Trust Agreement - Family Special Needs

Description

Definition and meaning

A Trust Agreement - Family Special Needs is a legal document that establishes a trust specifically designed to manage assets for a beneficiary with special needs. This type of trust ensures that the beneficiary can receive financial support without jeopardizing their eligibility for government benefits, such as Medicaid and Supplemental Security Income (SSI).

Key components of the form

Understanding the essential components of the Trust Agreement is crucial. Key elements include:

- Grantor: The individual who creates the trust.

- Trustee: The person or entity responsible for managing the trust assets.

- Beneficiary: The individual with special needs who is intended to benefit from the trust.

- Trust Property: The assets placed into the trust, which can be cash, property, or other valuables.

- Provisions: Specific instructions on how and when distributions are made to the beneficiary.

How to complete a form

Completing the Trust Agreement - Family Special Needs involves several steps:

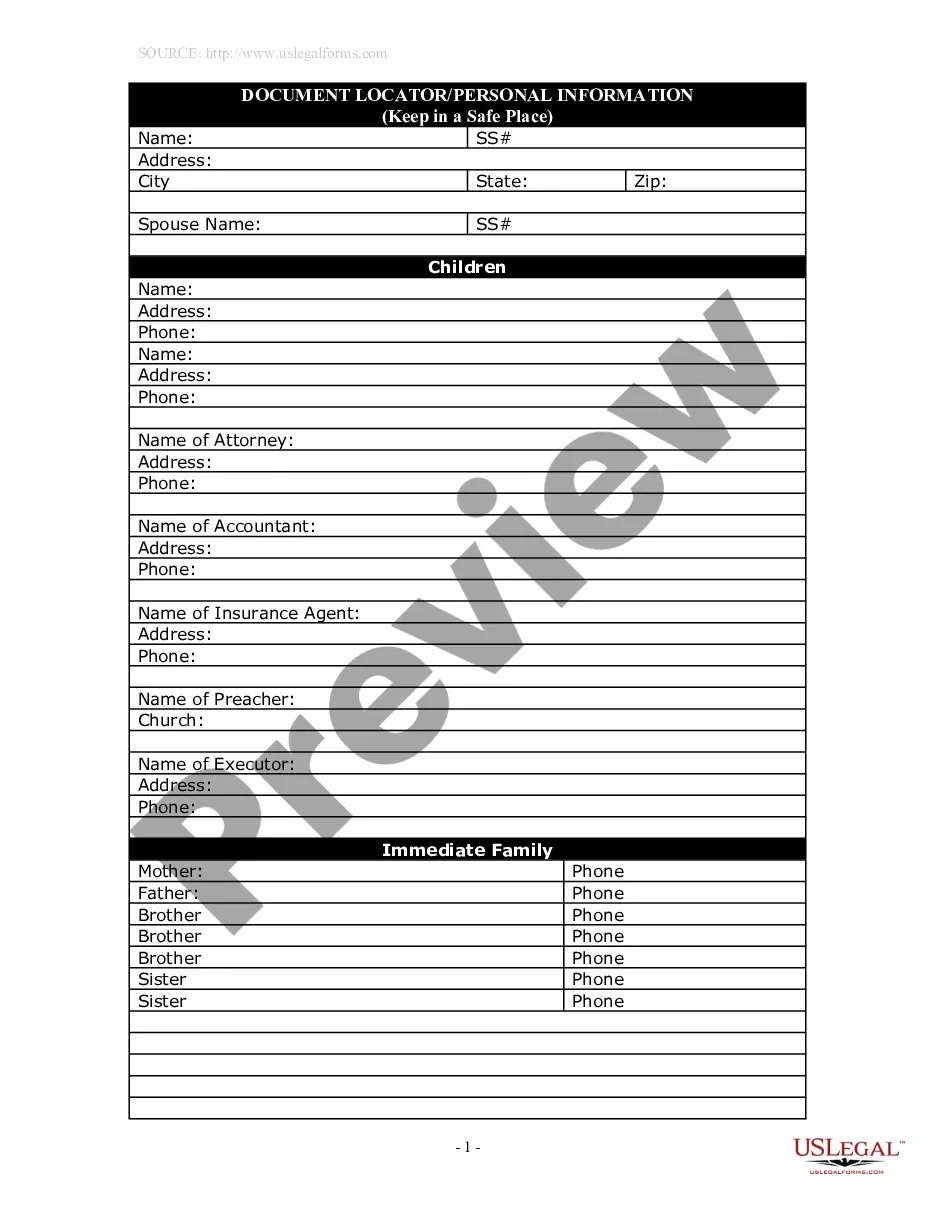

- Gather necessary information: Collect details about the grantor, trustee, and beneficiary, along with a list of assets to be included in the trust.

