A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. Usually, the party receiving the guaranty will first try to collect or obtain performance from the debtor before trying to collect from the one making the guaranty (guarantor).

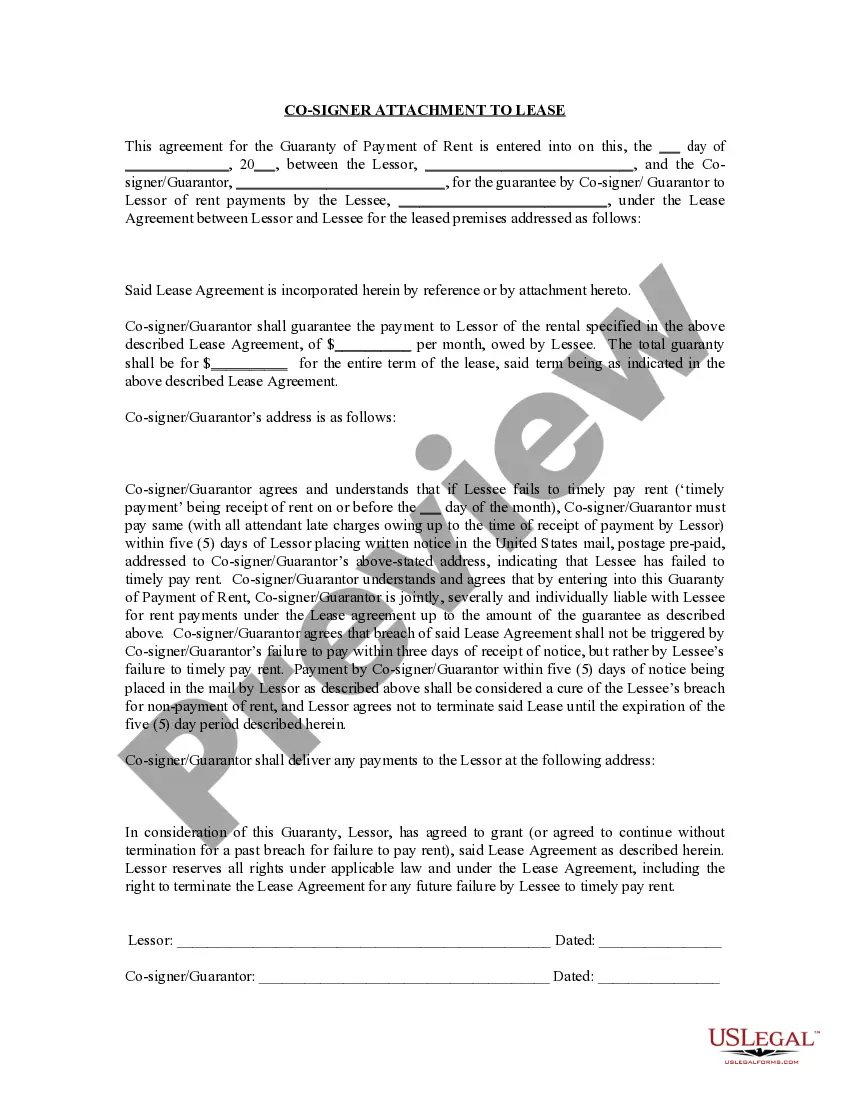

Mississippi Guaranty Attachment to Lease for Guarantor or Cosigner

Description

How to fill out Mississippi Guaranty Attachment To Lease For Guarantor Or Cosigner?

Get a printable Mississippi Guaranty Attachment to Lease for Guarantor or Cosigner in just several mouse clicks from the most complete library of legal e-files. Find, download and print professionally drafted and certified samples on the US Legal Forms website. US Legal Forms has been the #1 supplier of affordable legal and tax templates for US citizens and residents on-line since 1997.

Customers who have already a subscription, need to log in in to their US Legal Forms account, get the Mississippi Guaranty Attachment to Lease for Guarantor or Cosigner and find it saved in the My Forms tab. Customers who never have a subscription must follow the steps below:

- Ensure your template meets your state’s requirements.

- If available, read the form’s description to find out more.

- If readily available, preview the shape to see more content.

- Once you are sure the form is right for you, click Buy Now.

- Create a personal account.

- Pick a plan.

- Pay out via PayPal or credit card.

- Download the template in Word or PDF format.

When you’ve downloaded your Mississippi Guaranty Attachment to Lease for Guarantor or Cosigner, you may fill it out in any online editor or print it out and complete it by hand. Use US Legal Forms to get access to 85,000 professionally-drafted, state-specific files.

Form popularity

FAQ

The guarantor covenanted under the lease that the tenant would pay the rent and sums due under the lease and will observe the tenant's covenants. In the event of tenant default, the guarantor covenanted to make good to the landlord on demand all loss, damage, costs and expenses arising or incurred by the landlord.

A guarantor is another word for cosigner, and by definition, a guarantor is someone who guarantees to be legally responsible for paying the rent as stipulated by the lease, but only if the tenant cannot pay for one reason or another.

One reason could be the need to take a loan yourself. However, a bank may not allow a guarantor to withdraw from the role unless the borrower gets another guarantor or brings in additional collateral. Even if you get another guarantor, the bank has the discretion to disallow the switch.

It's very common for a guarantee to last as long as the tenancy lasts. So, if the tenant remains in the property for four years, you will continue to be responsible for any arrears or damages during that entire period. Most tenancies will run for a fixed term and will then continue on a month-by-month basis.

Does being a guarantor affect my credit rating? Providing the borrower keeps up with their repayments your credit score won't be affected. However, should they fail to make their payments and the loan/mortgage falls into default, it will be added to your credit report.

In a personal guarantee, the guarantor (usually the business owner) agrees to be responsible for the lease payments owed by the business under the terms of a commercial lease if the business fails to pay rent or fails to pay rent after vacating the leased space before the end of the lease term.

Almost anyone can act as your Guarantor; it can be a family member, a friend or a work colleague, but not your wife/husband. They will need to be at least 21 years old, and under 80 years old by the end of the loan term and have a good credit history.

When The Lease Is Up When having a guarantor on the lease, the best way to be able to have him removed as soon as possible is to set a good payment record with the landlord.

The most simple way to get out of being someone's guarantor is for the main borrower to pay off their loan and essentially, terminate the agreement.