New Hampshire Equal Pay - Administration and Enforcement Checklist

Description

How to fill out Equal Pay - Administration And Enforcement Checklist?

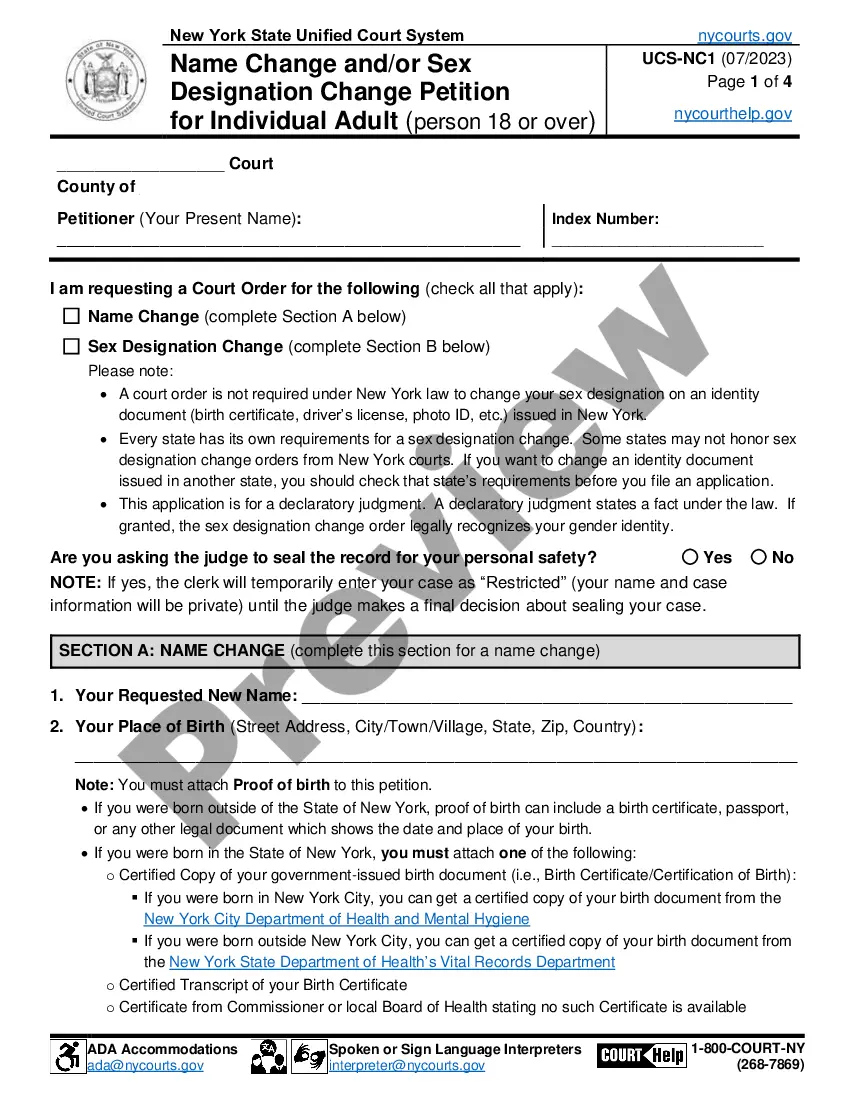

You might dedicate hours online seeking the legal document format that meets the state and federal guidelines you require.

US Legal Forms offers a vast array of legal forms that are reviewed by professionals.

You can readily obtain or print the New Hampshire Equal Pay - Administration and Enforcement Checklist from their services.

If available, use the Preview option to examine the document format as well.

- If you currently have a US Legal Forms account, you can Log In and select the Obtain option.

- After that, you can complete, modify, print, or sign the New Hampshire Equal Pay - Administration and Enforcement Checklist.

- Every legal document format you purchase is yours indefinitely.

- To acquire another copy of any purchased form, navigate to the My documents tab and select the appropriate option.

- If this is your first time using the US Legal Forms website, follow the basic instructions outlined below.

- First, ensure that you have chosen the correct document format for the state/region you select.

- Review the form details to confirm you have chosen the right form.

