New Hampshire Architect Agreement - Self-Employed Independent Contractor

Description

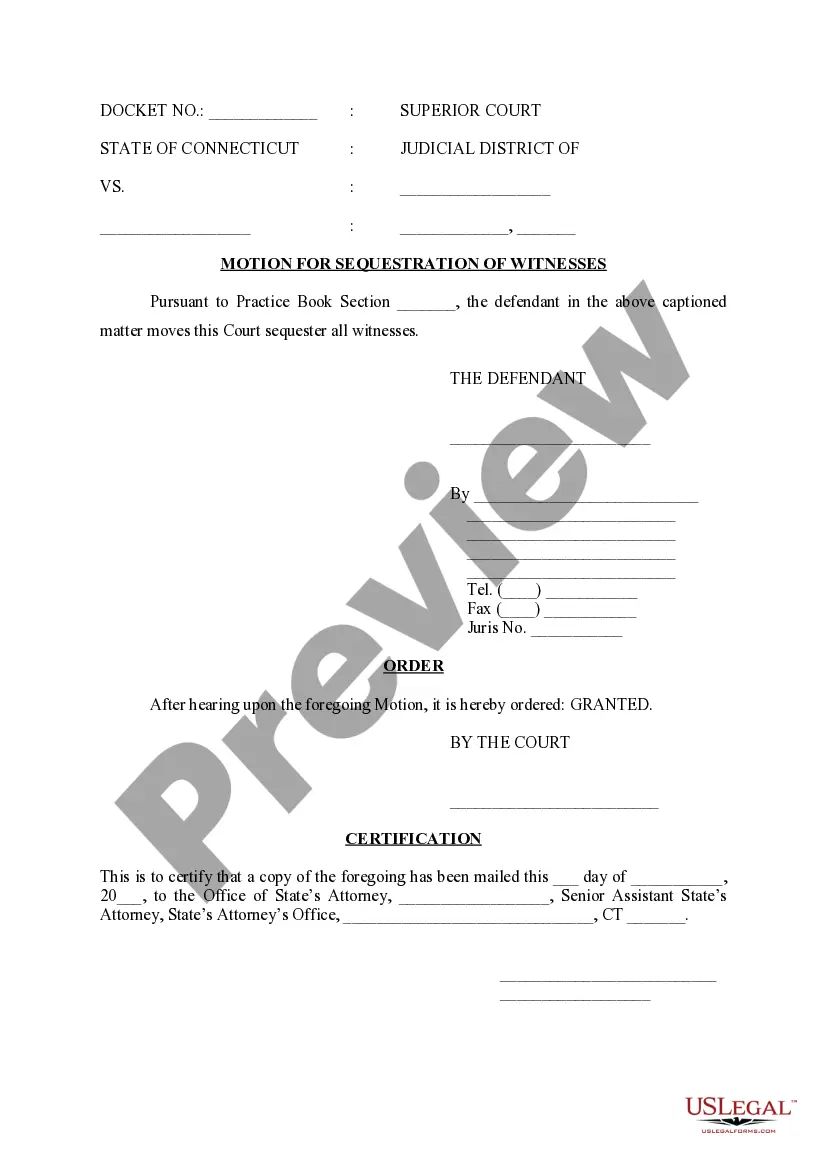

How to fill out Architect Agreement - Self-Employed Independent Contractor?

Finding the right valid document template can be a challenge.

Indeed, there are numerous layouts accessible online, but how do you identify the authentic form you require.

Make use of the US Legal Forms website. The platform offers thousands of templates, including the New Hampshire Architect Agreement - Self-Employed Independent Contractor, that you can utilize for business and personal purposes. All forms are vetted by experts and comply with state and federal regulations.

If the form does not meet your requirements, use the Search field to find the correct form. Once you confirm that the form is accurate, click the Get now button to obtain the form. Select the pricing plan you wish and enter the necessary information. Create your account and complete the purchase using your PayPal account or credit card. Choose the file format and download the legal document template to your device. Complete, modify, print, and sign the acquired New Hampshire Architect Agreement - Self-Employed Independent Contractor. US Legal Forms is the largest collection of legal forms where you can find various document templates. Utilize the service to obtain professionally crafted documents that meet state standards.

- If you are already registered, Log In to your account and click the Download button to acquire the New Hampshire Architect Agreement - Self-Employed Independent Contractor.

- Use your account to search for the legal forms you have previously purchased.

- Navigate to the My documents section of your account to obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

- Firstly, ensure that you have selected the correct form for your city/county.

- You can browse the form using the Review button and check the form details to verify it is the right one for you.

Form popularity

FAQ

Creating an independent contractor agreement involves several key steps. First, outline the scope of work, payment terms, and any deadlines associated with the project. Next, include confidentiality clauses and stipulations about the relationship between the parties, emphasizing that the agreement aligns with the New Hampshire Architect Agreement for Self-Employed Independent Contractors framework. Websites like uslegalforms offer useful templates and resources that can simplify this process and ensure you cover all essential aspects.

The independent contractor agreement is typically written by the party hiring the contractor. This document, in the context of a New Hampshire Architect Agreement for Self-Employed Independent Contractors, outlines the scope of work, payment terms, and project deadlines. Both parties should review and adapt it to ensure that it meets their needs and expectations. If you need guidance, you can use platforms like uslegalforms to access templates tailored for your requirements.

In New Hampshire, having an operating agreement is not a legal requirement for most businesses, including those set up under the New Hampshire Architect Agreement for Self-Employed Independent Contractors. However, having this document can help clarify the roles, responsibilities, and expectations between parties. It adds structure and transparency that can benefit your business operations. To establish clear mutual understanding, consider drafting an operating agreement that reflects your specific needs.

Writing an independent contractor agreement involves several key components. Start with the parties' information and a clear description of the work to be performed. Include payment terms, confidentiality clauses, and termination conditions, while referencing the New Hampshire Architect Agreement - Self-Employed Independent Contractor for context. Utilizing resources from platforms like USLegalForms can provide templates that make this process easier.

An architect can be considered an independent contractor if they work on a project basis rather than as a full-time employee. Under the New Hampshire Architect Agreement - Self-Employed Independent Contractor, architects typically set their own hours and manage their workload. This arrangement offers flexibility and autonomy in managing architectural projects. If you are an architect considering this status, be sure to comply with local regulations and documentation.

To fill out an independent contractor agreement, start with your personal information and the client's details. Clearly outline the scope of work, payment terms, and deadlines, referencing the New Hampshire Architect Agreement - Self-Employed Independent Contractor. Ensure both parties sign and date the document to solidify the agreement. Using a platform like USLegalForms can simplify this process with templates and guidance.

Filling out an independent contractor form is straightforward. First, include your personal information, such as name and address, followed by details about your work. Make sure to reference the New Hampshire Architect Agreement - Self-Employed Independent Contractor, detailing the services you will provide. Double-check all information for accuracy before submission to avoid any delays.

When discussing your work arrangement in the context of a New Hampshire Architect Agreement - Self-Employed Independent Contractor, both terms often mean the same. However, 'self-employed' generally implies you run your own business, while 'independent contractor' emphasizes your role in providing services under a contract. Clarity should guide your choice; if your clients value one term over the other, use it. Ultimately, regardless of your choice, both describe your autonomy and professional expertise.