Montana Revocable Living Trust for Married Couple

Description

How to fill out Revocable Living Trust For Married Couple?

Finding the appropriate legal document format can be challenging.

Clearly, there is a multitude of templates accessible online, but how do you obtain the legal document you require.

Utilize the US Legal Forms website.

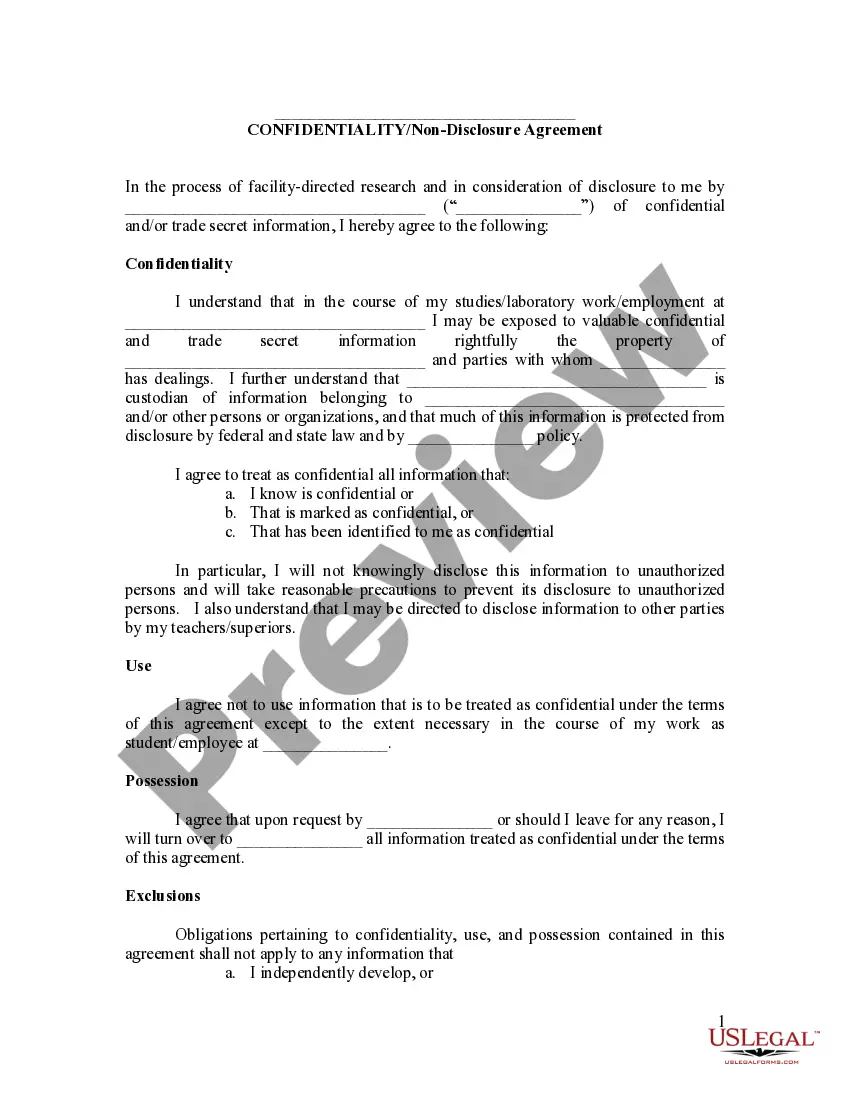

For new users of US Legal Forms, here are simple instructions to follow: First, ensure you have selected the correct form for your specific city or county. You can review the document using the Preview option and read the description to confirm it is suitable for you.

- The service offers thousands of templates, including the Montana Revocable Living Trust for Married Couples, suitable for both business and personal needs.

- All documents are verified by professionals and comply with federal and state laws.

- If you are already registered, Log In to your account and click on the Acquire button to obtain the Montana Revocable Living Trust for Married Couples.

- Use your account to access the legal documents you have previously acquired.

- Visit the My documents section of your account to obtain another copy of the document you need.

Form popularity

FAQ

A Montana Revocable Living Trust for Married Couples is an excellent option for couples looking to manage their assets collectively. This type of trust allows both spouses to retain control over their properties while ensuring that assets are distributed according to their wishes after one or both partners pass away. Additionally, it provides flexibility for changes as circumstances evolve over time, making it an ideal solution for many married couples. By using a platform like uslegalforms, you can easily create a tailored trust that meets your specific needs.

The minimum amount required to set up a Montana Revocable Living Trust for a Married Couple can vary based on your particular needs and goals. Generally, there is no strict minimum; it’s more about how you want to structure the trust and the assets you plan to include. However, many individuals find that having at least $100,000 in assets makes creating a living trust worthwhile. Ultimately, evaluating the benefits of your investment in relation to your family’s future is key.

To establish a Montana Revocable Living Trust for a Married Couple, begin by defining your goals and identifying your assets. Next, you should draft the trust document, which outlines how your assets will be managed and distributed. Utilizing a reliable platform like US Legal Forms can simplify this process, offering templates and guidance tailored to Montana's regulations. Finally, make sure to transfer your assets into the trust for it to be effective.

When considering a Montana Revocable Living Trust for a Married Couple, it's essential to understand the three primary types of trusts: revocable trusts, irrevocable trusts, and testamentary trusts. A revocable trust allows you to maintain control over your assets during your lifetime. In contrast, an irrevocable trust cannot be altered once established, providing potential tax benefits. Lastly, a testamentary trust is created through a will and comes into effect after your passing.

Yes, a married couple can absolutely create a joint revocable trust. This type of trust allows both spouses to manage and control their assets together, promoting seamless asset distribution after one spouse passes away. A joint Montana Revocable Living Trust for Married Couples can simplify estate planning and provide peace of mind regarding asset management and transfer.

Filing a trust in Montana involves several steps, primarily focusing on drafting the trust document, which should clearly define the terms and assets included. Once the trust is established, you may need to retitle assets in the trust’s name. For assistance, consider using resources from uslegalforms, which can simplify the process of creating a Montana Revocable Living Trust for Married Couples, making it easier to navigate state requirements.

Filing taxes for a revocable trust is typically straightforward, as the income generated is reported on the grantor's personal tax return. This means you continue to report earnings just like you would with personal income. If you are using a Montana Revocable Living Trust for Married Couples, it is beneficial to track your trust's income and expenses accurately to ensure proper tax compliance.

A revocable trust allows you to alter or dissolve it during your lifetime, offering flexibility for changing circumstances. In contrast, an irrevocable trust becomes permanent once established and cannot be modified without consent from the beneficiaries. This distinction is crucial when considering a Montana Revocable Living Trust for Married Couples, as it provides both partners with the control they may desire over their assets.

It's advisable not to put certain assets in a Montana Revocable Living Trust for a Married Couple, such as retirement accounts or life insurance policies with designated beneficiaries. Additionally, personal items with sentimental value or assets that face legal restrictions may also be better managed outside of the trust. Always consult a legal expert or use platforms like US Legal Forms for personalized guidance on which assets to include.

The best living trust for a married couple typically is a Montana Revocable Living Trust designed to accommodate both partners' needs. This type of trust allows for shared management of assets while providing flexibility and control over their distribution. Be sure to consider consulting with a legal professional or using resources like US Legal Forms to tailor the trust to your specific circumstances.