North Dakota Assignment and Bill of Sale to Corporation

Description

How to fill out Assignment And Bill Of Sale To Corporation?

If you intend to finalize, acquire, or print authentic document templates, utilize US Legal Forms, the premier collection of legal forms available online.

Make use of the site’s straightforward and user-friendly search to obtain the documents you require.

Various templates for business and personal purposes are organized by categories and regions, or keywords.

Step 5. Complete the transaction. You can use your credit card or PayPal account to process the payment.

Step 6. Choose the format of the legal document and download it to your device.

- Employ US Legal Forms to secure the North Dakota Assignment and Bill of Sale to Corporation with just a few clicks.

- If you are currently a US Legal Forms member, Log In to your account and click the Download button to acquire the North Dakota Assignment and Bill of Sale to Corporation.

- You can also retrieve forms you previously obtained in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the appropriate city/state.

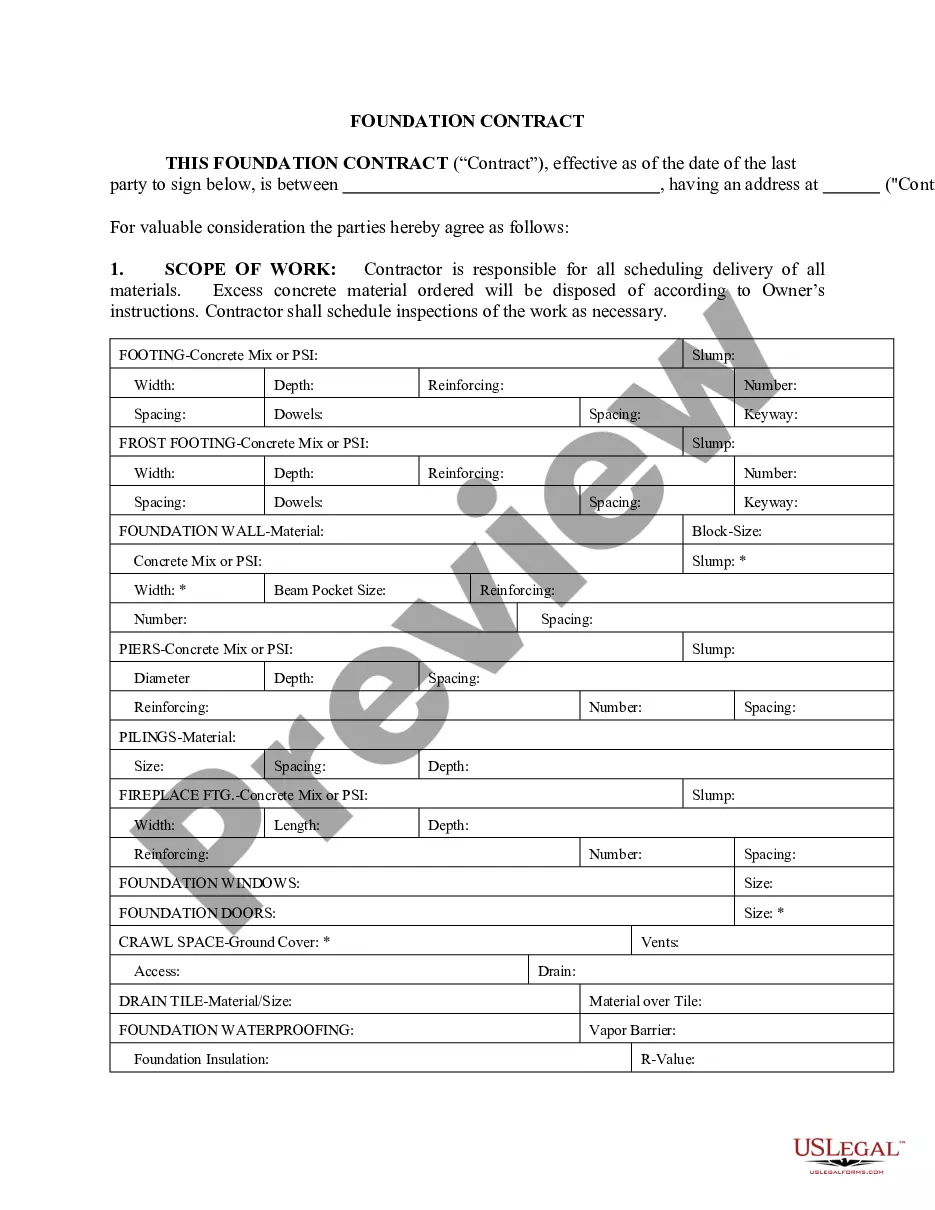

- Step 2. Utilize the Preview feature to review the form details. Be sure to read the summary.

