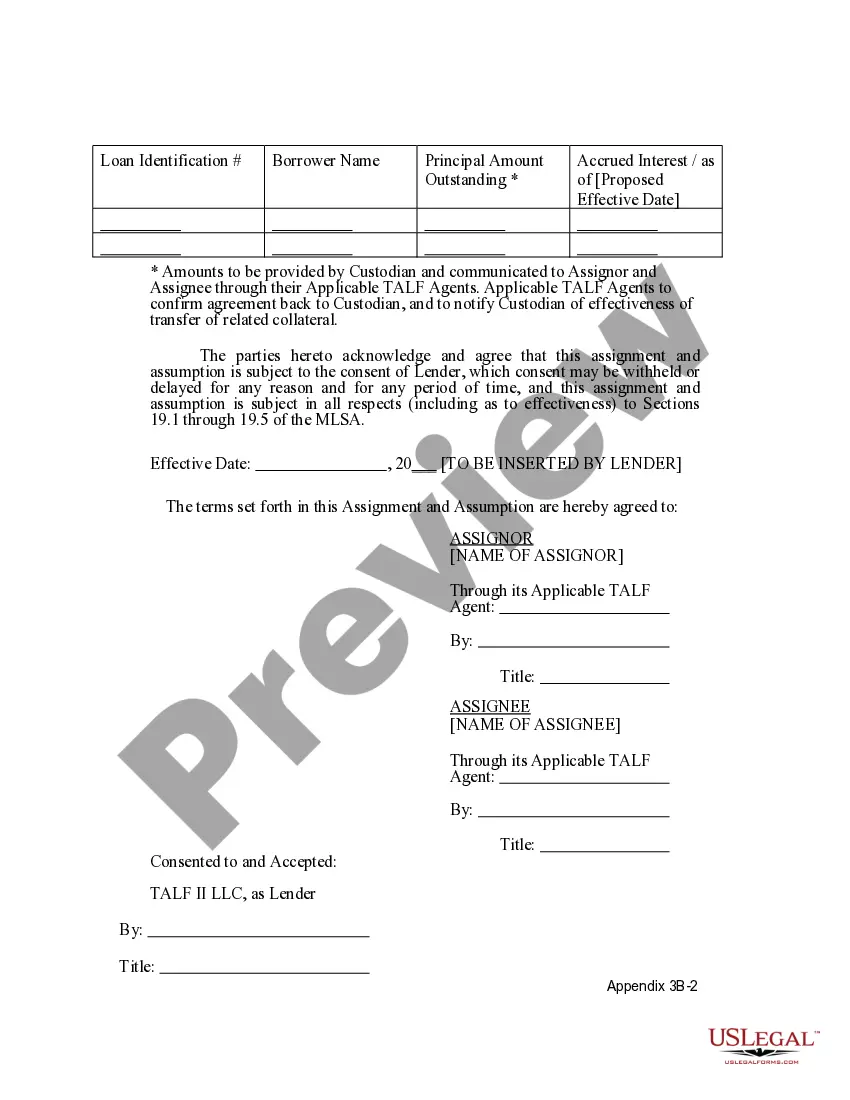

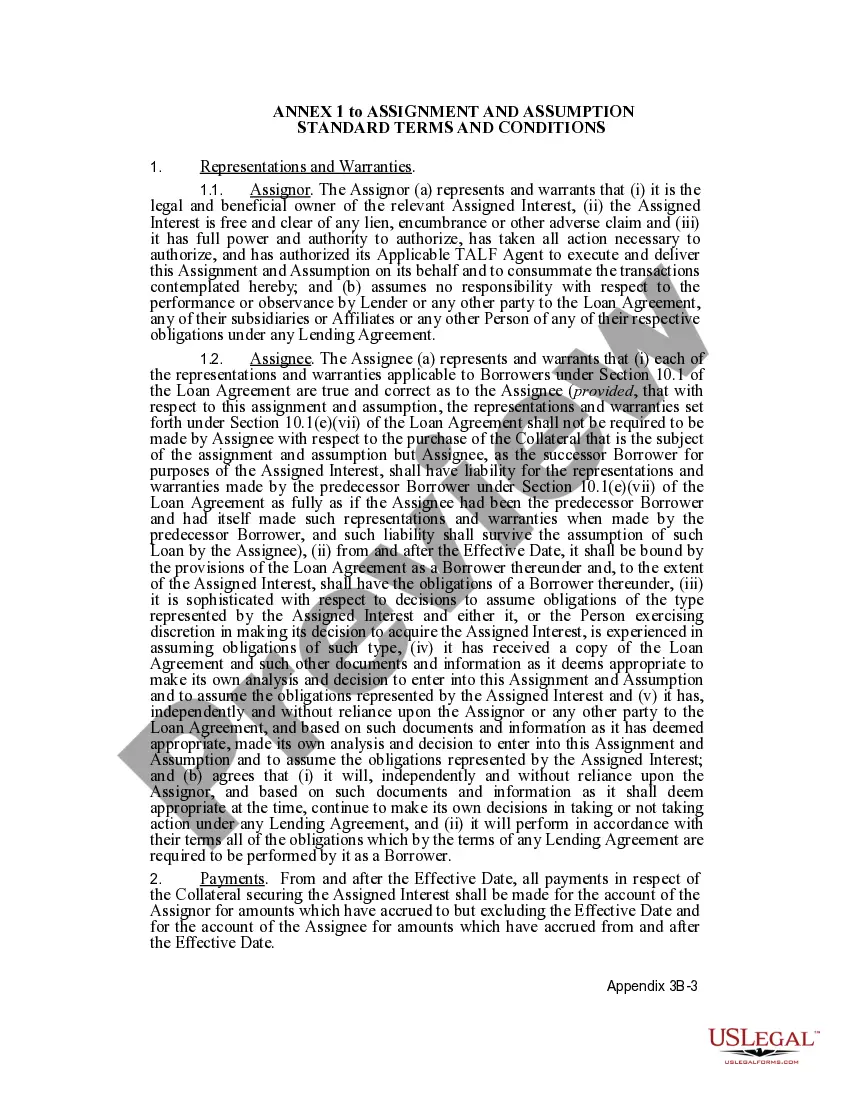

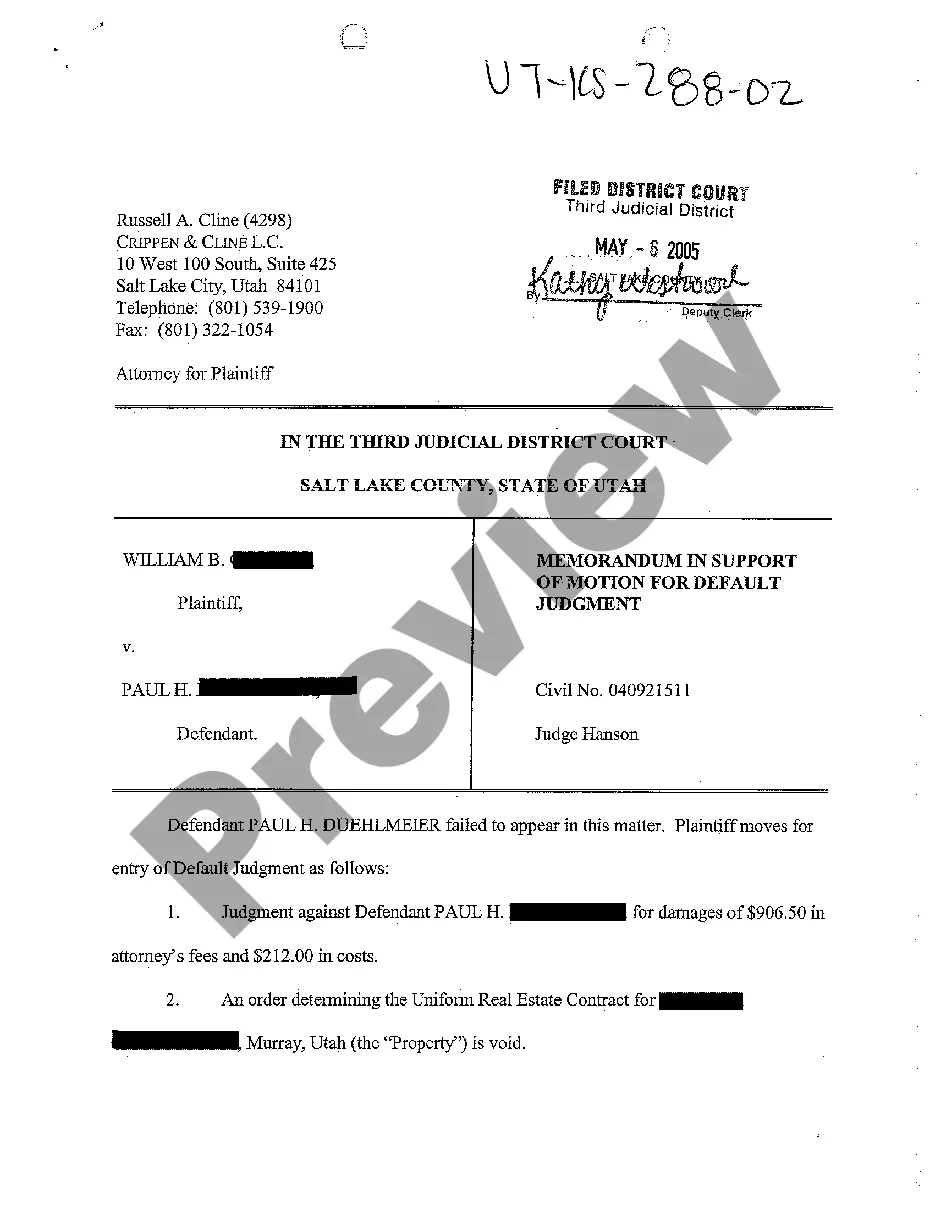

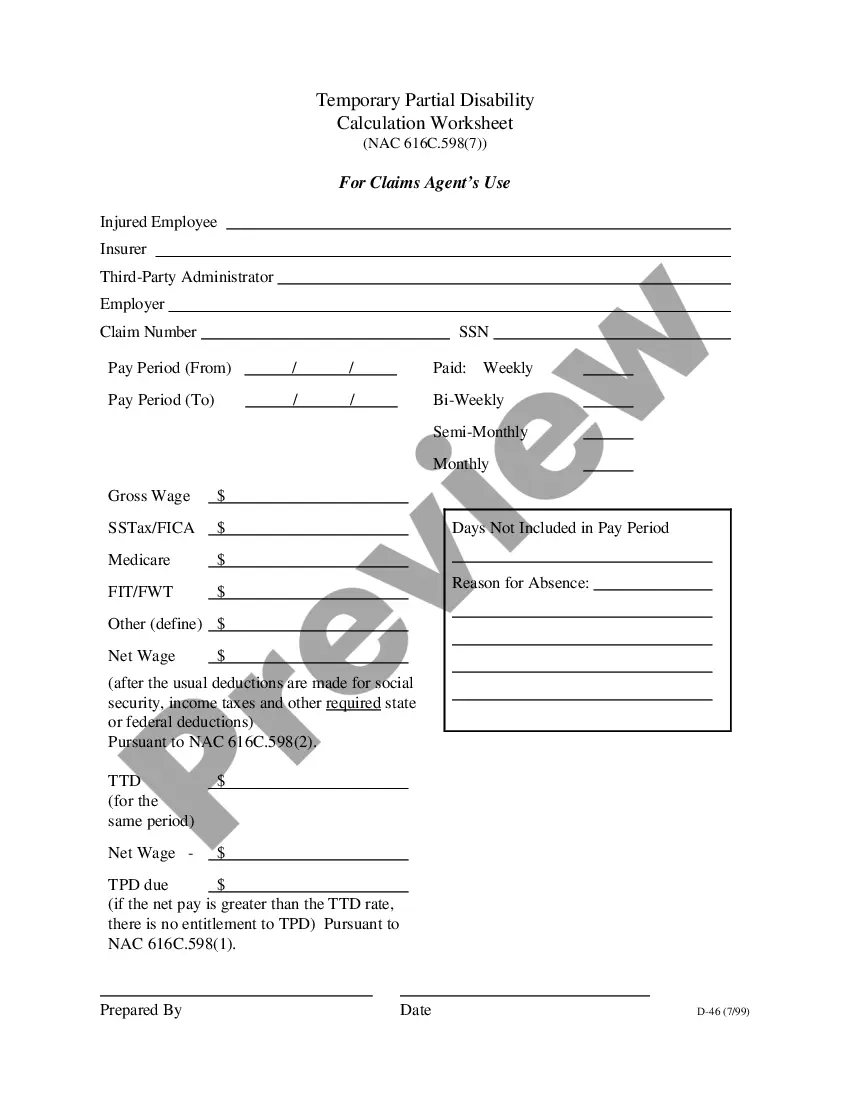

Form of Assignment and Assumption — Assumption by Borrower is a legal document used in mortgage transactions. It is used when a borrower (or a buyer) assumes the responsibility of paying the mortgage loan of the seller (or current borrower). By signing this document, the borrower agrees to the terms of the loan and acknowledges that they are taking over the loan from the seller. The document typically includes information such as the borrower's name and address, the loan amount, the loan term, the interest rate, the monthly payment, and any other relevant details. There are two types of Form of Assignment and Assumption — Assumption by borrower: Voluntary Assumption and Non-Voluntary Assumption. A Voluntary Assumption is when the borrower willingly takes over the loan from the seller. A Non-Voluntary Assumption is when the borrower is forced to take over the loan due to a foreclosure or other legal action.

Form of Assignment and Assumption - Assumption by Borrower

Description

How to fill out Form Of Assignment And Assumption - Assumption By Borrower?

