Nebraska Accounts Receivable - Guaranty

Description

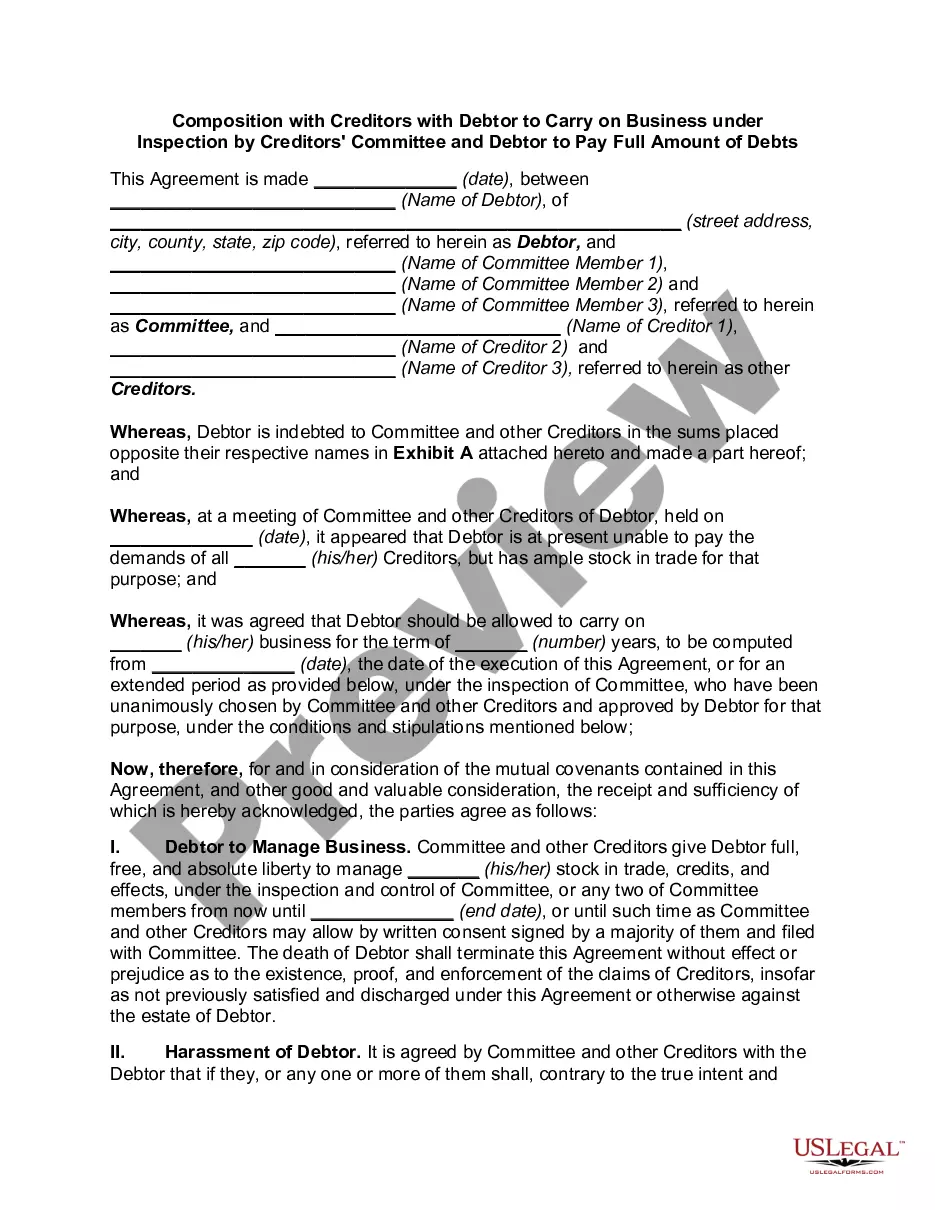

How to fill out Accounts Receivable - Guaranty?

If you want to total, acquire, or print out legitimate file layouts, use US Legal Forms, the largest assortment of legitimate types, that can be found on the web. Make use of the site`s basic and practical lookup to obtain the paperwork you need. Different layouts for business and specific functions are sorted by classes and suggests, or key phrases. Use US Legal Forms to obtain the Nebraska Accounts Receivable - Guaranty with a couple of click throughs.

If you are already a US Legal Forms customer, log in to your bank account and then click the Down load switch to have the Nebraska Accounts Receivable - Guaranty. You may also accessibility types you previously delivered electronically from the My Forms tab of your respective bank account.

If you are using US Legal Forms initially, follow the instructions beneath:

- Step 1. Ensure you have selected the shape for that appropriate area/country.

- Step 2. Use the Review option to look over the form`s content material. Never forget to read the description.

- Step 3. If you are not satisfied with all the develop, utilize the Look for industry on top of the display to locate other versions from the legitimate develop design.

- Step 4. Upon having located the shape you need, go through the Purchase now switch. Opt for the prices prepare you prefer and add your accreditations to register for an bank account.

- Step 5. Method the financial transaction. You may use your Мisa or Ьastercard or PayPal bank account to complete the financial transaction.

- Step 6. Pick the structure from the legitimate develop and acquire it on your own device.

- Step 7. Total, modify and print out or indication the Nebraska Accounts Receivable - Guaranty.

Each legitimate file design you acquire is your own property for a long time. You may have acces to each and every develop you delivered electronically within your acccount. Click on the My Forms section and select a develop to print out or acquire again.

Be competitive and acquire, and print out the Nebraska Accounts Receivable - Guaranty with US Legal Forms. There are thousands of professional and express-particular types you may use for the business or specific demands.