- Fill out the form: Clearly input the names and addresses of the parties involved.

- Specify the Trust Property: Include a detailed list of all assets being transferred into the trust.

- Define provisions: Write clear terms about how the trust will operate, including conditions for distributions.

- Review: Carefully read through the completed form to ensure accuracy and completeness before signing.

Who should use this form

This trust agreement is ideal for families who wish to provide for a member with special needs while preserving their eligibility for government assistance. Individuals with

disabilities, parents of children with disabilities, and caregivers are encouraged to use this form to create a legally binding structure for future support.

Common mistakes to avoid when using this form

When completing the Trust Agreement - Family Special Needs, consider these common pitfalls:

- Failing to clearly define 'Special Needs,' which may lead to misinterpretation of trust provisions.

- Neglecting to list all assets, which could result in incomplete funding of the trust.

- Not considering potential changes in laws governing public benefits that may affect the trust.

- Overlooking the importance of periodic reviews of the trust to ensure compliance with state laws.

What documents you may need alongside this one

To create a comprehensive Trust Agreement - Family Special Needs, you may need the following documents:

- Birth certificates or identification for the grantor, trustee, and beneficiary.

- Financial statements detailing the assets you plan to include in the trust.

- Proof of disability for the beneficiary, which may support the need for a special needs trust.

- Any existing legal documents related to the beneficiary's care or financial situation.

How to fill out Trust Agreement - Family Special Needs?

