Pennsylvania Agreement for Consulting Services

Description

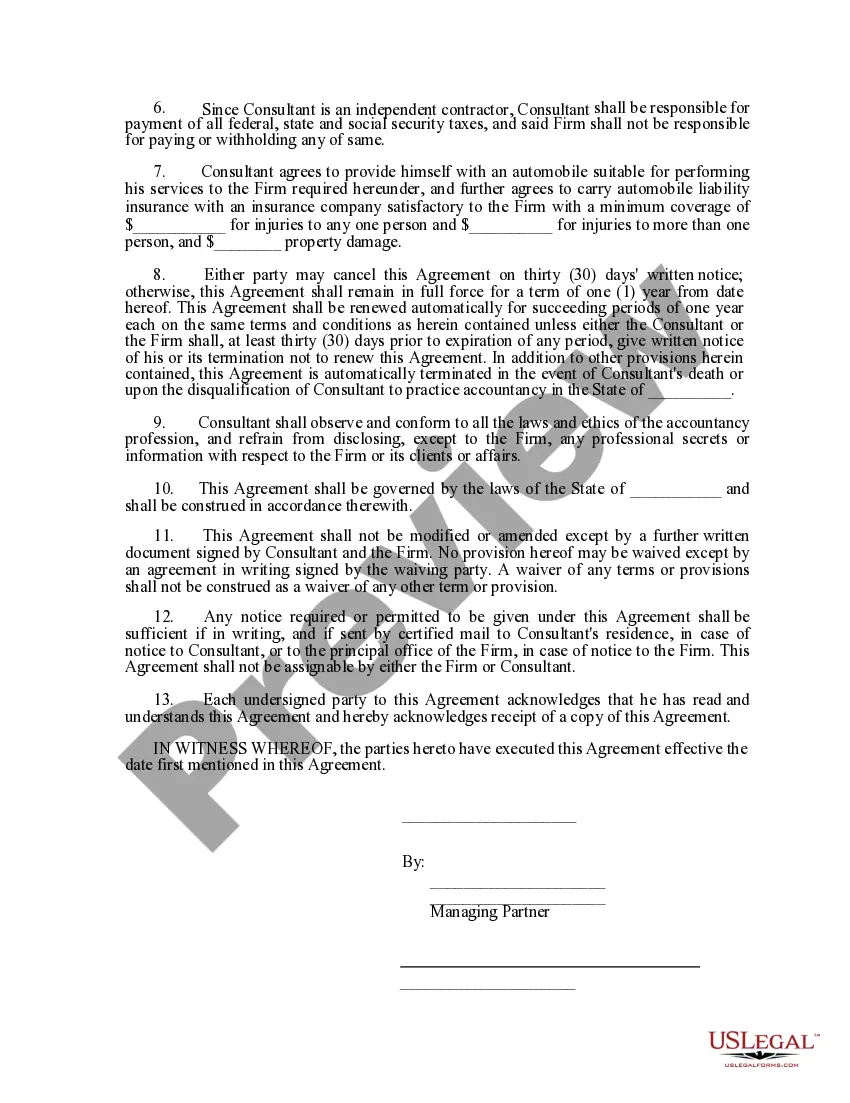

How to fill out Agreement For Consulting Services?

Selecting the appropriate authorized documents template can be a challenge. Clearly, there are numerous designs available online, but how can you locate the official document you require.

Utilize the US Legal Forms website. The service offers a vast array of templates, including the Pennsylvania Agreement for Consulting Services, suitable for both business and personal purposes. All templates are reviewed by experts and comply with state and federal standards.

If you are already registered, Log In to your account and click the Download button to obtain the Pennsylvania Agreement for Consulting Services. Use your account to access the legal documents you have acquired previously. Navigate to the My documents section of your account to retrieve another copy of the documents you need.

Choose the file format and download the authorized document template to your device. Complete, modify, print, and sign the received Pennsylvania Agreement for Consulting Services. US Legal Forms is the largest collection of legal forms where you can find various document templates. Utilize this service to obtain professionally-created documents that adhere to state requirements.

- First, ensure you have selected the correct form for your city/state.

- You can review the form by clicking the Review button and read the form description to ensure it suits your needs.

- If the form does not meet your expectations, use the Search field to find the appropriate form.

- Once you are confident that the form is appropriate, click on the Purchase now button to obtain the form.

- Select the pricing plan you prefer and provide the required information.

- Create your account and pay for the order using your PayPal account or a Visa or Mastercard.

Form popularity

FAQ

A comprehensive consulting agreement should include details such as the scope of work, timelines, payment details, and confidentiality terms. It must also outline the responsibilities of each party and any other pertinent information. By defining clear terms, you can help prevent misunderstandings. A Pennsylvania Agreement for Consulting Services template can provide a solid foundation for this document.

In Pennsylvania, some services may be exempt from sales tax, including certain professional and personal services. For instance, services related to healthcare or education often qualify for exemption. To determine specific exemptions, refer to Pennsylvania tax law or consult a tax expert. A Pennsylvania Agreement for Consulting Services can help outline any service exemptions clearly.

Yes, certain consulting services can be taxable in Pennsylvania, depending on their nature. It's essential to differentiate between taxable and non-taxable consulting services based on state regulations. Consulting agreements should address the tax implications clearly. Consider using a Pennsylvania Agreement for Consulting Services to ensure compliance and clarity regarding taxation.

A consulting services agreement is a contractual document that outlines the terms between a consultant and a client. It details the scope of services to be provided, payment arrangements, and timelines. This agreement protects both parties by establishing clear expectations and reducing potential disputes. A well-structured Pennsylvania Agreement for Consulting Services can enhance this collaboration.

In Pennsylvania, employment agency services are typically subject to sales tax. This includes services provided by agencies that assist in the placement of employees. However, the exact tax application may vary, so it's best to consult with a tax professional. A Pennsylvania Agreement for Consulting Services can help in clarifying the terms of employment-related services.

In many cases, consulting services may be taxable, but it often depends on the nature of the service and state laws. In Pennsylvania, you should verify if your specific consulting service falls under taxable activities. Consulting services generally may not be taxed unless they relate to a product sale. A Pennsylvania Agreement for Consulting Services can help clarify any tax-related terms.

To write a contract agreement for services, start by clearly defining the parties involved. Next, outline the services provided, payment terms, and duration of the agreement. Ensure you include any confidentiality clauses and dispute resolution methods. Utilizing a Pennsylvania Agreement for Consulting Services template can simplify this process and ensure completeness.

A consulting service agreement is a legal document that outlines the terms and conditions between a consultant and a client. It details the services to be provided, payment terms, deadlines, and confidentiality requirements. By using a Pennsylvania Agreement for Consulting Services, you can protect your interests and ensure both parties have a clear understanding of their obligations. This agreement serves as a roadmap for a successful consulting relationship.

Consulting services refer to professional advice or assistance offered in a specific area of expertise. These can vary widely, including business strategy, financial planning, or project management. Essentially, a consultant provides valuable insights that help organizations improve operations or achieve specific goals. Utilizing a well-structured Pennsylvania Agreement for Consulting Services can help clarify expectations and responsibilities between both parties.

To set up a consulting agreement, start by clearly defining the scope of services you require. Next, specify the terms of payment, duration, and any confidentiality clauses involved. Use a reliable source, like the Pennsylvania Agreement for Consulting Services from USLegalForms, to ensure all necessary legal requirements are met. This way, you create a strong foundation for your working relationship.