New Hampshire Design Agreement - Self-Employed Independent Contractor

Description

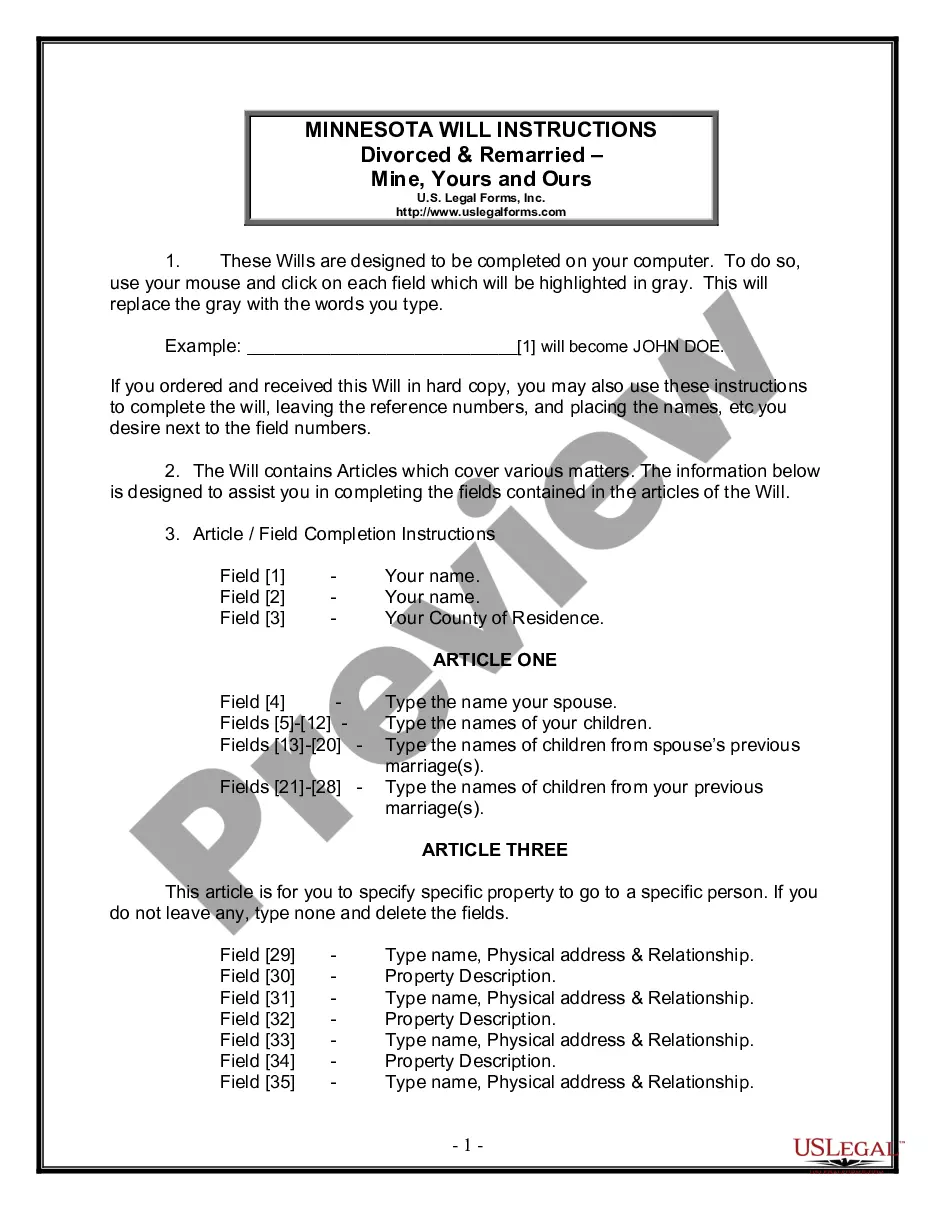

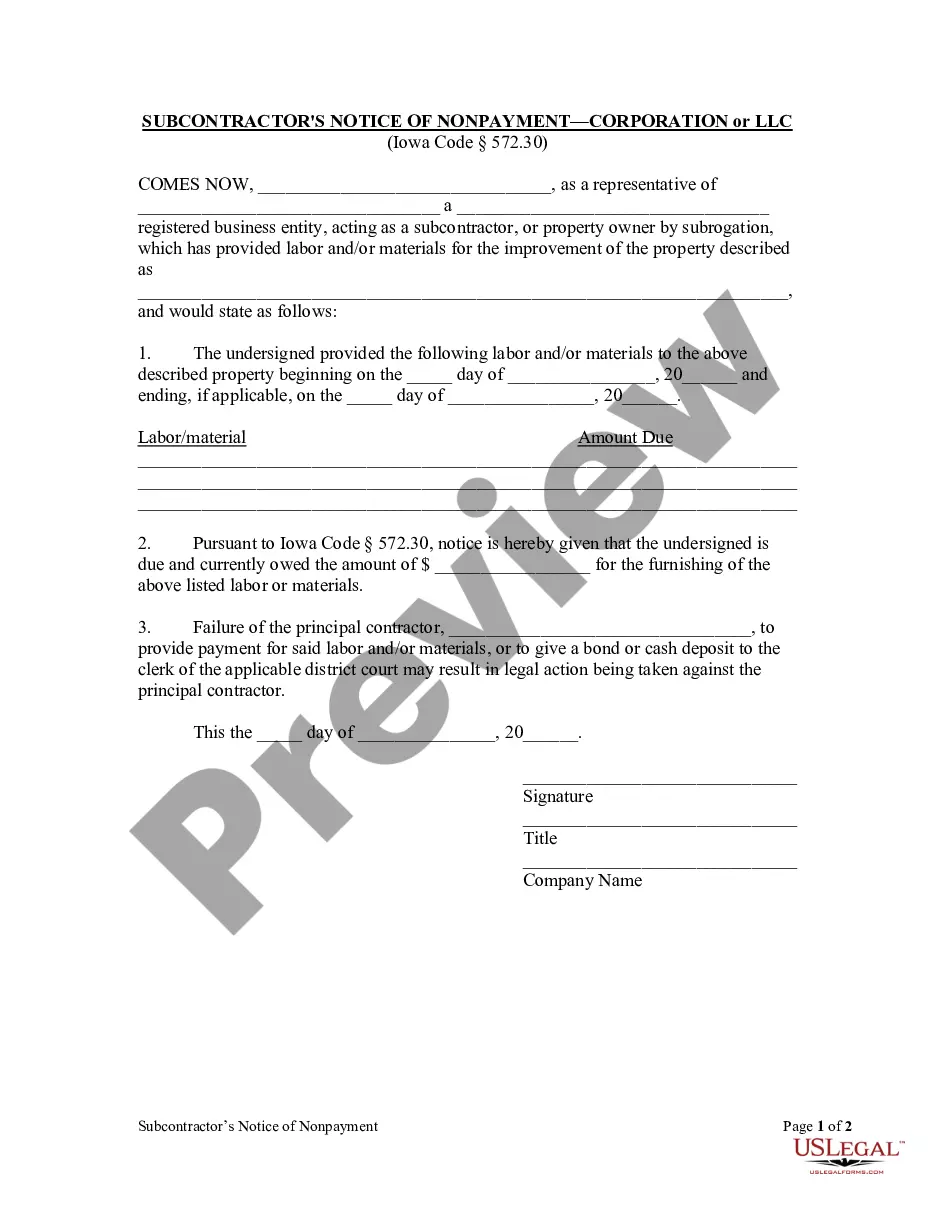

How to fill out Design Agreement - Self-Employed Independent Contractor?

You can dedicate hours online looking for the legal document template that fulfills the state and federal requirements you need. US Legal Forms offers a vast array of legal documents that are reviewed by experts. It is easy to obtain or print the New Hampshire Design Agreement - Self-Employed Independent Contractor from my service.

