Whenever any such account and notice is served upon the owner of the property or his duly authorized agent or representative, he shall furnish his contractor with a copy of the same, and if such contractor shall not within fifteen days after the receipt of such account and notice give the owner, his agent, or representative, written notice that he intends to dispute the claim, he shall be considered as assenting thereto and such owner may pay the same to the claimant when it becomes due and deduct the amount out of any moneys due such contractor, who may in like manner deduct such amount from any moneys due from him to his subcontractor or the claimant.

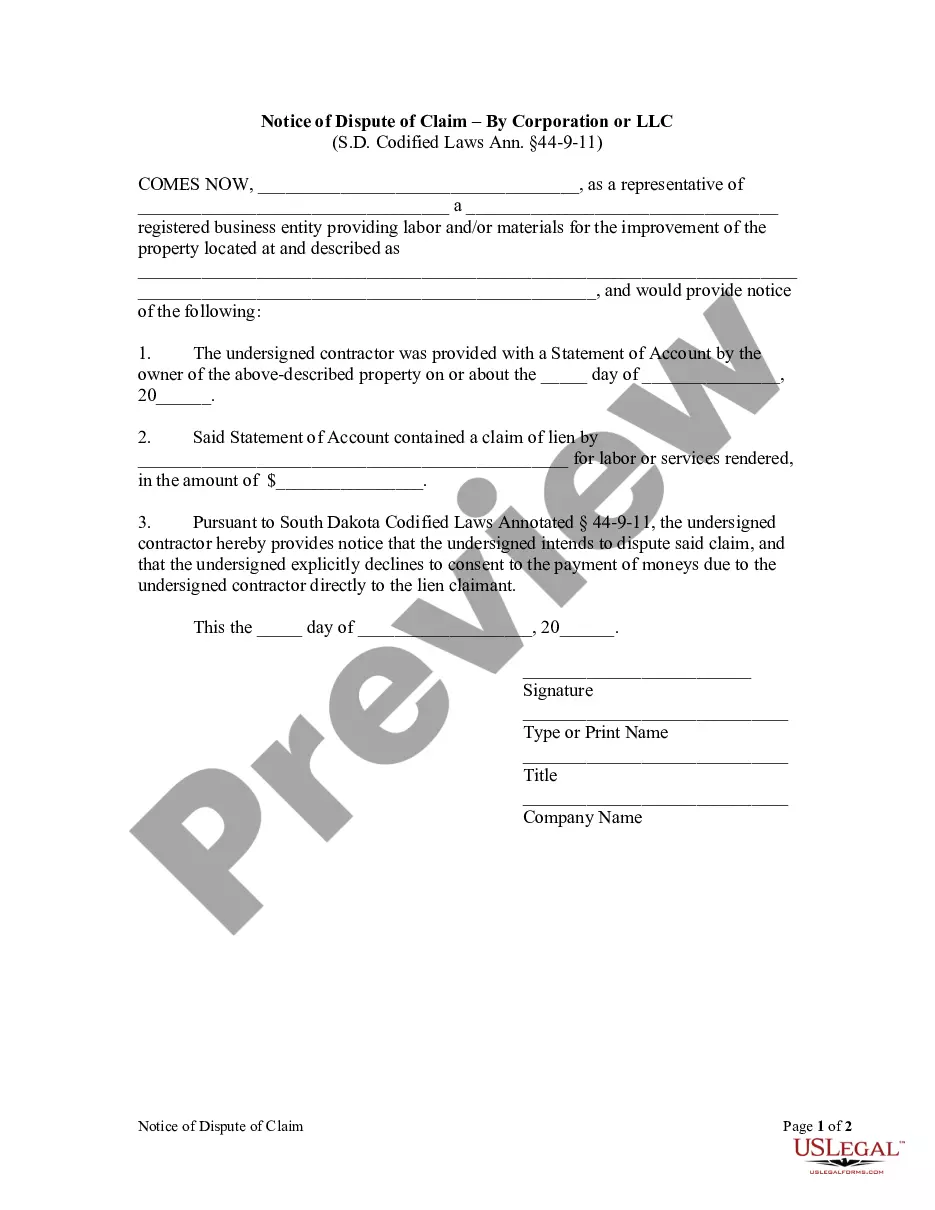

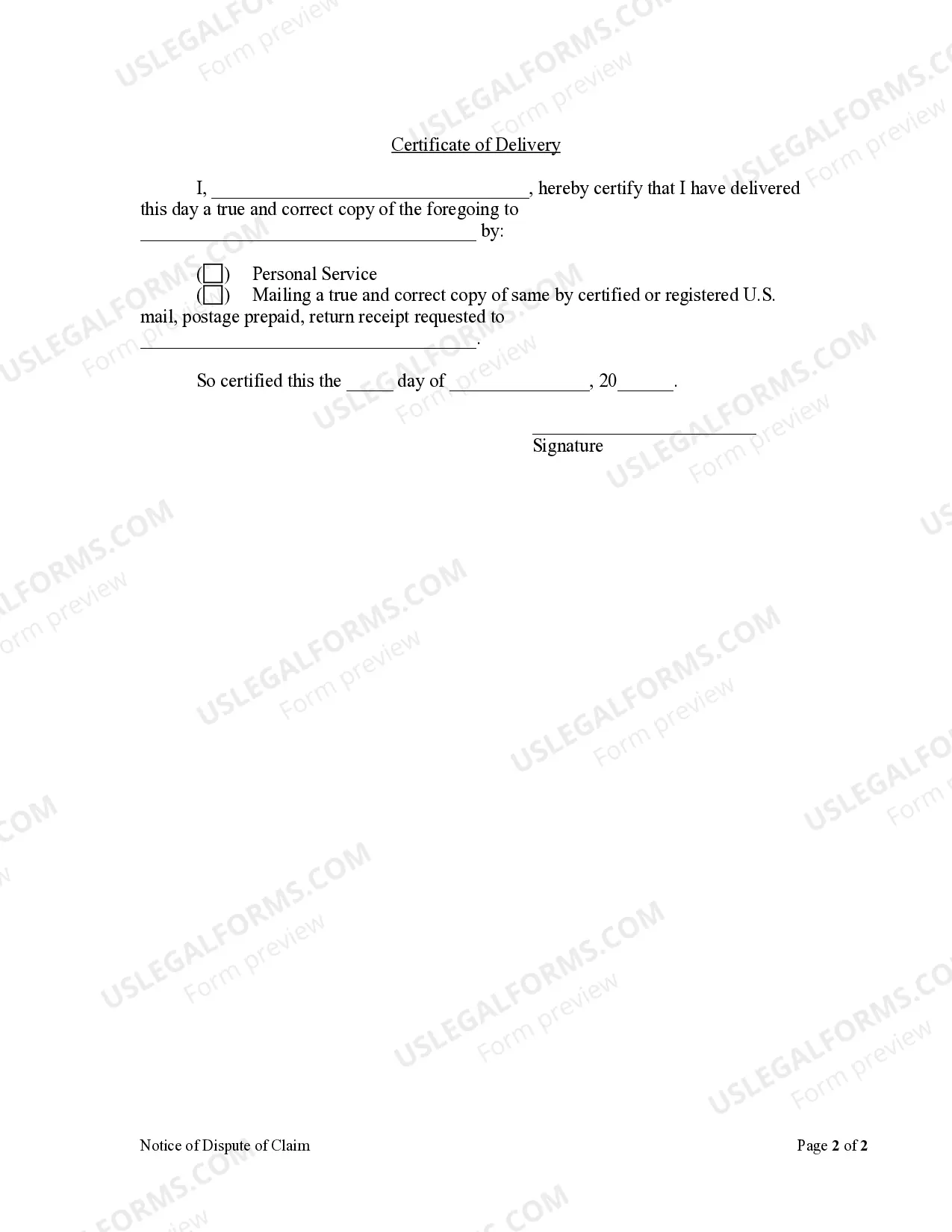

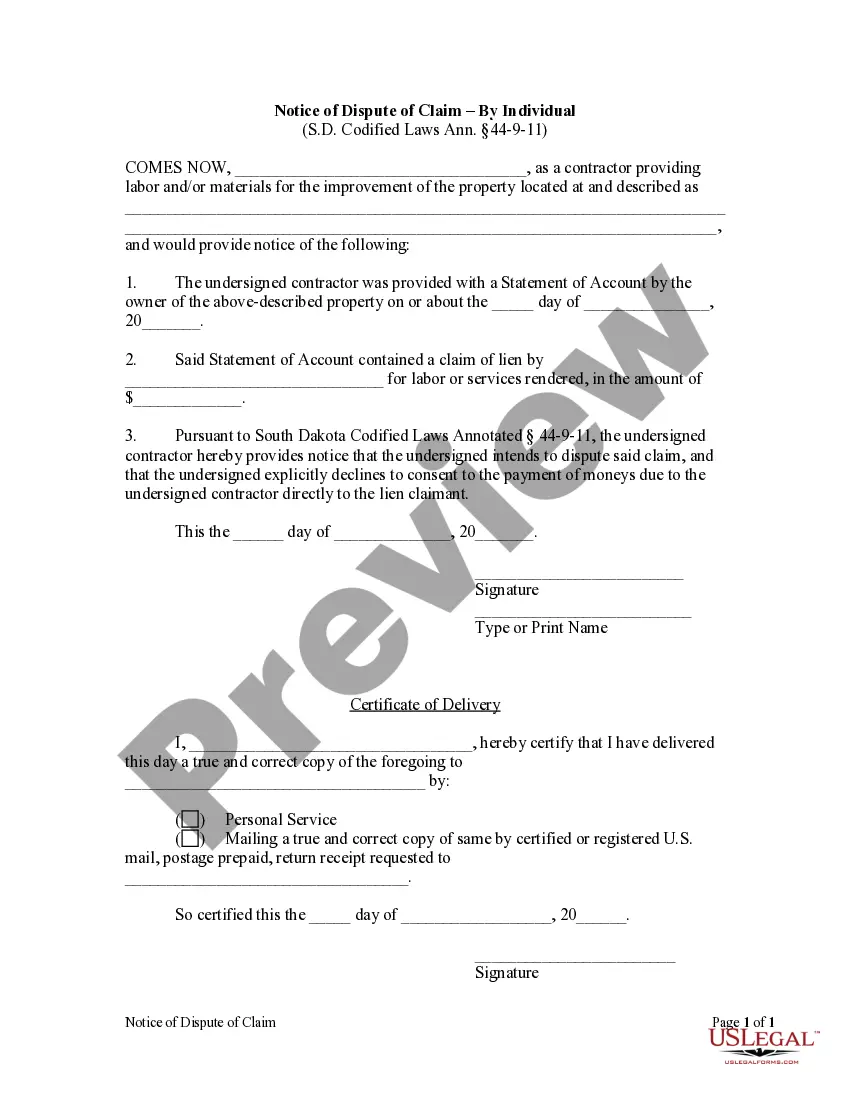

South Dakota Notice of Dispute by Corporation

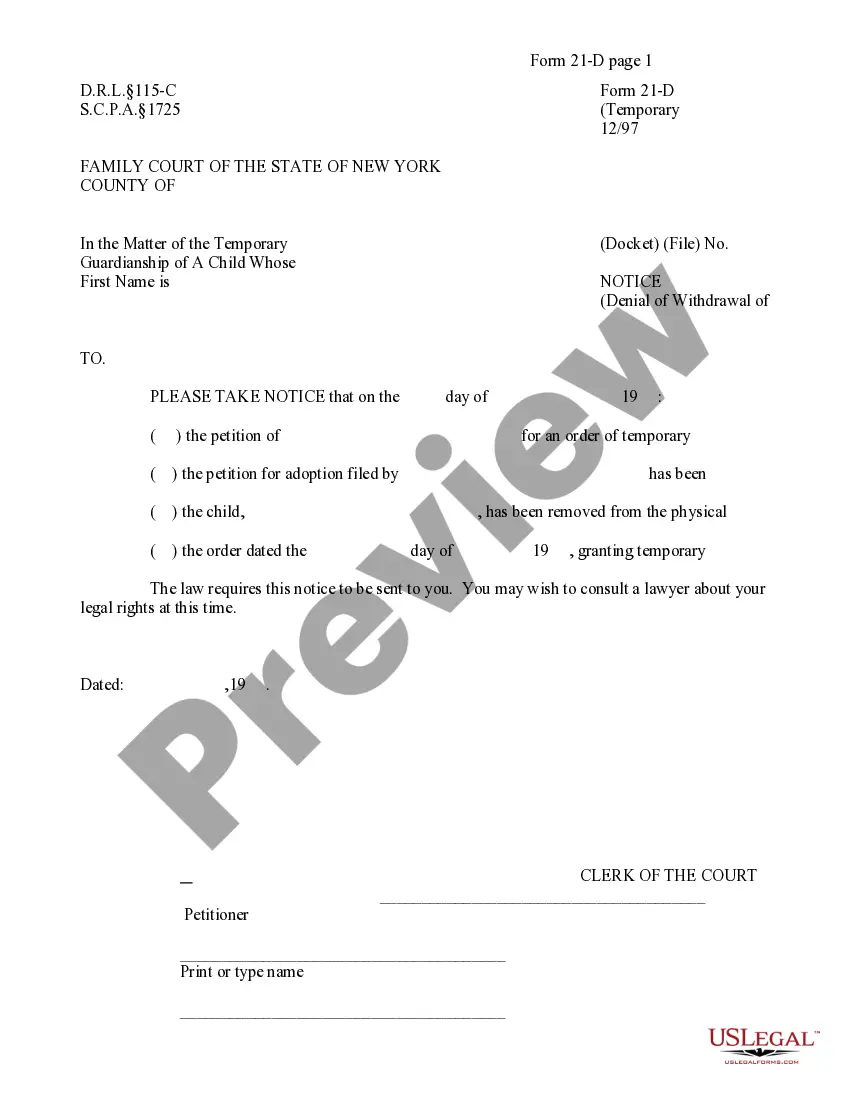

Description

How to fill out South Dakota Notice Of Dispute By Corporation?

Creating papers isn't the most simple job, especially for those who rarely deal with legal papers. That's why we recommend utilizing correct South Dakota Notice of Dispute by Corporation or LLC templates created by skilled attorneys. It gives you the ability to prevent difficulties when in court or dealing with formal organizations. Find the samples you want on our website for high-quality forms and exact explanations.