Form popularity

FAQ

The 2 hour rule in New Hampshire requires employees to receive a 30-minute break for every 5 consecutive hours worked. Additionally, when employees work more than 2 hours beyond their scheduled shift, they may be entitled to additional compensation. Keeping abreast of these specifics is crucial, and the New Hampshire Equal Pay - Administration and Enforcement Checklist provides essential information to help employers navigate workplace policies efficiently.

The 72 hour rule in New Hampshire refers to the requirement for employers to provide employees with at least 72 hours of advance notice before altering their shift schedules. This rule ensures employees have time to adjust their commitments accordingly. For businesses, staying compliant with such regulations is vital, and the New Hampshire Equal Pay - Administration and Enforcement Checklist can guide you through these requirements.

In New Hampshire, working 7 consecutive days is not inherently illegal. However, certain conditions apply under labor laws, especially regarding overtime and rest periods. Employers must comply with specific regulations concerning employee breaks and hours worked. For detailed guidance on employment laws and compliance, consult the New Hampshire Equal Pay - Administration and Enforcement Checklist.

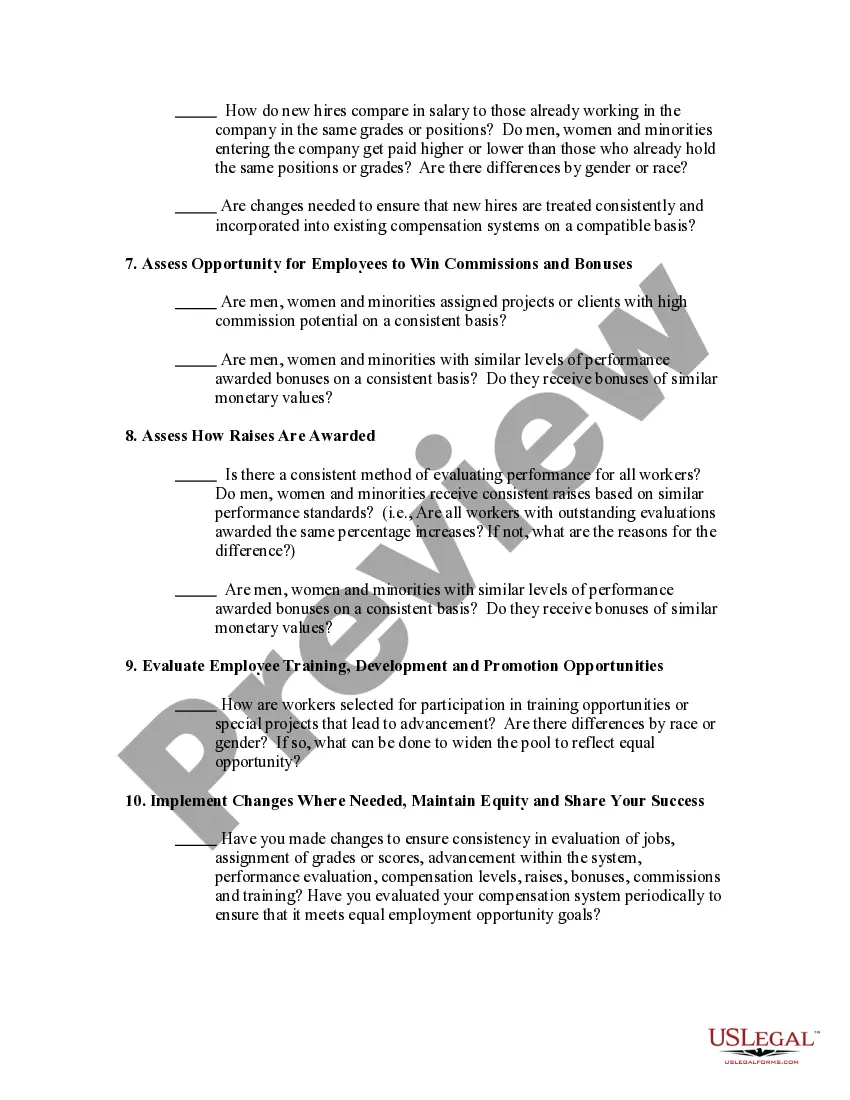

On January 29, 2009, President Barack Obama signed into law the Lilly Ledbetter Fair Pay Act. The Act requires employers to redouble their efforts to ensure that their pay practices are non-discriminatory and to make certain that they keep the records needed to prove the fairness of pay decisions.

