Nebraska Guaranty of Open Account - Alternate Form

Description

How to fill out Guaranty Of Open Account - Alternate Form?

US Legal Forms - one of the most substantial collections of legal forms in the United States - offers a variety of legal document templates that you can download or print.

By using the website, you can access thousands of forms for business and personal use, organized by categories, states, or keywords. You can obtain the latest forms like the Nebraska Guaranty of Open Account - Alternate Form in moments.

If you possess a monthly subscription, Log In and download the Nebraska Guaranty of Open Account - Alternate Form from the US Legal Forms library. The Download option will appear on every form you view. You can access all previously saved forms in the My documents tab of your account.

Make changes. Complete, edit, print, and sign the downloaded Nebraska Guaranty of Open Account - Alternate Form.

Every design you save to your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you require.

- If you wish to utilize US Legal Forms for the first time, here are simple instructions to help you get started.

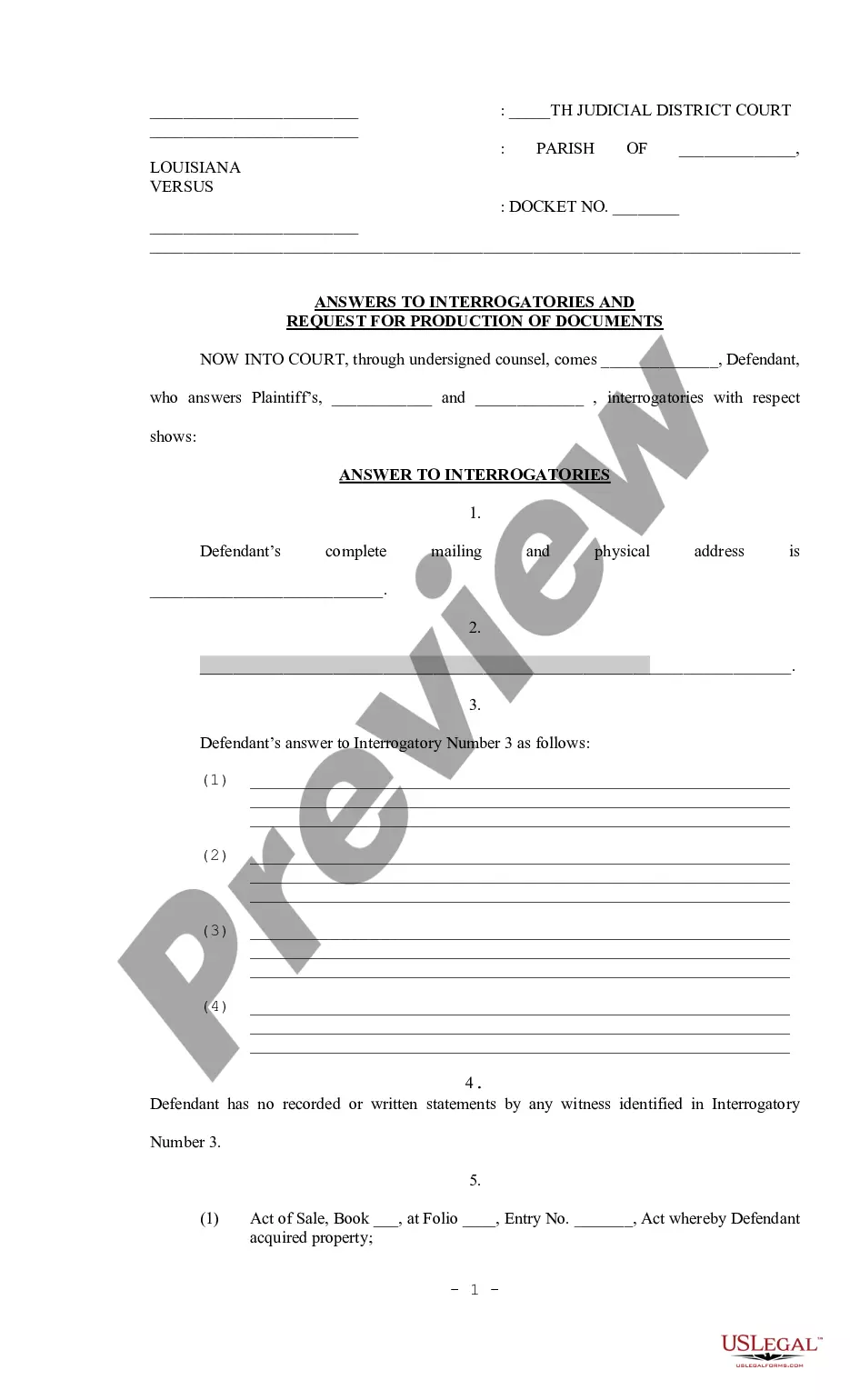

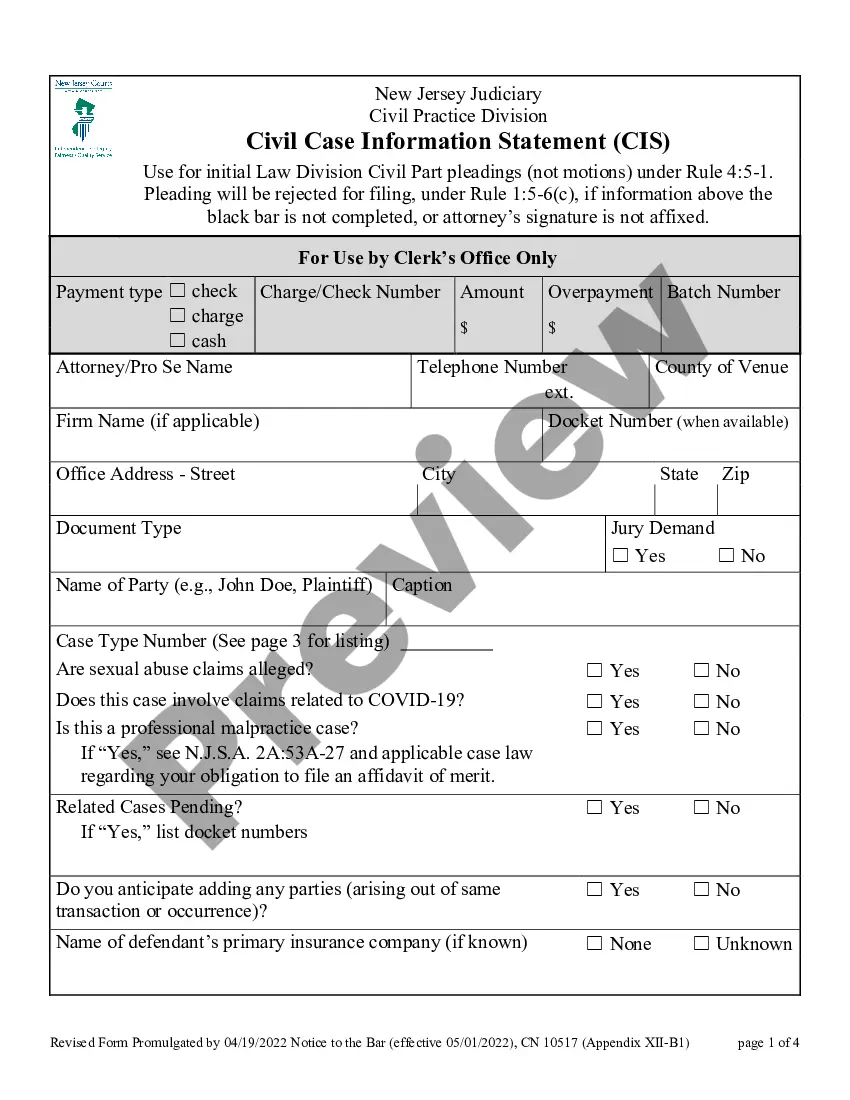

- Ensure you have chosen the correct form for your city/state. Click the Review button to verify the form's content. Read the form description to confirm that you have selected the correct form.

- If the form does not meet your requirements, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Buy Now button. Then, select the payment plan you prefer and provide your information to register for an account.

- Complete the transaction. Use a credit card or PayPal account to finalize the purchase.

- Choose the format and download the form to your device.