- Step 3. If you are not satisfied with the document, use the Search field at the top of the screen to find other models in the legal form format.

- Step 4. Once you have found the form you need, click the Purchase now button. Select the pricing plan you prefer and enter your details to register for the account.

Form popularity

FAQ

Starting a corporation in North Dakota involves several clear steps. First, you need to choose a unique name for your corporation that complies with state regulations. Next, you will need to file your Articles of Incorporation with the North Dakota Secretary of State, which officially creates your corporation. Additionally, utilizing a North Dakota Assignment and Bill of Sale to Corporation can aid in transferring ownership, assets, or agreements effectively during this process.

Transferring a car title to a family member in another state requires several steps. First, you will need to fill out the title transfer form and the North Dakota Assignment and Bill of Sale to Corporation, which documents the transfer of ownership. Then, send these documents to your family member, who must follow their state’s registration process. Make sure they check their local DMV’s requirements for out-of-state title transfers to ensure a smooth process.

To privately sell a car in North Dakota, first gather all necessary documents, including the title and a completed North Dakota Assignment and Bill of Sale to Corporation form. Discuss the sale terms with the buyer and ensure they understand the details. Once the buyer agrees, you will need to sign the title over and provide them with the bill of sale, which serves as proof of the transaction. After completing this, the buyer can register the car with their local DMV.

Registering a car in North Dakota without a title is possible under certain circumstances. If you recently purchased an unregistered vehicle, you may need to provide a bill of sale and proof of ownership. The North Dakota Assignment and Bill of Sale to Corporation can serve as a crucial document in this process, helping establish your ownership rights. Be sure to check with your local DMV for specific requirements and alternative documentation that may be necessary.

To transfer a title in North Dakota, you need to complete the title transfer process through your local Department of Motor Vehicles (DMV). Start by obtaining the title from the seller, ensuring all required fields are filled out correctly. You will also need to fill out a North Dakota Assignment and Bill of Sale to Corporation form, which helps document the transaction and transfer the ownership. Finally, submit the necessary paperwork and payment at the DMV to finalize the transfer.

To transfer a title in North Dakota, you must have the original title signed over to you by the seller. Along with the signed title, also provide a completed bill of sale if applicable, and any necessary identification. Making sure to complete these steps carefully ensures a smooth North Dakota Assignment and Bill of Sale to Corporation process.

Filing sales tax in North Dakota involves registering for a sales tax permit with the Office of State Tax Commissioner. Once registered, you need to collect sales tax from your customers and file your returns on a monthly or quarterly basis. You can manage your North Dakota Assignment and Bill of Sale to Corporation transactions easily through uSlegalforms, ensuring you stay compliant with all tax obligations.

In North Dakota, a bill of sale is not legally required for all purchases, but it serves as valuable documentation for vehicle transactions and transfers. Having a North Dakota Assignment and Bill of Sale to Corporation can protect both buyers and sellers by providing proof of sale. It is always advisable to have one, especially when dealing with significant assets.

The requirements for notarization of a bill of sale vary by state. Some states, like California and Florida, require notarization for certain transactions. However, in North Dakota, a bill of sale is not necessarily required to be notarized, but it can add an extra layer of legitimacy to your North Dakota Assignment and Bill of Sale to Corporation documents.

Changing a business name in North Dakota requires filing a name reservation application with the Secretary of State. You should also update any existing North Dakota Assignment and Bill of Sale to Corporation documents to reflect the new name. Once approved, notify your local and state agencies of the change and update any marketing materials to maintain consistency.