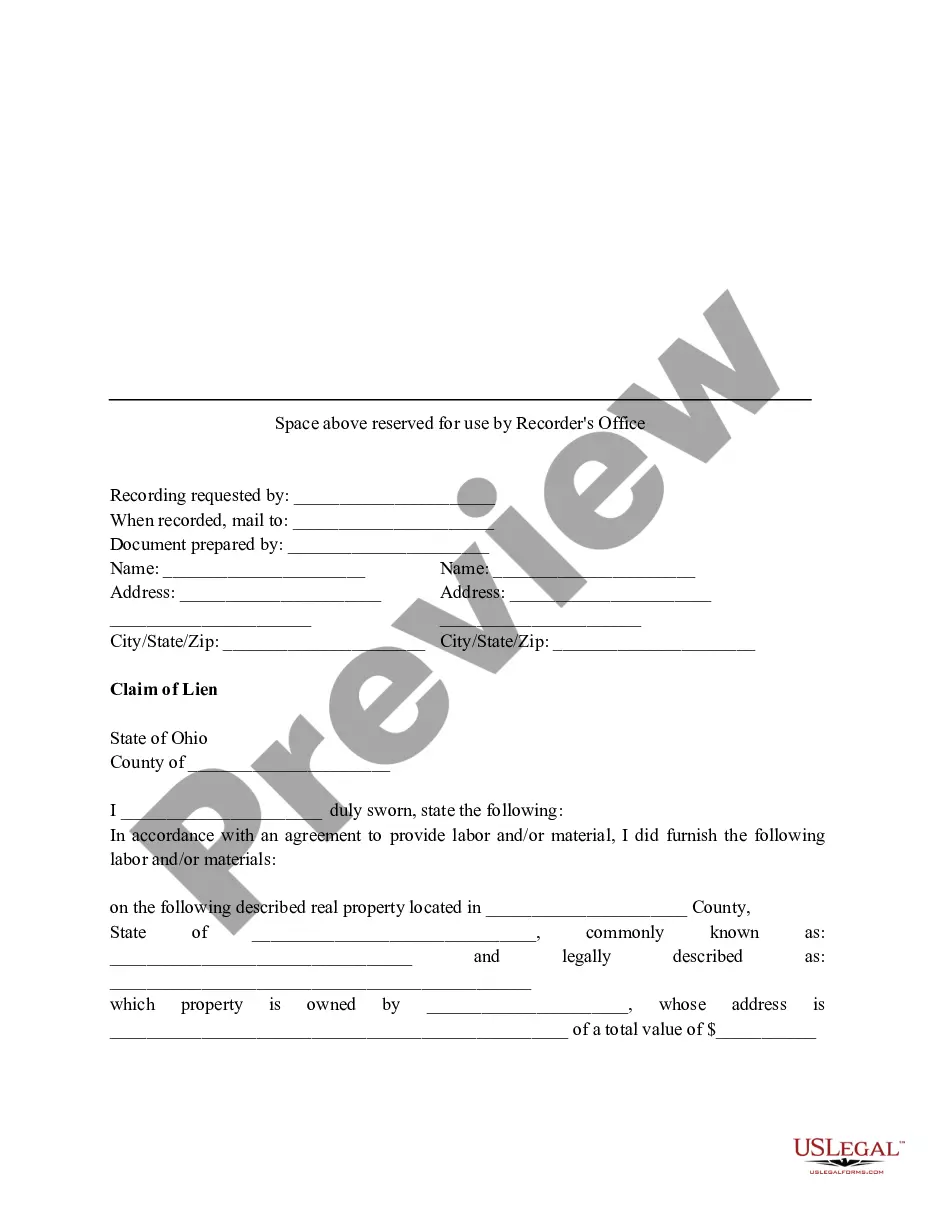

Ohio Recording Cover Page for Filing a Lien

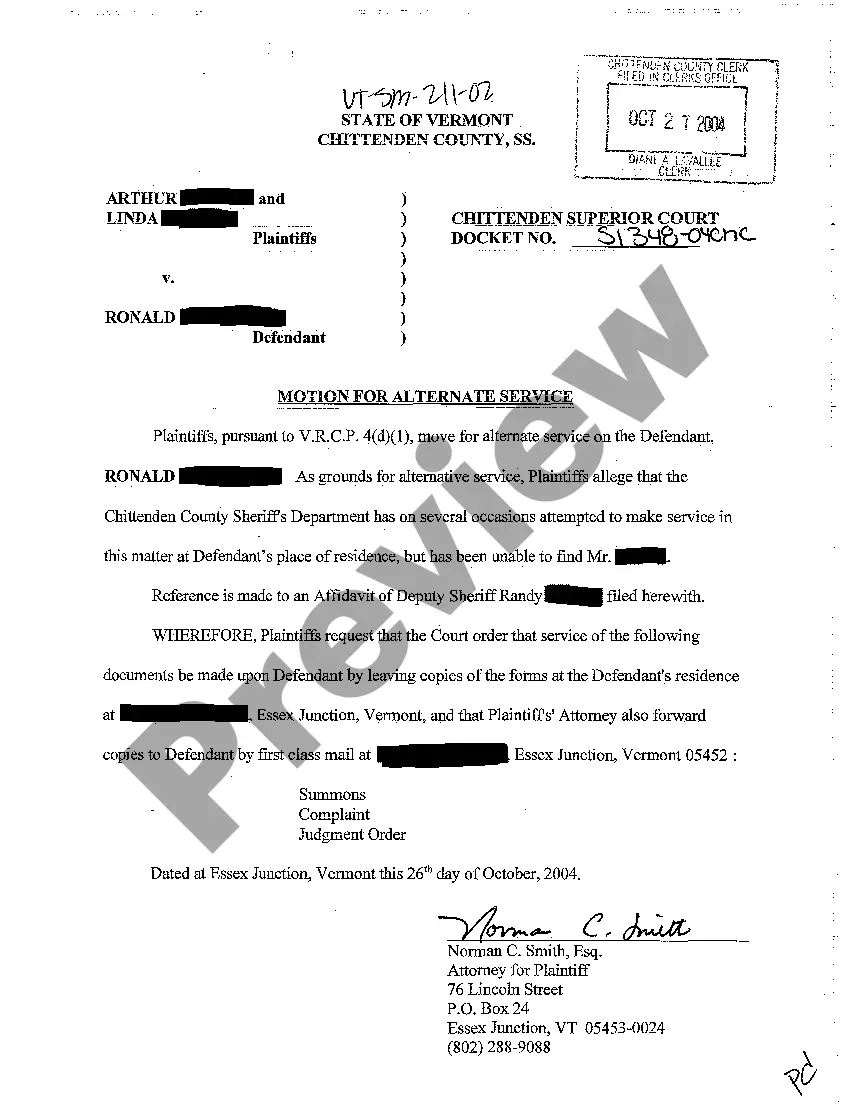

Description

How to fill out Ohio Recording Cover Page For Filing A Lien?

In terms of filling out Ohio Recording Cover Page for Filing a Lien, you almost certainly imagine a long process that consists of choosing a suitable form among countless similar ones and after that having to pay out legal counsel to fill it out to suit your needs. Generally, that’s a slow-moving and expensive option. Use US Legal Forms and select the state-specific document within clicks.

If you have a subscription, just log in and click on Download button to have the Ohio Recording Cover Page for Filing a Lien sample.

In the event you don’t have an account yet but want one, stick to the point-by-point guide listed below:

- Be sure the document you’re saving is valid in your state (or the state it’s needed in).

- Do it by reading through the form’s description and also by clicking on the Preview option (if available) to view the form’s information.

- Click Buy Now.

- Select the appropriate plan for your budget.

- Join an account and select how you would like to pay out: by PayPal or by card.

- Save the document in .pdf or .docx format.

- Find the document on your device or in your My Forms folder.

Skilled lawyers draw up our samples to ensure that after downloading, you don't have to worry about editing and enhancing content material outside of your personal information or your business’s details. Join US Legal Forms and receive your Ohio Recording Cover Page for Filing a Lien example now.

Form popularity

FAQ

Therefore, liens are not officially recorded, and personal property could be sold off to a third party who is unaware of the lien's existence. In most states, judgment liens must be filed by the creditor through the county or state.

