North Dakota Dividend Policy - Resolution Form - Corporate Resolutions

Description

How to fill out Dividend Policy - Resolution Form - Corporate Resolutions?

Selecting the optimal authentic document template can be a challenge.

Clearly, there are numerous templates accessible online, but how do you locate the legitimate version you need.

Utilize the US Legal Forms website. This service offers thousands of templates, including the North Dakota Dividend Policy - Resolution Form - Corporate Resolutions, which can be utilized for both business and personal purposes.

You can browse the form using the Review option and read the form details to confirm it is suitable for you.

- All documents are vetted by experts and comply with federal and state regulations.

- If you are already registered, Log In to your account and click on the Download button to access the North Dakota Dividend Policy - Resolution Form - Corporate Resolutions.

- You can use your account to search for the legal documents you have purchased previously.

- Visit the My documents tab of your account to obtain another copy of the documents you need.

- If you are a new user of US Legal Forms, here are some simple instructions to follow.

- First, ensure you have selected the correct document for your city/region.

Form popularity

FAQ

Registering a foreign corporation in North Dakota requires you to submit an Application for Certificate of Authority to the Secretary of State. Accompany this application with documents from your home state and comply with North Dakota laws. It is essential to outline your corporate structure, including your North Dakota Dividend Policy in your resolutions. Consider using US Legal Forms for seamless guidance and necessary forms.

To write a written resolution, start by stating the decision clearly and specifying the context, such as changes to your North Dakota Dividend Policy. Include an effective date and space for signatures from the appropriate directors or shareholders. This formal approach ensures that the resolution holds legal weight. Utilizing templates from US Legal Forms can help ensure your written resolutions comply with legal standards.

The format for writing a resolution typically includes a header stating the document's purpose, followed by clauses detailing the decision and rationale. Additionally, you should include spaces for signatures, indicating approval by relevant parties. Following this structure, particularly for defining your North Dakota Dividend Policy, ensures clarity and legal integrity. US Legal Forms offers structured templates that simplify this process.

To dissolve a corporation in North Dakota, you must first hold a vote among shareholders to approve the dissolution. Afterward, file a Certificate of Dissolution with the Secretary of State and ensure all taxes and debts are settled. Including a detailed resolution regarding the dissolution will clarify the process, especially if you reference your North Dakota Dividend Policy in available distributions.

To effectively write a corporate resolution, begin by stating the purpose at the top of the document. Include details such as the date, the individuals involved, and the specific decisions being made, like affirming the North Dakota Dividend Policy. Clear, formal language helps convey authority and intent. Consider consulting US Legal Forms for expertly crafted resolution templates.

An example of a resolution might be a decision to authorize the payment of dividends to shareholders, reflecting your North Dakota Dividend Policy. This resolution should outline the specifics, such as the dividend amount and payment date. Utilizing the right templates can make it easy to create this document, keeping it compliant and professional.

Writing a corporate resolution involves clearly stating the action to be taken, the supporting reasons, and the parties involved. You should document approvals from the board or shareholders regarding key decisions, such as adopting a North Dakota Dividend Policy. By using templates from US Legal Forms, you can ensure your corporate resolutions are formatted correctly.

To incorporate in North Dakota, you must first choose a unique name for your corporation. Next, prepare and file your Articles of Incorporation with the North Dakota Secretary of State. Be sure to establish a North Dakota Dividend Policy in your corporate resolutions to define how dividends will be handled. You can streamline this process by using US Legal Forms, which provides templates and guidance.

