Oklahoma Assignment of Security Agreement and Note with Recourse

Description

How to fill out Assignment Of Security Agreement And Note With Recourse?

Have you ever found yourself in a situation where you need documentation for both professional or personal purposes on a daily basis.

There are numerous legal document templates accessible online, however finding reliable ones can be challenging.

US Legal Forms provides a vast array of templates, including the Oklahoma Assignment of Security Agreement and Note with Recourse, that are designed to comply with state and federal regulations.

Once you find the appropriate document, simply click Purchase now.

Select the payment plan you wish, fill in the required information to set up your account, and complete the payment via PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Next, you can download the Oklahoma Assignment of Security Agreement and Note with Recourse template.

- If you do not have an account and would like to start using US Legal Forms, follow these steps.

- Find the document you need and ensure it is for your correct location/state.

- Utilize the Review feature to examine the document.

- Check the summary to confirm you have selected the right document.

- If the document does not meet your needs, use the Lookup field to discover a template that fits your requirements.

Form popularity

FAQ

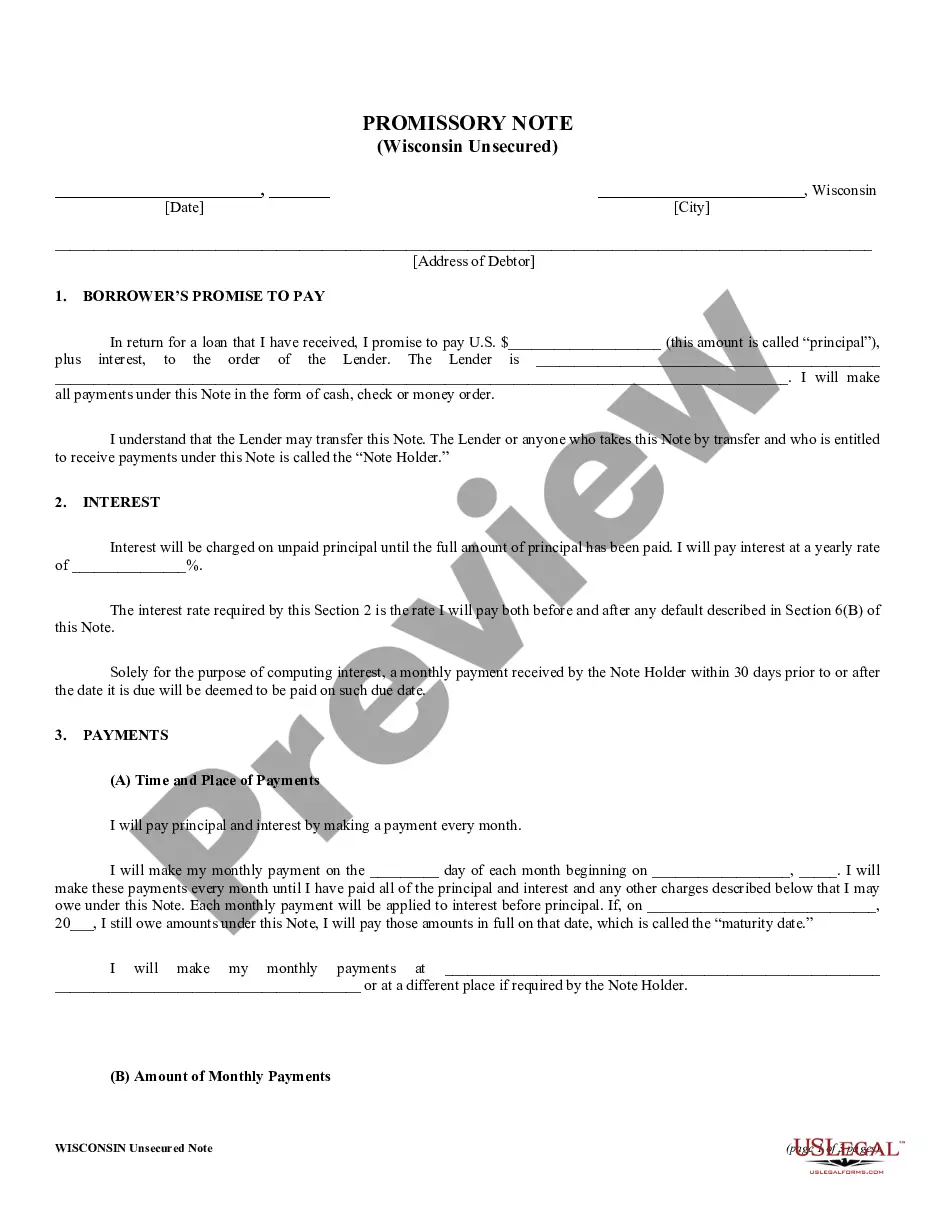

In order for a promissory note to be valid and legally binding, it needs to include specific information. "A promissory note should include details including the amount loaned, the repayment schedule and whether it is secured or unsecured," says Wheeler.

A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.

A mortgage note is the document that you sign at the end of your home closing. It should accurately reflect all the terms of the agreement between the borrower and the lender or be corrected immediately if it doesn't.

Acceptance is not an essential requirement of a valid promissory note.

Characteristics of promissory note:It is a written legal document. There must be a clear, point to point and unconditional promise of paying a certain amount to a specified person. It should be drawn and signed by the maker. It should be stamped properly. It specifically identifies the name of the maker and payee.

A loan agreement serves a similar purpose as a promissory note. Like a promissory note it is a contractual agreement between a lender who agrees to loan money to a borrower. However, a loan agreement is much more detailed than a promissory note. There are two types of loan agreements.

Security agreements are generally used to supplement a secured promissory note. The note is the borrower's actual promise to repay the money it received. The enclosed security agreement assumes the existence of a secured promissory note, but that agreement is not included with this package.

Security Assignment Agreement means a Global Assignment Agreement on the Global Assignment of Accounts Receivable, substantially in the form of EXHIBIT Q, entered into by the Subsidiary Borrower and the Administrative Agent for the benefit of the Lenders.

Generally, a Secured Promissory Note will be secured using an additional document. If the property being used as collateral is personal property, the Note will be secured using a Security Agreement. If the property being used as collateral is real property, the Note will be secured using a Deed of Trust.

What Is a Secured Note? A secured note is a type of loan or corporate bond that is backed by the borrower's assets as a form of collateral. If a borrower defaults on a secured note, the assets pledged as collateral can be sold to repay the note.