Montana Liquidation of Partnership with Sale of Assets and Assumption of Liabilities

Description

How to fill out Liquidation Of Partnership With Sale Of Assets And Assumption Of Liabilities?

Are you currently in a situation where you need to obtain documents for either business or personal purposes almost every day.

There are numerous legal document templates available online, but finding reliable ones isn't easy.

US Legal Forms provides thousands of template options, including the Montana Liquidation of Partnership with Sale of Assets and Assumption of Liabilities, designed to meet federal and state requirements.

Once you locate the appropriate form, click on Acquire now.

Select the pricing plan you require, complete the necessary information to create your account, and pay for the order using your PayPal or credit card. Choose a suitable file format and download your copy. You can find all the document templates you have purchased in the My documents menu. You are able to obtain another copy of the Montana Liquidation of Partnership with Sale of Assets and Assumption of Liabilities anytime if needed. Simply click on the desired form to download or print the template. Use US Legal Forms, the most extensive collection of legal documents, to save time and prevent mistakes. The service offers professionally crafted legal document templates for various purposes. Create an account on US Legal Forms and start simplifying your life a little more.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Montana Liquidation of Partnership with Sale of Assets and Assumption of Liabilities template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/region.

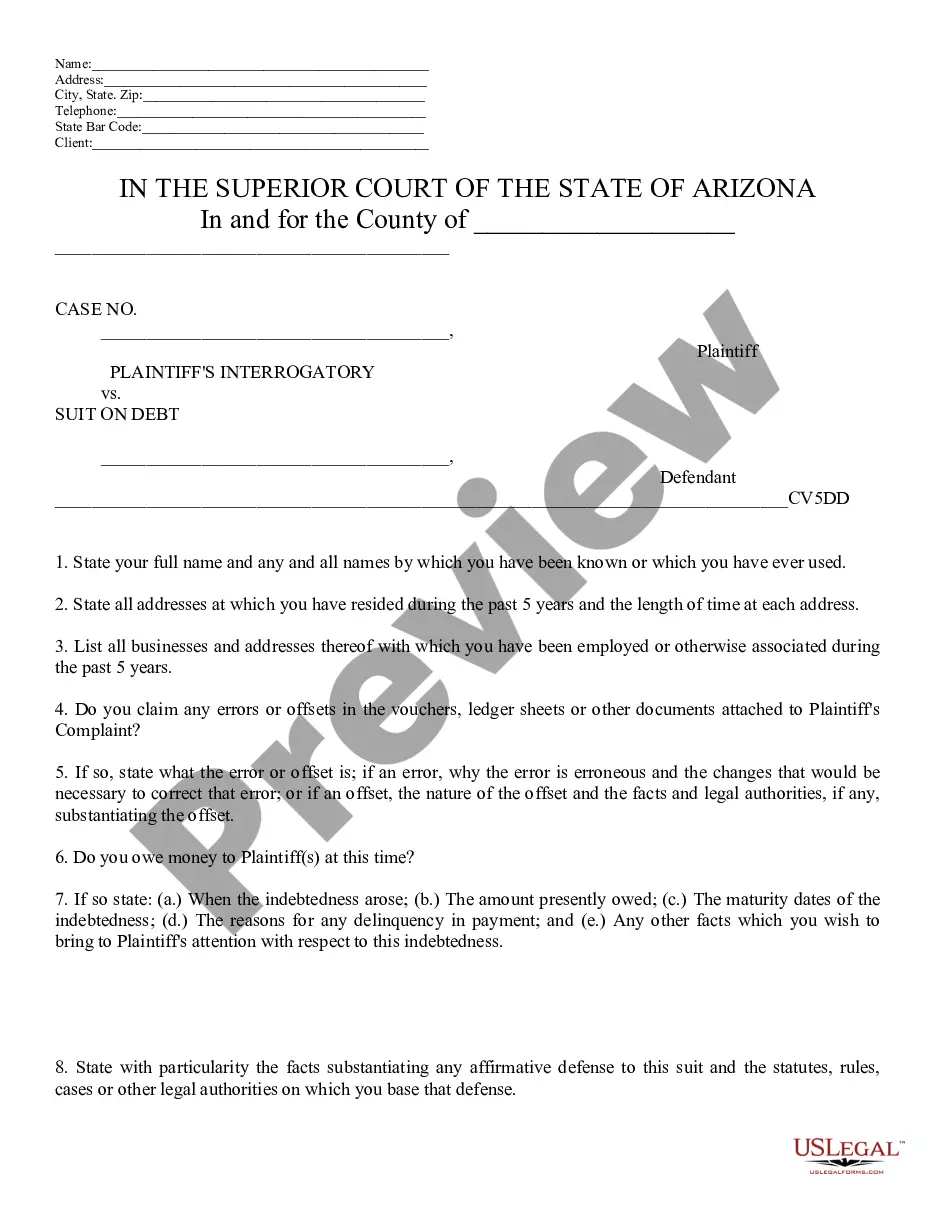

- Use the Preview button to review the template.

- Read through the details to confirm you have selected the right form.

- If the form isn't what you're looking for, utilize the Search area to discover the form that meets your requirements.

Form popularity

FAQ

Yes, when a partnership is dissolved, the assets are typically liquidated to satisfy creditors and distribute any remaining value to the partners. This liquidating process helps ensure that all liabilities are addressed before the partnership fully ceases operations. Understanding this aspect is essential for effective Montana Liquidation of Partnership with Sale of Assets and Assumption of Liabilities.

Only partners who receive a liquidating distribution of cash may have an immediate taxable gain or loss to report. The value of marketable securities, such as stock investments that are traded on a public stock exchange, and decreases to your share of the partnership's debt are both treated as cash distributions.

Partnerships are generally guided by a partnership agreement, which may allow or restrict transfers of partnership interest. Partners must follow the terms of the agreement. If the agreement allows it, a partner can transfer ownership stakes in terms of profits, voting rights and responsibilities.

The following four accounting steps must be taken, in order, to dissolve a partnership: sell noncash assets; allocate any gain or loss on the sale based on the income-sharing ratio in the partnership agreement; pay off liabilities; distribute any remaining cash to partners based on their capital account balances.

Contribution of encumbered property to a partnership can result in gain recognition under Code Sec. 731 (a)(1) if there is a distribution of money, actual or deemed, to the Contributing Partner which exceeds its basis in the Partnership.

In a general partnership company, all members share both profits and liabilities.

Partnership reports distributions of all other property on Schedule K, line 19b and on Form 1065, Schedule M-2. Liquidating partner determines if he must recognize gain or loss from the transaction on his Form 1040.

When a partner contributes a capital asset to a partnership in exchange for an interest in the partnership, the entire subsequent gain or loss realized by the partnership upon the sale of the capital asset is capital gain or loss if the property is sold within five years of when it is contributed.

Only partners who receive a liquidating distribution of cash may have an immediate taxable gain or loss to report. The value of marketable securities, such as stock investments that are traded on a public stock exchange, and decreases to your share of the partnership's debt are both treated as cash distributions.

This means the ownership interest a partner has in a partnership is treated as a separate asset that can be purchased and sold. The general rule is the selling partner treats the gain or loss on the sale of the partnership interest as the sale of a capital asset (see IRC 741).