New Hampshire Engineering Agreement - Self-Employed Independent Contractor

Description

How to fill out Engineering Agreement - Self-Employed Independent Contractor?

If you wish to complete, obtain, or print authentic document templates, utilize US Legal Forms, the largest repository of legal forms available online.

Employ the site’s straightforward and user-friendly search to find the documents you require. Various templates for business and personal purposes are organized by categories and states, or keywords.

Utilize US Legal Forms to acquire the New Hampshire Engineering Agreement - Self-Employed Independent Contractor with just a few clicks.

Each legal document template you purchase is yours indefinitely. You have access to every form you saved in your account. Navigate to the My documents section and choose a form to print or download again.

Stay competitive and download, and print the New Hampshire Engineering Agreement - Self-Employed Independent Contractor with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms customer, sign in to your account and click on the Download button to get the New Hampshire Engineering Agreement - Self-Employed Independent Contractor.

- You can also access forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct area/state.

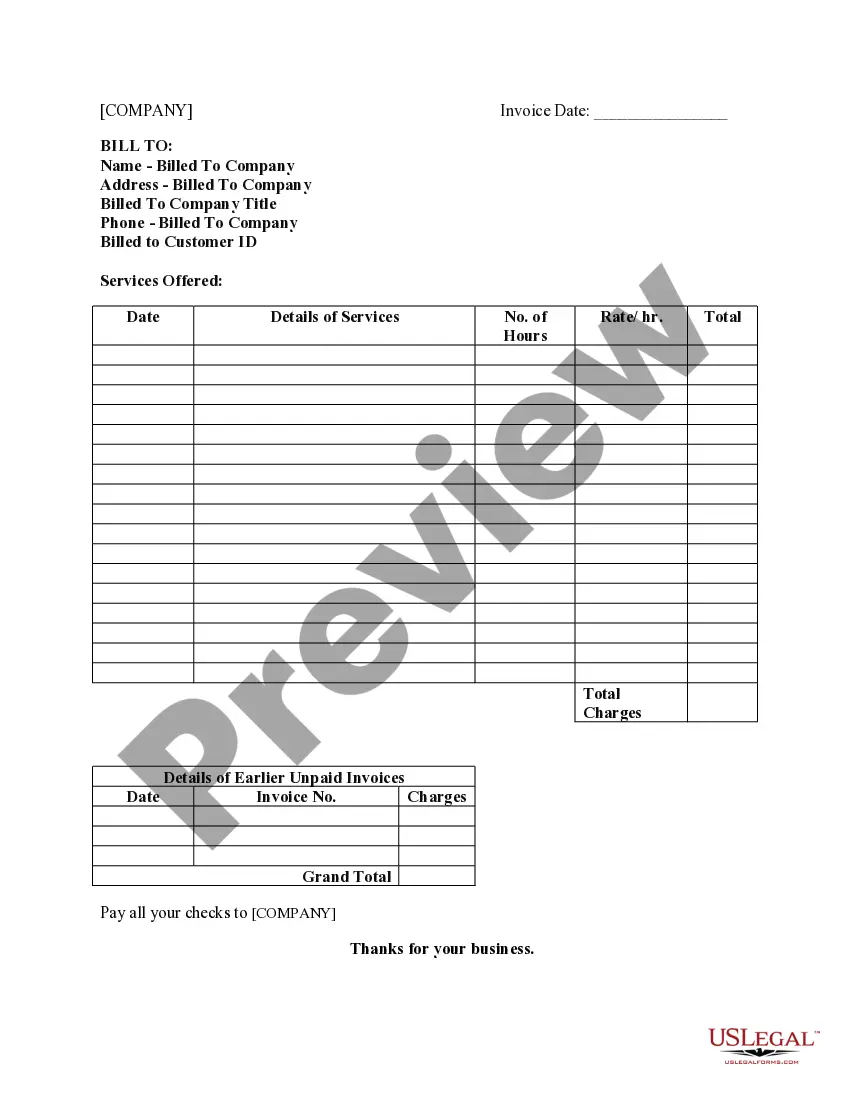

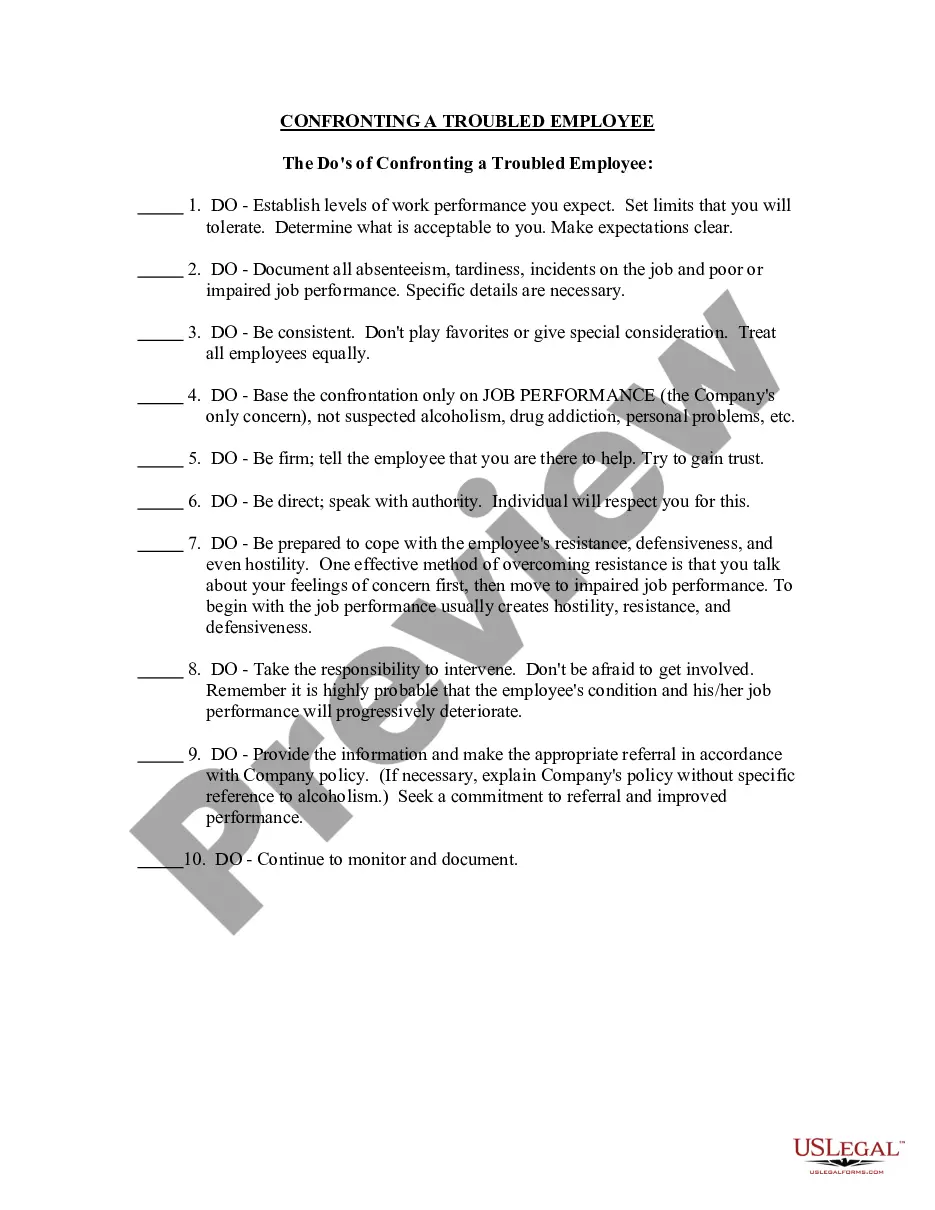

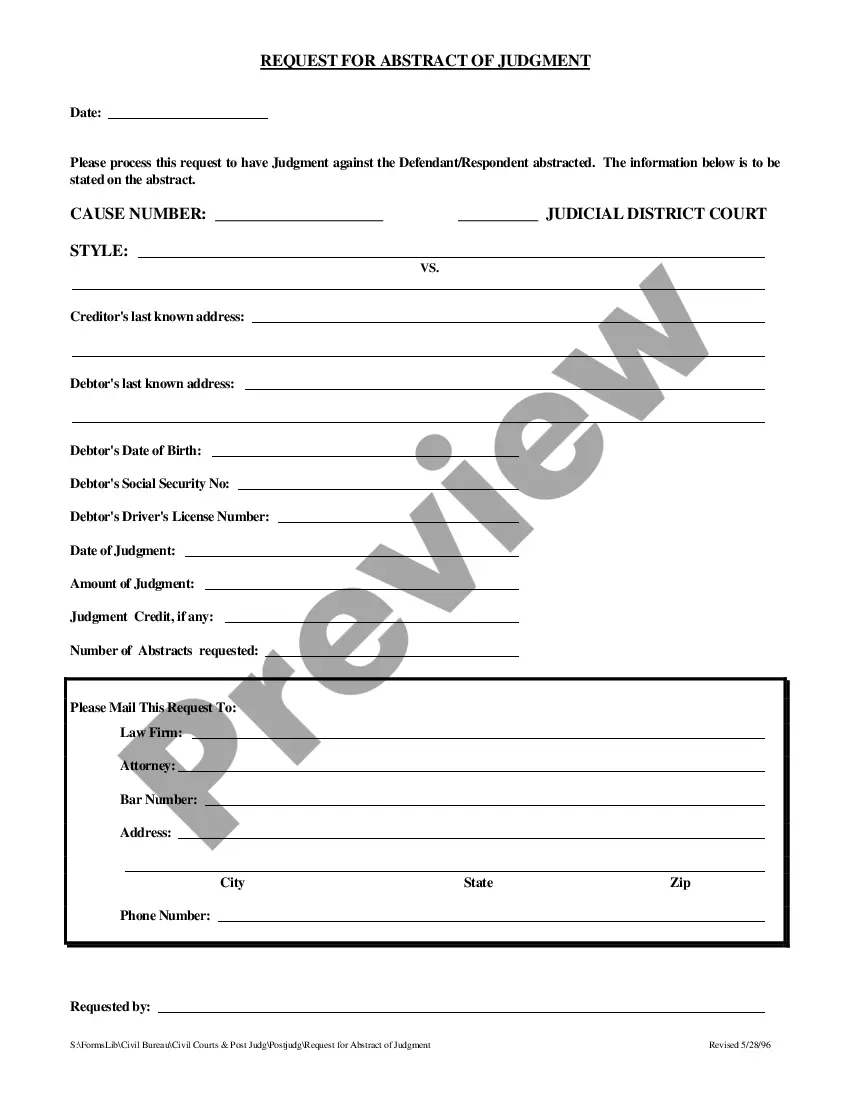

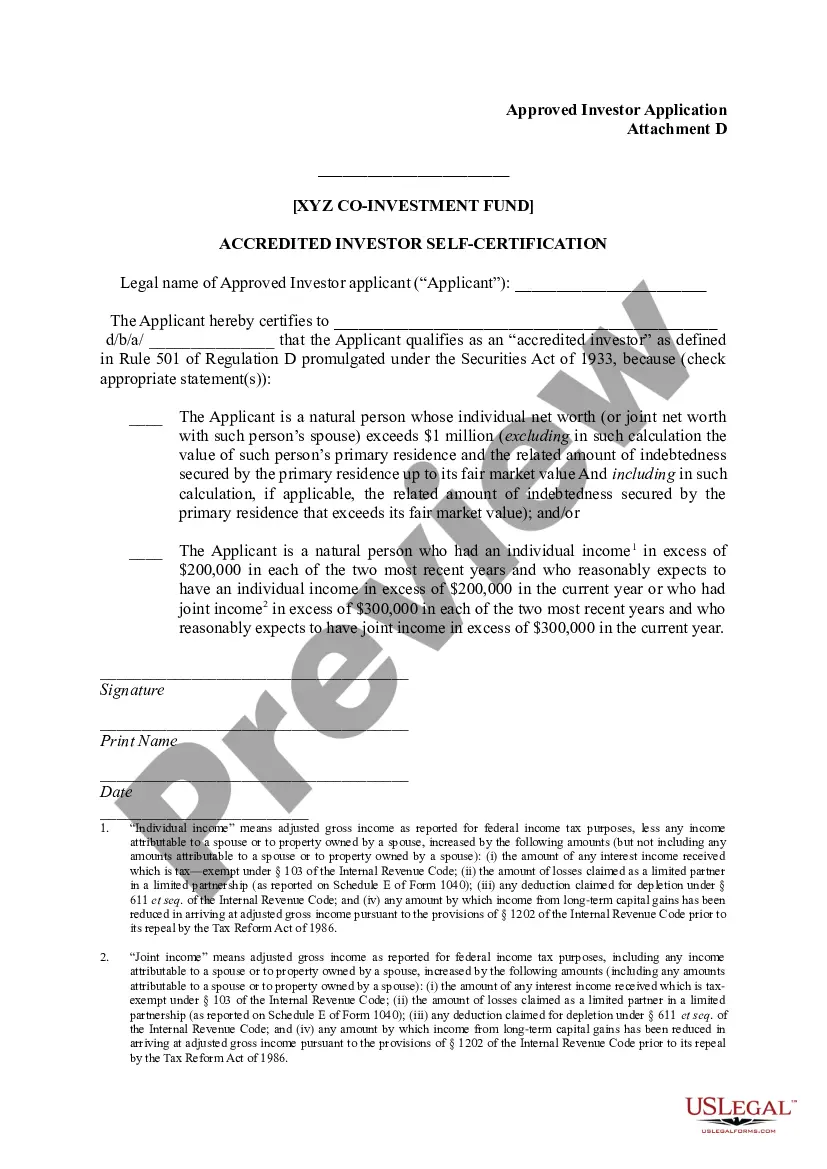

- Step 2. Use the Review option to examine the form’s content. Don’t forget to read through the summary.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you need, click on the Download now button. Choose the pricing plan you prefer and enter your details to create an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Step 6. Select the format of your legal form and download it to your system.

- Step 7. Complete, edit, and print or sign the New Hampshire Engineering Agreement - Self-Employed Independent Contractor.

Form popularity

FAQ

Both terms refer to the same situation, but the context may dictate which is more appropriate. 'Independent contractor' often emphasizes the contractual nature of your work, while 'self-employed' highlights your overall business status. In discussions about the New Hampshire Engineering Agreement - Self-Employed Independent Contractor, using either term can be correct. Choose the term that best fits your audience or purpose for clarity.

