A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. A guaranty agreement is a type of contract. Thus, questions relating to such matters as validity, interpretation, and enforceability of guaranty agreements are decided in accordance with basic principles of contract law. A conditional guaranty contemplates, as a condition to liability on the part of the guarantor, the happening of some contingent event. A guaranty of the payment of a debt is distinguished from a guaranty of the collection of the debt, the former being absolute and the latter conditional.

Nebraska Conditional Guaranty of Payment of Obligation

Description

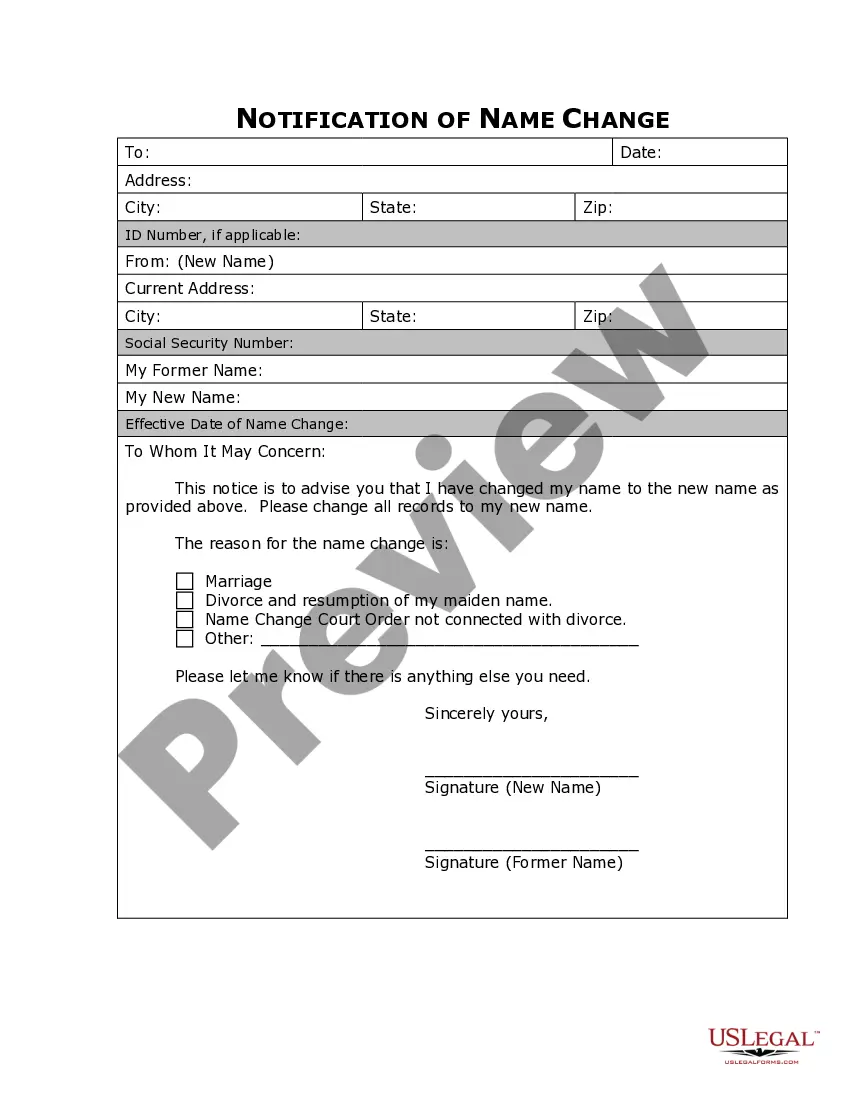

How to fill out Conditional Guaranty Of Payment Of Obligation?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a variety of legal template options for you to download or print.

By using the website, you can find numerous forms for business and individual purposes, categorized by areas, states, or keywords. You can locate the most recent versions of forms such as the Nebraska Conditional Guaranty of Payment of Obligation within minutes.

If you already have an account, Log In and download the Nebraska Conditional Guaranty of Payment of Obligation from the US Legal Forms library. The Download button will appear on each form you view. You have access to all previously saved forms in the My documents section of your account.

Make modifications. Fill out, edit, print, and sign the saved Nebraska Conditional Guaranty of Payment of Obligation.

Each template you add to your account does not have an expiration date and is yours permanently. Therefore, if you wish to download or print another copy, simply visit the My documents section and click on the form you want.

Access the Nebraska Conditional Guaranty of Payment of Obligation with US Legal Forms, the most extensive collection of legal document templates. Utilize a plethora of professional and state-specific templates that meet your business or individual needs and requirements.

- If you would like to use US Legal Forms for the first time, here are simple steps to help you get started.

- Make sure you have selected the correct form for your region/state. Click the View button to examine the form's details. Check the form information to ensure that the right form has been chosen.

- If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- When you are satisfied with the form, confirm your selection by clicking the Purchase now button. Then, choose the pricing plan you prefer and provide your details to register for an account.

- Process the payment. Use your Visa or Mastercard or PayPal account to complete the transaction.

- Select the format and download the form to your device.

Form popularity

FAQ

The distinction between a guarantee of collection and a guaranty of payment is significant in legal agreements. A guarantee of collection necessitates that the lender must prove efforts to collect from the borrower before seeking payment from the guarantor. In contrast, a guaranty of payment, such as in a Nebraska Conditional Guaranty of Payment of Obligation, allows the lender to directly pursue the guarantor without exhausting collection efforts first.

Exiting a guaranty usually involves a formal process, often requiring the consent of the lender. If the obligations have been fulfilled or if specific conditions in the guaranty are met, a release can be sought. However, it is essential to consult with a legal expert to navigate the complexities, especially in relation to the Nebraska Conditional Guaranty of Payment of Obligation.

A guaranty payment refers to the payment made by the guarantor when the borrower fails to meet their financial obligations. This payment ensures that the lender recovers the owed amount, providing security in financial transactions. In cases involving Nebraska Conditional Guaranty of Payment of Obligation, the guaranty payment is a crucial aspect of the financial safety net for lenders.

A form of payment guarantee is a commitment that assures the payment of a financial obligation, ensuring that a lender receives their funds. In the context of a Nebraska Conditional Guaranty of Payment of Obligation, this guarantee protects the lender by relying on the guarantor’s solvent status. It serves as a safety net that strengthens trust between parties involved in a transaction.

A guaranty fund serves as a financial safety cushion, helping to protect consumers when an insurance company becomes insolvent. Specifically within the Nebraska Conditional Guaranty of Payment of Obligation context, it guarantees that policyholders receive their due payments. This fund is essential for enhancing consumer confidence in the insurance market. By knowing a guaranty fund exists, policyholders can make informed decisions without fear of losing their investments.

The guaranty fund is a reserve established to provide benefits to policyholders in case an insurer cannot fulfill its obligations. This fund plays a crucial role in the Nebraska Conditional Guaranty of Payment of Obligation framework, as it ensures that payments continue even if a company faces financial difficulties. The security of knowing a fund exists helps you feel more confident in your insurance choices. Moreover, it enhances overall market stability.

Guaranty insurance provides protection against the failure of a party to meet its obligations. In the context of the Nebraska Conditional Guaranty of Payment of Obligation, this type of insurance safeguards you, ensuring that your financial interests remain protected. When unexpected events occur, having this insurance allows you to manage risks effectively. It delivers peace of mind, knowing you have a fallback plan.