Nebraska Guaranty of Payment of Open Account

Description

How to fill out Guaranty Of Payment Of Open Account?

Are you in the location where you require documents for either business or particular purposes nearly every day.

There are numerous legal document templates accessible online, but finding ones you can rely on is challenging.

US Legal Forms offers thousands of template documents, similar to the Nebraska Guaranty of Payment of Open Account, that are designed to meet federal and state regulations.

Access all the document templates you have purchased in the My documents list.

You can obtain an additional version of Nebraska Guaranty of Payment of Open Account at any time, if necessary. Just access the essential document to download or print the template.

- If you are already acquainted with the US Legal Forms site and have a free account, simply Log In.

- After that, you can obtain the Nebraska Guaranty of Payment of Open Account template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Find the document you need and ensure it is for the correct city/county.

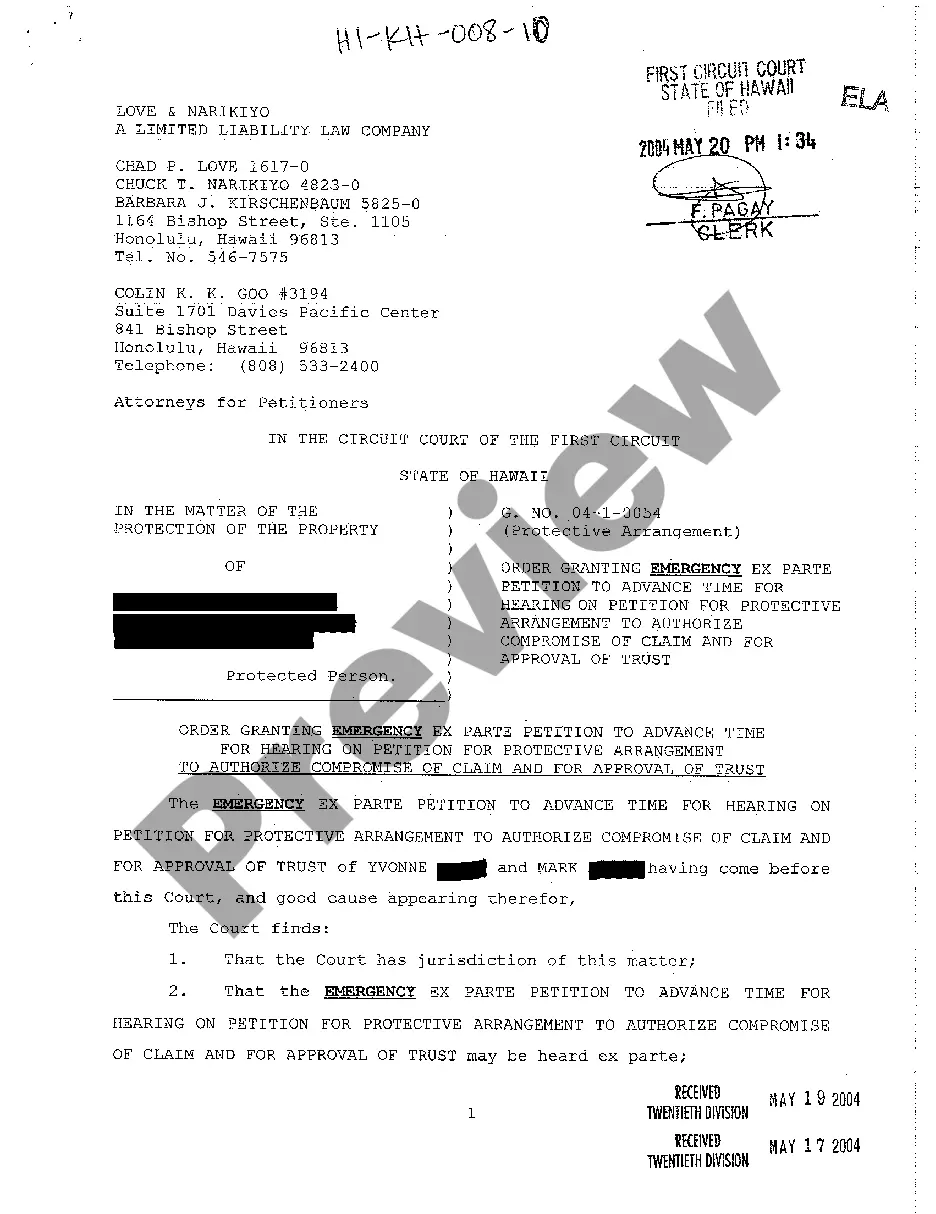

- Utilize the Preview button to view the form.

- Check the details to confirm that you have selected the correct document.

- If the document is not what you require, use the Search area to find the document that meets your needs.

- Once you find the right document, click on Get now.

- Choose the pricing plan you need, complete the required information to create your account, and pay for the order with your PayPal or credit card.

- Select a convenient file format and download your copy.

Form popularity

FAQ

In Nebraska, the statute of limitations for a contract is typically four years. This means that if you need to enforce a Nebraska Guaranty of Payment of Open Account, you must initiate legal action within four years of the event that triggered the claim. Understanding this time limit is crucial for protecting your legal rights. For more detailed assistance, consider using US Legal Forms to ensure compliance and guidance on your contracts.

Generally, a PTET refund is not considered taxable income because it represents a return of overpaid taxes. Instead, it may reduce your taxable income for the year you receive it. However, it is essential to remain aware of how refunds may impact your overall financial picture, especially related to the Nebraska Guaranty of Payment of Open Account.

through entity, such as an LLC or partnership, allows income to pass through to individual owners instead of being taxed at the corporate level. This structure enables business owners to report income directly on their personal tax returns, thus consolidating their tax obligations. Understanding this can improve efficiencies in managing your taxes, particularly with the Nebraska Guaranty of Payment of Open Account.

To contact the Nebraska Department of Revenue regarding the Nebraska Guaranty of Payment of Open Account, you can visit their official website for resources and contact information. You can also call their office directly for assistance with specific tax inquiries. They provide valuable support to help you navigate your obligations smoothly.

The purpose of the Nebraska Guaranty of Payment of Open Account is to ensure that business owners can fulfill their tax obligations as pass-through entities. This allows individuals and businesses to manage their state taxes effectively while encouraging compliance. Understanding PTET is crucial for maximizing financial benefits and minimizing liabilities related to open accounts.