If you’re a user having a US Legal Forms subscription, simply log in your account. When you’re in, the Download button will immediately appear on the template web page. Right after getting the sample, it will be stored in the My Forms menu.

Users without an active subscription can easily create an account. Follow this short step-by-step guide to get the South Dakota Notice of Dispute by Corporation or LLC:

- Ensure that the sample you found is eligible for use in the state it’s needed in.

- Confirm the document. Use the Preview feature or read its description (if available).

- Buy Now if this form is the thing you need or utilize the Search field to get a different one.

- Select a suitable subscription and create your account.

- Utilize your PayPal or credit card to pay for the service.

- Download your file in a wanted format.

Right after finishing these straightforward actions, it is possible to complete the form in an appropriate editor. Check the completed info and consider requesting a legal representative to examine your South Dakota Notice of Dispute by Corporation or LLC for correctness. With US Legal Forms, everything becomes much simpler. Give it a try now!

Form popularity

FAQ

The first efforts to form LLCs were thwarted by IRS rulings that the business form was too much like a corporation to escape corporate tax complications.Thus it is extremely important that the LLC promoters avoid the corporate characteristics of continuity of life and free transferability of interests.

By default, LLCs with more than one member are treated as partnerships and taxed under Subchapter K of the Internal Revenue Code. However, an LLC can elect to be treated as an association taxable as a corporation by filing Form 8832, Entity Classification Election.

As a side note, if you forget to renew the LLC, the company will generally be listed as inactive or administratively dissolved on the public record. If this is the case, don't panic; it just means the State hasplaced the LLC on the inactive list because of non-payment of fees.

The main advantage of having an LLC taxed as a corporation is the benefit to the owner of not having to take all of the business income on your personal tax return. You also don't have to pay self-employment tax on your income as an owner from the corporation. The main disadvantage is double taxation.

LLCs are not corporations and do not use articles of incorporation. Instead, LLCs form by filing articles of organization.

LLC owners must pay self-employment taxes for all income. S-corp owners may pay less on this tax, provided they pay themselves a "reasonable salary." LLCs can have an unlimited number of members, while S-corps are limited to 100 shareholders.

For example, in California an LLC expires when the members unanimously consent to file a certificate of cancellation. After the certificate is filed, registration of the LLC will be canceled and all of its powers, rights and privileges will cease.

By dissolving an LLC properly, it means that the LLC is no longer a legal business entity so you won't be expected to pay any fees or taxes, or file any more documents. Despite no longer operating, it is possible for members to create a new LLC and run it in the same way as the dissolved company.

The main difference between an LLC and a corporation is that an llc is owned by one or more individuals, and a corporation is owned by its shareholders. No matter which entity you choose, both entities offer big benefits to your business. Incorporating a business allows you to establish credibility and professionalism.