Nebraska Jury Instruction - 4.4.3 Rule 10(b) - 5(c) Fraudulent Practice or Course of Dealing Stockbroker Churning - Violation of Blue Sky Law and Breach of Fiduciary Duty

Description

How to fill out Jury Instruction - 4.4.3 Rule 10(b) - 5(c) Fraudulent Practice Or Course Of Dealing Stockbroker Churning - Violation Of Blue Sky Law And Breach Of Fiduciary Duty?

US Legal Forms - one of several largest libraries of legal varieties in America - delivers an array of legal record templates you can obtain or print. Utilizing the web site, you will get a large number of varieties for company and person purposes, categorized by categories, claims, or key phrases.You will find the latest models of varieties such as the Nebraska Jury Instruction - 4.4.3 Rule 10(b) - 5(c) Fraudulent Practice or Course of Dealing Stockbroker Churning - Violation of Blue Sky Law and Breach of Fiduciary Duty within minutes.

If you already have a membership, log in and obtain Nebraska Jury Instruction - 4.4.3 Rule 10(b) - 5(c) Fraudulent Practice or Course of Dealing Stockbroker Churning - Violation of Blue Sky Law and Breach of Fiduciary Duty through the US Legal Forms local library. The Down load key will appear on every single type you perspective. You have accessibility to all formerly delivered electronically varieties within the My Forms tab of the accounts.

If you wish to use US Legal Forms the very first time, here are simple directions to obtain started:

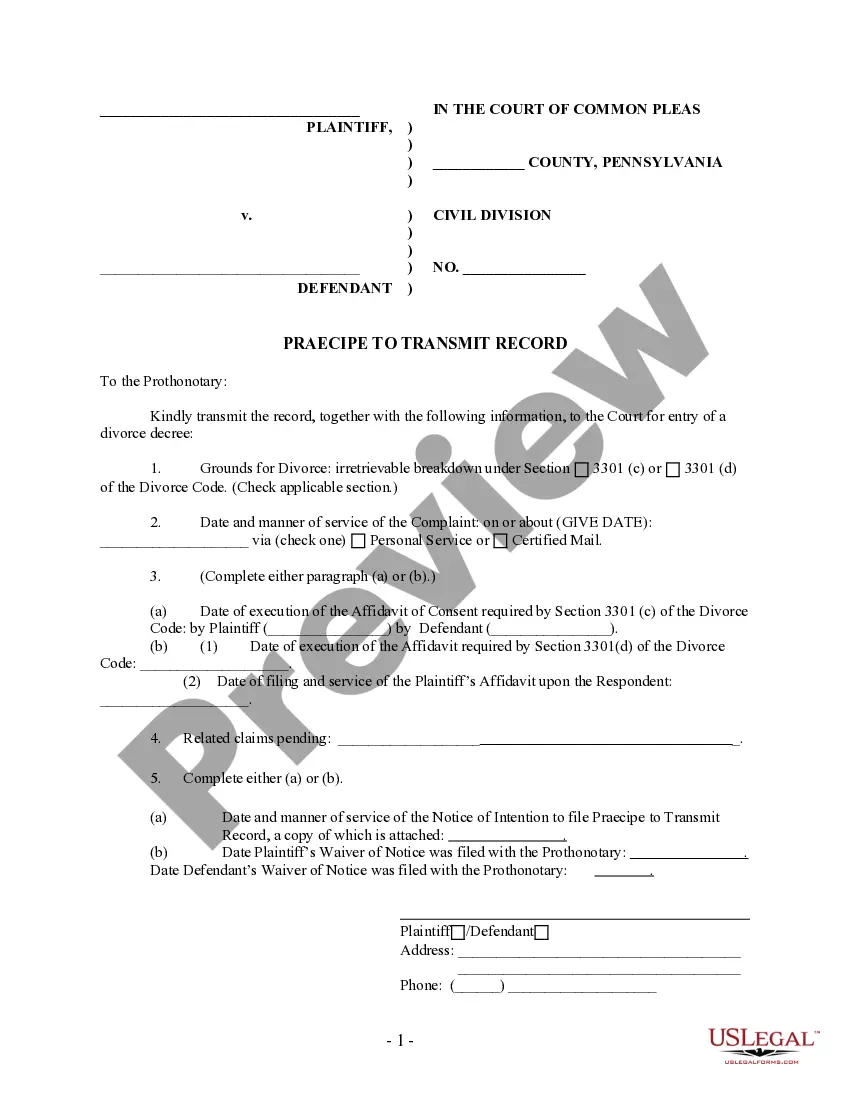

- Ensure you have selected the best type to your town/state. Click the Preview key to analyze the form`s content material. Browse the type outline to actually have selected the appropriate type.

- If the type doesn`t fit your demands, utilize the Research discipline on top of the display to obtain the one which does.

- When you are happy with the form, verify your choice by clicking on the Get now key. Then, pick the rates plan you want and supply your qualifications to sign up on an accounts.

- Process the transaction. Utilize your credit card or PayPal accounts to finish the transaction.

- Find the formatting and obtain the form on your own device.

- Make modifications. Load, edit and print and signal the delivered electronically Nebraska Jury Instruction - 4.4.3 Rule 10(b) - 5(c) Fraudulent Practice or Course of Dealing Stockbroker Churning - Violation of Blue Sky Law and Breach of Fiduciary Duty.

Each design you included in your bank account lacks an expiration time which is your own property eternally. So, in order to obtain or print yet another version, just check out the My Forms area and click on about the type you will need.

Get access to the Nebraska Jury Instruction - 4.4.3 Rule 10(b) - 5(c) Fraudulent Practice or Course of Dealing Stockbroker Churning - Violation of Blue Sky Law and Breach of Fiduciary Duty with US Legal Forms, by far the most comprehensive local library of legal record templates. Use a large number of specialist and state-certain templates that meet up with your business or person needs and demands.