Dealing with official paperwork requires attention, accuracy, and using well-drafted templates. US Legal Forms has been helping people countrywide do just that for 25 years, so when you pick your Form of Assignment and Assumption - Assumption by Borrower template from our service, you can be sure it complies with federal and state regulations.

Dealing with our service is simple and quick. To obtain the required paperwork, all you’ll need is an account with a valid subscription. Here’s a brief guide for you to obtain your Form of Assignment and Assumption - Assumption by Borrower within minutes:

- Make sure to attentively check the form content and its correspondence with general and legal requirements by previewing it or reading its description.

- Search for another official template if the previously opened one doesn’t suit your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and download the Form of Assignment and Assumption - Assumption by Borrower in the format you need. If it’s your first experience with our website, click Buy now to proceed.

- Create an account, choose your subscription plan, and pay with your credit card or PayPal account.

- Decide in what format you want to save your form and click Download. Print the blank or upload it to a professional PDF editor to submit it electronically.

All documents are drafted for multi-usage, like the Form of Assignment and Assumption - Assumption by Borrower you see on this page. If you need them one more time, you can fill them out without re-payment - simply open the My Forms tab in your profile and complete your document any time you need it. Try US Legal Forms and prepare your business and personal paperwork quickly and in total legal compliance!

Form popularity

FAQ

An assignment of promissory note is a formal document that is used by a lender to assign debt to a third party after selling it ? meaning a borrower will make payments to a third party instead of the original lender.

The assignment and assumption agreement An assignment and assumption agreement is used after a contract is signed, in order to transfer one of the contracting party's rights and obligations to a third party who was not originally a party to the contract.

The Borrower shall not assign or transfer any of its rights or obligations under any of the Loan Documents without the prior written consent of each of the Banks.

To assume a loan, the buyer must qualify with the lender. If the price of the house exceeds the remaining mortgage, the buyer must remit a down payment that is the difference between the sale price and the mortgage. If the difference is substantial, the buyer may need to secure a second mortgage.

The most important document in the loan assumption process is the deed of trust, which adds your name to the mortgage and absolves the original borrower of any obligations under the agreement, assuming a novation. All parties will be required to sign the final documents.

An assumable mortgage is a home loan that can be transferred from the original borrower to the next homeowner. The interest rate and payment period stay the same. For example, if a 30-year mortgage is three years old, the person assuming the loan has 27 years to pay it off.

An executed original of this Assumption Agreement will be recorded in the Land Records as a modification to the Security Instrument.

An assumption clause is a provision in a mortgage contract that allows the seller of a home to pass responsibility for the existing mortgage to the buyer of the property. In other words, the new homeowner assumes the existing mortgage and?along with it?ownership of the property that secures the loan.