If you already possess a US Legal Forms account, you can Log In and click on the Download button. Then, you can fill out, modify, print, or sign the New Hampshire Design Agreement - Self-Employed Independent Contractor. Each legal document template you obtain is yours indefinitely. To receive another copy of the purchased form, go to the My documents section and click on the appropriate button.

If you are accessing the US Legal Forms website for the first time, follow the straightforward instructions below: First, make sure you have selected the correct document template for the area/city you choose. Review the form description to confirm you have selected the appropriate document. If available, use the Review button to browse through the document template as well. To find another version of the form, use the Search field to locate the template that meets your needs and requirements. Once you have found the template you want, click Acquire now to proceed. Select the pricing plan you prefer, enter your details, and create an account on US Legal Forms. Complete the transaction. You can use your credit card or PayPal account to pay for the legal document. Choose the format of the document and download it to your device. Make alterations to your document as necessary. You can fill out, modify, sign, and print the New Hampshire Design Agreement - Self-Employed Independent Contractor. Download and print numerous document templates using the US Legal Forms website, which offers the largest collection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

Form popularity

FAQ

In New Hampshire, a Design Agreement for a self-employed independent contractor does not typically require notarization. However, certain situations may benefit from having a notarized agreement to ensure clarity and authenticity. Utilizing a legally binding document can help protect both parties involved. When you create your New Hampshire Design Agreement on platforms like US Legal Forms, you receive guidance to ensure compliance with local laws.

Writing an independent contractor agreement starts with identifying the parties and detailing the nature of the work. Include payment terms, timelines, and any specific legal clauses that apply to the agreement. It's crucial to provide clarity on both expectations and deliverables. Using a New Hampshire Design Agreement - Self-Employed Independent Contractor ensures that you have a solid foundation for a successful working relationship.

To write a freelance design contract, begin by specifying the parties involved and the project details. Clearly describe the scope of work, deadlines, payment structure, and ownership rights to the completed designs. Including a New Hampshire Design Agreement - Self-Employed Independent Contractor can help ensure that your agreement meets legal standards and protects your rights.

Filling out an independent contractor form involves providing personal information, such as your name and contact details, followed by a description of the services you will deliver. Clearly outline payment terms, including rates and schedule, and include any relevant terms of the agreement. For optimal results, using a New Hampshire Design Agreement - Self-Employed Independent Contractor is recommended to cover all bases.

An independent contractor typically needs to complete several essential documents, including a W-9 form for tax purposes and a detailed independent contractor agreement. Depending on the project, additional paperwork may include invoices and time tracking sheets. To ensure compliance, consider using a New Hampshire Design Agreement - Self-Employed Independent Contractor to clarify terms and conditions.

To fill out an independent contractor agreement, start by entering the names and addresses of both parties involved. Next, clearly define the scope of work, payment terms, and deadlines. Be sure to include any necessary legal clauses, such as confidentiality or termination conditions, to protect both you and the client. Utilizing a New Hampshire Design Agreement - Self-Employed Independent Contractor template can simplify this process.

To provide proof of employment as a New Hampshire Design Agreement - Self-Employed Independent Contractor, you can present several documents. Common options include invoices submitted for payment, a signed agreement, and tax forms that reflect your independent contractor status. Establishing a good record with clients and maintaining clear communication will also support your claims. Using platforms like US Legal Forms can help organize and present this documentation effectively.

Typically, the party hiring the independent contractor writes the New Hampshire Design Agreement - Self-Employed Independent Contractor. However, both parties can collaborate to ensure that their interests are represented. Using a platform like US Legal Forms can provide ready-made agreements that save time. Involving legal counsel can also enhance the clarity and effectiveness of the agreement.

Creating a New Hampshire Design Agreement - Self-Employed Independent Contractor begins with a clear outline of the terms of your work relationship. You should describe the services provided, payment structure, and project timelines. Utilize resources like US Legal Forms to obtain templates that simplify the process. This ensures both parties agree on the terms and reduces potential misunderstandings.