Notice Letter to Debt Collector of Section 808 Violation - Unfair Practices

Definition and meaning

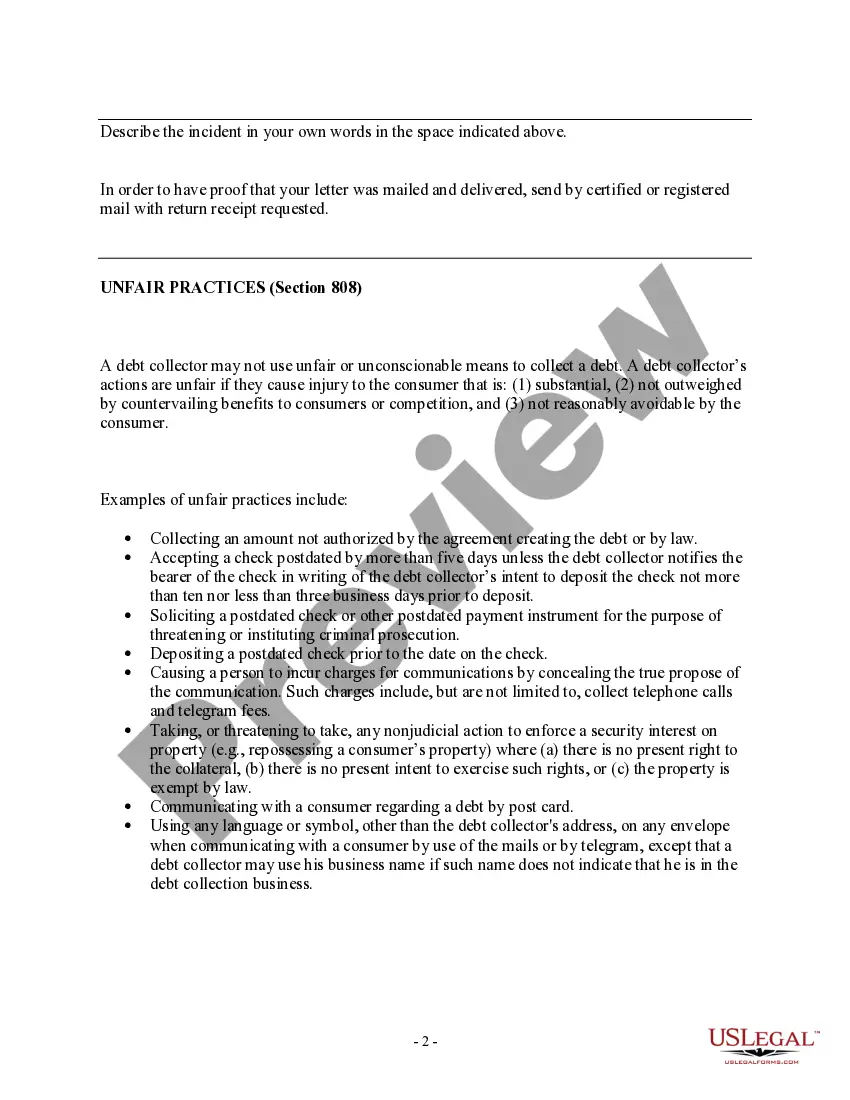

A Notice Letter to Debt Collector of Section 808 Violation - Unfair Practices is a formal communication sent by a consumer to a debt collector when unfair practices have been employed in the collection of a debt. This form informs the collector of their noncompliance with the Fair Debt Collection Practices Act (FDCPA), specifically Section 808, which prohibits the use of unfair or unconscionable means in debt collection.

Who should use this form

This form is intended for individuals who believe that a debt collector has violated Section 808 of the FDCPA while attempting to collect a debt. Users may include any consumer facing unethical debt collection practices, particularly those who experienced unfair treatment, such as excessive fees or harassment.

How to complete a form

To complete the Notice Letter, follow these steps:

