Indiana Qualifying Event Notice Information for Employer to Plan Administrator

Description

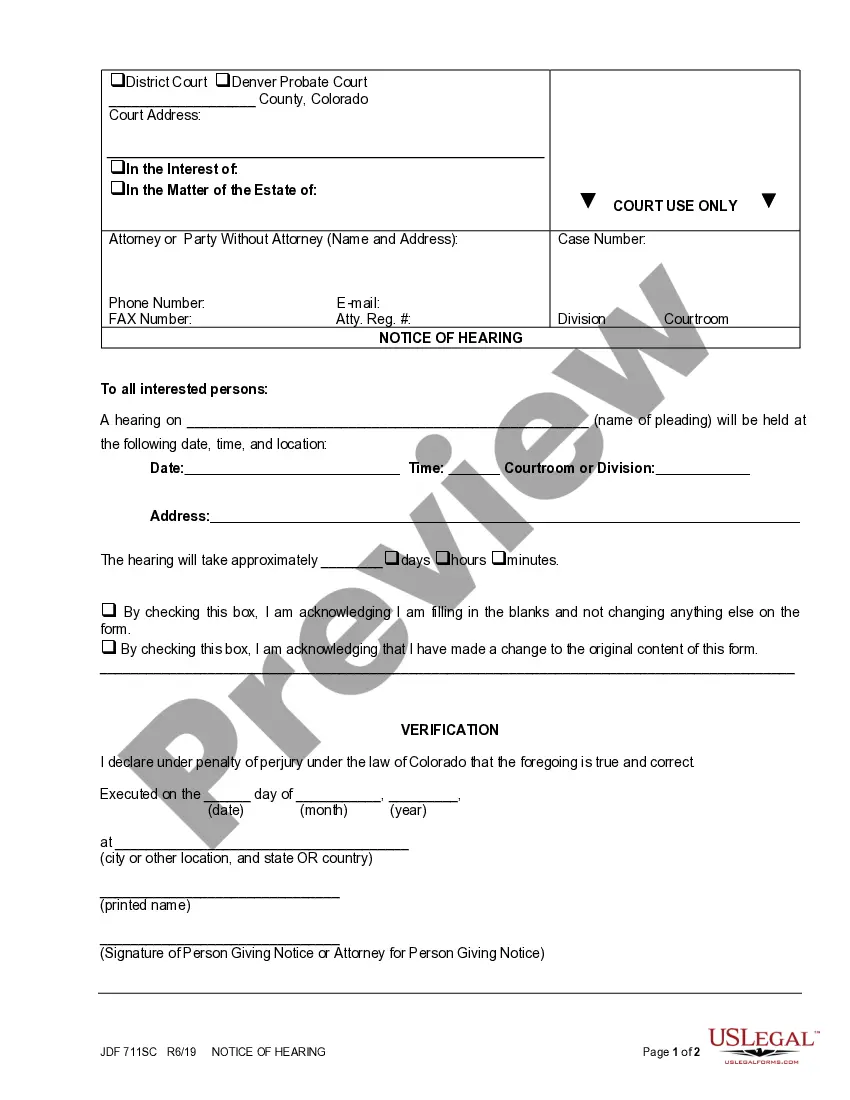

How to fill out Qualifying Event Notice Information For Employer To Plan Administrator?

Selecting the optimal legal document template can be challenging. Evidently, there are numerous online templates accessible, but how can you acquire the legal document you need? Utilize the US Legal Forms website. This service offers an extensive array of templates, such as the Indiana Qualifying Event Notice Information for Employer to Plan Administrator, suitable for both business and personal needs. Each of the forms is reviewed by experts and complies with federal and state regulations.

If you are already registered, sign in to your account and hit the Download button to obtain the Indiana Qualifying Event Notice Information for Employer to Plan Administrator. Use your account to explore the legal forms you have purchased previously. Visit the My documents section of your account to get another copy of the document you need.

If you are a new user of US Legal Forms, here are straightforward instructions to follow: First, ensure you have chosen the correct form for your region/county. You can review the form using the Preview button and read the form details to confirm it is suitable for you.

US Legal Forms is the largest repository of legal templates where you can access a variety of document templates. Leverage the service to download professionally crafted documents that adhere to state requirements.

- If the form does not satisfy your needs, use the Search field to locate the correct form.

- Once you are sure that the form is accurate, click on the Buy now button to acquire the form.

- Select the payment plan you prefer and provide the necessary information.

- Create your account and complete the purchase using your PayPal account or credit card.

- Choose the file format and download the legal document template to your device.

- Complete, modify, print, and sign the acquired Indiana Qualifying Event Notice Information for Employer to Plan Administrator.

Form popularity

FAQ

Q3: Which employers are required to offer COBRA coverage? COBRA generally applies to all private-sector group health plans maintained by employers that had at least 20 employees on more than 50 percent of its typical business days in the previous calendar year.

The following are qualifying events: the death of the covered employee; a covered employee's termination of employment or reduction of the hours of employment; the covered employee becoming entitled to Medicare; divorce or legal separation from the covered employee; or a dependent child ceasing to be a dependent under

Model COBRA notices are provided on the U.S. Department of Labor's COBRA Continuation webpage under the Regulations section.Step 1: Initial Notification.Step 2: Qualifying Event Notices.Step 3: Insurance Carrier Notification.Step 4: Election and Payment.Step 5 (if needed): Late or Missing Payments.More items...

COBRA is always retroactive to the day after your previous coverage ends, and you'll need to pay your premiums for that period too. One advantage of enrolling right away is that you can keep seeing doctors and filling prescriptions without a break in coverage. COBRA allows you to keep the exact same benefits as before.

(A single contract for Group Medical Insurance issued to an employer is known as a master policy.)

Cal-COBRA administration requires four basic compliance components:Notifying all eligible group health care participants of their Cal-COBRA rights.Providing timely notice of Cal-COBRA eligibility, enrollment forms, and notice of the duration of coverage and terms of payment after a qualifying event has occurred.More items...

The qualifying event for COBRA purposes is the employee's loss of employment date. However, the election period does not end until 60 days from the sent date of the election form to the employee or until 60 days after the loss of coverage, whichever is later.

A plan, however, may provide longer periods of coverage beyond the maximum period required by law. When the qualifying event is the covered employee's termination of employment or reduction in hours of employment, qualified beneficiaries are entitled to 18 months of continuation coverage.

COBRA Qualifying Event Notice The employer must notify the plan if the qualifying event is: Termination or reduction in hours of employment of the covered employee, 2022 Death of the covered employee, 2022 Covered employee becoming entitled to Medicare, or 2022 Employer bankruptcy.

Second qualifying events may include the death of the covered employee, divorce or legal separation from the covered employee, the covered employee becoming entitled to Medicare benefits (under Part A, Part B or both), or a dependent child ceasing to be eligible for coverage as a dependent under the group health plan.