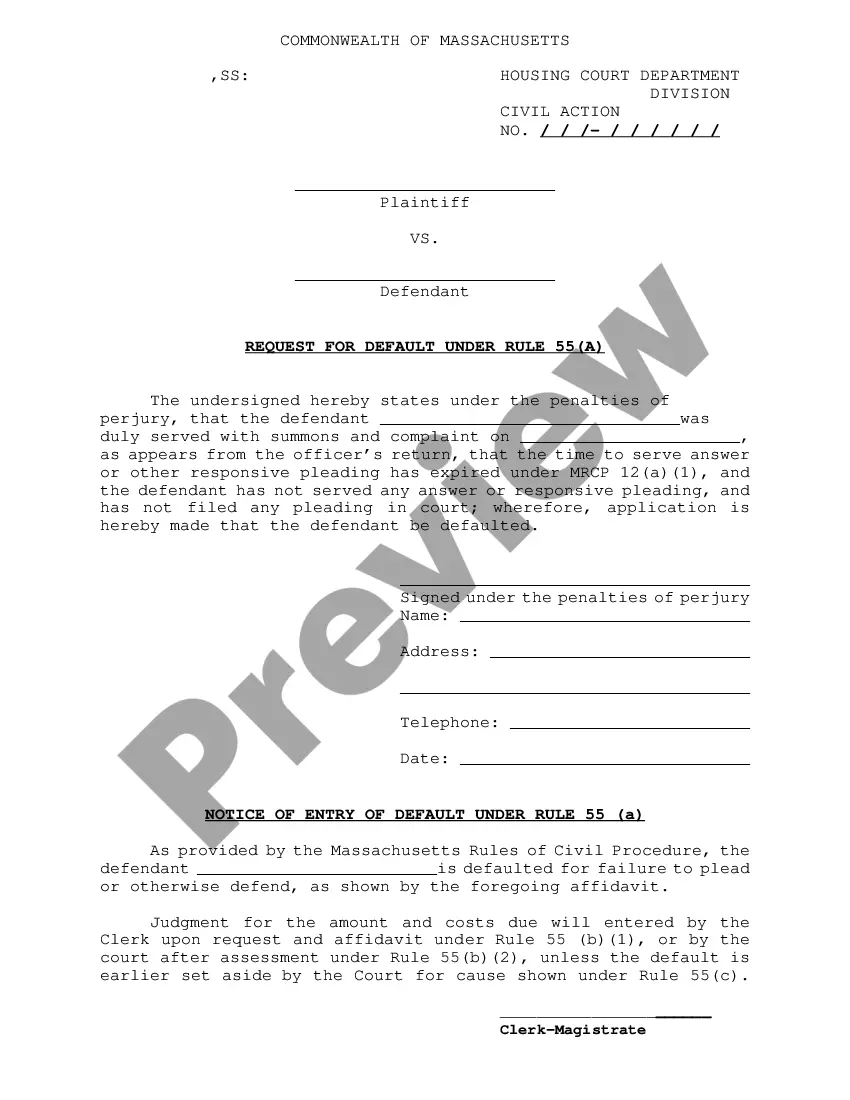

This form is an Application for Certificate of Discharge of IRS Lien. Use to obtain certificate of release when lien has been removed or satisfied. Check for compliance with your specific circumstances.

North Dakota Application for Certificate of Discharge of IRS Lien

Description

How to fill out Application For Certificate Of Discharge Of IRS Lien?

Choosing the right authorized file format could be a have difficulties. Needless to say, there are a lot of layouts available on the Internet, but how will you get the authorized type you require? Use the US Legal Forms site. The support provides a huge number of layouts, for example the North Dakota Application for Certificate of Discharge of IRS Lien, that you can use for organization and personal demands. Every one of the types are examined by professionals and fulfill state and federal specifications.

If you are presently listed, log in in your accounts and click the Down load button to have the North Dakota Application for Certificate of Discharge of IRS Lien. Use your accounts to appear from the authorized types you might have acquired earlier. Check out the My Forms tab of your accounts and have another version in the file you require.

If you are a brand new consumer of US Legal Forms, here are simple guidelines for you to adhere to:

- Initial, ensure you have selected the correct type for your personal area/area. You may examine the form using the Review button and study the form outline to ensure this is basically the right one for you.

- If the type fails to fulfill your needs, take advantage of the Seach industry to find the appropriate type.

- When you are sure that the form would work, go through the Purchase now button to have the type.

- Select the rates program you need and type in the required details. Build your accounts and pay for the order making use of your PayPal accounts or credit card.

- Pick the document file format and acquire the authorized file format in your gadget.

- Complete, change and print and indicator the attained North Dakota Application for Certificate of Discharge of IRS Lien.

US Legal Forms is the largest catalogue of authorized types that you can see numerous file layouts. Use the service to acquire skillfully-made documents that adhere to express specifications.

Form popularity

FAQ

To apply for a federal tax lien discharge, you will need to fill out Form 14135 and submit it to the IRS along with any required documentation. Make sure to provide thorough information about your tax payments and current financial status. Using a platform like US Legal Forms can help you effectively manage the North Dakota Application for Certificate of Discharge of IRS Lien, making the process smoother and more efficient.

Yes, you can remove a federal tax lien under certain conditions, such as paying off your tax debt or obtaining a discharge. Filing the North Dakota Application for Certificate of Discharge of IRS Lien can be a significant step in this process. Utilizing services like US Legal Forms can streamline your application, ensuring that you meet all requirements for successful removal.

You can obtain a copy of a federal tax lien by contacting the IRS directly or by checking with your local county recorder’s office. The IRS typically provides copies upon request, but you may need to provide specific information about the lien. Keep in mind that having this documentation is essential when you are preparing your North Dakota Application for Certificate of Discharge of IRS Lien.

To apply for a certificate of discharge from a federal tax lien, you need to fill out Form 14135 and submit it to the IRS. Ensure that you include all necessary details about your tax situation and any payments made. Using a reliable service like US Legal Forms can simplify the North Dakota Application for Certificate of Discharge of IRS Lien process, guiding you through each step.

Form 14135 is the IRS form used to apply for a Certificate of Discharge of Federal Tax Lien. This form allows taxpayers to request the removal of a federal tax lien when they have settled their tax debts or made arrangements. Completing the North Dakota Application for Certificate of Discharge of IRS Lien accurately is crucial for a successful outcome.

You can obtain a lien release form directly from the IRS website or through tax professionals. Additionally, using platforms like uslegalforms can provide you with the necessary resources and guidance for completing the lien release process. The North Dakota Application for Certificate of Discharge of IRS Lien is one such form that can help facilitate the release of a federal tax lien.

To request a lien discharge from the IRS, you need to complete Form 14135 and submit it along with required documentation. This application must demonstrate that you have satisfied your tax obligations or that the lien can be discharged under specific conditions. Using the North Dakota Application for Certificate of Discharge of IRS Lien simplifies this process, making it easier for you to manage your tax liabilities.

Yes, North Dakota is classified as a tax lien state. This means that the state can place a lien on your property for unpaid taxes. Understanding the implications of tax liens in North Dakota is crucial, and the North Dakota Application for Certificate of Discharge of IRS Lien can assist in addressing any federal tax liens that may affect your property.

The IRS uses Form 12277 to request a withdrawal of a federal tax lien. This form helps you ask for the removal of a lien recorded against your property if you meet certain criteria. Utilizing the North Dakota Application for Certificate of Discharge of IRS Lien can also be an effective strategy to manage tax liens and clear your property title.