North Dakota Partial Release of Judgment Lien

Description

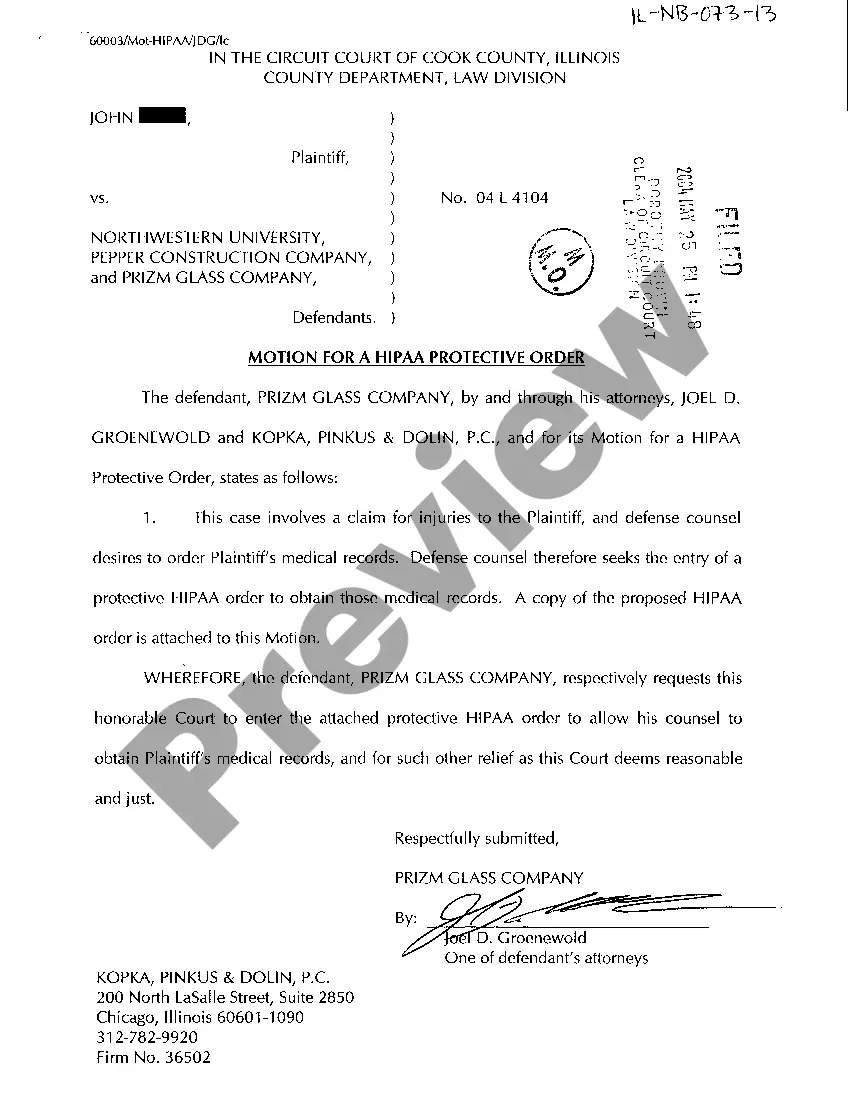

How to fill out Partial Release Of Judgment Lien?

Are you in a position the place you need to have paperwork for both enterprise or personal functions virtually every time? There are plenty of legal papers templates available on the Internet, but finding types you can rely on is not straightforward. US Legal Forms provides thousands of form templates, much like the North Dakota Partial Release of Judgment Lien, which can be created in order to meet state and federal needs.

When you are already acquainted with US Legal Forms website and have an account, just log in. Next, it is possible to acquire the North Dakota Partial Release of Judgment Lien web template.

Should you not offer an account and want to start using US Legal Forms, follow these steps:

- Get the form you will need and make sure it is for that right city/region.

- Make use of the Preview key to analyze the form.

- Browse the description to actually have chosen the right form.

- When the form is not what you`re looking for, make use of the Search area to obtain the form that fits your needs and needs.

- Whenever you find the right form, just click Purchase now.

- Select the costs strategy you want, fill out the necessary information and facts to generate your bank account, and purchase your order using your PayPal or Visa or Mastercard.

- Decide on a practical document structure and acquire your copy.

Find each of the papers templates you might have bought in the My Forms menu. You can aquire a further copy of North Dakota Partial Release of Judgment Lien any time, if required. Just select the required form to acquire or produce the papers web template.

Use US Legal Forms, the most substantial variety of legal varieties, to save some time and steer clear of mistakes. The assistance provides skillfully manufactured legal papers templates which you can use for a variety of functions. Produce an account on US Legal Forms and initiate creating your daily life a little easier.

Form popularity

FAQ

North Dakota follows federal law in terms of how much of your disposable income can be garnished by a creditor. Creditors can garnish whichever is less: 25% of your weekly disposable income, or. The amount by which your weekly income exceeds 40 times the federal minimum wage.

Key Takeaways. A judgment lien is a court ruling that gives a creditor the right to take possession of a debtor's property if the debtor fails to fulfill their contractual obligations. Judgment liens are nonconsensual because they are attached to property without the owner's consent or agreement.

Tells the court and others that a judgment has been paid in full or in part. Can be recorded with a county to release a lien against the judgment debtor's land or filed with the Secretary of State to release a lien against the debtor's personal property.

There are three things you can try to do to deal with a judgement if you can't pay: Try to negotiate a voluntary payment plan with the creditor. File to have the judgment vacated. File bankruptcy to discharge the debt.

The judgment creditor must apply for a writ of execution in the same North Dakota county that ordered the judgment. For foreign judgments registered in North Dakota, the judgment creditor must apply for a writ of execution in the same North Dakota county where the foreign judgment is registered.

FindLaw Newsletters Stay up-to-date with how the law affects your life Injury to PersonSix years (N.D.C.C. § 28-01-16)ContractsWritten: Six years (N.D.C.C. § 28-01-16(1)) ); Oral: Six years (N.D.C.C. § 28-01-16(1))Collection of Debt on AccountSix years (N.D.C.C. § 28-01-16(1))Judgments10 years (N.D.C.C. § 28-01-15)7 more rows

Statute of Limitations on Debt in North Dakota Debt TypeDeadlineStudent Loan6 yearsMortgage6 yearsPersonal Loan6 yearsJudgment10 years4 more rows ?

North Dakota follows federal law in terms of how much of your disposable income can be garnished by a creditor. Creditors can garnish whichever is less: 25% of your weekly disposable income, or. The amount by which your weekly income exceeds 40 times the federal minimum wage.