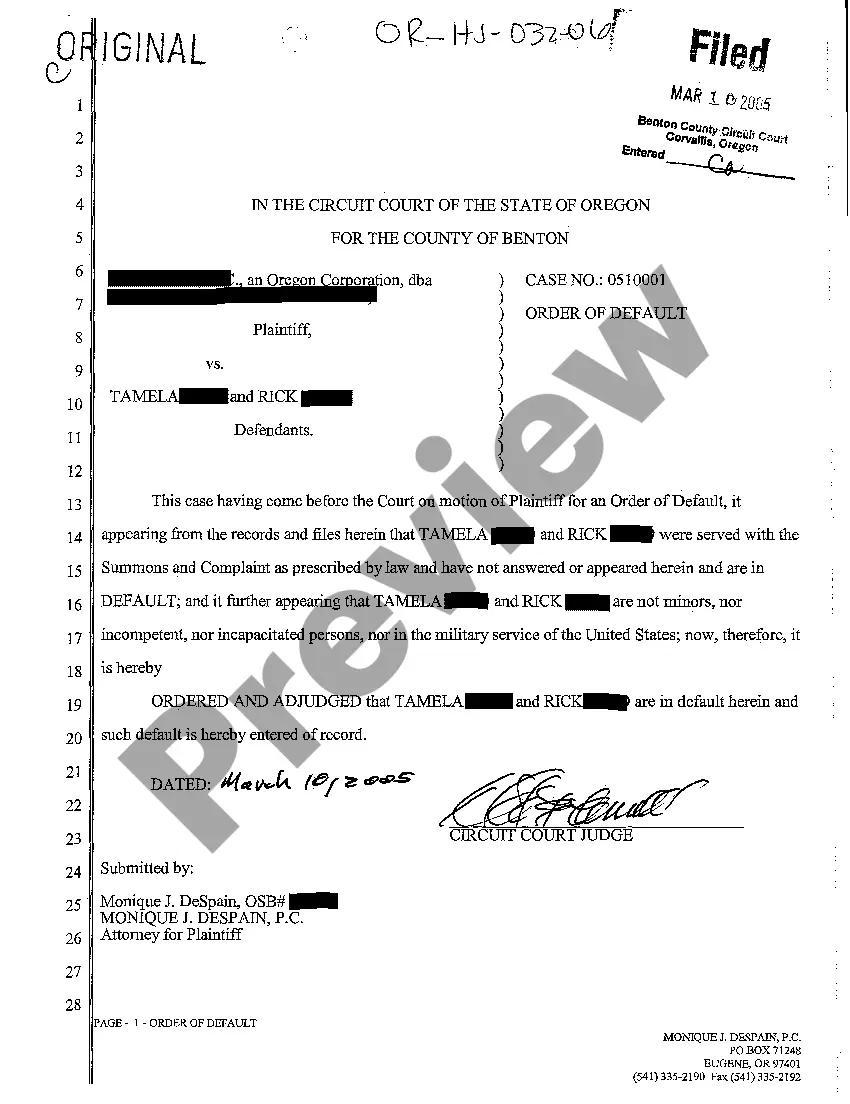

A Michigan Writ of Execution Against Property is a legal document issued by the court in order to collect a debt owed to a creditor. It is also known as a writ of garnishment. This writ orders a third party, such as a bank or employer, to turn over any property in their possession that belongs to the debtor in order to satisfy the debt. There are two main types of Michigan Writ of Execution Against Property: bank levy and wage garnishment. A bank levy allows the creditor to seize funds from the debtor’s bank account. The creditor must send a bank levy to the debtor’s financial institution. The financial institution will then be required to freeze the debtor’s account and turn over any funds in the account to the creditor. A wage garnishment allows the creditor to garnish the debtor’s wages or other forms of income. The creditor must send a wage garnishment to the debtor’s employer, who will then be required to withhold a portion of the debtor’s wages until the debt is satisfied.

Michigan Writ of Execution Against Property

Description

How to fill out Michigan Writ Of Execution Against Property?

US Legal Forms is the simplest and most economical method to discover suitable legal templates.

It boasts the largest online collection of business and personal legal paperwork created and verified by legal experts.

Here, you can find print-friendly and fillable forms that adhere to federal and local regulations - just like your Michigan Writ of Execution Against Property.

Peruse the form description or preview the document to confirm you've located the one that fulfills your requirements, or find another using the search option above.

Click Buy now when you’re confident about its alignment with all the criteria, and select the subscription plan you prefer.

- Obtaining your template requires just a few straightforward steps.

- Users who already possess an account with an active subscription only need to Log In to the platform and download the document to their device.

- Afterwards, it can be found in their profile under the My documents section.

- Here’s how to receive a professionally crafted Michigan Writ of Execution Against Property if this is your first time using US Legal Forms.

Form popularity

FAQ

The process of a Michigan Writ of Execution Against Property begins after a court judgment is rendered in favor of the creditor. The creditor must then apply for the writ through the court that issued the judgment. Once approved, the writ authorizes the sheriff or another officer to seize the debtor's property to satisfy the debt. This process ensures that creditors can legally reclaim what is owed to them while providing debtors a clear understanding of the steps involved.

In Michigan, certain properties are exempt from judgment when a Michigan Writ of Execution Against Property is issued. Key exemptions include a primary residence, personal property up to a specified value, and specific retirement accounts. This means that, in many cases, your home and essential items remain protected even if you face a judgment. Understanding these exemptions can help you navigate financial challenges with peace of mind.

But, a creditor with a judgment against both you and your spouse can seize the property. If your real property is being seized, an officer will deliver you notice of sale with an appraisal of your property. You have 60 days after this notice to pay your debt before your real property is seized and sold.

A creditor can file the lien on your property 21 days after the judgment is signed. A court-appointed officer does not need to serve or carry out a judgment lien. You must still get served with the lien, but a creditor can do this by certified mail. If the lien is for more than $25,000, you must be personally served.

Sec. 2809. (1) Unless subsection (2) or (3) applies, a judgment lien expires 5 years after the date it is recorded. (2) Unless subsection (3) applies, if a judgment lien is rerecorded under subsection (4), the judgment lien expires 5 years after the date it is rerecorded.

How long does a judgment lien last in Michigan? A judgment lien in Michigan will remain attached to the debtor's property (even if the property changes hands) for five years.

An action to enforce a Michigan mechanics lien must be commenced within 1 year from filing of lien. This deadline may not be extended. Notice of furnishing to owner and prime within 20 days after first providing labor or materials. Lien must be filed within 90 days from last providing materials or labor.

A judgment from a Small Claims case expires six years after it is issued. Most other judgments in Michigan expire 10 years after they are issued. You can renew a judgment before it expires by filing a motion to renew a judgment.

Request a Release-of-Lien Form ? After paying off the balance of your debt in full, the creditor will file a release-of-lien form. This will act as evidence that the debt has been paid and will formally release the lien from your property.

The spouses each have a survivorship right, and each is presumed to own the entire property. Neither can sell or transfer their interest in the property without the other's consent. Creditors of one spouse cannot put a lien on the property.