Montana Complex Will - Maximum Unified Credit to Spouse

Description

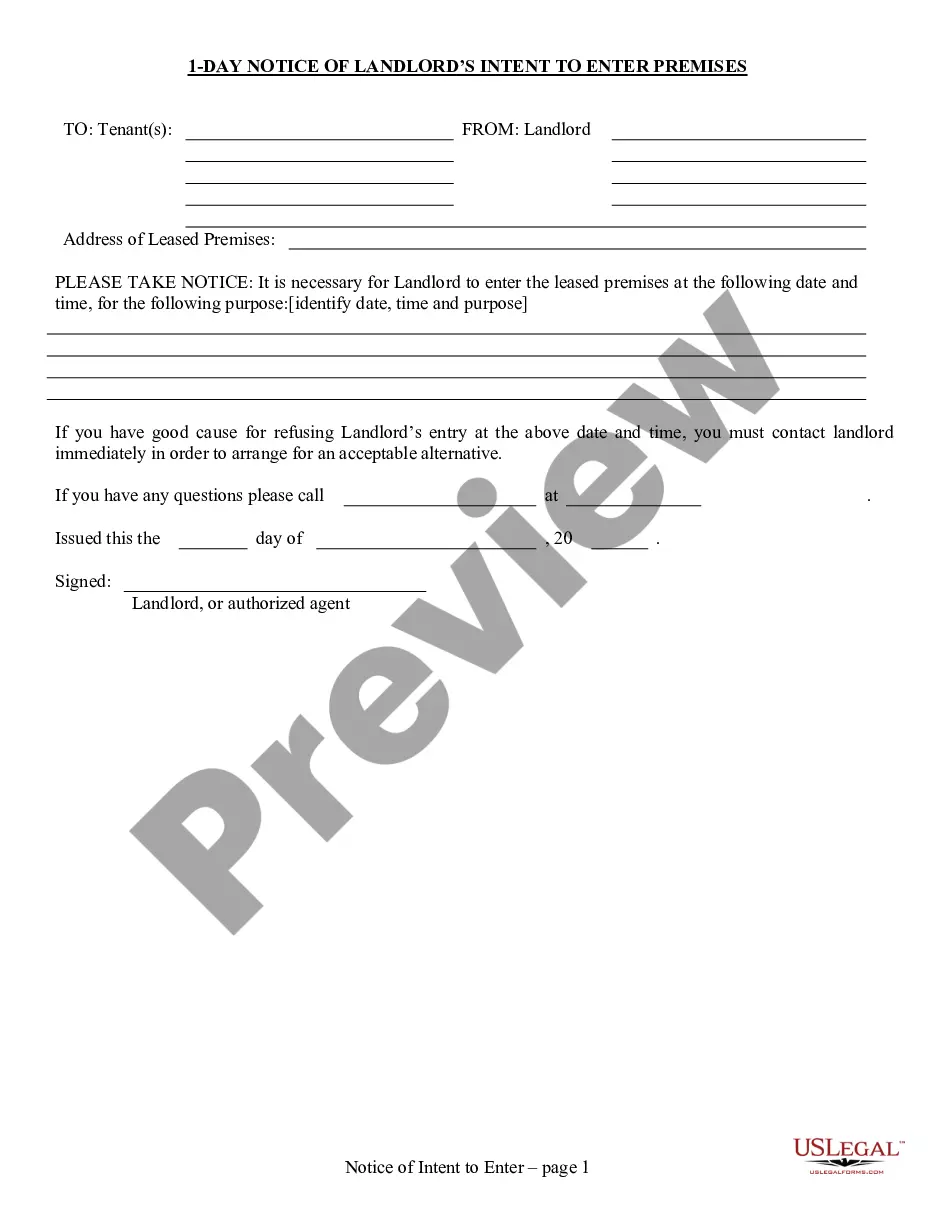

How to fill out Complex Will - Maximum Unified Credit To Spouse?

Choosing the best legitimate document design could be a struggle. Needless to say, there are a variety of templates available on the net, but how will you find the legitimate type you need? Utilize the US Legal Forms web site. The services offers 1000s of templates, such as the Montana Complex Will - Maximum Unified Credit to Spouse, which you can use for organization and personal demands. All of the forms are inspected by experts and fulfill state and federal requirements.

Should you be previously authorized, log in to your profile and then click the Down load switch to find the Montana Complex Will - Maximum Unified Credit to Spouse. Make use of your profile to search through the legitimate forms you might have purchased formerly. Go to the My Forms tab of your profile and acquire another copy from the document you need.

Should you be a fresh user of US Legal Forms, here are basic guidelines for you to comply with:

- Initial, make sure you have selected the appropriate type for your personal area/county. You may check out the form making use of the Review switch and read the form information to make certain this is the right one for you.

- In the event the type is not going to fulfill your requirements, take advantage of the Seach discipline to get the right type.

- When you are sure that the form is suitable, click on the Purchase now switch to find the type.

- Choose the pricing prepare you desire and enter the necessary information and facts. Build your profile and pay for the transaction with your PayPal profile or Visa or Mastercard.

- Select the submit structure and download the legitimate document design to your product.

- Comprehensive, edit and printing and signal the received Montana Complex Will - Maximum Unified Credit to Spouse.

US Legal Forms will be the biggest collection of legitimate forms for which you will find a variety of document templates. Utilize the service to download professionally-made files that comply with status requirements.

Form popularity

FAQ

What Is Maximum Unified Credit? The current maximum unified credit for 2022 is standing at $12.06 million. This is up from $11.7 million in 2021.

The federal government and most states have a marital exemption for estate taxes, which allows a surviving spouse to inherit a certain amount of the deceased spouse's estate without having to pay estate taxes on it.

The spouse exemption is unlimited if neither of the spouses or civil partners is UK domiciled or if a non-UK domiciled individual makes gifts to a UK domiciled spouse or civil partner. However, the spouse exemption is capped when a UK domiciled individual gives assets to a non-UK domiciled spouse or civil partner.

Another problem with making full use of the unlimited marital deduction is the person you ultimately want to have property might not receive it. Many people assume their surviving spouses will leave their estate to the children of the marriage.

The unlimited marital deduction allows spouses to transfer an unlimited amount of money to one another, including upon death, without penalty or tax. Any asset transferred to a surviving spouse can be included in the spouse's taxable estate.

Spousal Planning As stated, each person has a unified credit. This means that each spouse in a marriage has a unified credit and that by using both of those credits a married couple may exempt from transfer taxes a marital estate worth up to $10.86 million.

The unified credit in 2023 will be $12,920,000, up from $12,060,000 in 2022. Since the credit can be shared between spouses, when used correctly, a married couple can transfer up to a combined $25,840,000 without incurring gift or estate tax.

Estate Tax Marital Deduction: Key Considerations For 2022 returns, estates that exceed $12.06 million for individuals and $24.12 million for married couples are subject to estate tax. In 2023 those limits rise to $12.92 million and $25.84 million, respectively.