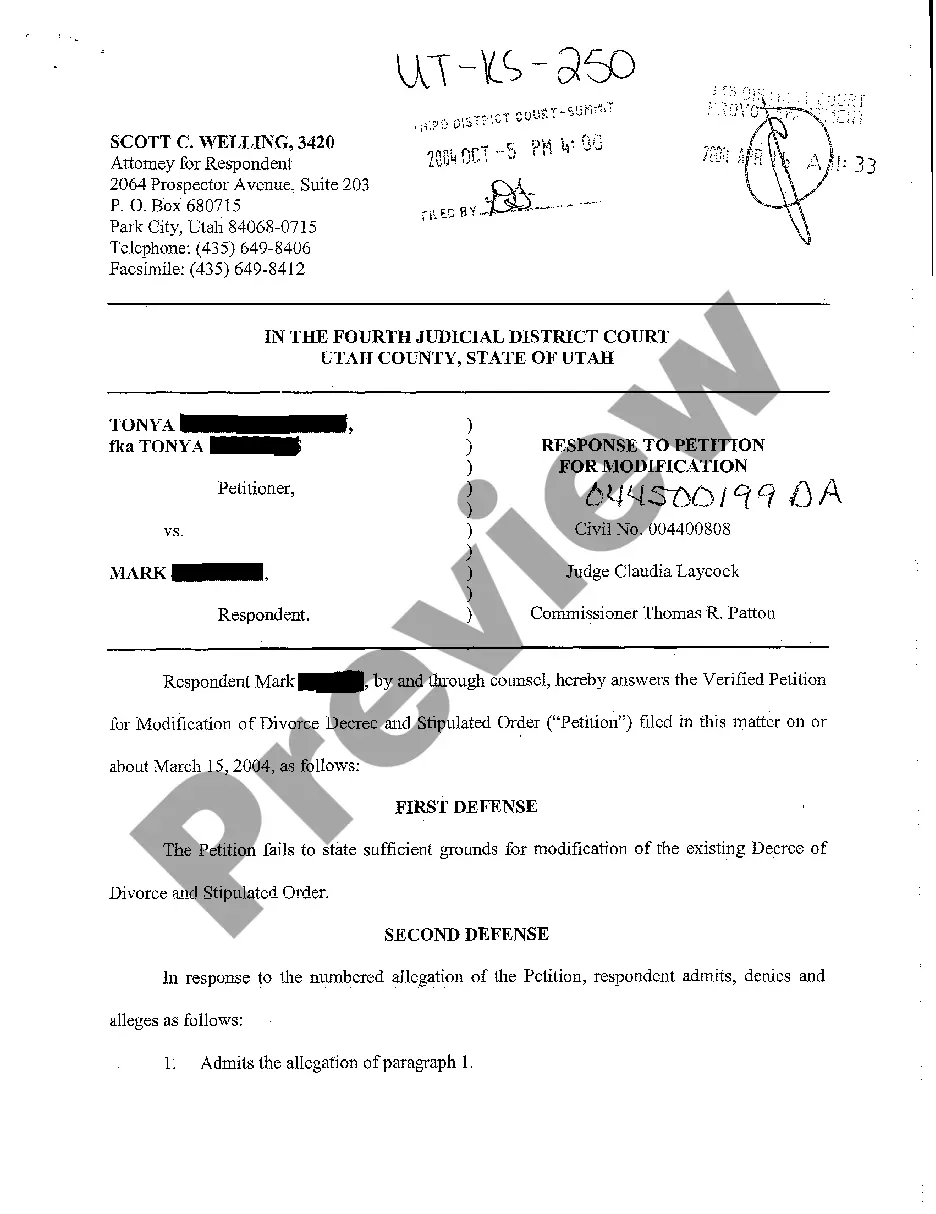

A resolution form is a legal document that records the decisions made by an organization’s governing body. It captures the specifics regarding what resolutions were adopted, such as the North Dakota Dividend Policy - Resolution Form - Corporate Resolutions. This form not only documents decisions but also provides a framework for future transactions or actions.

The main purpose of a corporate resolution is to formalize decisions made by the company's leadership. This documentation ensures that all major actions, like adopting a North Dakota Dividend Policy - Resolution Form - Corporate Resolutions, are legally binding and clearly recorded. It enhances accountability and provides transparency in the company's operations.