Nebraska Non-Monetary Receipts are documents issued by the Nebraska Department of Revenue when a taxpayer submits a request for a refund or credit of sales or use tax. These receipts serve as proof of the taxpayer's request and can be used to secure a refund or credit from the Department of Revenue. There are two types of Nebraska Non-Monetary Receipts: a Notice of Refund or Credit and a Notice of Credit. The Notice of Refund or Credit is issued when a taxpayer is due a refund or credit of sales or use tax, while the Notice of Credit is issued when a taxpayer has requested a credit of sales or use tax. Both of these receipts provide the taxpayer with the necessary information including the taxpayer's name, address, invoice number, refund or credit amount, and the date of the transaction.

Nebraska Non Monetary Receipt

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Nebraska Non Monetary Receipt?

How much time and resources do you usually spend on drafting formal paperwork? There’s a greater way to get such forms than hiring legal specialists or spending hours searching the web for a proper blank. US Legal Forms is the top online library that provides professionally designed and verified state-specific legal documents for any purpose, such as the Nebraska Non Monetary Receipt.

To get and prepare a suitable Nebraska Non Monetary Receipt blank, follow these simple instructions:

- Examine the form content to ensure it complies with your state regulations. To do so, check the form description or take advantage of the Preview option.

- In case your legal template doesn’t satisfy your needs, locate another one using the search bar at the top of the page.

- If you already have an account with us, log in and download the Nebraska Non Monetary Receipt. Otherwise, proceed to the next steps.

- Click Buy now once you find the right document. Select the subscription plan that suits you best to access our library’s full opportunities.

- Register for an account and pay for your subscription. You can make a transaction with your credit card or via PayPal - our service is totally reliable for that.

- Download your Nebraska Non Monetary Receipt on your device and complete it on a printed-out hard copy or electronically.

Another advantage of our service is that you can access previously purchased documents that you safely keep in your profile in the My Forms tab. Get them at any moment and re-complete your paperwork as often as you need.

Save time and effort completing official paperwork with US Legal Forms, one of the most reliable web services. Join us today!

