North Dakota Receipt as Payment in Full

Description

How to fill out Receipt As Payment In Full?

You can spend time online searching for the legal document template that fulfills the federal and state requirements you need.

US Legal Forms offers thousands of legal documents that can be reviewed by professionals.

You can easily download or print the North Dakota Receipt as Payment in Full from our service.

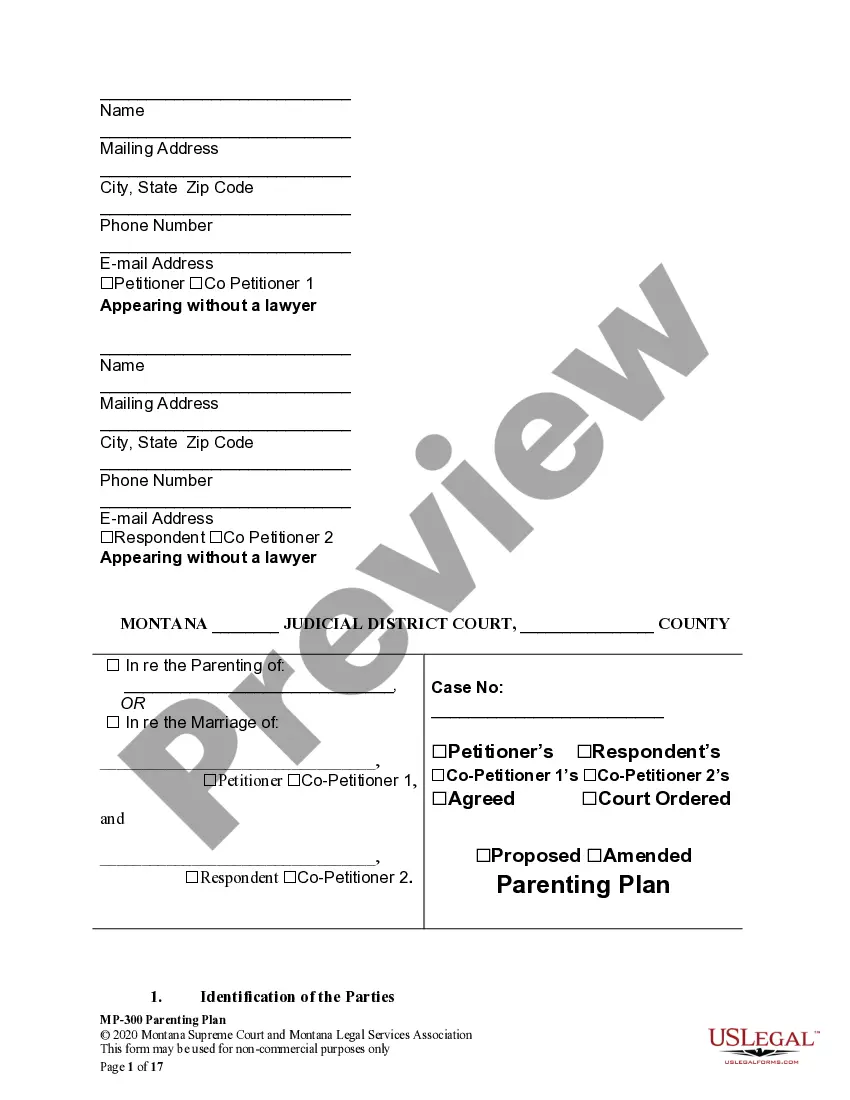

If available, utilize the Preview button to browse through the document template as well.

- If you have a US Legal Forms account, you can Log In and click on the Download button.

- Next, you can fill out, modify, print, or sign the North Dakota Receipt as Payment in Full.

- Every legal document template you obtain is yours indefinitely.

- To acquire an additional copy of any purchased form, go to the My documents section and click on the respective button.

- If you are using the US Legal Forms website for the first time, follow the easy steps provided below.

- First, ensure that you have selected the appropriate document template for your preferred state/city.

- Review the document description to confirm that you have selected the right document.

Form popularity

FAQ

To establish residency in North Dakota, you generally need to live in the state for at least 1 year. This duration helps prove your intention to make North Dakota your permanent home. Once you meet this requirement, you can benefit from the state's laws, including those related to a North Dakota Receipt as Payment in Full, which can help clarify payment agreements.

Yes, North Dakota enforces state withholding for both residents and non-residents earning income in the state. It is vital for all employers and businesses to remain compliant with this requirement. Being aware of the implications of North Dakota Receipt as Payment in Full helps you manage your financial commitments effectively.

The non-resident withholding tax in the US varies by state and the type of income earned. Generally, this applies to income earned by individuals who do not reside in the state. Consider using a resource like uslegalforms to understand how North Dakota Receipt as Payment in Full fits into your obligation as a non-resident.

For non-resident partners, North Dakota requires withholding on certain income types such as partnership income. The standard withholding rate is 2.9%, ensuring that tax obligations are met at the state level. If you’re navigating this as part of your transactions, knowing about North Dakota Receipt as Payment in Full can help streamline the process.

North Dakota has a state income tax that varies based on income levels. The tax rates can range from 1.1% to 2.9%, depending on individual circumstances. Understanding state tax is essential when making financial decisions, particularly with legal documents like North Dakota Receipt as Payment in Full.

Yes, North Dakota does impose a state withholding tax. Employers must withhold taxes from employee wages, ensuring compliance with state tax laws. This is an important aspect to consider when dealing with any financial transaction, especially for those operating under North Dakota Receipt as Payment in Full.

North Dakota generally offers a favorable tax environment, characterized by reasonable tax rates. When considering North Dakota Receipt as Payment in Full, you can benefit from understanding how local taxes might apply. Evaluating your overall tax obligations will help you determine if North Dakota aligns with your financial goals.

Yes, North Dakota does tax non-residents on income earned within the state. This means that if you have income sources in North Dakota, you need to consider the impact of the North Dakota Receipt as Payment in Full. It's prudent to familiarize yourself with the specific rates and regulations to ensure compliance with state tax laws.

North Dakota is not a tax-exempt state. It has a variety of taxes that apply to both residents and non-residents. However, understanding the implications of North Dakota Receipt as Payment in Full can help streamline your tax process. It is essential to consult with a tax professional to navigate state regulations effectively.

North Dakota has several categories of income and transactions that are not subject to tax. These can include certain retirement benefits, gift taxes, and some forms of interest income. Understanding these exemptions can help you maximize your financial efficiency, especially when coupled with strategies like the North Dakota Receipt as Payment in Full.