Mechanic's lien. Which of the following liens does not need to be recorded to be valid? A statutory lien is created by statute. A real estate tax lien, then, is an involuntary, statutory lien.

Preliminary Title Report- California case law is clear that a preliminary title report cannot be relied upon as a true and reliable condition of title to real property.No duties or liabilities arise with a preliminary title report. Therefore, there is no liability to a title company if any recorded document is missed.

If the borrower on a recorded mortgage defaults, the lender can foreclose and either be paid in full or receive the property. However, if a mortgage or deed of trust was not recorded, the lender cannot foreclose against the property, just against the defaulting borrower personally.

Although recording statutes vary between U.S. states, they virtually all require that an interest in real property be formally recorded in the appropriate county office in order to be valid.If your deed has not been recorded, you are not recognized as the legal owner of your property.

In the case of mortgage liens, courts use the date of a recording to determine the priority for which liens should receive payment first. To understand which documents have been or must be recorded, check with your state and county recording division.

According to the Ohio Revised Code (ORC), it is the duty of the County Recorder to record all deeds, mortgages, plats or other instruments of writing that are required or authorized by the ORC.

In order to clear the title to the real property owned by the mortgagor, the Satisfaction of Mortgage document must be recorded with the County Recorder or Recorder of Deeds. If the mortgagee fails to record a satisfaction within the set time limits, the mortgagee may be responsible for damages set out by statute.

A "lien" is a notice that attaches to your property, telling the world that a creditor claims you owe it some money. A lien is typically a public record.Liens are a common way for creditors to collect what they're owed.