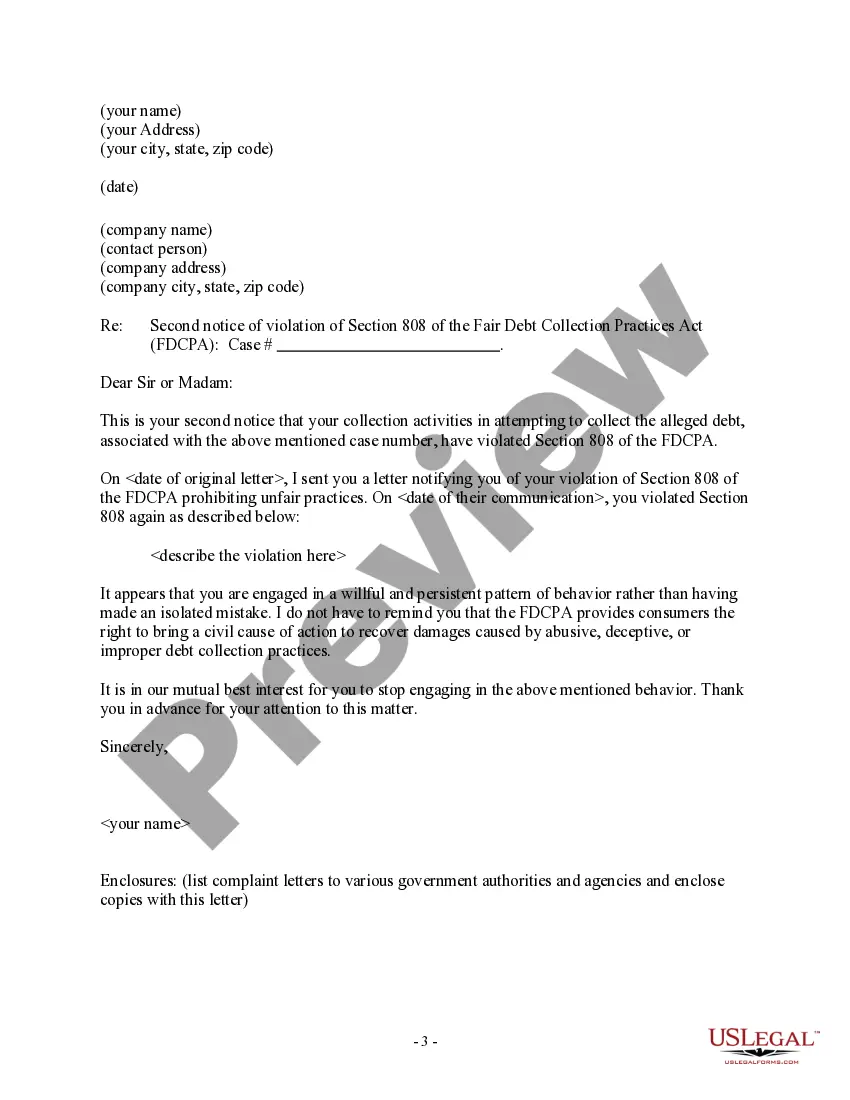

- Begin by filling in your name, address, and date at the top of the letter.

- Identify the debt collector's name, address, and the contact person, if known.

- Clearly state the case number related to the alleged debt.

- Provide a detailed description of the unfair practices experienced, including specific dates and actions taken by the debt collector.

- Sign and date the letter.

- Send the letter via certified or registered mail to ensure delivery and retain proof of sending.

Key components of the form

This form must include several key elements to be effective:

- Your contact information

- The debt collector’s contact information

- Reference to relevant legislation, specifically Section 808 of the FDCPA

- A clear account of the unfair practices experienced

- A request for the debt collector to cease such practices

Common mistakes to avoid when using this form

When completing the Notice Letter, be mindful of the following common errors:

- Neglecting to document specific incidents or details related to the violation.

- Addressing the letter incorrectly or failing to send it to the right recipient.

- Not keeping a copy of the letter and proof of sending.

- Failing to follow up if there is no response from the debt collector.

What documents you may need alongside this one

To support your case, you may require the following documents:

- Previous correspondence with the debt collector

- Records of payments or agreements related to the debt

- Any evidence of unfair practices, such as communications that demonstrate harassment

Form popularity

FAQ

Never Give Them Your Personal Information. A call from a debt collection agency will include a series of questions. Never Admit That The Debt Is Yours. Even if the debt is yours, don't admit that to the debt collector. Never Provide Bank Account Information.

Write and Mail a Letter State that you're requesting validation of the debt or removal of the debt from your credit report. Then mail the letter and request a return receipt so you have proof that you sent it and that the collection agency received it.

Under the Fair Debt collection Practices Act (FDCPA), I have the right to request validation of the debt you say I owe you. I am requesting proof that I am indeed the party you are asking to pay this debt, and there is some contractual obligation that is binding on me to pay this debt.

In the letter, reference the date of the initial contact and the method, for example, "a phone call received from your agency on April 25, 2019." You also need to provide a statement that you're requesting validation of the debt. Do not admit to owing the debt or make any reference to payment.

You're protected from harassing or abusive practices The Fair Debt Collection Practices Act prohibits debt collectors from using any harassing or abusive practices in an attempt to collect the debt.Along with other restrictions, debt collectors cannot: Use profane language. Threaten or use violence.

The debt dispute letter should include your personal identifying information; verification of the amount of debt owed; the name of the creditor for the debt; and a request that the debt not be reported to credit reporting agencies until the matter is resolved or have it removed from the report, if it already has been

Once a debt collector receives written notice from a consumer that he or she refuses to pay the debt or wants the collector to stop further collection efforts, the debt collector must cease any further communication with the consumer except "(1) to advise the consumer that the debt collector's further efforts are being

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

A debt validation letter can be an effective tool for dealing with debt collectors.