Form popularity

FAQ

The Nebraska Supreme Court sessions are held in Lincoln, typically at the State Capitol. This location serves as a central point for legal matters and appeals across the state. If you have inquiries regarding specific forms, such as the Nebraska Guaranty of Open Account - Alternate Form, you can access resources directly at the court or through platforms like US Legal Forms.

The Nebraska Supreme Court is located in Lincoln, the state capital. It resides in the State Capitol building, which is an important landmark. Residents seeking to understand legal frameworks, including the Nebraska Guaranty of Open Account - Alternate Form, can visit the court for information or to observe proceedings.

Nebraska has a total of seven Supreme Court justices. This small number allows for more efficient deliberations on important legal issues, including those involving the Nebraska Guaranty of Open Account - Alternate Form. The justices work together to ensure fair application of the law across the state.

In Nebraska, a Supreme Court justice serves for a term of six years after being elected. They may seek re-election to continue serving on the bench. This stability in judicial leadership is essential for maintaining consistent legal standards, including matters like the Nebraska Guaranty of Open Account - Alternate Form.

To file for full custody in Nebraska, you must complete the appropriate forms and submit them to the court. You can find these forms on the Nebraska Judicial Branch website or use platforms like US Legal Forms that provide the Nebraska Guaranty of Open Account - Alternate Form. Ensure you include all necessary documents that demonstrate your capability to provide a stable environment for the child.