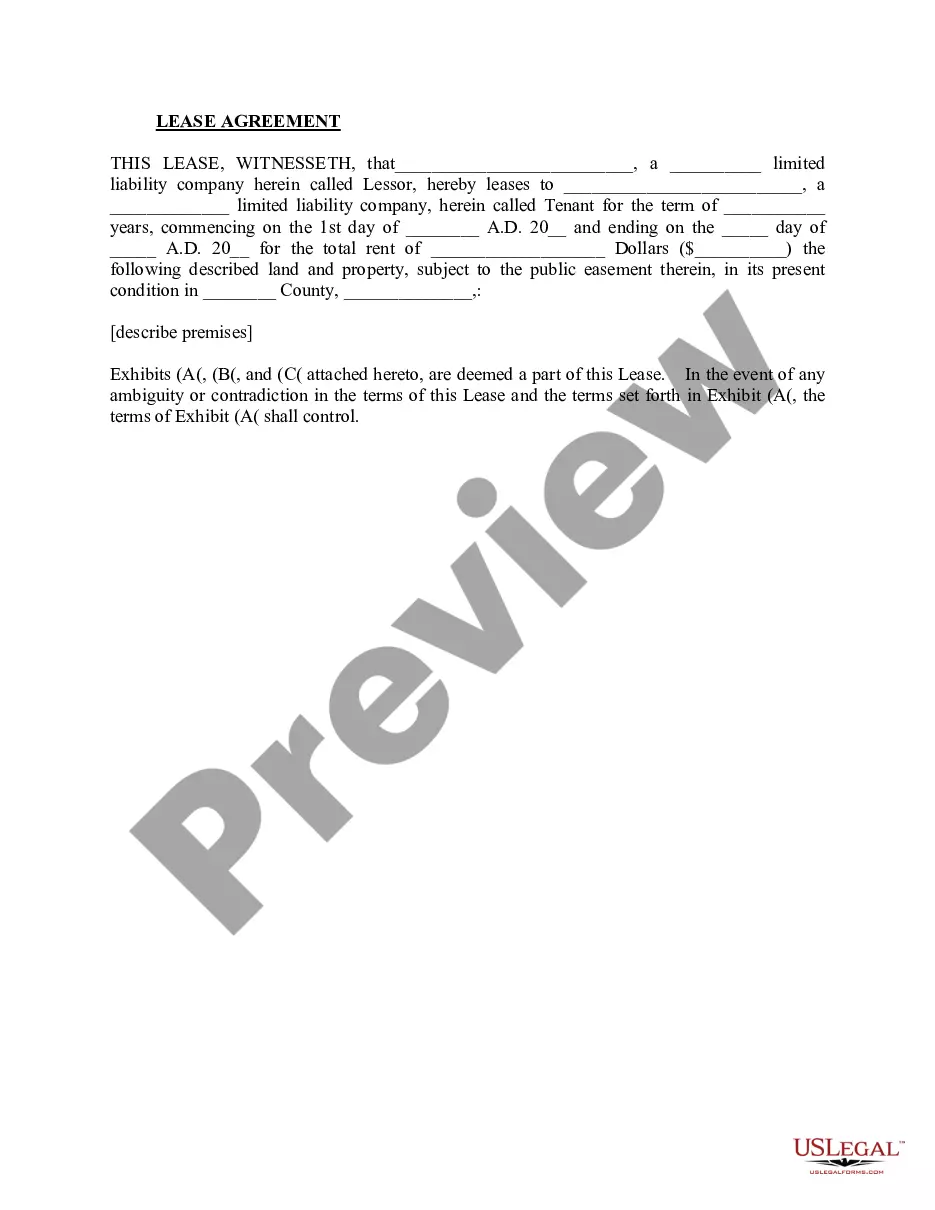

Aren't you sick and tired of choosing from numerous samples every time you need to create a Trust Agreement - Family Special Needs? US Legal Forms eliminates the lost time numerous American citizens spend browsing the internet for ideal tax and legal forms. Our expert crew of attorneys is constantly upgrading the state-specific Templates catalogue, so it always has the proper files for your scenarion.

If you’re a US Legal Forms subscriber, simply log in to your account and click on the Download button. After that, the form may be found in the My Forms tab.

Visitors who don't have an active subscription should complete simple steps before having the capability to get access to their Trust Agreement - Family Special Needs:

- Utilize the Preview function and look at the form description (if available) to be sure that it’s the best document for what you’re trying to find.

- Pay attention to the validity of the sample, meaning make sure it's the proper example to your state and situation.

- Make use of the Search field at the top of the webpage if you have to look for another file.

- Click Buy Now and choose a preferred pricing plan.

- Create an account and pay for the services using a credit card or a PayPal.

- Download your file in a convenient format to complete, create a hard copy, and sign the document.

Once you’ve followed the step-by-step guidelines above, you'll always be capable of log in and download whatever file you will need for whatever state you want it in. With US Legal Forms, completing Trust Agreement - Family Special Needs templates or any other legal files is easy. Get going now, and don't forget to recheck your samples with accredited attorneys!

Form popularity

FAQ

The child cannot accumulate more than $2,000 in assets or risk losing important and life-sustaining public assistance benefits. For that reason, a special needs trust must to be set up carefully and by an experienced special needs planning attorney. Regardless, once you set up the trust, it must be funded.

Special Needs Trusts are typically irrevocable, which means that they cannot be revoked and can only be amended in very limited circumstances, if at all. These trusts are usually in place for the lifetime of the Beneficiary, and over such a long time, various circumstances invariably change.

Special needs trusts are beneficial for those who have permanent special needs or disabilities, those who currently qualify for governmental benefits, those who have special needs but may not qualify for governmental benefits later, and those who cannot manage finances on their own.

A special needs trust lets parents, other family members and other interested parties contribute funds for the benefit of a disabled person, while also enabling him or her to still receive means-tested benefits such as Medicaid and Security Supplemental Income (SSI).

Special needs trusts pay for comforts and luxuries -- "special needs" -- that could not be paid for by public assistance funds. This means that if money from the trust is used for food or shelter costs on a regular basis or distributed directly to the beneficiary, such payments will count as income to the beneficiary.

Failure to set up a special needs trust might affect them, even if not as much as another person who receives, say, SSI and Medicaid. Even someone receiving Medicare will have some effect from having a higher income.

A special needs trust is a trust tailored to a person with special needs that is designed to manage assets for that person's benefit while not compromising access to important government benefits. There are three main types of special needs trusts: the first-party trust, the third-party trust, and the pooled trust.

In general, trust structures are intended to provide a legal way to title and hold assets to be used to support one or more beneficiaries. Special needs trusts are similar and are used to benefit someone who has physical or mental disabilities.