Montana Complex Will - Credit Shelter Marital Trust for Spouse

Description

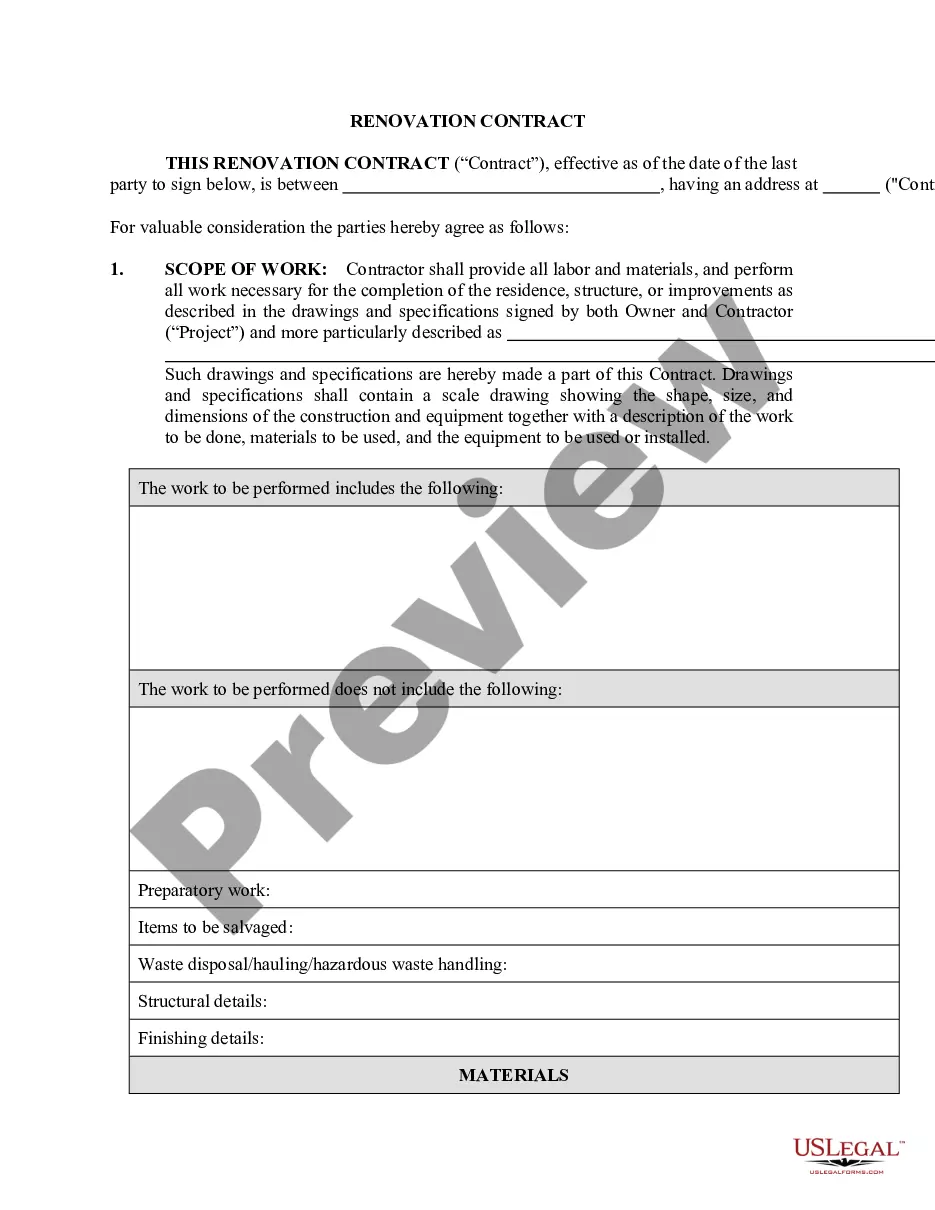

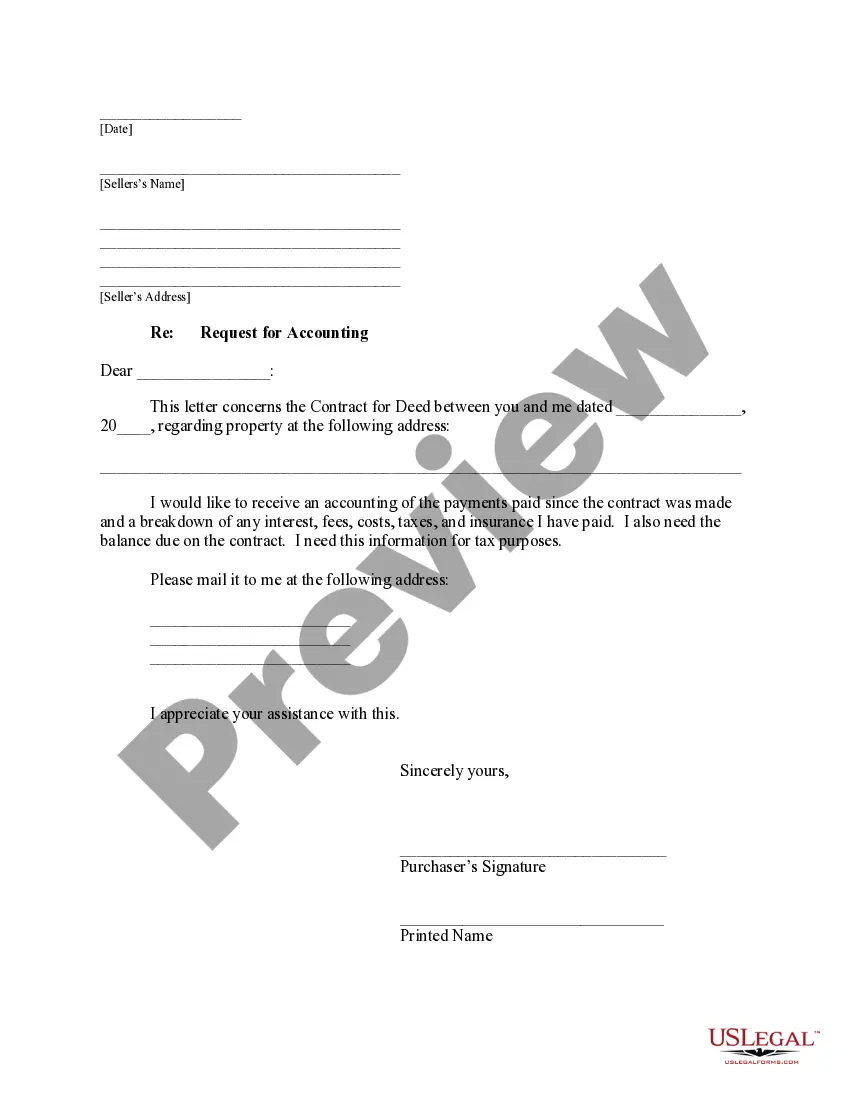

How to fill out Complex Will - Credit Shelter Marital Trust For Spouse?

If you have to total, down load, or produce legal file layouts, use US Legal Forms, the largest assortment of legal types, that can be found on the Internet. Use the site`s simple and easy convenient research to obtain the files you need. Different layouts for enterprise and individual functions are categorized by categories and claims, or search phrases. Use US Legal Forms to obtain the Montana Complex Will - Credit Shelter Marital Trust for Spouse within a few mouse clicks.

When you are already a US Legal Forms customer, log in to the accounts and click on the Download button to have the Montana Complex Will - Credit Shelter Marital Trust for Spouse. Also you can accessibility types you previously delivered electronically in the My Forms tab of your accounts.

If you use US Legal Forms initially, refer to the instructions listed below:

- Step 1. Be sure you have chosen the shape to the appropriate city/nation.

- Step 2. Utilize the Review method to examine the form`s content material. Don`t overlook to learn the description.

- Step 3. When you are unhappy with all the kind, make use of the Lookup field on top of the monitor to locate other versions of your legal kind web template.

- Step 4. Once you have discovered the shape you need, select the Purchase now button. Select the costs plan you favor and put your references to register for the accounts.

- Step 5. Method the purchase. You should use your charge card or PayPal accounts to perform the purchase.

- Step 6. Pick the file format of your legal kind and down load it in your device.

- Step 7. Total, change and produce or sign the Montana Complex Will - Credit Shelter Marital Trust for Spouse.

Each and every legal file web template you buy is the one you have for a long time. You may have acces to each and every kind you delivered electronically with your acccount. Go through the My Forms portion and select a kind to produce or down load again.

Compete and down load, and produce the Montana Complex Will - Credit Shelter Marital Trust for Spouse with US Legal Forms. There are thousands of expert and express-particular types you can use to your enterprise or individual requirements.