Form popularity

FAQ

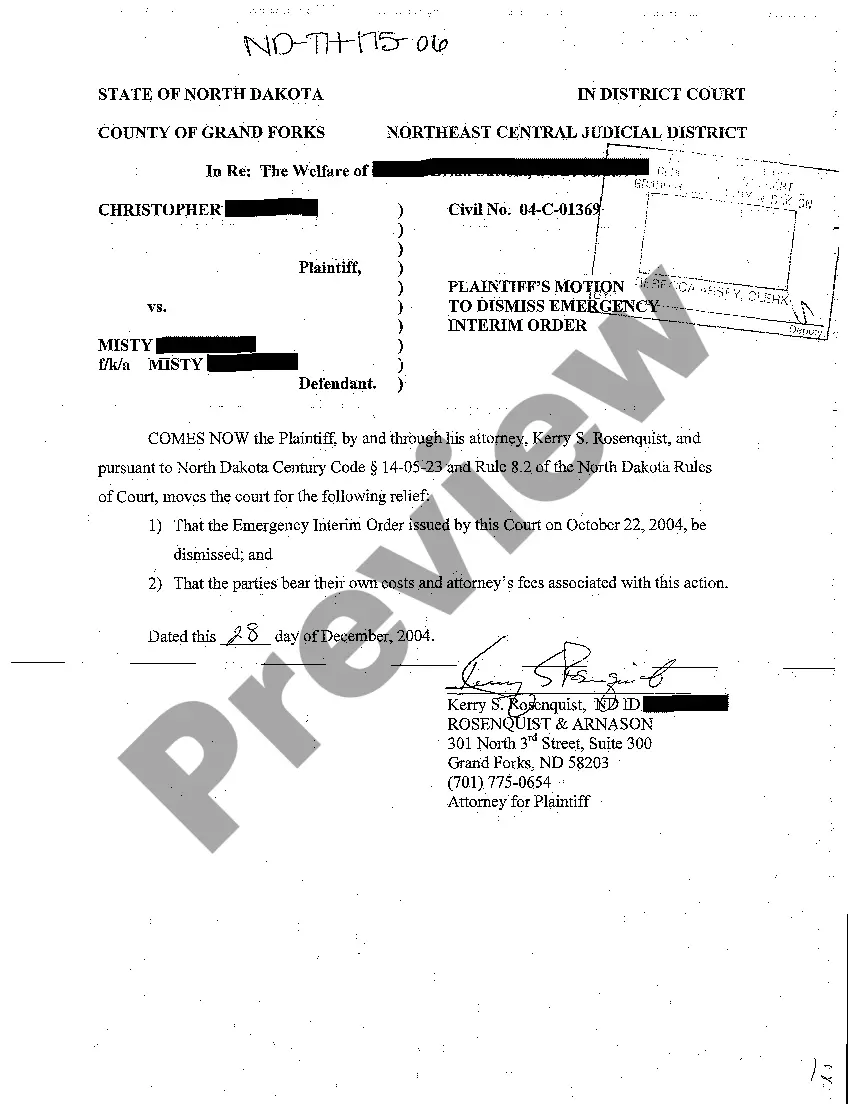

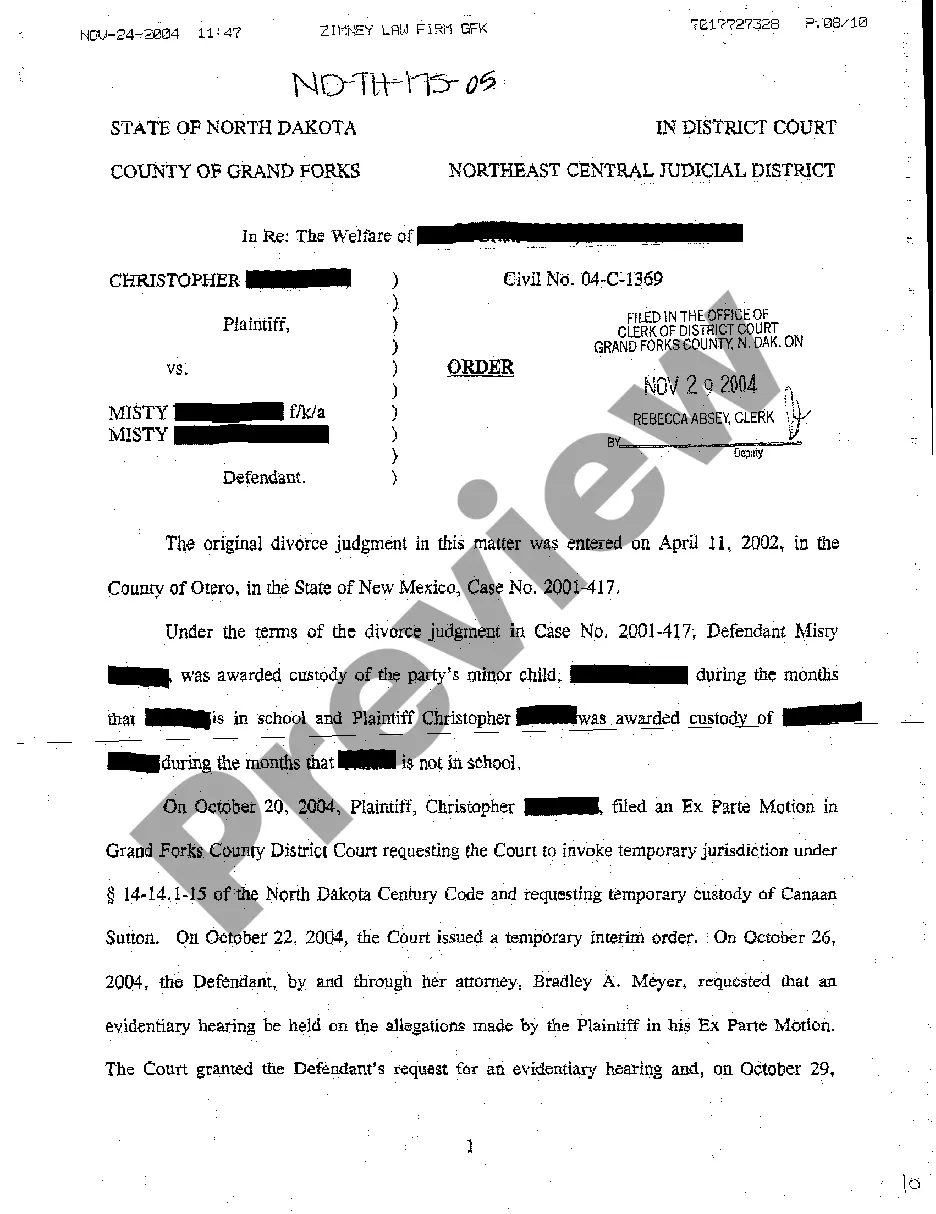

For example, if a person has not paid the child support, health-care expenses or child-care expenses as ordered, the judge can hold the person in contempt, sentence the person to jail, and then give the person a chance to stay out of jail and obey the order by making regular payments to bring the payments current.

This form is used when a Payee receives a direct payment and or wishes to waive/credit support amounts when no actual cash is received from the Payor.