Yes, employers must provide, in writing, an employee's rate of pay at the time of hire and upon any changes, as well as all policies pertaining to any fringe benefits.

Employers must give all their employees and workers payslips, by law (Employment Rights Act 1996). Workers can include people on zero-hours contracts and agency workers. Agency workers get their payslips from their agency.

Steps to Hiring your First Employee in New HampshireStep 1 Register as an Employer.Step 2 Employee Eligibility Verification.Step 3 Employee Withholding Allowance Certificate.Step 4 New Hire Reporting.Step 5 Payroll Taxes.Step 6 Workers' Compensation Insurance.Step 7 Labor Law Posters and Required Notices.More items...?

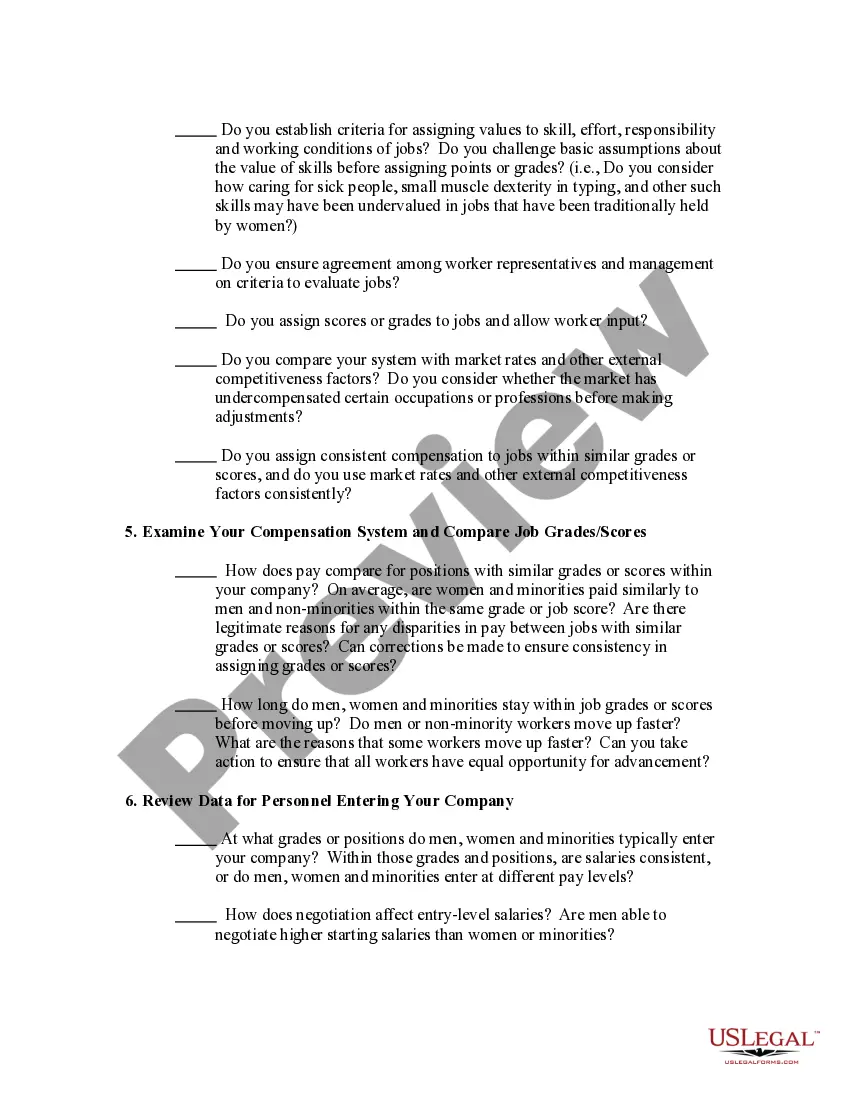

The equal pay act prohibits sex-based wage discrimination between men and women in the same establishment who perform jobs that require substantially equal skill, education, effort and responsibility under similar working conditions.

There are several elements that must be met in compensation discrimination complaints under the Equal Pay Act. The jobs being compared must require substantially equal skill, effort, and responsibility and be performed under similar working conditions within the same establishment.

The Equal Pay Act of 1963 is a U.S. law that prohibits employers from paying different wages to men and women who work under similar conditions and whose jobs require the same level of skill, effort, and responsibility. It is part of the amended Fair Labor Standards Act of 1938.