Cosigner-Agreement is an agreement between two or more parties in which one party agrees to be responsible for the repayment of a loan or other financial obligation of another party. This agreement is typically used when a borrower does not have enough income or credit history to qualify for a loan on their own. The cosigner is responsible for making sure the loan is repaid in full, and if the borrower defaults, the lender may pursue legal action against the cosigner. There are two main types of cosigner agreements: personal cosigner agreements and business cosigner agreements. Personal cosigner agreements involve a cosigner signing on behalf of an individual or family member. Business cosigner agreements involve a cosigner signing on behalf of a business entity. In both cases, the cosigner is taking on full responsibility for the repayment of the loan.

Cosigner-Agreement

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Cosigner-Agreement?

If you’re searching for a way to appropriately prepare the Cosigner-Agreement without hiring a legal representative, then you’re just in the right place. US Legal Forms has proven itself as the most extensive and reliable library of official templates for every personal and business situation. Every piece of documentation you find on our online service is created in accordance with federal and state regulations, so you can be certain that your documents are in order.

Follow these straightforward instructions on how to obtain the ready-to-use Cosigner-Agreement:

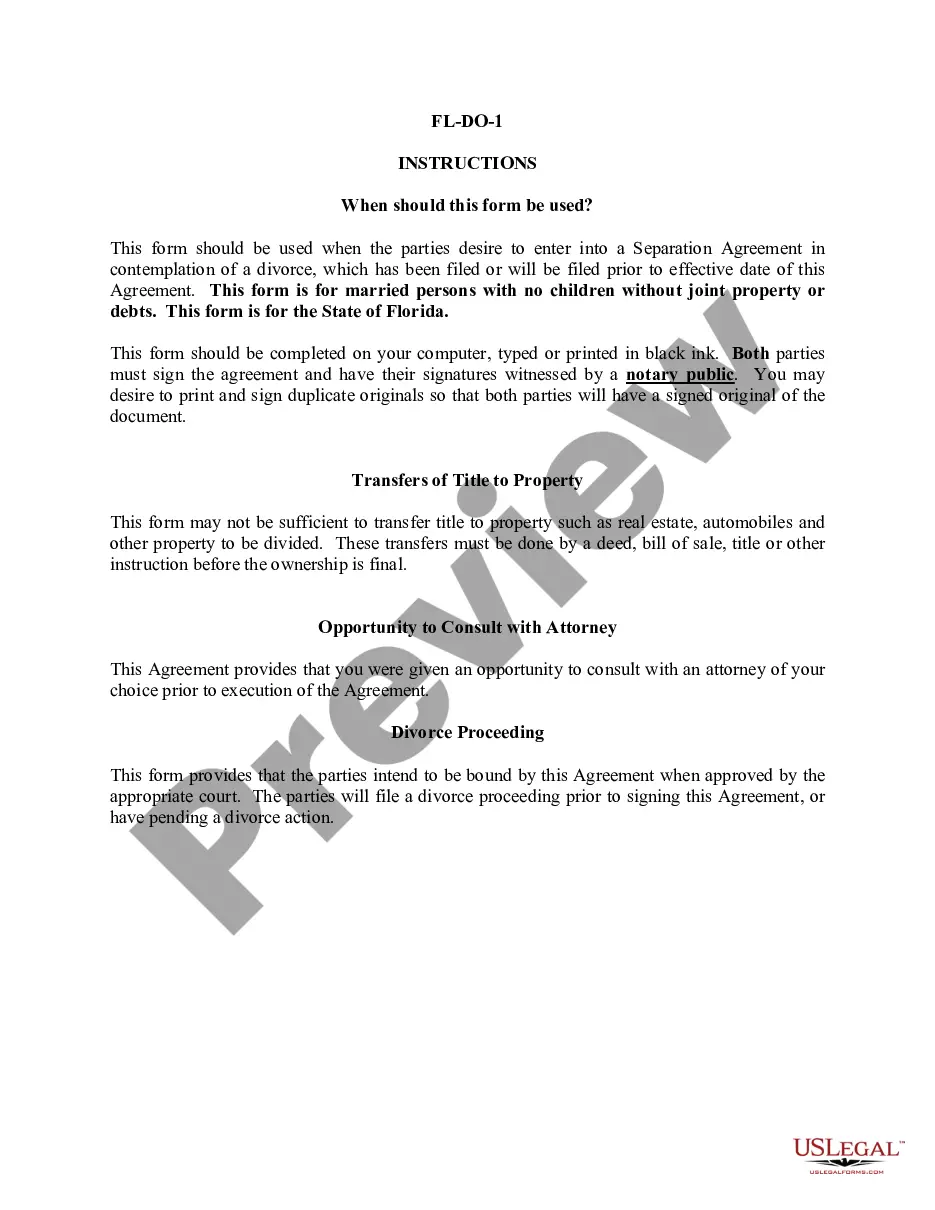

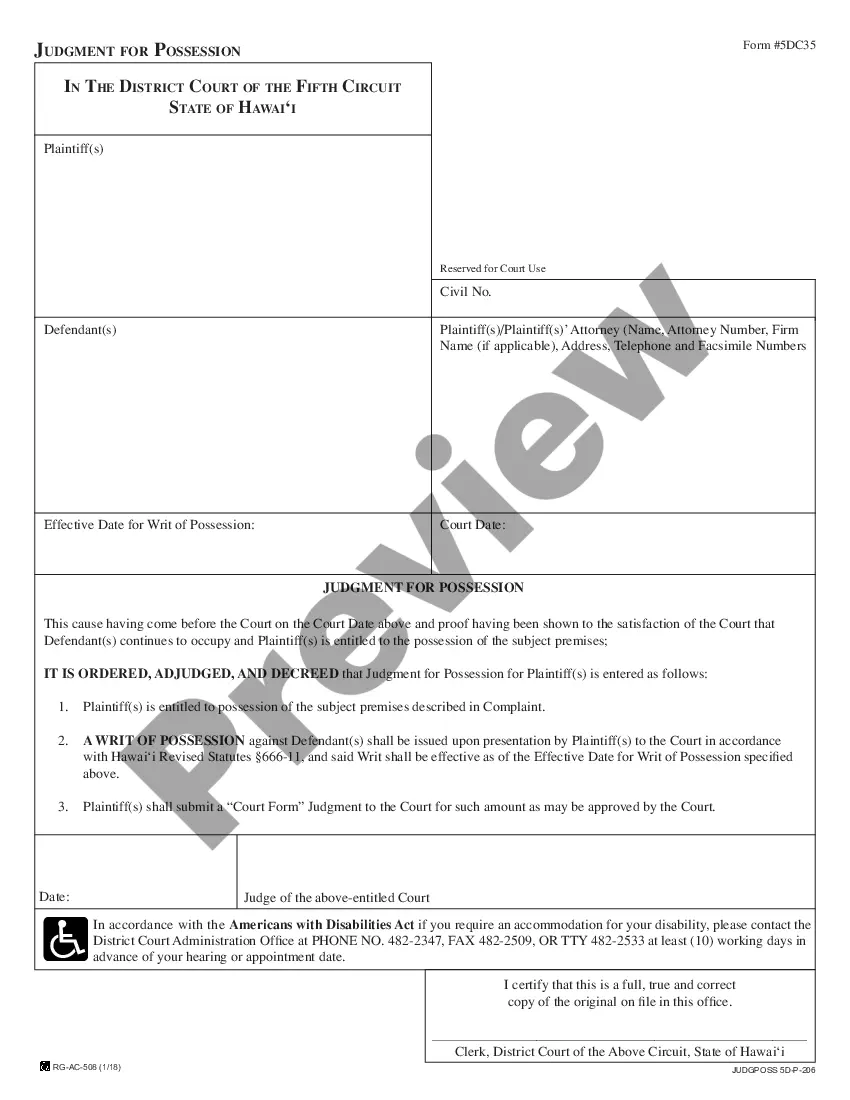

- Make sure the document you see on the page meets your legal situation and state regulations by examining its text description or looking through the Preview mode.

- Type in the document name in the Search tab on the top of the page and choose your state from the dropdown to locate another template if there are any inconsistencies.

- Repeat with the content check and click Buy now when you are confident with the paperwork compliance with all the demands.

- Log in to your account and click Download. Register for the service and select the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to purchase your US Legal Forms subscription. The document will be available to download right after.

