Oregon Assignment of Security Agreement and Note with Recourse

Description

How to fill out Assignment Of Security Agreement And Note With Recourse?

If you need to extensive, obtain, or create valid document templates, utilize US Legal Forms, the largest selection of legal forms, which are accessible online.

Take advantage of the site`s straightforward and convenient search to locate the documents you require.

A variety of templates for business and individual purposes are organized by categories and states, or keywords.

Step 3. If you are dissatisfied with the document, use the Search box at the top of the screen to find alternative types of the legal document template.

Step 4. Once you have located the form you need, click the Buy now button. Choose the payment plan you prefer and enter your details to register for an account.

- Utilize US Legal Forms to find the Oregon Assignment of Security Agreement and Note with Recourse in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the Oregon Assignment of Security Agreement and Note with Recourse.

- You can also access forms you previously obtained in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

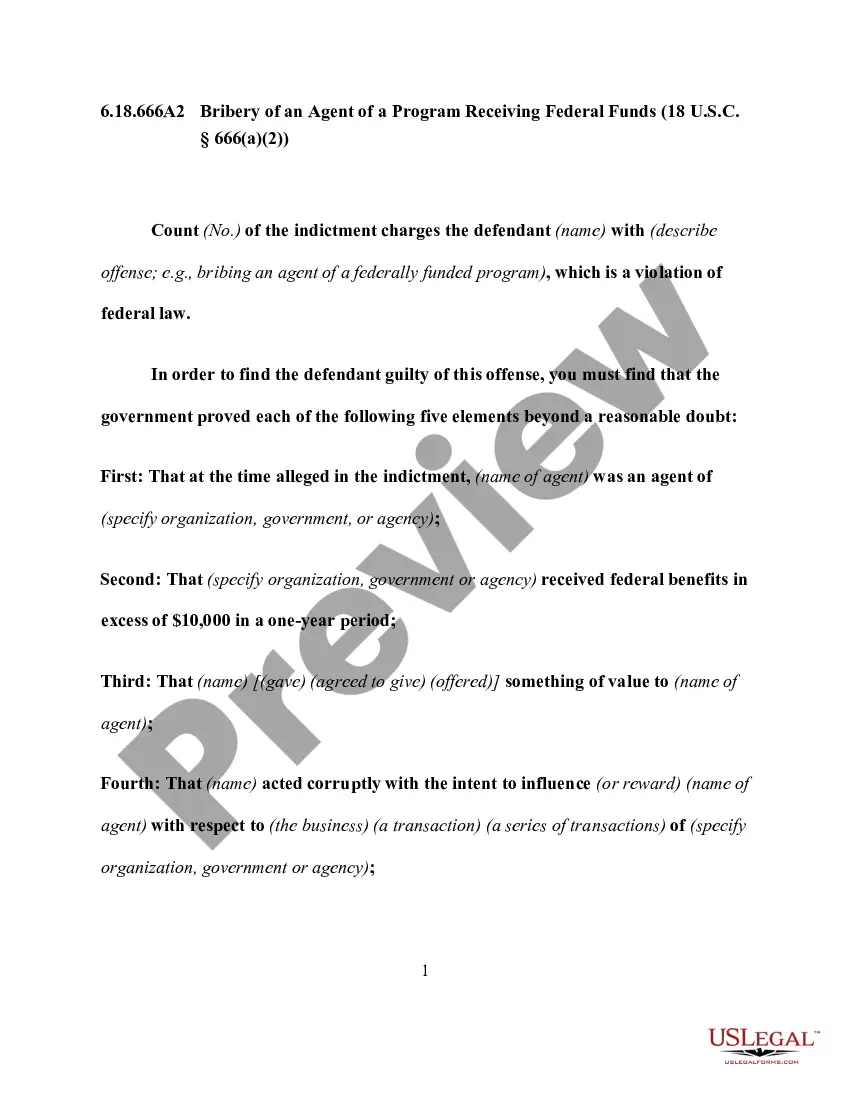

- Step 2. Use the Preview option to review the form’s content. Don’t forget to check the details.

Form popularity

FAQ

Security agreements are generally used to supplement a secured promissory note. The note is the borrower's actual promise to repay the money it received. The enclosed security agreement assumes the existence of a secured promissory note, but that agreement is not included with this package.

What Is a Secured Note? A secured note is a type of loan or corporate bond that is backed by the borrower's assets as a form of collateral. If a borrower defaults on a secured note, the assets pledged as collateral can be sold to repay the note.

To transfer a promissory note, it must be negotiable and/or have a provision that allows and explains transfer. In addition, it must comply with state statutes governing promissory notes and assignments thereof. Create a Promissory Note Transfer Agreement.

A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.

Unless specifically prohibited in the language of the note, a promissory note is assignable by the lender. That is, the lender can sell or assign the note to a third party who the borrower must then repay.

A promissory note can become invalid if it excludes A) the total sum of money the borrower owes the lender (aka the amount of the note) or B) the number of payments due and the date each increment is due.

In general, the promissory note is your written promise to repay the loan and a security agreement is used when collateral is given for the loan.

A mortgage note is the document that you sign at the end of your home closing. It should accurately reflect all the terms of the agreement between the borrower and the lender or be corrected immediately if it doesn't.

A loan agreement serves a similar purpose as a promissory note. Like a promissory note it is a contractual agreement between a lender who agrees to loan money to a borrower. However, a loan agreement is much more detailed than a promissory note. There are two types of loan agreements.