Form popularity

FAQ

The primary benefit of CSTs is that the surviving spouse can use the trust's principal and income during the remainder of their lifetime, for example, for medical or educational expenses. The remaining assets then pass to the beneficiaries and are not subject to estate taxes.

Upon the death of the surviving spouse, the trust transfers to the heirs, who are exempt from the estate tax that would have resulted from a combined inheritance. Disadvantages of a CST include formation costs and the surviving spouse's lack of control.

The assets you cannot put into a trust include the following: Medical savings accounts (MSAs) Health savings accounts (HSAs) Retirement assets: 403(b)s, 401(k)s, IRAs. Any assets that are held outside of the United States. Cash. Vehicles.

Credit shelter trust (CST) (also called an AB trust or a bypass trust) is a tool used by well-off married individuals to legally maximize their estate tax exemptions. The strategy involves creating two separate trusts after one spouse passes.

Property interests passing to a surviving spouse that are not included in the decedent's gross estate do not qualify for the marital deduction. Expenses, indebtedness, taxes, and losses chargeable against property passing to the surviving spouse will reduce the marital deduction.

When the credit shelter trust is initially funded upon the death of one spouse, the assets that are placed under the trust receive a step-up in basis. This is an important consideration, because any assets held in a CST don't receive a second step-up in basis upon the death of the surviving spouse.

This trust is irrevocable and will pass to beneficiaries other than the surviving spouse (usually their children). The surviving spouse must follow the trust's plan without overly benefiting from its operation, but this trust often passes income to the surviving spouse to live on for the rest of their life.

No. Credit Shelter Trusts are a popular tool for estate planning, and there are two main types of CSTs, the Marital Gift Trust and the Qualified Terminable Interest Property Trust (QTIP). Both of these Trusts preserve wealth via estate tax exemptions.