Being self-employed means you work for yourself rather than for an employer. You may operate a small business, provide freelance services, or have multiple clients, like in the New Hampshire Engineering Agreement - Self-Employed Independent Contractor scenario. Self-employment brings responsibilities, such as managing your own taxes and benefits. Understanding these aspects is vital for your success.

Yes, an independent contractor is always considered self-employed. This role allows you the freedom to work with various clients and projects. The New Hampshire Engineering Agreement - Self-Employed Independent Contractor helps define this relationship clearly, ensuring you understand your rights. Knowing your status as self-employed empowers you to manage your business effectively.

While it is not always legally required, having a contract as an independent contractor is strongly recommended. A written agreement, such as a New Hampshire Engineering Agreement - Self-Employed Independent Contractor, outlines the terms of your work, payment details, and project expectations. This clarity helps prevent misunderstandings and protects your interests. It establishes a professional relationship with your clients.

Yes, an independent contractor is indeed classified as self-employed. When you engage in work without a traditional employer-employee relationship, you operate as a self-employed individual. The New Hampshire Engineering Agreement - Self-Employed Independent Contractor further clarifies your rights and responsibilities in this independent role. This distinction is key for tax and business purposes.

Yes, receiving a 1099 form typically indicates you are self-employed. This form is used by businesses to report payments made to independent contractors. In the context of a New Hampshire Engineering Agreement - Self-Employed Independent Contractor, this income reflects your status as a self-employed individual. Always consult with a tax professional for accurate classification and tax obligations.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

Remember that an independent contractor is considered to be self-employed, so in effect, you are running your own one-person business. Any income that you earn as an independent contractor must be reported on Schedule C. You'll then pay income taxes on the total profit.

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees.