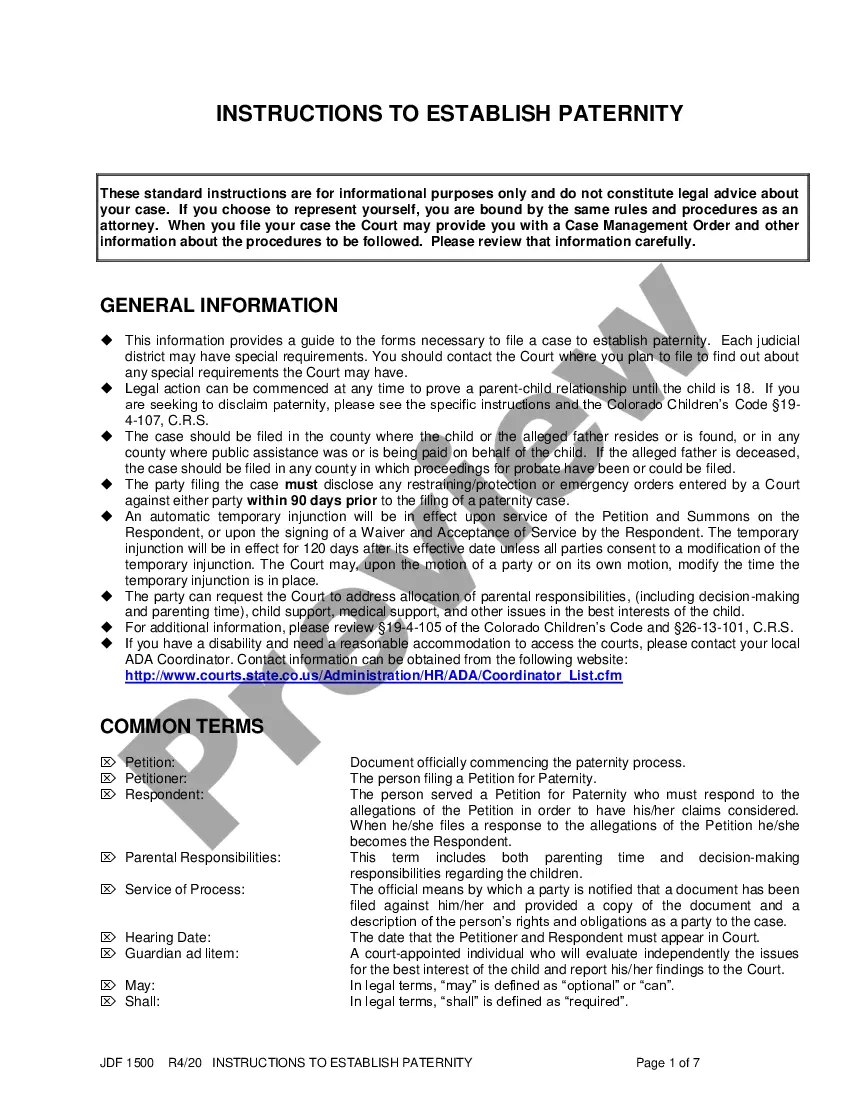

This form is a trust used to provide supplemental support for a disabled beneficiary without loss of government benefits. It may be revocable or irrevocable, as the funds are contributed by a third party, and not the beneficiary. The Omnibus Budget Reconciliation Act of 1993 established the supplemental needs trusts.

Supplemental Needs Trust for Third Party - Disabled Beneficiary

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

Key Concepts & Definitions

A supplemental needs trust for third party, also known as a third-party special needs trust, is a legal arrangement in the United States where one person or an entity (the grantor) sets aside assets to benefit another individual (the beneficiary) who has a disability, without disqualifying them from government aid like Medicaid or Supplemental Security Income (SSI). This type of trust is funded with assets that never belonged to the beneficiary, thereby not affecting their eligibility for public benefits.

Step-by-Step Guide

- Choose the Trustee: Select a trusted individual or a financial institution to manage the trust. This choice is crucial as they will be responsible for the proper management of the trust's assets and distributions.

- Draft the Trust Agreement: Work with an experienced attorney to create the trust document. It should specify the trusts terms, the beneficiary, and how the assets are to be used.

- Fund the Trust: Transfer assets into the trust. These can include money, stocks, real estate, or other valuables.

- Register the Trust: Ensure compliance with state laws by properly registering the trust, if required.

- Manage the Trust: The trustee manages the trust's assets and makes distributions for the benefit of the disabled individual, adhering strictly to the terms of the trust.

Risk Analysis

- Improper Funding: Assets not properly transferred into the trust may jeopardize the beneficiarys eligibility for government benefits.

- Legal Non-Compliance: Failure to comply with federal and state regulations can lead to the disqualification of the trust.

- Mismanagement by Trustee: If the trustee fails to manage the trust properly, it can result in financial losses or legal ramifications.

Key Takeaways

Key Takeaways: A supplemental needs trust for third party helps protect the financial future of a disabled person without affecting their eligibility for government benefits. Proper setup and management are crucial for its success.

Pros & Cons

Pros:

- Preserves eligibility for public aid.

- Provides financial security for the beneficiary.

- Flexibility in how assets are managed and used.

Cons:

- Can be complex and costly to set up and administer.

- Requires meticulous compliance with legal standards.

- Dependence on the competency of the trustee.

Common Mistakes & How to Avoid Them

- Choosing the Wrong Trustee: Ensure the trustee is reliable and capable of managing the trust by checking their background or considering a professional trustee from a financial institution.

- Neglecting Annual Reviews: Regular reviews of the trust can prevent issues and adapt to any changes in laws or the beneficiarys situation.

- Ignoring Tax Obligations: Consult with a tax advisor to manage any state and federal tax obligations for trust assets properly.

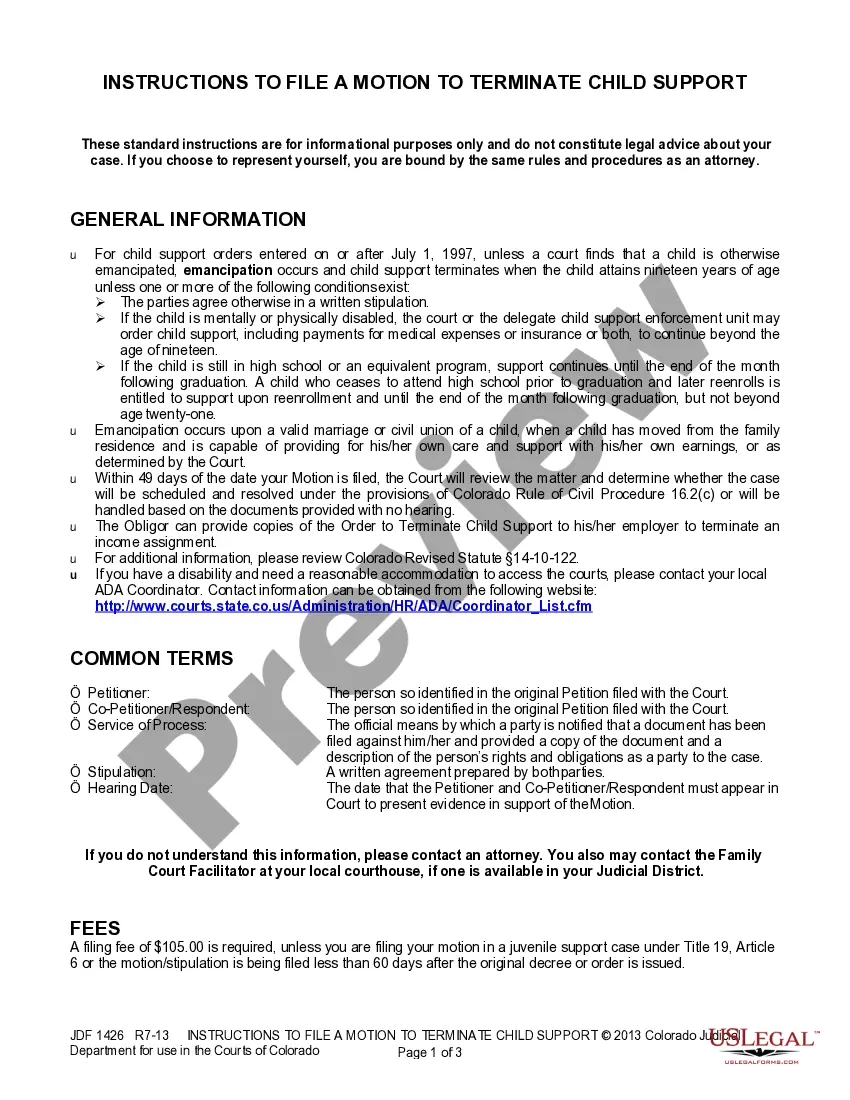

How to fill out Supplemental Needs Trust For Third Party - Disabled Beneficiary?

Utilize the most comprehensive legal catalogue of forms. US Legal Forms is the perfect place for getting up-to-date Supplemental Needs Trust for Third Party - Disabled Beneficiary templates. Our service provides a large number of legal forms drafted by certified attorneys and grouped by state.

To obtain a sample from US Legal Forms, users just need to sign up for an account first. If you’re already registered on our platform, log in and choose the template you are looking for and buy it. After purchasing forms, users can see them in the My Forms section.

To get a US Legal Forms subscription on-line, follow the guidelines listed below:

- Find out if the Form name you’ve found is state-specific and suits your requirements.

- In case the form features a Preview function, use it to review the sample.

- If the sample does not suit you, use the search bar to find a better one.

- Hit Buy Now if the template corresponds to your needs.

- Choose a pricing plan.

- Create a free account.

- Pay via PayPal or with the credit/credit card.

- Select a document format and download the template.

- Once it is downloaded, print it and fill it out.

Save your time and effort with our service to find, download, and fill out the Form name. Join a huge number of delighted customers who’re already using US Legal Forms!

Form popularity

FAQ

If a third-party SNT is considered a grantor trust, all items of income, deduction and credit are generally taxed to the individual(s) who created and funded the SNT (typically parents or other relatives of the beneficiary with a disability).All items of income, deduction and credit are reported on Form 1041.

A supplemental needs trust is a third party trust when assets other than those assets belonging to the disabled person are used to fund the trust. To keep its status as a third-party trust, no funds belonging to the disabled person nor funds to which the disabled person is entitled should be used to fund the trust.

Since most special needs trusts will be funded with the parents' own assets, including perhaps life insurance proceeds and gifts from other family members, they can be established and treated as qualified disability trusts.

Decide the Amount of Money to Put in the Fund Based on the Level of Care Required. What type of care is required for your loved one? Choose the Best Special Needs Trust Type According to Need. Ensure your Family has a Special Needs Attorney to Protect the Assets.

Supplemental Needs Trusts are often used to receive an inheritance or personal injury litigation proceeds on behalf of an individual with a disability, in order to allow the person to qualify for Medicaid benefits despite their receipt of the settlement.

While a beneficiary may also act as trustee in some types of trusts, a special needs trust beneficiary will almost never be able to act as trustee.Incapacity of a beneficiary may sometimes be important as well.

The term "special needs trust" refers to the purpose of the trust -- to pay for the beneficiary's unique or special needs. In short, the name is focused more on the beneficiary, while the name "supplemental needs trust" addresses the shortfalls of our public benefits programs.

Generally, only a parent, grandparent, legal guardian or court can set up a special needs trust. The person with disabilities, no matter how competent, cannot be the creator of the trust (even if the trust is funded by their personal assets). Funds in the special needs trust may not be available to the beneficiary.