- Decide in what format you want to save your Cosigner-Agreement and download it by clicking the appropriate button.

- Import your template to an online editor to fill out and sign it rapidly or print it out to prepare your hard copy manually.

Another great advantage of US Legal Forms is that you never lose the paperwork you purchased - you can pick any of your downloaded templates in the My Forms tab of your profile whenever you need it.

Form popularity

FAQ

5 ways to protect yourself as a co-signer Serve as a co-signer only for close friends or relatives. A big risk that comes with acting as a loan co-signer is potential damage to your credit score.Make sure your name is on the vehicle title.Create a contract.Track monthly payments.Ensure you can afford payments.

Cosigner release is the process of having a cosigner removed from an existing loan, which means the cosigner is no longer responsible for the loan. If a borrower can prove to the lender they're financially stable on their own, they might qualify for cosigner release.

It is possible to remove a cosigner without refinancing. However, in most cases, the lender will likely require the borrower to refinance the loan anyway. This is because it's unlikely that the borrower would qualify for the same rate and terms without the cosigner.

Removing a cosigner or co-borrower from a mortgage almost always requires paying off the loan in full or refinancing by getting a new loan in your own name. Under rare circumstances, though, the lender may allow you to take over an existing mortgage from your other signer.

signer is a person who is equally responsible for paying off the loan, but doesn't have any legal ownership of the vehicle. owner has equal claim towards it.

The cosigner is a party with an established financial history who agrees to back up one or more tenants on the lease. They function as a safety net for the landlord. If the other people named in the lease can't make rent or cause damages they can't afford to repair, the cosigner has agreed to pay instead.

Removing a co-borrower or cosigner from a mortgage is possible but difficult, and your lender may insist that you pay off the mortgage in full or refinance the house by taking out a new loan solely in your name.